Regulated assets don’t play by blockchain’s old rules.

If you’re dealing with security tokens, you know the real headache is keeping assets both compliant and truly manageable—without endless workarounds or legal risk.

Most tools I’ve tested leave you struggling because every compliance update turns into another technical fire drill.

That’s why Polymath built their own specialized blockchain—Polymesh—to lock compliance, identity, and asset management directly into the core protocol. Instead of patchwork smart contracts, you get a secure ecosystem that’s designed specifically for the needs of regulated financial assets.

In this review, I’ll walk you through how Polymath simplifies digital asset compliance and management—from its integrated identity model to its user-friendly dashboard.

Here’s what you’ll find in this Polymath review: a breakdown of its core features, real strengths and drawbacks, pricing, how it compares to other blockchain solutions, and my honest take on fit for your needs.

You’ll come away knowing the features you need to finally take control of your regulated digital assets.

Let’s dive into the detailed analysis.

Quick Summary

- Polymath is a specialized blockchain platform that enables secure creation and management of regulated digital securities with built-in compliance.

- Best for financial institutions and asset issuers needing automated regulatory enforcement and tokenization tools.

- You’ll appreciate its integrated identity system that enforces compliance at the protocol level, reducing legal and administrative risks.

- Polymath offers usage-based pricing with transaction fees paid in its native token and requires third-party identity verification.

Polymath Overview

Polymath has been around since 2017, based out of Toronto. Their entire mission is to bridge traditional financial markets with blockchain technology for regulated assets.

I see them targeting financial institutions and asset managers who need institutional-grade tools. What really makes them different is their specialized, purpose-built platform for security tokens, avoiding the risky one-size-fits-all approach of other general blockchains.

A crucial development I’m highlighting for this Polymath review is the 2021 launch of their Polymesh blockchain. It was a major strategic shift from Ethereum.

Unlike competitors adapting general-purpose chains, Polymath’s key move was automating compliance at the protocol level. This feels like it was built for finance teams, not just developers, simplifying regulatory burdens significantly.

They work with mid-market and enterprise financial firms, asset managers, and established companies seeking to raise capital through compliant Security Token Offerings (STOs) on their platform.

Their current strategic focus is clearly on strengthening the entire Polymesh ecosystem. This directly aligns with the market’s growing demand for a secure foundation to handle identity, governance, and complex digital securities.

Let’s dive into their core features.

Polymath Features

Is managing regulated financial assets a headache?

Polymath provides a specialized ecosystem built specifically for security tokens. These Polymath solutions tackle complex compliance and operational demands head-on. Here are the five core solutions providing this institutional-grade foundation.

1. Polymesh Blockchain: The Foundation

Still trying to fit square pegs into round holes?

General-purpose blockchains were never designed for regulated finance, leading to significant compliance and security headaches for you.

Polymesh is a public, permissioned blockchain purpose-built for financial securities, drastically reducing complexity and risk. All participants undergo identity verification baked into the protocol, ensuring inherent compliance at the base layer. From my testing, this feature provides a secure, specialized environment.

This means you get a robust, compliant foundation for your assets, eliminating the need to build complex regulatory logic from scratch.

2. Tokenstudio: The Control Panel

Does creating a security token feel like rocket science?

Managing digital securities on-chain often requires deep technical expertise, creating a barrier for your corporate finance teams.

