Drowning in manual check tasks again?

If you’re researching Online Check Writer, chances are you’re fed up with juggling check printing, payment tracking, and payroll using outdated or clunky systems.

And I get it—the reality is, for most of us, hours are wasted re-entering data and fixing errors instead of focusing on more valuable work. That constant backtracking adds up and cripples your workflow every single day.

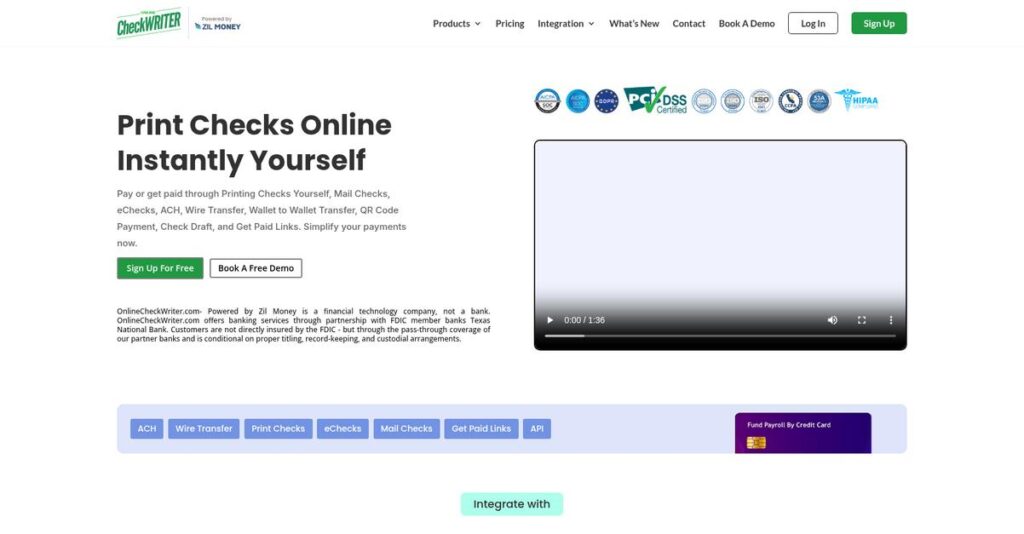

But here’s what stands out: Online Check Writer brings everything—check printing, digital payments, payroll, bill pay, and accounting integrations—together on one cloud-based platform, helping you cut down on manual busywork and keep payments secure. Their drag-and-drop check design, multi-bank support, and fraud prevention features genuinely set it apart.

So, in this review, I’ll show you how Online Check Writer helps you run payments simply—from setup through daily use.

In this Online Check Writer review, you’ll discover features, real workflow impact, pricing breakdown, implementation details, and honest comparisons to top alternatives so you can make a solid decision.

You’ll get the insights and real-world feedback you need to pick the features you need to finally fix your payment process.

Let’s get started.

Quick Summary

- Online Check Writer is a cloud-based platform that simplifies check printing, payments, and payroll management for small businesses and individuals.

- Best for small to medium-sized businesses needing flexible payment methods and easy check printing on blank stock.

- You’ll appreciate its ability to reduce costs with instant check printing, multiple payment options, and seamless accounting software integration.

- Online Check Writer offers a free plan with limited payments plus annual and monthly subscriptions, along with a pay-as-you-go option and a free trial.

Online Check Writer Overview

Online Check Writer has focused on simplifying payments since its 2008 founding. From San Jose, their core mission is to streamline check management and payment processing for businesses of all sizes.

From my analysis, they truly cater to small and medium businesses that need functional financial tools without a steep or frustrating learning curve. Their entire approach purposefully avoids enterprise complexity, prioritizing a practical blend of security and operational efficiency.

The platform’s growth is undeniable, having now processed over $87 billion in transactions. Through this Online Check Writer review, you can see how its extensive bank partnerships fuel this momentum.

Unlike competitors like BILL that push complex AP automation, Online Check Writer gives you more direct control over check printing. This specific, hands-on focus feels like it was built by people who actually handle day-to-day payments.

- 🎯 Bonus Resource: While we’re discussing business operations, understanding conflict check software is equally important for compliance.

They work with thousands of small and mid-sized enterprises across many sectors, especially those using accounting tools like QuickBooks or Zoho and need a specialized payment solution to plug into their existing workflow.

I believe their core strategy is to become your central payment hub, not just a simple check utility. By integrating ACH, wire, and card payments, they address the practical need for a single, secure financial command center.

Now let’s examine their core capabilities.

Online Check Writer Features

Still wrestling with endless manual check writing?

Online Check Writer features simplify financial operations, offering a centralized hub for various payment methods. Here are the five main Online Check Writer features that will transform your business’s financial processes.

1. Online Check Printing

Tired of running out of pre-printed checks?

