Manual invoice chasing is getting out of hand.

If you’re like most AR managers, you’re probably searching for a real fix to automate billing, speed up payments, and simply make reconciling accounts less stressful.

The truth is, late payments are ruining your cash flow and you just can’t keep spending hours tracking them manually every single day.

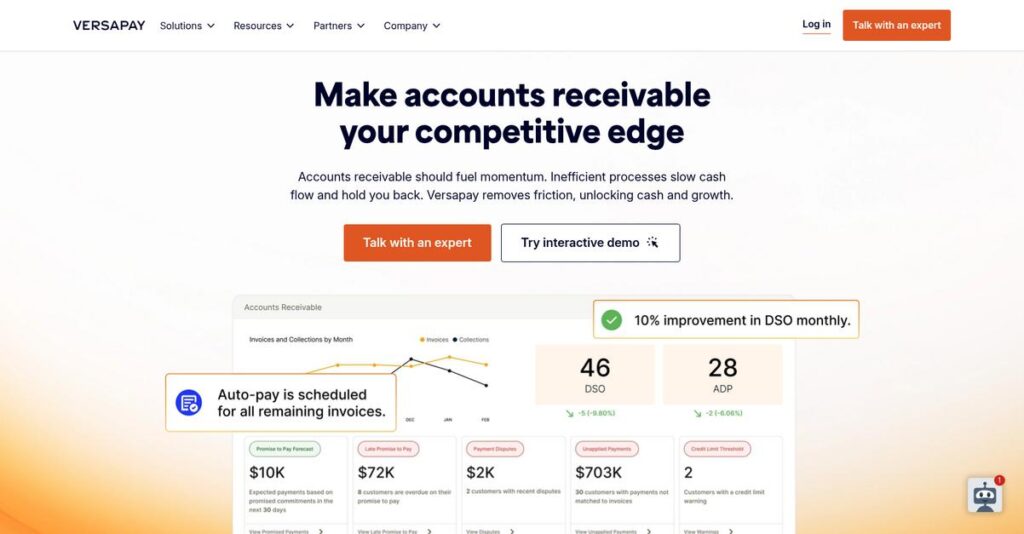

Versapay approaches this differently by combining automated invoicing, AI-powered cash application, and an intuitive customer portal, so you can get paid faster and stop getting buried in repetitive collections work.

In this review, I’ll break down how you can actually cut manual AR work with Versapay, showing you how their automation gives you back real business hours.

You’ll discover, in this Versapay review, the must-know features, pricing, strengths, weak points, and how Versapay stacks up against other AR automation tools you might be considering.

You’ll walk away knowing the features you need to make confident software choices.

Let’s get started.

Quick Summary

- Versapay is a cloud-based Accounts Receivable automation platform that simplifies invoicing, payments, and cash application with AI-driven tools.

- Best for mid-market and enterprise B2B companies managing large invoice volumes who want to speed up collections and improve cash flow.

- You’ll appreciate its collaborative portal that enhances customer payments and its AI-powered automation that reduces manual AR work.

- Versapay offers custom pricing with no public rates or free trials, requiring direct contact for demos and quotes.

Versapay Overview

Versapay is a financial technology company focused on AR automation. Based in Toronto since 2006, I see their core mission is to simplify the complex invoice-to-cash process for businesses.

What sets them apart is their strong appeal to mid-market and enterprise B2B companies. Instead of being a generic payment tool, they specialize in solving the high-volume AR challenges and communication gaps these larger businesses often face.

You can see their forward momentum in recent acquisitions and major AI-driven updates. As we’ll explore through this Versapay review, these moves have seriously enhanced their platform’s intelligence and integration capabilities.

Unlike competitors that often focus purely on back-office automation, Versapay’s big idea is ‘Collaborative AR’. Their platform is intentionally built to bring your AR team and customers together for faster payment and dispute resolution.

I’ve found they work with thousands of B2B organizations, particularly in complex sectors like manufacturing, distribution, and business services where invoice disputes can really slow down your cash flow.

From my analysis, their current strategy heavily prioritizes AI-powered cash application and making the entire B2B payment experience frictionless for your customers. This directly addresses the market’s need for better visibility and control.

