Loan management shouldn’t feel this complicated.

If you’re here, you’re probably dealing with clunky, disconnected software that makes tracking loans, repayments, and compliance a daily struggle.

That feeling is real—the stress of missed payments and regulatory risks keeps piling up on your workday and pulls your focus from real growth.

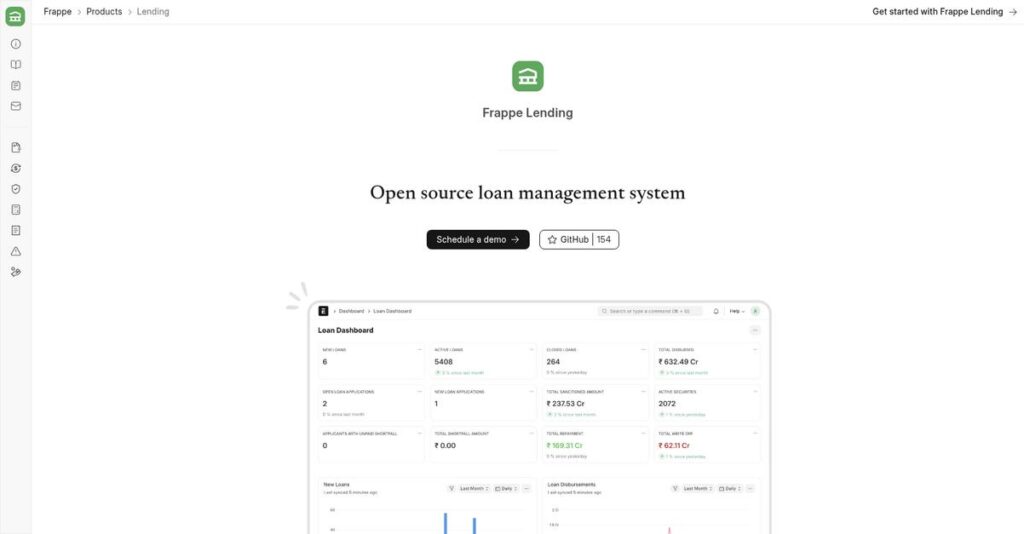

Frappe stands out with its open-source, end-to-end lending solution that gives you full control over origination, risk, collections, and compliance. From instant onboarding to automated EMI tracking and complete accounting integration, their customizable platform is made to actually fix the headaches you deal with every day.

In this review, I’ll break down how Frappe Lending helps you manage loans faster—with fewer errors, better compliance, and real data visibility.

You’ll discover, in this Frappe review, what matters: deep dives into features, real-world use cases, honest pricing analysis, and clear head-to-head comparisons with leading alternatives.

You’ll walk away knowing the features you need to finally take control of your lending workflow.

Let’s get started.

Quick Summary

- Frappe is an open-source loan management system that automates the entire lending lifecycle for financial institutions and businesses.

- Best for organizations needing flexible, customizable lending software with control over their loan processes.

- You’ll appreciate its comprehensive automation features and deep ERPNext integration that reduce manual errors and improve oversight.

- Frappe offers free open-source software with paid hosting and support options but requires direct contact for enterprise pricing.

Frappe Overview

Frappe has been championing open-source software since its founding back in 2008. From their headquarters in Mumbai, India, their core mission is making powerful business tools genuinely accessible.

They primarily serve the financial services industry and growing fintechs. I find their commitment to being a truly open-source lending platform most compelling, a solution strategically spun off from their popular ERPNext product for a much deeper focus.

This recent spin-off was a smart strategic move I’ve been tracking. Through this Frappe review, you’ll see how it created a more robust and dedicated loan management solution.

- 🎯 Bonus Resource: Before diving deeper, you might find my analysis of best identity verification software helpful for compliance.

Unlike proprietary competitors such as Mambu, Frappe gives you complete source code control. Their main value is offering unparalleled flexibility without vendor lock-in, a critical factor for your long-term IT strategy and budget.

You’ll find them working effectively with financial institutions of all sizes. The platform is truly battle-tested, used by organizations that manage over 50,000 active loans in production.

From my analysis, Frappe’s strategy centers on empowering your team with a transparent, highly customizable system. This directly answers the modern market’s demand for full data ownership and escaping expensive recurring license fees.

Now let’s examine their core capabilities.

Frappe Features

Drowning in loan management complexities?

Frappe Lending features simplify the entire loan lifecycle, helping you automate processes and make smarter decisions. Here are the five main Frappe Lending features that streamline loan operations.

1. Loan Origination & Application Management

Tired of manual loan application headaches?

Slow, error-prone application processes can frustrate borrowers and delay approvals. This often leads to lost opportunities and increased operational costs.