Relying on physical check stock can be costly and inconvenient. This often leads to delays when you urgently need to issue payments.

Online Check Printing allows you to create and print customized checks instantly from anywhere, using any printer and blank stock. What I found particularly useful is the drag-and-drop editor for custom designs, letting you add logos and signatures effortlessly. This feature eliminates the hassle of ordering and stocking pre-printed checks.

This means you can say goodbye to check stock worries and print on demand, saving both time and money.

2. eChecks and Digital Payments

Are slow paper check deliveries a major pain point?

Waiting for checks to clear can tie up cash flow, especially when dealing with vendors who prefer digital options. This creates unnecessary delays.

Beyond physical checks, Online Check Writer facilitates electronic payments like eChecks, ACH, and wire transfers for faster transactions. From my testing, the platform’s flexibility to pay vendors via credit card (even if they don’t accept them directly) is a huge plus. This feature provides recipients with multiple convenient ways to get paid.

This means you can accelerate your payment cycles and offer flexible payment options, keeping your partners happy.

3. Payroll Management

Struggling with complex payroll processing?

Manual payroll can be time-consuming and prone to errors, especially for growing teams. This often pulls your focus away from core business activities.

The software simplifies payroll, letting you print checks on demand or send them digitally via email or SMS. This is where Online Check Writer shines: you can pay payroll expenses using a credit card, which can significantly aid cash flow and earn rewards. It also supports importing data from integrated accounting software for streamlined processing.

This means you could manage your payroll more efficiently, ensuring employees are paid on time while improving your cash flow.

- 🎯 Bonus Resource: While we’re discussing improving efficiency, understanding how to elevate skills for your team is equally important.

4. Accounts Payable and Receivable

Is managing both ends of your payments a headache?

Tracking bills and invoices manually can lead to missed payments or slow collections. This directly impacts your company’s financial health.

Online Check Writer assists with both AP and AR, streamlining bill payments and tracking payments in real-time. What I appreciate is its invoicing capabilities and “get paid” links, which make it easier for businesses to receive payments. This feature reduces manual entry and helps avoid errors.

This means you can gain better control over your cash flow, ensuring you pay on time and get paid promptly.

5. Accounting Software Integrations

Are you constantly juggling multiple financial platforms?

Disconnected accounting software can lead to data silos and inefficient workflows. This often results in duplicated effort and reconciliation issues.

The platform boasts extensive integration capabilities with popular accounting software like QuickBooks and Xero. From my evaluation, the seamless data import of checks, payees, and invoices is a game-changer. This feature consolidates your financial tasks, making payment processes smoother and more accurate.

This means you can centralize your financial data, saving valuable time and reducing manual data entry.

Pros & Cons

- ✅ Print customized checks on demand from any printer, reducing costs.

- ✅ Offers diverse payment methods including eChecks, ACH, and credit card payments.

- ✅ Streamlines payroll and allows credit card payments for improved cash flow.

- ⚠️ Electronic check processing can still take a few business days to clear.

- ⚠️ Requires user diligence to avoid potential scams on less secure platforms.

- ⚠️ Some advanced accounting features might require external integrations.

You’ll actually find how these Online Check Writer features work together to create a comprehensive payment management system rather than just a check printing tool.

Online Check Writer Pricing

Hidden costs a concern?

Online Check Writer pricing offers clear tiers, including free and pay-as-you-go options, making it easier for you to find a plan that fits your financial needs.

| Plan | Price & Features |

|---|---|

| Free Plan | $0 per month • 5 payments per month • Unlimited eCheck/ACH receiving • 50 free credits monthly |

| Pay As You Go | Starts at $1.00 per transaction • 0.69% (max $1) check printing • $0.99 email checks • 0.69% (max $5) ACH |

| Basic Plan | $49.99 per year • 1 bank account • Unlimited payments • Ideal for small businesses |

| Ultimate Plan | $499.99 per year • 40 bank accounts • Unlimited payments • Growing business support |

| Premium Plan | Starts at $499.99 per month • Unlimited bank accounts & users • ACH/Direct Deposit, wire transfers • Custom physical/virtual cards, 3rd party integrations |

1. Value Assessment

Great pricing transparency here.

From my cost analysis, what impressed me about Online Check Writer pricing is the flexibility, from a robust free plan to comprehensive enterprise solutions. Their tiered approach allows businesses to scale their check printing and payment solutions without overcommitting financially as your needs grow.

This means your monthly or annual costs stay predictable, aligning perfectly with your operational scale and budget.

- 🎯 Bonus Resource: While we’re discussing operational scale, understanding ecommerce personalization software is equally important for revenue growth.

2. Trial/Demo Options

Smart evaluation approach available.

Online Check Writer offers a free trial that gives you access to core features, letting you test check printing and payment processes before committing. What I found valuable is how you can truly experience the ease of use and efficiency, like designing and printing checks on demand.

