Juggling too many disconnected projects?

With projects scattered across different tools, you lack a single source of truth. This makes it impossible to see the bigger picture for your teams.

The real issue is when disjointed workflows kill productivity and prevent your teams from collaborating effectively, ultimately hindering your company’s growth potential.

This chaos often leads to missed deadlines, budget overruns, and frustrated stakeholders. Without a unified view, you’re managing in the dark, reacting to problems instead of preventing them.

Speaking of managing your business effectively, my guide on predict cash flow explores essential tools for financial stability.

The right software solves this by providing a centralized command center for all your projects, giving you total visibility and control.

In this guide, I’ll show you the best portfolio management software to unify your teams. We’ll explore solutions that deliver the clarity you need.

You’ll find tools that streamline workflows, improve collaboration, and give you the data to make smarter decisions and accelerate your company’s growth.

Let’s dive in.

Quick Summary:

| # | Software | Rating | Best For |

|---|---|---|---|

| 1 | Sharesight → | Individual investors & small teams | |

| 2 | Ziggma → | Consolidating multi-account investors | |

| 3 | Kubera → | Operations managers at SaaS firms | |

| 4 | Addepar → | Investment professionals & enterprises | |

| 5 | eMoney Advisor → | SaaS/digital agencies scaling fast |

1. Sharesight

Struggling to unify your investment data from disparate sources?

Sharesight offers powerful portfolio tracking software that consolidates your investments in one centralized place. This means you can gain award-winning performance, accurate dividend tracking, and comprehensive tax reporting effortlessly.

You’ll quickly see that Sharesight can simplify complex investment management, offering a clear, unified view that overcomes the lack of integration common with other tools. Here’s how to simplify your investment oversight.

Sharesight streamlines your operations by integrating with hundreds of brokers and finance apps. This solves the painful problem of fragmented data and gives you a single source of truth for all your investments.

You can finally get a full, transparent picture of your portfolio’s performance with its advanced reporting features, helping you make informed decisions. Its award-winning performance and dividend tracking capabilities mean you’ll always have precise, up-to-date information. Additionally, the software provides essential tax reporting, like the Australian CGT calculator, ensuring compliance and saving you valuable time.

The result is enhanced efficiency and better investment outcomes.

Before diving deeper, you might find my analysis of fixed asset accounting software helpful for broader financial insights.

Key features:

- Comprehensive Tracking: Unify all your investments from various brokers and finance apps into a single, intuitive platform, eliminating data silos and simplifying oversight.

- Advanced Reporting: Access detailed performance, dividend, and tax reports, including specific calculators like the Australian CGT, to ensure accuracy and compliance.

- Seamless Integration: Connect effortlessly with over 200 software, broker, and partner integrations, providing flexibility and supporting diverse investment strategies.

Sharesight features, pricing, & alternatives →

Verdict: Sharesight stands out as the best portfolio management software, especially for its robust integration with 200+ partners and support for over 700,000 stocks, ETFs, and funds. Its unified view and advanced reporting empower you to overcome data fragmentation and make smarter investment decisions.

2. Ziggma

Do your current investment tools lack necessary integration and depth?

Ziggma offers a combined view of your investments, bringing all accounts into one single portfolio. This means you can track complete portfolio allocation, income, risk, and quality.

This powerful aggregation capability directly addresses the pain point of monitoring multiple investment accounts, allowing you to visualize all your investments consolidated into a single portfolio.

Here’s how to gain full control of your investments.

Ziggma helps you take full control with [smart analytics and insights], providing detailed portfolio performance, investment income, risk assessment, and quality scores. You can also save hours with algorithm-powered fundamental stock analysis, finding top stocks in seconds.

Additionally, Ziggma includes a dividend tracker to measure and track cashflow across all your accounts, ensuring you can aggregate your investment income effortlessly. Plus, automated portfolio monitoring through Smart Alerts lets you set thresholds for diversification, price targets, or dividend yields, receiving notifications when limits are hit.

The Portfolio Simulator is another powerful feature, allowing you to evaluate a trade’s impact on [portfolio diversification, risk, and yield] before executing, helping you make better decisions with every trade. This means you can build and own your best portfolios.

The result: smarter tools for better returns.