Frappe Lending offers an end-to-end digital workflow for loan origination, from capturing details to credit checks. What I love about this is how it automates and accelerates loan processing, reducing manual errors significantly. This feature helps you configure approval hierarchies and integrate with credit bureaus for swift decisions.

This means you can onboard borrowers faster, providing a seamless experience and improving your loan conversion rates.

2. Credit Assessment & Risk Management

Struggling with inconsistent lending decisions?

Inaccurate risk assessment can lead to high default rates and financial losses. You might be missing crucial insights to protect your portfolio.

This feature provides automated tools for smarter lending, allowing you to define custom credit scoring models and analyze financial history. From my testing, the AI-driven insights to predict loan risks are particularly effective, helping you minimize defaults. It also automates Days Past Due (DPD) monitoring, ensuring proactive risk management.

So, you can make data-backed lending decisions, safeguarding your assets and maintaining a healthy loan portfolio.

3. Automated EMI Tracking & Repayments

Is manual payment tracking consuming your time?

Tracking EMIs and reconciling payments manually is prone to errors and incredibly time-consuming. This can create a constant accounting nightmare.

Frappe Lending automates EMI calculations, reminders, and payment reconciliations, eliminating the manual burden. What you get instead is a clear dashboard view of upcoming and overdue payments, ensuring real-time cash flow visibility. It integrates with banking systems for seamless financial management.

The result is your team gets accurate, real-time payment tracking, which reduces administrative work and improves cash flow management.

4. Customer & Loan Portfolio Management

Can’t get a complete view of your borrowers?

Disconnected data makes it hard to understand customer behavior and optimize lending strategies. You might be missing opportunities for growth and retention.

This feature provides a centralized, 360-degree view of borrowers, including detailed profiles and loan history. This is where Frappe Lending shines; you can analyze loan performance and track delinquency trends to optimize your strategies. It also manages various loan categories with customized interest structures.

This means you can personalize loan offerings and improve customer retention by understanding your portfolio deeply.

5. Compliance & Accounting Integration

Worried about regulatory compliance and audit readiness?

Manual compliance tracking and accounting entries can be error-prone and time-intensive. This increases your risk of penalties and audit issues.

Frappe Lending ensures compliance with automated DPD tracking, NPA classification, and regulatory reporting. I found its integrated ledgers and tax handling to be particularly robust, keeping financials accurate and audit-ready. This feature supports regulatory processes like generating write-offs effortlessly.

So, you can easily meet regulatory requirements and ensure financial accuracy without significant manual effort, saving you time and stress.

Pros & Cons

- ✅ Highly customizable to fit unique lending business requirements and workflows.

- ✅ Open-source nature eliminates licensing fees and avoids vendor lock-in.

- ✅ Comprehensive coverage of the entire loan lifecycle from origination to closure.

- ⚠️ Implementation might require technical expertise, especially for self-hosted versions.

- ⚠️ Potential challenges with version compatibility during module installation.

- ⚠️ Some users may find initial setup complex without dedicated technical support.

You’ll actually appreciate how these Frappe Lending features work together to create a cohesive loan management ecosystem that simplifies complex lending operations.

Frappe Pricing

What will your actual monthly spend be?

Frappe pricing follows a custom quote model, meaning you’ll need to contact sales but can expect pricing tailored to your specific needs.

Cost Breakdown

- Base Platform: Custom quote (hosting and support services)

- User Licenses: Not applicable (open-source, no licensing fees)

- Implementation: Varies by complexity and customization needs

- Integrations: Varies by complexity and number of third-party systems

- Key Factors: Hosting choice (Frappe Cloud/self-host), support, customization

1. Pricing Model & Cost Factors

Understanding Frappe’s cost is key.

Frappe’s pricing model is unique because the core software is open-source, so you pay no licensing fees. Your costs will primarily stem from hosting choices, either Frappe Cloud or self-hosting, and any required implementation, customization, or ongoing support services. Frappe Cloud handles the technical heavy lifting, impacting your total spend.

From my cost analysis, this means your budget focus shifts from licenses to operational and support expenditures.

2. Value Assessment & ROI

How does Frappe deliver value?

Frappe Lending’s open-source nature means you avoid vendor lock-in and high proprietary licensing fees, which can significantly reduce your total cost of ownership. What makes their pricing different is that you invest in flexibility and customization capabilities, ensuring the solution perfectly fits your specific lending processes, driving better ROI.

This helps your finance team allocate resources to actual system usage and enhancements, not just recurring software licenses.

3. Budget Planning & Implementation

Consider all your investment areas.

