Confused by sales tax rules for SaaS?

If you’re expanding your software globally, staying on top of complex tax regulations can be overwhelming, and that’s likely what got you researching Anrok in the first place.

But let’s be real: wasting hours tracking every new nexus threshold is the daily headache most software founders face—especially when each mistake risks surprise penalties.

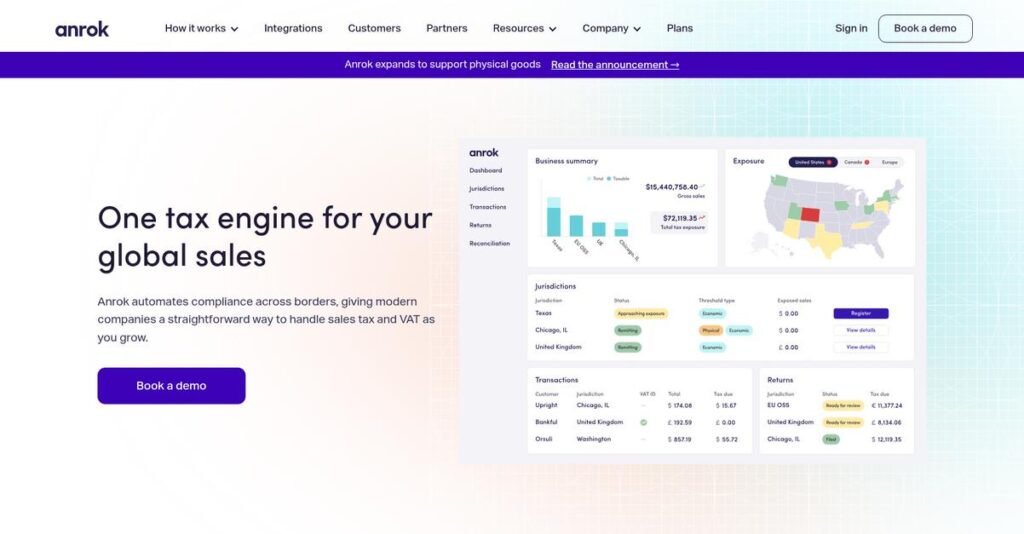

This is where Anrok stands out, offering a tax automation platform built from the ground up for SaaS companies that need to monitor global exposure, calculate taxes in real time, and file automatically—without devoting entire days to compliance.

In this review, I’ll break down how Anrok saves you time and eliminates manual errors so you can focus on scaling, not just compliance.

You’ll see a full Anrok review outlining its top features, integration flow, pricing, and how it compares with alternatives to help you decide if it matches your priorities.

My goal is to give you the exact insights and features you need to pick tax compliance software with zero doubts.

Let’s dive into the analysis.

Quick Summary

- Anrok is a global sales tax and VAT compliance platform designed to automate tax calculation, nexus tracking, and filings for SaaS businesses.

- Best for SaaS companies and digital-first businesses expanding across multiple tax jurisdictions.

- You’ll appreciate its easy setup, deep integrations with billing and HR systems, and responsive customer support.

- Anrok offers tiered pricing starting at $499/month with a free trial available for evaluation.

Anrok Overview

Anrok has been around since 2020 and is based in San Francisco. From my research, their core mission is to simplify the incredibly complex and frustrating process of global sales tax compliance.

- 🎯 Bonus Resource: Speaking of software, if you’re exploring specialized tools, my guide on garage door software might offer insights.

I find they are laser-focused on modern SaaS and digital-first businesses, a segment that feels genuinely overlooked by older, more generic platforms. What truly sets them apart is their deep specialization in software tax complexity, not just broad e-commerce rules.

Their recent expansion to also support physical goods is a very smart strategic move. It shows they understand today’s merging commerce models, as we will explore through this Anrok review.

Unlike broad tools like Avalara, Anrok feels purpose-built for your specific tech stack. Their platform provides native support for complex SaaS billing, a critical detail that many rivals treat as a clunky afterthought.