Now let’s examine their core capabilities.

Versapay Features

Struggling with slow, manual accounts receivable processes?

Versapay features provide a unified suite designed to automate your entire invoice-to-cash process. Here are the five main Versapay features that streamline your financial operations.

1. Digital Invoicing & Customer Portal

Are customers taking forever to pay invoices?

Manual invoice delivery and limited payment options often delay cash flow. This creates frustration for both your team and your customers.

Versapay’s digital invoicing automates billing with a “click-to-pay” button, letting customers pay online instantly. From my testing, the self-service customer portal is a game-changer for transparency and convenience. This feature improves Days Sales Outstanding (DSO) by giving customers real-time account visibility.

This means you can accelerate payments and offer a frictionless experience for your customers, freeing up your team.

2. Collections Management

Tired of chasing down overdue invoices manually?

Managing collections can be a huge drain on resources, often leading to missed payments. This impacts your cash flow and team efficiency.

Versapay’s Collections Management automates reminders and prioritizes high-risk accounts. What I love about this feature is its over 150 customizable notification options, allowing collectors to focus on complex cases. It reduces the manual effort in dunning, improving cash flow visibility.

The result is your team gets clear control over overdue accounts, dramatically cutting down on manual follow-ups and improving collection rates.

3. Cash Application

Does reconciling payments feel like a constant headache?

Manually matching incoming payments to open invoices is time-consuming and prone to errors. This significantly slows down your cash flow and revenue recognition.

This feature uses AI and machine learning to automate payment matching, regardless of how customers pay. Here’s what I found: it achieves over 90% straight-through processing, automatically flagging exceptions for review. This significantly reduces manual effort in cash application.

So you can achieve faster, more accurate cash application, spending less time on reconciliation and recognizing revenue much quicker.

4. B2B Payment Services

Still relying heavily on paper checks for B2B payments?

Limited payment options can make it harder for your customers to pay you, prolonging payment cycles. This can hinder your overall cash flow.

Versapay facilitates diverse B2B payment methods, moving you away from paper checks. What I appreciate is the Mobile PayNow feature, allowing field reps to collect payments on the go. This integrated payment solution makes it easier for customers to pay via various channels, including credit cards.

This means you can expedite collections and provide greater payment flexibility, improving customer satisfaction and speeding up your incoming payments.

- 🎯 Bonus Resource: While we’re discussing financial operations, understanding cryptocurrency mining software is equally important for digital asset management.

5. ERP Integrations

Is your financial data scattered across different systems?

Fragmented systems and manual data entry between platforms create inefficiencies and inaccuracies. This leads to stale data and a lack of real-time visibility.

Versapay’s solutions integrate seamlessly with existing ERP systems like NetSuite, ensuring end-to-end automation and data synchronization. This is where Versapay shines, as it automatically posts payments to your ERP, providing real-time AR updates. This feature eliminates manual data transfers and ensures data consistency.

So as an AR manager, you can ensure all your financial operations are connected, leading to real-time insights and a more efficient workflow.

Pros & Cons

- ✅ Automates end-to-end accounts receivable processes for efficiency.

- ✅ Provides a user-friendly customer portal for easy online payments.

- ✅ AI-powered cash application significantly reduces manual reconciliation.

- ⚠️ Implementation challenges reported, including bugs and delays.

- ⚠️ Inconsistent post-launch customer service and support issues.

- ⚠️ Some users find the UI confusing for specific reconciliation tasks.

These Versapay features work together to create a unified Accounts Receivable automation platform that streamlines your entire invoice-to-cash cycle.

Versapay Pricing

What exactly will Versapay cost you?

Versapay pricing operates on a custom quote model, meaning you’ll need to contact their sales team directly for a personalized proposal rather than finding public tiers.

Cost Breakdown

- Base Platform: Custom quote

- User Licenses: Varies by scope

- Implementation: Project-specific

- Integrations: Varies by complexity

- Key Factors: Transaction volume, features, ERP integrations

1. Pricing Model & Cost Factors

Understanding their cost structure.