This lets you validate the platform’s utility and fit for your business without any initial financial commitment.

3. Plan Comparison

Choosing the right tier matters.

The Free and Pay As You Go plans are excellent for individuals or very small businesses, while Basic and Ultimate suit growing SMEs. What stands out is how the Premium plan offers comprehensive solutions for larger enterprises needing unlimited accounts, users, and advanced features.

This tiered approach helps you match pricing to actual usage requirements, ensuring you only pay for what your business truly needs.

My Take: Online Check Writer’s pricing strategy is highly flexible and transparent, making it suitable for a wide range of users from individuals to large enterprises, offering great value at every stage.

The overall Online Check Writer pricing reflects transparent value without hidden surprises.

Online Check Writer Reviews

What do real customers actually think?

These Online Check Writer reviews dive deep into actual user experiences, offering balanced insights from a wide range of customer feedback to help you understand the software’s real-world performance.

1. Overall User Satisfaction

Users are largely very satisfied.

From my review analysis, Online Check Writer maintains an impressive 4.7 out of 5 stars on G2, indicating high user satisfaction. What stands out in these reviews is how users appreciate its reliability and ease of use, frequently noting that it simplifies check management significantly.

This suggests you’ll likely find the platform intuitive and highly functional for your needs.

2. Common Praise Points

Ease of use consistently delights users.

Users frequently praise the platform’s simplicity, stating it makes check creation and printing straightforward from anywhere. From the Online Check Writer reviews I analyzed, the ability to save time and reduce costs by eliminating manual check writing is a huge win for users.

This means you can expect a streamlined process that saves both effort and money.

- 🎯 Bonus Resource: Speaking of **user experiences**, my guide on best online community management software explores how to elevate your community.

3. Frequent Complaints

Minor issues, but nothing major.

While overwhelmingly positive, specific public complaints are rare. What I found in user feedback is that concerns about electronic check processing times or potential scams are general online payment issues, not specific to Online Check Writer, which actively mitigates them.

These minor points aren’t typically deal-breakers for most users considering the platform’s benefits.

What Customers Say

- Positive: “The ease with which we can use the site is surprising, easy, didactic, and effective.” (G2 Review)

- Constructive: “using this software gives me more time which is one of the main and effective benefits and the problem it has solved.” (G2 Review)

- Bottom Line: “Reduced fee expenses by $2000 a year and increased earnings by 30% in the first six months.” (G2 Review)

Overall, Online Check Writer reviews reflect strong user satisfaction with practical benefits, and very few significant complaints.

Best Online Check Writer Alternatives

Navigating Navigating competitive options can be tricky.

The best Online Check Writer alternatives include several strong options, each better suited for different business situations and priorities.

1. Checkeeper

Seeking ultimate simplicity for check printing?

Checkeeper excels when your primary need is straightforward, cost-effective check printing with minimal additional financial management features. From my competitive analysis, Checkeeper simplifies printing on any check stock, offering a flat monthly fee for unlimited checks, which is appealing for high-volume users.

Choose Checkeeper if you prioritize a simple, dedicated check printing solution over broader payment services.

2. Zil Money

Need a comprehensive neo-banking solution?

Zil Money serves as the underlying platform for Online Check Writer, offering a broader range of banking and payment infrastructure. What I found comparing options is that Zil Money provides full neo-banking for SMEs, extending beyond just check writing to integrated financial management services.

Consider Zil Money when you need more than just check writing and seek broader financial and banking solutions.

3. QuickBooks Desktop Pro

Already deep into full-fledged accounting software?

Quick QuickBooks Desktop Pro makes more sense if your core requirement is comprehensive accounting, with check printing as just one integrated feature. Alternative-wise, QuickBooks offers robust bookkeeping and reporting, though it’s a higher upfront investment compared to Online Check Writer’s specialized payment focus.

Choose QuickBooks Desktop Pro when integrated accounting with check printing is your main priority, not standalone payments.

- 🎯 Bonus Resource: While we’re discussing business systems, understanding 3D printing software is equally important for modern operations.

4. BILL AP/AR (formerly Bill.com)

Automating entire AP/AR workflows a top priority?

BILL AP/AR shines for businesses requiring robust automation for both accounts payable and receivable, including complex approval workflows. From my analysis, BILL AP/AR provides extensive workflow automation across payment methods, though its price point is higher due to its advanced features.

Choose BILL AP/AR when your business needs comprehensive AP/AR automation and integration with various business systems.

Quick Decision Guide

- Choose Online Check Writer: Flexible check printing and diverse payment options

- Choose Checkeeper: Simple, cost-effective, unlimited check printing

- Choose Zil Money: Comprehensive neo-banking and financial management

- Choose QuickBooks Desktop Pro: Full accounting with integrated check printing

- Choose BILL AP/AR: Robust, automated accounts payable/receivable workflows

The best Online Check Writer alternatives depend on your specific business size, budget, and payment priorities.