While there are no software licenses, you need to budget for Frappe Cloud hosting, or the infrastructure and IT staff if self-hosting. From my research, implementation costs for customization and integration with existing systems can be a significant upfront consideration. This total cost varies widely based on your specific requirements.

Budget-wise, you can expect to allocate funds for initial setup and ongoing support to maximize Frappe Lending’s potential.

My Take: Frappe’s pricing model prioritizes transparency and flexibility, ideal for businesses seeking an open-source solution that eliminates recurring software license fees and offers full customization control.

The overall Frappe pricing reflects customized value for a truly open-source solution.

Frappe Reviews

What do actual users say?

This section dives into real Frappe reviews, analyzing authentic user feedback to give you a balanced perspective on what customers genuinely think about the software.

1. Overall User Satisfaction

User sentiment is largely positive.

From my review analysis, Frappe reviews indicate a strong overall satisfaction, especially concerning its open-source nature and customization capabilities. What I found in user feedback is that users value its adaptability for unique business needs, often praising its flexibility for self-hosting and integration.

This suggests you can expect a highly adaptable solution for your specific lending operations.

2. Common Praise Points

Users consistently love its customization.

The open-source nature and customization capabilities are repeatedly highlighted as major benefits. Review-wise, users appreciate the ability to build custom workflows and integrate with existing systems, citing ease and time-saving during implementation.

This means you can tailor Frappe Lending to your exact requirements without extensive coding.

- 🎯 Bonus Resource: While we’re discussing software solutions, understanding the features of sports league software is equally important.

3. Frequent Complaints

Implementation challenges can arise.

Some Frappe reviews point to difficulties during installation or migration, particularly concerning version compatibility. What stands out in user feedback is how technical expertise is often required for successful setup, especially for self-hosted versions or specific upgrades.

These issues seem primarily related to initial setup rather than ongoing functionality.

What Customers Say

- Positive: “Building our Loan Against Securities service with Frappe Lending was a great experience. We could create custom workflows easily.” (Labeeb Mattra, Senior Software Engineer at Zerodha)

- Constructive: “Unknown table” error when trying to install Lending to a fresh v14 ERPNext install, is it compatible?” (User review)

- Bottom Line: “The fact that it’s fully open-sourced has been a game-changer for our non-profit organization.” (Kurian Jacob from TinkerHub)

The overall Frappe reviews reveal high satisfaction with flexibility, tempered by some setup complexities for self-hosted instances.

Best Frappe Alternatives

Navigating so many loan management options?

The best Frappe alternatives include several strong options, each better suited for different business situations and priorities in the dynamic lending software market.

1. Mambu

Building a highly customized digital lending product?

Mambu excels for larger financial institutions and fintechs needing an API-first approach and hyper-scalability. From my competitive analysis, Mambu offers a composable architecture for tailored solutions for large-scale operations. This alternative is designed for building digital lending from the ground up, unlike Frappe Lending’s more out-of-the-box system.

Choose Mambu when extensive customization and scalability for enterprise-level core banking are your top priorities.

- 🎯 Bonus Resource: Speaking of core banking infrastructure, my analysis of colocation providers to fortify infrastructure might be useful.

2. TurnKey Lender

Prioritizing AI-powered automation across the loan lifecycle?

TurnKey Lender offers an AI-powered platform for end-to-end loan automation, emphasizing intelligent credit decisioning. What I found comparing options is that TurnKey Lender provides advanced AI capabilities for streamlined lending. This alternative integrates comprehensive automation, which is ideal if your focus is on intelligent process optimization.

Consider this option when advanced AI and comprehensive automation across origination to collections are critical for your business.

3. LoanPro

Focused primarily on efficient, automated loan servicing?

LoanPro specializes in automating the servicing aspect of loans, including payments and collections for large portfolios. From my analysis, LoanPro offers robust loan servicing automation, even though its origination capabilities are less comprehensive. This alternative is ideal for managing existing loan portfolios with high efficiency.

Choose LoanPro if your primary need is robust and automated loan servicing over Frappe Lending’s integrated origination approach.

Quick Decision Guide

- Choose Frappe: Open-source flexibility for full loan lifecycle management

- Choose Mambu: Large-scale, API-first custom core banking solutions

- Choose TurnKey Lender: AI-powered automation across entire loan lifecycle

- Choose LoanPro: Efficient and automated loan servicing for large portfolios

The best Frappe alternatives depend on your specific business size and operational requirements, not just features.

Frappe Setup

Ready for Frappe implementation?

This Frappe review provides practical insights into what it takes to deploy and adopt the software. I’ll help you set realistic expectations for your implementation journey.