Key features:

- Combined Investment View: Aggregates all your investment and retirement accounts into a single portfolio for unified tracking of allocation, income, risk, and quality.

- Automated Monitoring & Alerts: Saves time by monitoring your portfolio automatically and notifying you when preset thresholds for diversification, price, or dividend yields are met.

- Portfolio Optimization & Research: Features a Portfolio Simulator to evaluate trade impacts pre-execution, alongside algorithm-powered fundamental stock research and a high-performance screener.

Ziggma features, pricing, & alternatives →

Verdict: Ziggma is an excellent choice for those seeking the best portfolio management software, especially if you’re looking to consolidate multiple investment accounts. Its robust analytics, automated alerts, and powerful Portfolio Simulator provide comprehensive tools to optimize your investment strategy and save valuable time.

3. Kubera

Are you struggling with fragmented financial visibility?

Many operations managers and IT leads find current tools lack crucial integration and reporting depth, hindering a unified view. This means you’re often stuck with manual grunt work.

Kubera saves you over 25 hours a year by automating data aggregation. It eliminates the tedious tasks, freeing your team to focus on strategic initiatives and growth.

Discover how to gain complete financial control.

Kubera provides a truly unified view of your wealth, regardless of asset diversity. This helps your team see the complete picture, from banks and brokerages to alternative investments.

It partners with multiple aggregators for the best connectivity, ensuring reliable access to thousands of institutions worldwide, including major stock exchanges. You can also track nearly any stock, ETF, or mutual fund globally by adding tickers. Additionally, Kubera offers deep crypto support, understanding the nuances of DeFi, NFTs, staking, and lending. The software integrates directly with platforms like Carta for alternative investments, and even tracks real estate, cars, or precious metals. Plus, AI Import digitizes PDFs and screenshots, consolidating all financial data into one interactive balance sheet.

This comprehensive aggregation and AI-powered data entry ensure you have dynamic, real-time reporting on all your investments, empowering better decision-making and accelerating project delivery.

The result is clarity, calm, and control over every asset you own.

Key features:

- Unified Asset Aggregation: Connects with thousands of banks, brokerages, and crypto exchanges, providing a complete, real-time overview of all your diverse financial assets.

- Advanced AI Import: Automates data entry from PDFs and screenshots, transforming static documents into actionable insights and eliminating manual busy work for your team.

- Multi-Entity & Multi-Currency Support: Manages complex ownership structures and global wealth across different currencies, making it ideal for international operations and diverse portfolios.

Kubera features, pricing, & alternatives →

Verdict: With its comprehensive aggregation, AI Import, and multi-entity capabilities, Kubera stands out as the best portfolio management software for operations managers and IT leads at growing SaaS companies or digital agencies. It delivers robust project tracking and intuitive UI, saving users over 25 hours annually by unifying complex financial data for clarity and control.

4. Addepar

Struggling with fragmented portfolio data and unclear insights?

Addepar offers a transformative technology and data platform built to simplify complexity for investment professionals. This means you can aggregate every ownable asset, analyze portfolio data instantly, and create customized, branded reports for your clients.

Here’s how Addepar empowers you to make smarter investment decisions and drive greater outcomes for the portfolios under your care.

This platform helps investment professionals do what they do best, even better.

You can align portfolios to targets with rebalancing on demand for select accounts or even an entire book of business. Additionally, you can model asset allocations, including illiquid assets, to optimally achieve your client’s goals, objectives, and cash flow requirements. You can also test hypothetical performance across different scenarios using various capital market assumptions. The system also streamlines billing by simplifying the calculation, production, and tracking of fees, and allows you to run and review any bill across all accounts with digestible layouts and granular fee calculation details.

Know where you’ve been, where you are, and where you’re going.

While focusing on portfolio efficiency, understanding your overall IT infrastructure is also key. My guide on best endpoint management software covers crucial aspects of security and cost management.

Key features:

- Portfolio Trading and Rebalancing: Align portfolios to targets and rebalance on demand for accounts, households, or an entire book of business using aggregated data.

- Scenario Modeling and Forecasting: Model asset allocations, including illiquid assets, and test hypothetical performance across various scenarios using different capital market assumptions.

