Recurring billing shouldn’t be this stressful.

If you’re evaluating subscription management software, you know how painful it is to juggle complex pricing, invoice changes, and failed payments on top of everything else.

And frankly, the real frustration is that manual billing errors eat into your revenue and force you to fix the same problems week after week.

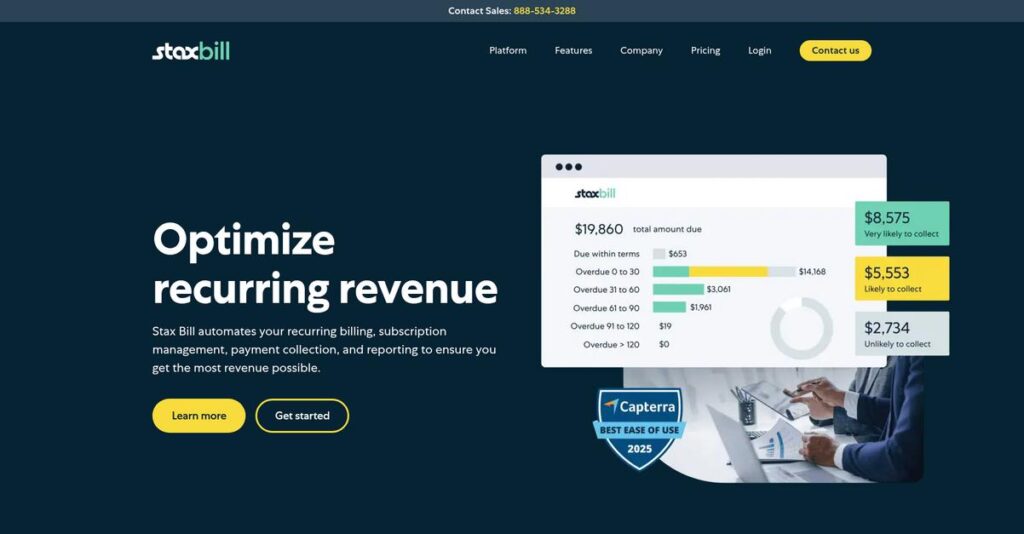

That’s why I took a deep dive into Stax Bill’s platform—looking closely at how its automation, flexible billing, and customizable dunning tools could finally free you from those headaches.

In this review, I’ll break down how Stax Bill automates your billing so you worry less and get back to actually growing your business.

Here’s what you’ll discover in this Stax Bill review: a full walkthrough of features, pricing details, hands-on pros and cons, and my honest take versus leading alternatives to support your evaluation.

You’ll leave knowing the features you need to make the right call—without the guesswork.

Let’s get started.

Quick Summary

- Stax Bill is a cloud-based platform that automates recurring billing, invoicing, and payment processing for subscription businesses.

- Best for subscription-based companies looking to simplify billing and improve revenue recovery.

- You’ll appreciate its flexible pricing models and strong automated dunning to reduce payment failures and revenue loss.

- Stax Bill offers transparent annual pricing starting at $499/month with a free demo available.

Stax Bill Overview

Stax Bill, which you might know as Fusebill, has been focused on simplifying complex subscription billing since 2011. They’re based in Ottawa, Canada, and built their reputation from there.

They’ve really carved out a niche by automating billing for high-growth businesses, especially B2B SaaS companies. I find they are a great fit when your pricing models become too difficult to manage with basic tools.

The 2021 acquisition by Stax was a smart move, integrating robust billing into a broader payment ecosystem. I’ll explore what that means for you throughout this Stax Bill review.

- 🎯 Bonus Resource: While we’re discussing business tools, understanding the best roofing software is equally important for specialized industries.

Unlike competitors such as Chargebee or the developer-centric Stripe, Stax Bill positions itself with its predictable flat-rate pricing model. This focus on cost certainty helps you avoid the surprise overage fees common elsewhere.

I see them working with scaling SaaS and subscription-based companies that have outgrown simpler tools like Zoho but aren’t ready for the heavyweight complexity and cost of enterprise systems.

Their current strategic focus is clearly on creating a single, unified platform for both billing and payments. This is designed to help you streamline revenue operations and improve payment collection efficiency.

Now let’s examine their core capabilities.

Stax Bill Features

Subscription billing giving you a headache?

Stax Bill features are designed to streamline recurring billing, invoicing, and payment processing. Here are the five main Stax Bill features that transform your financial operations.

1. Automated Subscription Billing & Flexible Pricing Models

Tired of managing complex billing manually?

Handling diverse pricing models or constantly updating recurring invoices can eat up your valuable time. This often leads to errors and delays.

Stax Bill automates recurring billing and supports various models like usage-based or tiered pricing. Here’s what I found: it handles specific plans and products within a single plan, something I found incredibly flexible. This feature ensures timely and accurate invoicing, minimizing your effort.