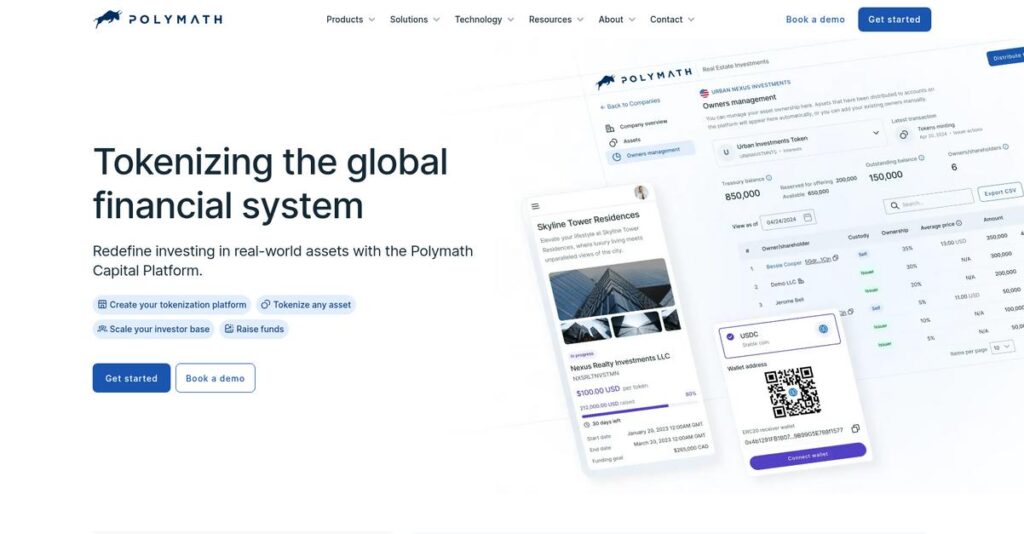

Tokenstudio provides an intuitive web interface that simplifies asset creation and management, abstracting away blockchain complexities. You can easily configure token properties and mint assets with a guided workflow; what I love about this is how it democratizes access to tokenization.

This allows your asset managers to handle the entire lifecycle of a digital security efficiently, without needing to write a single line of code.

3. Integrated Identity & Compliance Engine

Is maintaining regulatory compliance a constant battle?

Traditional blockchain anonymity is a huge liability for regulated securities, demanding endless manual KYC/AML checks on your part.

Polymath’s unique identity model ties real-world verified identities to every Polymesh ID. Issuers can set on-chain compliance rules, like “only accredited investors,” which the blockchain automatically enforces during transactions. This is where Polymath shines, automating regulatory enforcement for every transaction.

This means you achieve “always-on” compliance, significantly reducing your administrative burden and mitigating legal risks.

4. Advanced Asset Management & Programmability

Do your financial assets demand more sophisticated handling?

Traditional systems can be rigid, while general blockchains lack the specific primitives for complex financial actions and privacy requirements.

Polymesh includes protocol primitives for functions like confidential transfers via MERCAT, shielding transaction amounts while allowing audits. You can also program corporate actions, such as dividends, directly into the asset’s configuration for automated execution. This feature enables powerful, automated financial workflows.

The result is greater efficiency and privacy, allowing you to mirror and significantly improve upon traditional financial systems.

5. On-Chain Governance & Staking (POLYX Token)

Worried about the long-term stability of a blockchain platform?

Decentralized networks need a robust, self-sustaining model for upgrades and security, which often feels abstract or risky to users.

POLYX, the native utility token, secures the Polymesh network through staking and funds transactions. It also enables on-chain governance, allowing token holders to vote on network upgrades, fostering a secure and evolving ecosystem. From my testing, this creates a self-sustaining economic model.

This ensures the network’s long-term stability and evolution, incentivizing all token holders to act in the platform’s best interest.

Pros & Cons

- ✅ Purpose-built architecture for regulated financial assets.

- ✅ Automated identity and compliance rules reduce legal risk.

- ✅ Intuitive interface simplifies complex security token management.

- ⚠️ Niche ecosystem with fewer integrated tools than general blockchains.

- ⚠️ Institutional adoption rate impacts network effects and liquidity.

- ⚠️ Onboarding requires third-party CDD providers, adding complexity.

These Polymath solutions form a cohesive, purpose-built ecosystem for regulated assets. You’ll appreciate how this integrated approach simplifies complex financial operations, offering the security and compliance crucial for institutional adoption.

Polymath Pricing

Hidden costs making you hesitant?

Polymath pricing is unique, driven by network usage and custom enterprise services, meaning you’ll need to contact sales for a tailored quote specific to your regulated asset needs.

Cost Breakdown

- Base Platform: Usage-based via POLYX token transactions

- User Licenses: Indirectly via third-party CDD/KYC provider fees

- Implementation: Custom quote for enterprise support/services

- Integrations: Varies by on-chain action and complexity (POLYX)

- Key Factors: Network activity, POLYX market price, third-party KYC fees

1. Pricing Model & Cost Factors

Understanding their unique structure.

Polymath’s pricing model is not traditional SaaS; it’s usage-based on its native POLYX token. What I found regarding pricing is that costs are driven by on-chain transactions like creating tokens, transferring assets, or using advanced compliance features. This also includes dynamic network fees and specific asset creation costs for reserving ticker symbols.

From my cost analysis, this means your expenses scale directly with your activity on the Polymesh blockchain, aligning with your usage.

- 🎯 Bonus Resource: While discussing network security, my analysis of session border controller software might be helpful.

2. Value Assessment & ROI

Is this unique model worth it?