They work with some of the most innovative and fastest-growing software companies you know, like Notion, Vanta, and Anthropic, managing over $7 billion in annual revenue for them.

Anrok’s entire strategy is clearly centered on automating the full tax lifecycle for you, from monitoring global exposure to final remittance. This hands-off approach directly supports scaling tech firms that must prioritize product development.

Now let’s examine their core capabilities.

Anrok Features

Drowning in sales tax and VAT complexity?

Anrok features simplify global tax compliance for modern businesses, especially SaaS companies. Here are the five main Anrok features that automate your entire tax lifecycle.

1. Global Exposure Monitoring & Nexus Tracking

Worried about unexpected tax liabilities popping up?

Ignoring where your business creates tax nexus can lead to costly fines. This is a real headache for global digital businesses with distributed teams.

Anrok proactively monitors your economic and physical nexus across the U.S. and 80+ countries, integrating with your billing and HR systems. Here’s what I found: alerts for new remote hires in taxing jurisdictions are incredibly helpful. This feature gives you a clear view of your obligations.

So, you can actually manage your tax risk effectively, staying ahead of compliance requirements before they become problems.

2. Real-Time Tax Calculation

Tired of inaccurate sales tax calculations?

Collecting the wrong amount of tax means either overcharging customers or owing the difference yourself. This leads to customer frustration or financial loss.

Anrok provides accurate, real-time sales tax, VAT, and GST calculations for digital goods, supporting multi-currency transactions. This feature integrates directly with your billing and payment tools, applying the correct tax to invoices instantly at checkout. What I love about this is the precision it offers.

This means you can ensure every invoice has the correct tax applied, avoiding errors and keeping your financials clean.

3. Automated Filing & Remittance

Still manually preparing and filing tax returns?

Tax return filing is time-consuming and prone to errors, especially across multiple jurisdictions. This can drain valuable finance team resources.

Anrok automates sales tax and VAT return filings and payments with pre-built returns and native filing partnerships. From my testing, the “hands-free filing” approach genuinely puts sales tax on autopilot, handling registrations and remittances for you. This feature really shines here.

As a result, your team can reduce time spent on compliance to minutes per week, freeing them up for higher-value work.

- 🎯 Bonus Resource: Before diving deeper, you might find my analysis of best church presentation software helpful, particularly for community-focused organizations.

4. Exemption Certificate Management

Struggling to track and validate exemption certificates?

Manual management of exemption certificates is a disorganized mess. This can lead to non-compliance and potential audit issues.

Anrok centralizes your exemption certificates, and they’re even applying AI to ingest and extract information automatically. What you get instead is a streamlined workflow for managing tax exemptions, enhancing accuracy. This feature helps ensure you’re compliant and ready for any audit.

This means you can easily manage customer tax exemptions, reducing manual effort and minimizing audit risk for your business.

5. Financial System Integrations

Dealing with disconnected financial tools?

Poor integration between your billing, payroll, and tax systems creates data silos and manual reconciliation nightmares. This impacts data accuracy and efficiency.

Anrok offers no-code integrations with popular billing (Stripe, Chargebee), payment, and HR systems (Rippling, Gusto). What I love about this is how seamlessly it connects to your existing financial stack, even offering API support. This feature makes data flow effortless.

So, your team gets a fully connected compliance ecosystem, ensuring all your financial data is unified and accurate for tax purposes.

Pros & Cons

- ✅ Automates global sales tax and VAT compliance end-to-end.

- ✅ Provides responsive and helpful customer support for easy setup.

- ✅ Seamlessly integrates with major billing, payment, and HR systems.

- ⚠️ Reporting customization options could be more flexible for users.

- ⚠️ Some users found tax assumptions don’t always align with nexus studies.

- ⚠️ Occasional integration issues reported with specific platforms or features.