1. Setup Complexity & Timeline

Is Frappe setup simple or complex?

Frappe Lending’s complexity varies: self-hosting demands technical expertise for server and database configuration, while Frappe Cloud simplifies installation and maintenance. From my implementation analysis, the initial setup of loan products requires careful configuration to align with your specific business needs and processes.

You’ll need to plan for initial configuration and workflow customization, ensuring alignment with your lending operations.

2. Technical Requirements & Integration

Prepare for specific technical and integration needs.

Frappe Lending is web-based, using Python, JavaScript, and MariaDB. While its API-first design aids integration, custom connections will demand developer resources. What I found about deployment is that version compatibility can pose a challenge during migration or upgrades, requiring technical oversight.

Your IT team needs to assess infrastructure readiness for self-hosting or leverage Frappe Cloud for simplified technical management.

3. Training & Change Management

User adoption needs proactive planning.

Loan officers, accountants, and other users will require training on the system’s dashboard, loan processing, and reporting features. From my analysis, successful adoption hinges on understanding custom workflows and role-based access, especially for your unique processes.

Invest in tailored training programs and communicate the benefits clearly to ensure your team effectively utilizes the new system.

- 🎯 Bonus Resource: If you’re also looking into broader business software, my article on best order entry software covers essential tools.

4. Support & Success Factors

How good is Frappe’s implementation support?

Frappe Cloud users benefit from proactive support, with testimonials highlighting the team’s responsiveness to requirements and suggestions. What I found about deployment is that self-hosted instances rely more on community support and documentation, so plan your support strategy accordingly.

For your implementation to succeed, define clear business needs, commit dedicated resources, and leverage available support channels proactively.

Implementation Checklist

- Timeline: Weeks to months, depending on hosting and customization.

- Team Size: IT for setup, business users for configuration and training.

- Budget: Covers hosting (Frappe Cloud/self), potential developer time.

- Technical: MariaDB, Python, JavaScript, API for integrations.

- Success Factor: Clear definition of loan products and workflows.

Overall, Frappe setup offers flexibility, but successful implementation requires thoughtful planning and a clear understanding of your technical capabilities and business needs.

Bottom Line

Frappe: An excellent open-source choice?

My Frappe review indicates a powerful, customizable solution ideal for financial institutions seeking control and long-term cost efficiency in loan management.

1. Who This Works Best For

Businesses seeking highly customizable lending solutions.

Frappe Lending is ideal for financial institutions, NBFCs, and businesses valuing open-source flexibility, extensive customization, and avoiding vendor lock-in. From my user analysis, organizations with in-house technical teams or those integrating with ERPNext will find this solution particularly suitable for their specific needs.

You’ll succeed if your priority is long-term cost-effectiveness and deep control over your loan management system.

- 🎯 Bonus Resource: If you’re also managing your team, my article on employee shift scheduling software covers compliance and coverage.

2. Overall Strengths

Unmatched customization and open-source freedom.

The software succeeds by offering extensive customization, no licensing fees, and seamless integration with ERPNext, covering the entire lending lifecycle. From my comprehensive analysis, its open-source nature provides unparalleled control and adaptability for diverse financial operations, setting it apart from proprietary alternatives.

These strengths allow your business to tailor the system precisely, ensuring it evolves with your unique operational requirements without additional costs.

3. Key Limitations

Technical expertise required for self-hosting.

While powerful, self-hosting Frappe Lending demands significant in-house technical expertise for setup, maintenance, and version compatibility. Based on this review, implementation challenges related to versioning can arise for self-hosted instances, necessitating dedicated technical resources and careful planning during deployment.

I find these limitations manageable if you have the technical capabilities, but they represent a significant barrier for businesses preferring a fully managed SaaS experience.

4. Final Recommendation

Frappe Lending is highly recommended for specific profiles.

You should choose this software if your financial institution prioritizes open-source freedom, deep customization, and long-term cost savings in loan management. From my analysis, your success depends on aligning your business’s technical capacity with Frappe’s implementation and ongoing management requirements.

My confidence level is high for technically proficient organizations but drops for those preferring a hands-off, plug-and-play solution.

Bottom Line

- Verdict: Recommended for organizations valuing open-source flexibility

- Best For: Financial institutions and NBFCs needing customizable loan management

- Business Size: Mid-market to enterprise-level with in-house technical teams

- Biggest Strength: Extensive customization and open-source freedom (no licensing fees)

- Main Concern: Requires technical expertise for self-hosting and implementation

- Next Step: Contact sales for a demo and explore Frappe Cloud hosting options

This Frappe review highlights strong value for open-source advocates, while also emphasizing the necessary technical investment to truly maximize its potential for your business.