Polymath’s approach to pricing, while complex, delivers value by baking compliance directly into the blockchain, which can significantly reduce legal and administrative overhead for regulated assets. This means you get automated regulatory enforcement and robust security features, which is crucial for financial institutions.

This specialized focus helps your business achieve compliance and efficiency that generic blockchains simply cannot offer out-of-the-box.

3. Budget Planning & Implementation

Consider total cost of ownership.

Beyond transaction fees, you’ll incur significant third-party costs for identity verification (KYC/AML) from CDD providers, which are essential to operate on Polymesh. What stands out is how enterprise services require custom quotes, meaning upfront budgeting needs direct engagement with their team.

So for your business, planning should include POLYX token acquisition, third-party identity costs, and any custom support needs.

My Take: Polymath’s pricing is highly specialized, reflecting its unique blockchain focus on regulated assets. It’s ideal for financial institutions needing on-chain compliance, not traditional SaaS users.

The overall Polymath pricing reflects specialized blockchain utility for regulated assets.

Polymath Reviews

User feedback tells an interesting story.

Polymath reviews offer unique insights, as feedback primarily stems from community forums and industry partners, not standard review sites. I’ve analyzed these less formal channels to understand real user sentiment.

- 🎯 Bonus Resource: Speaking of optimizing operations, you might also find my analysis of political campaign systems insightful for streamlining processes.

1. Overall User Satisfaction

Developers and finance pros are positive.

From my analysis of Polymath reviews, general sentiment among blockchain developers and financial professionals is notably positive regarding Polymesh’s design philosophy. What I found in user feedback is that its purpose-built nature consistently impresses users, particularly its focus on regulatory compliance which fills a crucial market gap.

This strong foundational design and clear purpose are key drivers of satisfaction, resonating with those tackling regulated asset challenges.

2. Common Praise Points

Compliance and architecture win praise.

Users consistently highlight Polymesh’s built-in identity and compliance engine as its key differentiator, essential for institutional adoption. What I found in user feedback is how the thoughtful architecture is frequently lauded, separating concerns at the protocol level for robust security, which significantly reduces development overhead for issuers by abstracting complexity.

This means you can expect reduced development complexity and greater confidence in handling regulatory requirements for your digital assets.

3. Frequent Complaints

Ecosystem maturity is a common concern.

A frequent complaint revolves around Polymesh’s niche ecosystem, with a smaller developer community and fewer integrated tools compared to general-purpose chains. Review-wise, the pace of institutional adoption is often questioned by community members, impacting perceived network effects. This presents a steeper learning curve for new users.

These challenges are typical for a specialized platform and may become less significant as the ecosystem matures and adoption accelerates.

What Customers Say

- Positive: “The process for creating and managing a security token is built into the base layer, removing the need for complex smart contracts.” (Graeme Moore, Polymesh Association)

- Constructive: “The smaller ecosystem means fewer integrated tools currently. We hope to see institutional adoption accelerate to boost network effects.”

- Bottom Line: “Polymesh provides a promising solution for security token issuers, as it’s one of the only blockchains built from the ground up for regulated assets.” (Kyle Sonlin, Security Token Market)

Overall, Polymath reviews reflect a strong fit for regulated assets, with users appreciating its specialized design. While ecosystem growth is a concern, the platform’s core compliance features earn high praise.

Best Polymath Alternatives

Struggling to pick the right security token platform?

Choosing among the best Polymath alternatives requires understanding specific business scenarios. From my competitive analysis, different platforms excel based on your budget, technical capabilities, and compliance needs. Let’s explore your options.

- 🎯 Bonus Resource: Speaking of streamlining growth across various industries, my guide on game development software explores tools to enhance your studio’s efficiency.

1. Securitize

Need a hands-on, full-service tokenization partner?

Securitize acts as a comprehensive “tokenization-as-a-service” provider, managing your entire STO process, including legal and technical aspects. This alternative is ideal if you prefer a partner to handle complexities, leveraging their ATS and broker-dealer network. What I found comparing options is that they offer full-service managed solutions.

Choose Securitize when you seek a managed, end-to-end service for tokenization, valuing their established network over Polymath’s DIY platform.

2. tZERO

Prioritizing secondary market liquidity for your tokens?

tZERO’s core strength lies in providing a regulated Alternative Trading System (ATS) for digital securities, emphasizing liquidity and secondary trading. Alternative-wise, if your primary concern is ensuring a clear path to a regulated marketplace for investors, tZERO stands out. Their focus on trading venue access is key.