This means you can easily scale your offerings without drowning in manual billing complexities.

2. Automated Invoicing and Customization

Struggling with inconsistent invoices?

Manually generating invoices and ensuring they match your brand can be time-consuming and prone to errors. This impacts your professional image.

The platform automates the entire invoicing cycle, allowing extensive customization to match your branding. Stax Bill handles complex calculations like pro-rata, taxes, upgrades, and downgrades with surprising ease. This feature ensures every invoice is professional and accurate, even with mid-cycle changes.

The result is consistent, professional invoicing that saves you countless hours each month.

3. Payment Processing & Multi-Currency Support

Are failed payments costing you revenue?

Managing multiple payment gateways and dealing with expired cards can lead to lost revenue and customer frustration. This affects your cash flow.

Stax Bill facilitates secure payment processing across various gateways and methods, including an Account Updater feature. From my testing, the automatic card updates are a huge win for revenue recovery. This feature helps reduce involuntary churn by keeping payment information current.

So you can maintain healthier cash flow and ensure your global customers pay effortlessly.

4. Automated Dunning & Revenue Recovery

Losing customers to involuntary churn?

Failed payments can lead to lost subscriptions and revenue leakage if not managed proactively. This is a critical blow to your financial health.

Stax Bill offers intelligent dunning management to retry failed payments and customize dunning workflows. This is where Stax Bill shines: it proactively engages customers for payment updates, a feature crucial for recovering lost revenue. This proactive approach significantly boosts your recovery rates.

This means you can drastically reduce lost revenue from failed payments and keep your customers active.

- 🎯 Bonus Resource: While we’re discussing financial health, understanding stress management is key. My article on mental health software can help boost wellness.

5. Analytics & Reporting

Can’t get a clear picture of your subscription health?

Without real-time insights, making informed business decisions about your subscriptions is nearly impossible. This can hinder your growth.

Stax Bill provides robust analytics and reporting, offering real-time insights into key subscription metrics. What I love about this approach is the dashboard overview for quick performance access. This feature helps you track revenue and customer subscriptions, providing a clear overview of operations.

This means you get the clear data needed to make smarter, data-driven decisions for your business.

Pros & Cons

- ✅ Excellent automation features, especially for complex billing and invoicing.

- ✅ Highly customizable to fit diverse billing needs and company branding.

- ✅ Strong customer support known for being responsive and helpful.

- ⚠️ Some users report documentation can be vague and hard to locate.

- ⚠️ Cost might be a factor for smaller businesses with tighter budgets.

- ⚠️ Integration options, while present, may be fewer than some competitors.

These Stax Bill features work together to create a complete subscription billing ecosystem that automates your financial operations.

Stax Bill Pricing

Unsure what you’ll really pay?

Stax Bill pricing offers a transparent structure with clear plans, making it straightforward to understand the costs for your subscription management needs.

| Plan | Price & Features |

|---|---|

| Growth Plan | Starting at $499/month (billed annually) • Up to $85,000 monthly billings • Full feature set • No overage charges or hidden fees • Cost predictability |

| Enterprise Plan | Customized pricing – contact sales • For >$10M annual revenue • Tailored for large customer bases • Diverse subscription offerings • Scalable solutions |

1. Value Assessment

Transparent value available.

What I found regarding Stax Bill pricing is that their Growth plan offers excellent predictability for businesses up to $85,000 in monthly billings. Their no-overage-charge policy is a huge plus, preventing unexpected expenses as your revenue grows. You get access to the full feature set without hidden fees.

This means your budget gets clearer allocation, allowing you to focus on growth rather than variable software costs.

- 🎯 Bonus Resource: While discussing business operations, best whistleblowing software can help ensure compliance and build trust.

2. Trial/Demo Options

Evaluate before you buy.

Stax Bill offers a free demo option, which I highly recommend. This allows you to explore the platform’s capabilities and see how it fits your specific billing processes before committing to any pricing tier. What stood out is how this demo helps you validate operational fit for your unique subscription models.

This lets you confirm value for your business, ensuring you invest wisely when considering their full pricing.

3. Plan Comparison

Choose your scale wisely.

For businesses with moderate billing volumes, the Growth Plan offers robust features at a transparent cost, avoiding complex pricing. The Enterprise Plan, however, caters to larger organizations needing highly customized solutions. What impressed me is how Stax Bill scales gracefully with your revenue, preventing you from overpaying.

This helps you match pricing to actual usage requirements, ensuring you only pay for what your business truly needs.

My Take: Stax Bill’s pricing approach prioritizes transparency for growing businesses and customization for large enterprises, making it suitable for varying scales of subscription revenue.