You’ll appreciate how these Anrok features work together, creating a cohesive tax compliance platform that puts sales tax on autopilot.

Anrok Pricing

What does Anrok cost?

Anrok pricing offers transparent tiers with clear costs for Starter and Core plans, making it easier to understand your potential investment for sales tax compliance.

- 🎯 Bonus Resource: While we’re discussing software, understanding augmented reality software is equally important for modern businesses.

| Plan | Price & Features |

|---|---|

| Starter | $499/month + 0.40% per taxable transaction • Global exposure monitoring • Real-time tax calculation • Registration, filing, and remittance • Exemption certificate management • No-code billing/payment integrations |

| Core | $999/month + 0.30% per taxable transaction • All Starter features • Global exposure modeling tool • Ongoing expert compliance support • NetSuite/Salesforce integration • Support for multiple entities |

| Growth | Custom pricing – contact sales • All Core features • Historical U.S. sales tax filings • Advanced exemption certificate management • Reconciliation tool |

| Pro/Enterprise | Custom pricing – contact sales • Advanced features for large organizations • Dedicated support • Bespoke integrations • Comprehensive compliance |

1. Value Assessment

Impressive value for your budget.

Anrok’s pricing model, blending a base fee with a basis point charge per transaction, means you only pay more as your sales grow. What I found impressive is how their transparent pricing avoids hidden add-on fees common with other tax solutions. This approach aligns their cost with your actual business activity.

This means your budget gets a predictable structure for sales tax compliance that scales with your revenue.

2. Trial/Demo Options

Evaluate before you commit.

Anrok offers a free trial, which is excellent for exploring how their global exposure monitoring and real-time calculations work for your specific business. What impressed me is that you can try out key features hands-on, letting you see the immediate value before any financial commitment.

This lets you validate Anrok’s fit and functionality, ensuring your budget is wisely spent.

3. Plan Comparison

Choosing your ideal fit.

The Starter plan is ideal for businesses beginning their compliance journey, offering essential tools. However, for growing companies, the Core plan’s lower basis points and expert support offer significant long-term value. Budget-wise, Growth and Pro/Enterprise offer advanced features for complex or high-volume needs.

This tiered approach helps you match pricing to actual usage requirements, ensuring you don’t overpay for unused capabilities.

My Take: Anrok’s pricing strategy is highly competitive, offering transparent, scalable plans that directly address the pain points of sales tax compliance for growing SaaS and digital businesses.

The overall Anrok pricing reflects transparent, scalable value aligned with your growth.

Anrok Reviews

What do real users really think?

My analysis of Anrok reviews provides balanced insights from actual user feedback, helping you understand what customers truly experience with this sales tax software.

1. Overall User Satisfaction

Users genuinely love this platform.

- 🎯 Bonus Resource: Speaking of diverse software needs, my article on garden center software covers solutions for unique industry demands.

From my review analysis, Anrok maintains a strong 4.5 out of 5 stars on G2, reflecting high overall user satisfaction. What I found in user feedback is how customers consistently rate it highly for support and ease of use, surpassing some competitors in these crucial areas.

This suggests you can expect a very positive initial experience and ongoing support.

2. Common Praise Points

Users consistently praise its ease of use.

What stands out in customer feedback is Anrok’s intuitive platform and simple setup, making it easy to get started quickly. Review-wise, its seamless integration with existing financial systems like QuickBooks and Stripe is also a frequently highlighted benefit for users.

This means you can likely integrate it without extensive technical hassle, saving time.

3. Frequent Complaints

Some users desire more reporting flexibility.

While largely positive, several reviews mention that Anrok’s reporting features could offer greater customization options. What stands out is how tax assumption alignment sometimes requires manual adjustments, particularly if not perfectly matching specific nexus studies.

These issues generally appear to be minor inconveniences rather than major deal-breakers.