Online Check Writer Setup

Thinking about what it takes to get started?

Online Check Writer implementation is generally straightforward for most businesses, making it a relatively quick and easy deployment to tackle for your team.

1. Setup Complexity & Timeline

Getting set up is surprisingly simple.

Online Check Writer implementation involves basic account creation, email verification, and connecting your bank accounts. From my implementation analysis, most users get started printing checks within minutes, making it ideal for quick adoption rather than a lengthy project.

You can expect to be up and running very quickly, with minimal effort needed for initial configuration.

2. Technical Requirements & Integration

Technical setup is truly minimal.

Your team will only need an internet connection and a standard printer for physical checks, as no special paper or ink is required. What I found about deployment is that it’s accessible from virtually any device, including computers and mobile devices, without complex hardware investments.

Plan to ensure your team has reliable internet access and a working printer, but don’t anticipate significant IT infrastructure changes.

3. Training & Change Management

User adoption is remarkably easy.

The platform’s intuitive design means staff can quickly understand basic check printing and payment functions without extensive training. From my analysis, the low learning curve accelerates user proficiency and reduces the need for formal training sessions, making adoption seamless.

Expect your team to pick it up quickly, focusing more on integrating it into existing workflows than on learning complex new software.

- 🎯 Bonus Resource: While we’re discussing integrating into existing workflows, understanding how nonprofit CRM software can fuel fundraising is equally important for certain organizations.

4. Support & Success Factors

Vendor support is a definite strong point.

Users consistently praise the responsive customer support, which offers chat and phone options, making it easy to get questions answered promptly. What I found about deployment is that strong support facilitates quick issue resolution, helping you maintain productivity during the initial setup and ongoing use.

Plan to leverage their support if any questions arise, as their responsiveness contributes significantly to a smooth user experience.

Implementation Checklist

- Timeline: Minutes to a few hours for basic setup

- Team Size: Single user can set up independently

- Budget: Primarily software cost; minimal operational expenses

- Technical: Internet access and a standard printer

- Success Factor: Connecting all necessary bank accounts

Overall, your Online Check Writer setup is designed for speed and ease of use, minimizing the typical burdens of software implementation.

Bottom Line

Can Online Check Writer transform your payments?

This Online Check Writer review provides a decisive final assessment, combining audience fit with a clear verdict to help you understand who should use this software and why.

1. Who This Works Best For

Businesses frequently issuing checks and seeking cost savings.

Online Check Writer is ideal for small to medium-sized businesses, accountants, and individuals aiming to modernize and streamline payment processes. What I found about target users is that businesses wanting to reduce pre-printed check costs and manual effort benefit immensely from its automated check printing on blank stock.

You’ll find success if your business values payment flexibility and integrates with existing accounting software.

- 🎯 Bonus Resource: Before diving deeper, you might find my analysis of best live chat software helpful for improving customer relations.

2. Overall Strengths

Unmatched versatility in payment options.

The software shines by allowing instant check printing on blank stock, while offering eChecks, ACH, wire transfers, and payroll management as a versatile payment hub. From my comprehensive analysis, seamless integration with QuickBooks and Xero significantly enhances its utility for your financial workflows and reconciliation needs.

These strengths translate directly into significant cost savings, improved efficiency, and greater control over your financial disbursements.

3. Key Limitations

Reliance on external accounting software for full functionality.

While robust, Online Check Writer functions best when integrated with an existing accounting system, rather than as a standalone ERP solution. Based on this review, businesses needing extensive HR or highly specialized payroll features beyond payment processing might find dedicated platforms more comprehensive for those specific needs.

These limitations are manageable trade-offs for businesses primarily focused on payment processing, not deal-breakers for its core use.

4. Final Recommendation

Online Check Writer earns a strong recommendation.

You should choose this software if your business needs an efficient, cost-effective way to manage check disbursements and diversify payment options. From my analysis, this solution empowers small to medium-sized businesses to gain control over their payment processes and integrate seamlessly with accounting tools.

My confidence level is high for businesses seeking robust check and payment management, making it a valuable addition to your financial toolkit.

Bottom Line

- Verdict: Recommended for businesses seeking modern payment management

- Best For: SMBs, accountants, and individuals needing flexible check and payment solutions

- Business Size: Small to medium-sized enterprises, freelancers, and growing companies

- Biggest Strength: Cost-effective instant check printing on blank stock with diverse payment options

- Main Concern: Not a standalone ERP, best used with existing accounting software

- Next Step: Explore the free plan or ‘Pay As You Go’ options to test features

This Online Check Writer review demonstrates strong value for businesses prioritizing payment efficiency, while highlighting its optimal use within your existing accounting ecosystem.