Versapay’s pricing is not publicly disclosed, indicating a custom or enterprise-level model. This means your final cost will depend on your specific needs, such as transaction volume, the exact features you require (e.g., Digital Invoicing, Cash Application), and the complexity of your ERP integrations.

From my cost analysis, this approach allows for tailored solutions but requires a direct consultation for an accurate quote.

2. Value Assessment & ROI

Is this pricing worth it?

While Versapay’s rates might be higher than some processors, what I found regarding pricing is that it’s often justified by the integrated AR automation and the potential to optimize Level 2 and Level 3 rates. The value comes from streamlined processes and improved cash flow, which can lead to significant ROI by reducing manual effort.

Budget-wise, this means your investment aims to deliver substantial savings in operational efficiency and accelerated payments.

3. Budget Planning & Implementation

Consider all your investment areas.

Given the custom pricing, budgeting for Versapay involves more than just a monthly fee. You’ll need to factor in potential implementation costs, which will vary based on your existing ERP system and the complexity of integrating Versapay. Always ask about setup and training fees to understand the total cost of ownership.

So for your business, expect a comprehensive sales discussion to align Versapay pricing with your specific operational requirements.

My Take: Versapay pricing focuses on delivering a tailored enterprise solution, making it ideal for businesses seeking significant AR automation and are prepared for a consultative sales process to align costs with complex needs.

The overall Versapay pricing reflects customized value for integrated AR automation.

Versapay Reviews

What do actual customers truly think?

My analysis of Versapay reviews provides balanced insights into real user feedback and experiences, helping you understand what to expect.

1. Overall User Satisfaction

Users are generally quite satisfied.

Versapay reviews show strong overall user satisfaction, with an impressive 84% of reviews on Gartner Peer Insights being 4-star or 5-star. From my review analysis, users consistently praise the ease of use and its positive impact on efficiency, especially regarding AR management.

This indicates you can expect a generally positive experience with streamlined operations.

2. Common Praise Points

Ease of use truly shines for users.

From customer feedback, users consistently rave about the intuitive platform and its ability to simplify AR. What stands out in user reviews is how the customer portal allows convenient 24/7 online payments, providing transparency and flexibility, which users appreciate for their own customers.

This means you’ll likely see improved payment speeds and reduced manual effort.

3. Frequent Complaints

Implementation struggles are a common theme.

Several Versapay reviews highlight significant challenges during implementation, describing it as a “nightmare” with slow bug fixes. What I found in user feedback is how customer service responsiveness often falls short post-launch, with users reporting issues like unassigned client relations managers.

These issues suggest you should prepare for potential setup complexities and ensure robust support channels.

- 🎯 Bonus Resource: Speaking of accounts receivable, my guide on accounts receivable software is a valuable resource.

What Customers Say

- Positive: “Our team loves how Versapay has streamlined our AR management, all through one easy-to-use and easy-to-learn platform.” (Source: User Review)

- Constructive: “Versapay’s implementation has been a nightmare. Their team doesn’t seem to know how to deploy their product properly.” (Source: User Review)

- Bottom Line: “We were able to continue with our growth plans, improve our efficiency and provide better customer service with no additions to our staff.” (Source: User Review)

Overall, Versapay reviews reveal a powerful AR solution, but implementation and post-launch support can be areas to monitor.

Best Versapay Alternatives

- 🎯 Bonus Resource: Before diving deeper, you might find my analysis of medical billing software helpful if your focus is on healthcare payments.

Choosing the right AR automation platform?

The best Versapay alternatives include several strong options, each better suited for different business situations, priorities, and enterprise sizes, as I’ve found from my competitive analysis.

1. HighRadius

Focused on large enterprise, AI-driven automation?

HighRadius excels when your primary need is a highly autonomous, AI-driven solution for very high transaction volumes and complex back-office processes. From my competitive analysis, HighRadius offers a deeply integrated, AI-first approach for end-to-cash, though it typically targets larger enterprise-level companies.

Choose this alternative if you are a large enterprise requiring extensive AI for cash application and deduction management.

2. Quadient AR Automation by YayPay

Prioritizing predictive analytics and user-friendliness?