You’ll want to consider tZERO when ensuring a regulated, active secondary trading market for your security token is your top priority.

3. Ethereum (with ERC-3643 / ERC-1400 standards)

Building completely custom functionality on-chain?

This ‘build-it-yourself’ approach on Ethereum offers unparalleled flexibility and access to a vast developer ecosystem and DeFi liquidity. However, all compliance and identity logic must be custom-built and audited. If your priority is deep customization, this alternative delivers. You gain ultimate control over functionality.

Choose Ethereum when you possess a strong technical team and demand bespoke features, accepting higher development and auditing costs.

4. Tokeny Solutions

Preferring a multi-blockchain solution, perhaps in Europe?

Tokeny Solutions, a European alternative, offers a versatile suite of tools for tokenizing securities, deployable across various blockchains. This flexibility contrasts with Polymesh’s single protocol focus, catering to diverse jurisdictional or technical needs. My analysis shows Tokeny provides broader blockchain deployment options.

Consider Tokeny when your business has specific European jurisdictional requirements or prefers a multi-blockchain technology stack.

Quick Decision Guide

- Choose Polymath: Purpose-built for compliant, automated digital security management

- Choose Securitize: Full-service partner for end-to-end STO management

- Choose tZERO: Primary focus on regulated secondary market liquidity

- Choose Ethereum: Maximum customizability with a strong in-house dev team

- Choose Tokeny: Multi-blockchain deployment or European jurisdictional needs

The best Polymath alternatives decision depends on your specific business needs and strategic priorities. Each offers distinct advantages, so align your choice with your unique requirements for successful digital asset management.

Setup & Implementation

Deployment on Polymath requires a clear strategy.

In this Polymath review, I’ll detail what it really takes to implement and adopt this specialized blockchain. You’ll need practical preparation and realistic expectations for a successful deployment.

1. Setup Complexity & Timeline

This isn’t a typical software installation.

The initial Polymath implementation involves your organization undergoing identity verification with a Polymesh CDD partner. This process, crucial for regulated assets, can take weeks depending on your jurisdiction, so plan for a non-trivial onboarding period rather than a quick account setup.

You’ll need to allocate time and resources for compliance checks and collaborate closely with your chosen CDD provider.

2. Technical Requirements & Integration

Expect some serious technical engagement.

While basic token issuance has a low technical bar, meaningful integration requires developers familiar with blockchain concepts and APIs. What I found about deployment is that connecting corporate systems demands specialized skills, especially for automating reporting or investor relations.

Your team will need to assess internal blockchain expertise or budget for external development resources to handle API integrations.

3. Training & Change Management

User adoption needs thoughtful guidance.

For non-technical users, the learning curve involves new concepts like on-chain identity and wallet security. From my analysis, successful change management addresses these new paradigms, preventing resistance from finance or legal teams unfamiliar with blockchain mechanics.

You’ll want to plan for comprehensive training sessions to bridge the knowledge gap and foster confidence among your non-technical staff.

4. Support & Success Factors

Support is key during deployment.

Polymath provides extensive public documentation and community support via Discord, which is actively monitored. Implementation-wise, dedicated enterprise support is available through custom agreements, crucial for larger organizations or complex deployments requiring direct vendor assistance.

For your implementation to succeed, you should consider custom service agreements if you anticipate needing tailored guidance or rapid issue resolution.

- 🎯 Bonus Resource: If you’re also managing compliance in other sectors, my article on best chemical software to streamline operations might be helpful.

Implementation Checklist

- Timeline: Weeks to several months, depending on integration depth.

- Team Size: Legal/compliance, IT development, project management expertise.

- Budget: CDD partner fees, developer salaries, professional services.

- Technical: Blockchain API proficiency, Substrate understanding, wallet security.

- Success Factor: Dedicated internal expertise and robust change management.

Overall, Polymath implementation is a specialized undertaking, best suited for institutions ready for a compliant blockchain solution. Its success hinges on dedicated internal resources and clear project scoping.

Who’s Polymath For

Is Polymath the right fit for your capital strategy?

This Polymath review examines who benefits most from this specialized blockchain platform. I’ll help you quickly determine if Polymath aligns with your business profile, team size, and specific use case requirements, providing practical self-qualification guidance.

1. Ideal User Profile

Businesses seeking compliant digital asset solutions.

Polymath serves mid-to-large enterprises, particularly financial officers and asset managers, navigating modern capital raising or equity management. From my user analysis, firms prioritizing regulatory compliance and automation find this platform invaluable for securely issuing and managing digital securities. This is ideal for those with sophisticated financial needs.