- Streamlined Billing: Simplify fee calculation, production, and tracking, and review bills across all accounts with detailed insights into granular fee calculations.

Addepar features, pricing, & alternatives →

Verdict: If you’re seeking the best portfolio management software to unify your teams and grow, Addepar’s comprehensive platform helps overcome data fragmentation, scale operations, and deepen reporting. With $7T+ assets managed globally, it offers unparalleled flexibility for operations managers and IT leads needing robust project tracking and seamless integration.

5. eMoney Advisor

Struggling with fragmented portfolio tools and limited insights?

eMoney Advisor addresses this directly with its centralized product, helping your team consolidate financial data.

This platform empowers you to easily organize client data and stress-test for risks, ensuring you map out the road to their goals.

Your planning can now achieve every possibility.

eMoney Advisor helps you overcome integration gaps and scale your operations by offering comprehensive planning solutions. This means you can save time and money with one centralized product for generating reports, updating plans, and reviewing client assets. You can make quick adjustments, speed up data entry, and increase accuracy, leading to improved business processes and efficiency. Additionally, interactive financial planning tools and visualizations help you engage clients, build confidence, and answer complex “what-if” scenarios, ultimately increasing your ability to attract new clients.

It’s about increasing your service level.

While we’re discussing various types of management software, understanding how social work case management software can streamline client care is also valuable.

Key features:

- Monte Carlo Analysis: Enables you to plan for every possibility and eventuality, providing robust risk assessment for your clients’ financial futures.

- Account Aggregation: Brings together all of your client’s financial information into one centralized location, simplifying data management and holistic viewing.

- Client Portal: Provides an always-on connection with your clients, offering them 24/7/365 access to important updates and documents between meetings.

eMoney Advisor features, pricing, & alternatives →

Verdict: If your SaaS company or digital agency needs the best portfolio management software that scales with your growth, eMoney Advisor is a strong contender. Its planning, aggregation, and client portal features help unify teams, improve efficiency (90% reported), and deepen client relationships (94% improved client engagement), providing the robust project tracking and seamless integration you need.

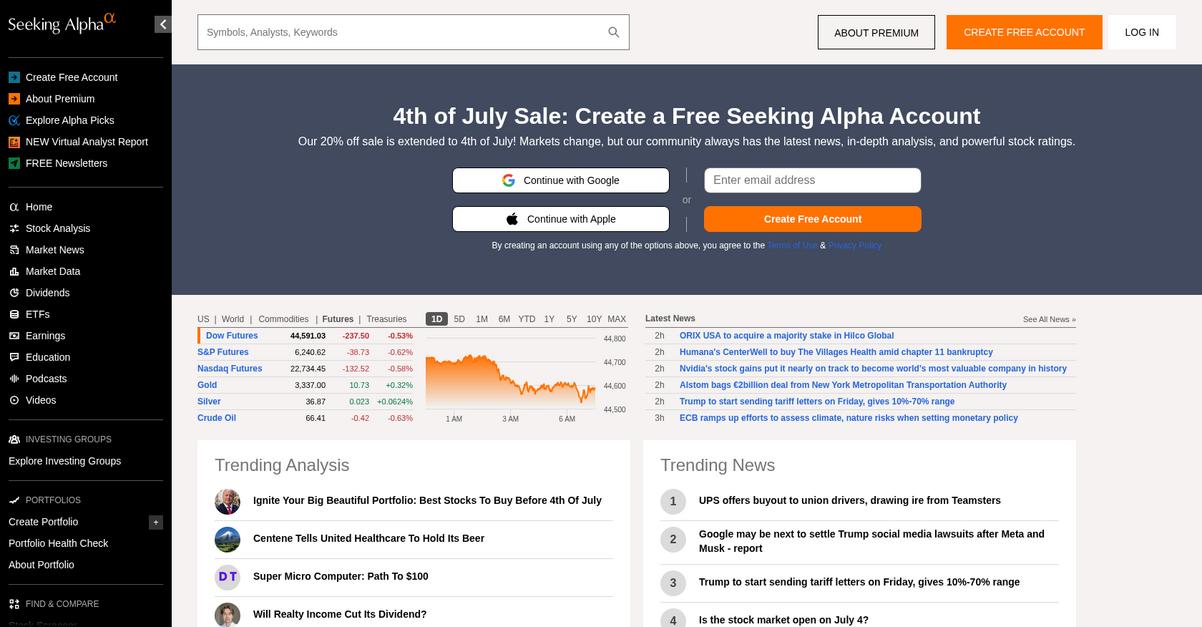

6. Seeking Alpha

Struggling to find clarity in a crowded market?