The overall Stax Bill pricing offers predictable costs tailored to your business stage.

Stax Bill Reviews

What do real users think?

My analysis of Stax Bill reviews provides balanced insights into what actual customers experience. I’ve gathered feedback from platforms like Gartner Peer Insights and G2 to give you a clear picture.

1. Overall User Satisfaction

Users seem quite satisfied overall.

- 🎯 Bonus Resource: While we’re discussing user experience, creating a captivating visual identity for your brand through pixel art software is equally important.

From my review analysis, Stax Bill generally earns high ratings, sitting at 4.4 on Gartner and 4.2 on G2. What I found in user feedback is how most customers report significant improvements in their billing processes, which is a strong indicator of positive sentiment across Stax Bill reviews.

This suggests you can expect a generally positive experience with the platform.

2. Common Praise Points

Ease of use consistently delights users.

Customers frequently highlight the intuitive interface, making it simple to manage subscriptions and customize settings. From the reviews I analyzed, Stax Bill’s customer support is often praised for being highly responsive and knowledgeable, which significantly enhances the user experience.

This means you can expect a user-friendly system backed by strong support.

3. Frequent Complaints

Some minor frustrations do emerge.

While feedback is largely positive, some users mention vague documentation and integration limitations compared to competitors. Review-wise, what stands out is how cost can be a concern for smaller businesses, suggesting it might be perceived as expensive for some budgets.

These issues appear to be minor irritants rather than deal-breakers for most users.

What Customers Say

- Positive: “Staxbill is super easy to use. It is customisable to suit your billing needs and has a great customer support team.” (G2)

- Constructive: “Documentation can sometimes be vague or hard to find if you’re not used to navigating the system.” (Gartner Peer Insights)

- Bottom Line: “Reduced a week-long billing period down to a couple of hours, completely transformed our process.” (G2)

Overall, Stax Bill reviews reveal a highly positive user sentiment, though you should consider minor documentation and cost points.

Best Stax Bill Alternatives

So many billing options, which one is right?

The best Stax Bill alternatives include several strong options, each better suited for different business situations and priorities regarding subscription management and revenue.

1. Chargebee

Need extensive integrations and revenue recovery?

Chargebee excels if your business heavily relies on a wider array of pre-built integrations with your existing CRM, accounting, and marketing tech stack. What I found comparing options is that Chargebee offers robust revenue recovery tools and broader “Billing Automation” than Stax Bill, though often at a slightly higher cost.

Choose this alternative when deep integration capabilities and advanced revenue recovery are your top priorities.

2. Maxio

Seeking advanced revenue recognition and GAAP compliance?

Maxio (formerly SaaSOptics and Chargify) is a strong choice for scaling B2B SaaS companies that need robust revenue recognition and detailed financial reporting to ensure compliance. From my competitive analysis, Maxio provides more comprehensive financial solutions beyond just subscription management, though its “Grow” plan typically starts at a higher price point.

Consider Maxio if GAAP-compliant reporting and advanced revenue recognition are crucial for your B2B SaaS growth.

- 🎯 Bonus Resource: While discussing business operations and compliance, understanding best docket systems can help streamline legal processes.

3. Stripe Billing

Already deeply integrated with the Stripe ecosystem?

Stripe Billing is ideal if your business is already heavily invested in the broader Stripe ecosystem or if you have strong development resources. Alternative-wise, Stripe offers highly developer-friendly APIs and seamless embedding of payments, though it might require more custom work for full subscription management features compared to Stax Bill’s out-of-the-box solution.

Choose Stripe Billing if you prioritize developer control and a transaction-based pricing model within the Stripe platform.

4. Zoho Billing

Looking for a budget-friendly option within an ecosystem?

Zoho Billing (formerly Zoho Subscriptions) is often considered a more affordable alternative, especially for small to medium-sized businesses already using other Zoho products. What I found comparing options is that Zoho Billing provides cost-effective integration within the broader Zoho suite, making it a convenient and budget-conscious choice for existing Zoho users.

For your specific needs, Zoho Billing works best if you seek a cost-effective solution integrated with other Zoho applications.

Quick Decision Guide

- Choose Stax Bill: High-growth focus, payment flexibility, and strong revenue accrual

- Choose Chargebee: Extensive integrations and advanced revenue recovery tools

- Choose Maxio: Robust GAAP-compliant revenue recognition for B2B SaaS

- Choose Stripe Billing: Developer-centric with deep Stripe ecosystem integration

- Choose Zoho Billing: Cost-effective solution within the Zoho ecosystem

The best Stax Bill alternatives depend on your specific business size, budget, and integration needs rather than just features.

Stax Bill Setup

How complex is Stax Bill implementation?