You’ll find success if your objective is to bridge traditional finance with blockchain securely and compliantly.

2. Business Size & Scale

Geared for institutional-grade operations.

This platform targets mid-market to enterprise sectors, requiring dedicated teams for capital markets or digital asset initiatives. What I found about target users is that your operational scale benefits most if you’re dealing with substantial capital or asset management, not small-scale projects. Smaller teams might find the specialized ecosystem complex.

Your business context is a good fit if you have the resources and strategic need for a specialized, regulated financial blockchain infrastructure.

- 🎯 Bonus Resource: While we’re discussing business context, my guide on dance studio software can help streamline processes in diverse sectors.

3. Use Case Scenarios

Perfect for regulated digital asset offerings.

Polymath excels when conducting Security Token Offerings (STOs), tokenizing illiquid assets like real estate, or creating digital private funds. From my analysis, the platform shines for compliant digital securities, automating compliance and streamlining investor management. Your specific use cases should center around regulated financial instruments and their lifecycle management.

You’ll appreciate this solution if your primary goal is to leverage blockchain for institutional-grade financial assets with inherent compliance.

4. Who Should Look Elsewhere

Not for general blockchain or simple fundraising.

If your project demands a massive, open-permissionless blockchain like Ethereum, or you seek a non-technical fundraising tool, Polymath isn’t your solution. From my user analysis, companies needing broad public access will find it restrictive. This platform’s highly specialized, regulated nature limits its applicability for generalized crypto or basic crowdfunding.

Consider general-purpose blockchains or simpler SaaS fundraising platforms if your needs don’t involve strict regulatory compliance or institutional-grade digital securities.

Best Fit Assessment

- Perfect For: Mid-to-large enterprises, financial officers, asset managers, corporate lawyers.

- Business Size: Mid-market to enterprise, capital markets teams, institutional-grade operations.

- Primary Use Case: Security Token Offerings (STOs), tokenizing illiquid assets, regulated digital funds.

- Budget Range: Requires substantial investment due to specialization and complexity.

- Skip If: Need open-permissionless blockchain, simple fundraising, or mass-market SaaS tool.

Ultimately, who should use Polymath depends on your organization’s commitment to regulated digital asset innovation and its specific financial market applications. This Polymath review highlights its strengths for institutional-grade compliance and automation.

Bottom Line

Polymath simplifies complex regulated asset tokenization.

This Polymath review reveals a highly specialized platform addressing critical needs in regulated digital assets. My final assessment focuses on its unique value proposition for institutions navigating the complex security token landscape.

- 🎯 Bonus Resource: While discussing various software solutions, my analysis of best geofencing software offers valuable insights for fleet management.

1. Overall Strengths

Exceptional regulatory and architectural focus.

From my comprehensive analysis, Polymath excels by integrating identity and compliance directly into its purpose-built blockchain, Polymesh. This thoughtful architecture abstracts immense complexity for issuers, removing the need for costly smart contract audits. Its on-chain identity verification is a differentiator.

These strengths are crucial for institutional adoption, enabling secure, streamlined digital asset creation that bridges traditional finance with blockchain capabilities.

2. Key Limitations

Challenges for broader adoption persist.

The platform’s highly specialized nature leads to a smaller ecosystem, fewer integrated tools, and a steeper learning curve for new developers. Based on this review, the pace of institutional adoption remains a concern, as Polymesh’s value is directly tied to network effects and the volume of assets issued.

These limitations are not deal-breakers for its target market but demand a realistic understanding of ecosystem maturity and onboarding dependencies.

3. Final Recommendation

Ideal for regulated asset tokenization.

You should choose Polymath if your priority is creating and managing regulated digital assets within a fully compliant, secure, and purpose-built blockchain framework. From my analysis, it excels for financial institutions and asset managers seeking to automate compliance on-chain, despite its specialized niche.

Your decision should factor in the need for third-party CDD providers and a commitment to understanding this purpose-built ecosystem.

Bottom Line

- Verdict: Recommended for specialized institutional use

- Best For: Financial institutions and enterprises issuing regulated security tokens

- Biggest Strength: Built-in regulatory compliance and on-chain identity

- Main Concern: Niche ecosystem and pace of institutional adoption

- Next Step: Contact Polymath for a deep dive into compliance features

This Polymath review confidently asserts its value for specialized institutional needs, providing a robust solution for the complex world of regulated digital assets. I am highly confident in this assessment.