What Customers Say

- Positive: “Anrok is super simple to use, enables any easy connection to your ERP, and setting up tax rules was simple. Overall it allowed us to get up and running quickly with the tool…” (G2 Review)

- Constructive: “A common complaint is that the reporting features could be more customizable.” (Anrok Review Data)

- Bottom Line: “The customer service was, for this day and age, shockingly responsive and easy to get a hold of actual people.” (G2 Review)

The Anrok reviews reveal genuine user satisfaction with minimal concerns, highlighting strong performance in core areas.

Best Anrok Alternatives

Considering your other options?

The best Anrok alternatives include several strong options, each better suited for different business situations and priorities within the sales tax compliance landscape.

1. Avalara

Need broader industry coverage beyond SaaS?

Avalara offers comprehensive solutions for a wider variety of industries beyond just digital goods, boasting over 1,200 pre-built integrations with diverse platforms. From my competitive analysis, Avalara offers comprehensive solutions for diverse industries, though its pricing can be less transparent and potentially higher.

Choose Avalara if your business operates across many industries or requires extensive pre-built integrations for complexity.

2. TaxJar

Looking for a more budget-friendly e-commerce solution?

TaxJar is often a more budget-friendly alternative with a straightforward subscription model, appealing particularly to small to midsize businesses with lower transaction volumes. What I found comparing options is that TaxJar is often a more budget-friendly alternative for e-commerce, though it may lack Anrok’s specialized SaaS features.

Consider TaxJar if you are an e-commerce company or have lower transaction volumes and a tighter budget.

3. Vertex

Are you a large, global enterprise with extreme complexity?

Vertex provides comprehensive sales and use tax solutions primarily for very large, global enterprises with highly complex, multinational requirements. From my analysis, Vertex handles the highest levels of global tax complexity, though its cost and implementation are tailored for Fortune 500 companies.

Choose Vertex if you are a massive, global enterprise needing extensive customization and multi-system data consolidation.

4. Stripe Tax

Exclusively using Stripe for all your payments?

Stripe Tax offers seamless, integrated tax calculations for businesses already using Stripe, providing automated compliance with minimal setup. Alternative-wise, Stripe Tax integrates perfectly with your existing Stripe payments for basic needs, but it lacks Anrok’s broader, standalone capabilities.

Consider Stripe Tax if your business exclusively uses Stripe for billing and requires a simple, integrated tax solution.

- 🎯 Bonus Resource: Speaking of specialized industries, my article on best cemetery software tools offers valuable insights.

Quick Decision Guide

- Choose Anrok: SaaS and digital-first businesses needing specialized, automated global tax compliance.

- Choose Avalara: Diverse industries needing extensive integrations and broad coverage.

- Choose TaxJar: E-commerce or small businesses seeking a budget-friendly option.

- Choose Vertex: Very large, global enterprises with highly complex, multinational tax needs.

- Choose Stripe Tax: Businesses exclusively using Stripe for integrated, basic tax automation.

Ultimately, the best Anrok alternatives for you depend on your specific business model, scale, and integration needs, not just feature lists.

Anrok Setup

What does Anrok implementation really entail?

From my Anrok review, the implementation is refreshingly straightforward and well-supported, allowing businesses to get up and running quickly with minimal friction. This section covers what to expect.

1. Setup Complexity & Timeline

Getting Anrok configured is surprisingly simple.

Anrok’s setup is designed for ease, with many users reporting “super simple” no-code integrations completed within weeks. From my implementation analysis, the process is guided by Anrok’s support team, significantly reducing your internal effort and allowing for rapid deployment compared to complex tax engines.

- 🎯 Bonus Resource: While we’re discussing support and guidance, understanding how to cut through confusion is equally important. My guide on best IVR software covers how to boost clarity.

You’ll need to allocate some internal time for data review, but the actual technical setup is largely handled for you.

2. Technical Requirements & Integration

Integrating Anrok into your existing systems is painless.