For your Stax Bill review, understanding the setup process is key. This section provides practical guidance on what deployment entails, helping you set realistic expectations for time, resources, and potential challenges.

1. Setup Complexity & Timeline

Getting started is surprisingly straightforward.

Stax Bill’s cloud-based nature means you can be up and running in minutes for basic functions. However, full implementation, including custom billing rules and integrations, will require more planning. What I found about deployment is that its intuitive interface significantly reduces initial setup complexity for most businesses.

You should still allocate time for configuration, data migration, and testing to ensure everything aligns with your specific billing needs.

2. Technical Requirements & Integration

Expect minimal technical hurdles.

Your primary technical requirements include reliable internet access and compatible web browsers, which is typical for a cloud solution. From my implementation analysis, Stax Bill offers robust API capabilities and native integrations with popular software like Salesforce and QuickBooks. This means connecting to your existing systems is generally well-supported.

Plan for your IT team to manage API keys and data mapping for specific integrations, but extensive hardware or server setup isn’t required.

- 🎯 Bonus Resource: While we’re discussing software solutions, you might find my analysis of garage door software helpful for different industries.

3. Training & Change Management

User adoption is generally smooth with good support.

While Stax Bill is praised for ease of use, some advanced features might require initial training to master. From my analysis, comprehensive training and ongoing support are readily available from Stax Bill, helping your team leverage its full potential. This proactive approach supports a smoother transition for your users.

Invest in dedicated training sessions and identify internal champions to ensure your team quickly becomes proficient and adopts the new billing processes.

4. Support & Success Factors

Vendor support is a significant asset.

Customer support is consistently highlighted as a strong point, with users praising the team’s responsiveness and knowledge during setup and beyond. What I found about deployment is that their thorough assistance can significantly simplify your implementation process, addressing challenges promptly and effectively.

Leverage their support team for guidance on complex configurations and integrations to ensure a successful and efficient Stax Bill implementation.

Implementation Checklist

- Timeline: Weeks for full configuration and integrations

- Team Size: Finance/billing lead plus IT for integrations

- Budget: Primarily software costs; minimal additional setup fees

- Technical: Internet, browser, and integration API access

- Success Factor: Clear billing process definition and data readiness

The Stax Bill setup process offers a relatively straightforward deployment experience, especially with their strong customer support, allowing you to quickly automate your billing.

Bottom Line

Is Stax Bill the right choice for your business?

This Stax Bill review offers a comprehensive assessment, guiding you through who benefits most and why, ensuring your decision aligns perfectly with your business needs.

1. Who This Works Best For

Businesses with recurring revenue models.

Stax Bill is ideal for SaaS companies, online retailers, and membership-based organizations, regardless of size, needing to automate complex subscription billing. From my user analysis, businesses seeking to reduce manual billing errors and improve revenue recovery will find it exceptionally beneficial for their operations.

You’ll succeed if your current billing processes are manual, error-prone, or lack real-time financial insights and reporting capabilities.

2. Overall Strengths

Powerful automation and flexible pricing are key.

The software shines with its robust automation for invoicing, support for flexible pricing models like usage-based billing, and effective automated dunning for revenue recovery. From my comprehensive analysis, users report significant time savings and improved financial accuracy thanks to its intuitive interface and reliable performance.

These strengths directly translate into reduced operational overhead, better cash flow, and clearer insights into your recurring revenue metrics.

3. Key Limitations

Integration depth and documentation present challenges.

While Stax Bill offers integrations, some users might find its ecosystem less expansive compared to certain competitors, and a few note that documentation can be vague. Based on this review, businesses needing extensive niche integrations beyond its current offerings might need to develop custom solutions or explore alternatives.

I’d say these limitations are manageable if the core billing automation benefits outweigh the need for a vast array of pre-built integrations.

- 🎯 Bonus Resource: While we’re discussing business operations, understanding [endpoint security software](https://nerdisa.com/best-endpoint-security-software/) is equally important to protect your data.

4. Final Recommendation

Stax Bill earns a strong recommendation.

You should choose this software if your business relies on recurring revenue and you prioritize automation, efficient billing, and comprehensive subscription management. From my analysis, this solution significantly streamlines financial operations, making it a valuable asset for growth-focused companies managing subscriptions.

My confidence level is high for businesses seeking to modernize and optimize their billing processes with a reliable, user-friendly platform.

Bottom Line

- Verdict: Recommended

- Best For: SaaS companies and businesses with recurring revenue models

- Business Size: Small startups to large enterprises

- Biggest Strength: Automated invoicing and flexible pricing models

- Main Concern: Potential integration limitations for niche needs

- Next Step: Explore a demo to see its features in action

This Stax Bill review underscores its significant value for subscription-based businesses, providing a clear path to enhanced efficiency and revenue management.