Seeking Alpha provides stock analysis, market news, and robust screening tools. This means you can cut through the noise.

It offers unrivaled coverage across all asset classes, empowering you to gain actionable insights for your portfolio.

Understand market trends and company performance.

Seeking Alpha helps you make informed decisions, offering stock analysis, market news, and powerful stock ratings. This allows you to track portfolio health, identify opportunities, and mitigate risks. Additionally, you can dive deep into various investment strategies, including dividends, ETFs, and even cryptocurrency. You’ll find trending analysis, earnings calendars, and in-depth articles from a large community of investors and analysts. The result? Enhanced project tracking and clearer insights to scale your operations.

The software also provides stock and ETF screeners to help you quickly compare options, ensuring solutions align with your company’s workflows and future needs for improved project delivery.

Before diving deeper, you might find my analysis of best marketing analytics tools helpful.

Key features:

- In-depth Analysis and Ratings: Access comprehensive stock and ETF analysis, market news, and powerful stock ratings from a community of investors.

- Robust Screening Tools: Utilize stock and ETF screeners, along with comparison tools for various assets like AI or dividend stocks, to filter options effectively.

- Extensive Market Data: Get real-time market data, earnings calendars, cryptocurrency prices, and sector-specific news to stay informed and track performance.

Seeking Alpha features, pricing, & alternatives →

Verdict: For operations managers and IT leads needing the best portfolio management software, Seeking Alpha offers extensive market analysis, powerful screening capabilities, and a deep well of actionable insights to reduce risk and justify investment.

7. Empower

Tired of disconnected portfolio views?

Empower offers personalized investment strategies and advice, addressing your unique goals.

This means you can gain guidance to make better money decisions at every stage of your life.

See your financial full picture.

Empower solves the pain of fragmented financial data by securely connecting all your accounts in one place. You can view your investments, cash, and credit, gaining a comprehensive understanding of your financial standing.

This means you get crucial insights to help you invest your next dollar wisely, ensuring your money works harder for you. Plus, with tools like the Retirement Planner and Budgeting & Cash Flow, you can test-drive future scenarios, spend smarter, and make informed decisions about saving and planning for your future.

The result is greater confidence in your financial decisions, supported by transparent insights and robust security measures.

Speaking of unifying teams, empowering your content team with the right tools is also crucial. Check out my guide on best mobile content management systems.

Key features:

- Comprehensive Financial Overview: Securely connect all your investment, cash, and credit accounts to see your entire financial picture in one dashboard.

- Personalized Investment Strategy: Benefit from custom portfolio development, tax optimization, and financial planning tailored to your unique goals and needs.

- Robust Financial Tools: Access tools for retirement planning, net worth tracking, budgeting, and portfolio analysis to make smarter money decisions.

Empower features, pricing, & alternatives →

Verdict: Empower stands out as a strong contender for best portfolio management software, especially if you need a unified view of your finances. Their personalized advice, comprehensive tools, and secure platform ensure you can make confident financial decisions, just like Benjamin D. who found his financial life clearer and easier.

Conclusion

Stop juggling disconnected financial tools.

I know the struggle of choosing the right tool. It feels overwhelming when disjointed workflows are already killing your team’s productivity and preventing real growth.

This isn’t just an inconvenience. It’s a major roadblock that prevents you from making strategic decisions with real confidence. It keeps your business stuck reacting to problems instead of proactively growing.

Here’s how you can fix this.

From my extensive review, Quicken is the clear winner for unifying your financial data. It provides the single source of truth your team needs.

What I find most effective is its powerful all-in-one dashboard. Using the best portfolio management software like Quicken, you centralize everything, saving countless hours and boosting team collaboration.

I suggest you visit Quicken’s website and explore their plans. See how it can finally bring all your critical financial data together.

This clarity will fuel your growth.