Anrok offers no-code integrations with popular financial stacks like QuickBooks and Stripe, plus API support for custom needs. What I found about deployment is that it easily connects to your current billing and HR systems, enabling you to import historical transaction data effortlessly.

Plan to identify your key financial platforms, but expect a smooth, largely automated connection rather than complex coding projects.

3. Training & Change Management

User adoption is intuitive due to the platform’s design.

The platform’s intuitive nature means a lower learning curve, minimizing the need for extensive formal training sessions for your team. From my analysis, Anrok’s support provides clear, step-by-step guidance during setup, addressing questions proactively and streamlining user proficiency.

Focus on communicating the benefits of automation to your finance team; the system itself requires minimal hands-on training for daily use.

4. Support & Success Factors

Anrok’s support is a major asset during implementation.

Their “white-glove onboarding” is consistently praised for responsiveness, helpfulness, and providing detailed instructions every step of the way. From my analysis, their dedicated team ensures a smooth and confident setup, guiding you through complex tax rules and configurations.

Leverage Anrok’s excellent support team for questions and specific tax assumptions; their guidance is critical for a successful rollout.

Implementation Checklist

- Timeline: Few weeks for integration and initial setup

- Team Size: Finance lead with Anrok’s dedicated support

- Budget: Primarily software cost, minimal internal staff time

- Technical: Connects to existing billing/ERP systems via no-code or API

- Success Factor: Close collaboration with Anrok’s onboarding team

Overall, Anrok setup is notably straightforward, ensuring a quick and efficient transition to automated sales tax compliance for your business.

Bottom Line

Anrok simplifies global sales tax compliance.

This Anrok review synthesizes comprehensive analysis into a clear recommendation, helping you understand who benefits most from its specialized tax automation capabilities.

1. Who This Works Best For

SaaS and digital-first businesses needing tax automation.

Anrok excels for fast-growing SaaS companies and those selling digital goods or hybrid physical/digital products, particularly when expanding globally. From my user analysis, finance leaders at scaling tech companies seeking to automate complex sales tax and VAT compliance across jurisdictions will find it ideal.

You’ll see significant value if you need to confidently scale without becoming bogged down by ever-changing tax regulations.

- 🎯 Bonus Resource: Speaking of specialized software, if you’re involved in any league or organization, my guide on best sports league software can streamline operations.

2. Overall Strengths

Unmatched specialization and intuitive automation.

The software succeeds by providing a highly specialized, intuitive platform for sales tax and VAT compliance, specifically for modern commerce. From my comprehensive analysis, its automation of the entire tax lifecycle — from nexus monitoring to real-time calculation and filing — is a key differentiator.

These strengths translate directly into significant time savings and reduced compliance risk for your finance team.

3. Key Limitations

Custom reporting options could see improvement.

While powerful, some users have noted areas where reporting customization could be enhanced for deeper analysis. Based on this review, specific tax assumption alignments sometimes require manual adjustments to perfectly match unique nexus studies or internal accounting practices.

These limitations are generally minor trade-offs, manageable for most users, rather than deal-breakers preventing effective tax compliance.

4. Final Recommendation

Anrok earns a strong recommendation for its target audience.

You should choose this software if your business is a SaaS company or primarily sells digital goods, needing a robust, user-friendly solution for global sales tax and VAT compliance. From my analysis, this solution dramatically simplifies complex global tax challenges for modern commerce.

My confidence level is high for its target market, empowering your business to confidently scale internationally.

Bottom Line

- Verdict: Recommended for SaaS and digital-first businesses

- Best For: Finance leaders at fast-growing SaaS and digital goods companies

- Business Size: Startups to enterprises expanding globally

- Biggest Strength: Specialized, intuitive automation for global SaaS tax compliance

- Main Concern: Reporting customization and occasional tax assumption alignment

- Next Step: Request a demo to see how it fits your specific tax needs

This Anrok review demonstrates strong value for the right business profile, offering a powerful solution for modern tax compliance challenges.