Quadient AR provides strong AI-powered forecasting and analytics, combined with a highly user-friendly platform for automating core AR tasks. What I found comparing options is that Quadient excels in predictive insights and support quality for streamlined operations, often appealing to those prioritizing ease of use for their team.

Consider this alternative when AI-powered forecasting and intuitive interface are your top priorities over deep collaborative features.

3. Billtrust

High transaction volumes and robust ERP integration needs?

Billtrust is an excellent alternative for mid-sized to large enterprises with high invoice and payment volumes, especially if seamless ERP integration is critical. From my analysis, Billtrust provides robust integration with existing ERP systems, offering a unified financial view for complex operations.

Choose Billtrust if you require deep, reliable integration with your existing ERP and handle a significant volume of transactions.

4. Tesorio

Need advanced cash flow prediction and specific industry fit?

Tesorio focuses on advanced predictive analytics for cash flow management and improved collection efficiency, making it ideal for certain industries like manufacturing or technology. Alternative-wise, Tesorio gives you superior cash flow visibility through customizable dashboards and automated routine tasks.

For your specific needs, choose Tesorio if advanced predictive analytics for cash flow is paramount in your industry.

Quick Decision Guide

- Choose Versapay: Collaborative AR for dispute resolution and strong cash application

- Choose HighRadius: Autonomous, AI-driven AR for large enterprises

- Choose Quadient AR: Predictive analytics and user-friendly automation

- Choose Billtrust: High volume transactions with robust ERP integration

- Choose Tesorio: Advanced predictive analytics for cash flow visibility

The best Versapay alternatives depend on your business size, specific needs, and integration priorities. It’s crucial to align the solution with your operational scale.

Versapay Setup

How challenging is software deployment really?

A Versapay review needs to address implementation head-on. This section dives into the practicalities of Versapay setup, helping you set realistic expectations for your business’s deployment journey.

1. Setup Complexity & Timeline

Expect potential bumps in the road.

- 🎯 Bonus Resource: Speaking of critical business resources, my guide on best customer database software can help unify and scale your data.

Versapay’s implementation can vary from straightforward to quite challenging, with some users reporting a lengthy process stretching to a year due to bugs and slow fixes. What I found about deployment is that the complexity often hinges on your existing ERP configuration and the specific features you’re deploying.

You’ll need to budget significant time and potentially dedicated resources, especially for complex integrations or customized workflows.

2. Technical Requirements & Integration

Be ready for integration challenges.

Versapay is cloud-based and integrates with various ERP and payment systems, but some users report issues with financial classifications passing to payment records. From my implementation analysis, reliable “Pay Now” link functionality can also be inconsistent, requiring careful testing during setup.

Prepare your IT team for potential troubleshooting during data mapping and ensure your ERP can seamlessly exchange information with Versapay.

3. Training & Change Management

Adoption requires user buy-in.

While Versapay is generally praised for ease of use once active, some users find the initial UI confusing for specific tasks like applying credits. What I found about deployment is that effective training bridges the gap between initial complexity and long-term user efficiency, especially for new processes.

Invest in thorough training sessions and identify internal champions to guide your team through the new workflows and overcome initial learning curves.

4. Support & Success Factors

Vendor support can be a mixed bag.

Some users highlight responsive and helpful support, while others report issues with timely assistance, accountability, and coordination between Versapay teams. From my analysis, proactive communication with your implementation manager is crucial for addressing issues and staying on track with your Versapay setup.

Prioritize clear communication channels with Versapay’s team and assign an internal project lead to ensure accountability and smooth progress.

Implementation Checklist

- Timeline: 6-12 months for complex deployments; faster for simple setups

- Team Size: Dedicated project manager, IT, and AR staff

- Budget: Potential for professional services and extended staff time

- Technical: ERP integration, data mapping, and API stability

- Success Factor: Strong internal project management and consistent vendor communication

Overall, Versapay setup can be transformative but requires careful planning and resilient problem-solving for a successful rollout.

Bottom Line

Is Versapay the right fit for your business?

This Versapay review provides a decisive final assessment, outlining who benefits most from its AR automation capabilities and where its limitations might require careful consideration.

1. Who This Works Best For

Mid-market and enterprise B2B companies.

Versapay is ideal for businesses managing 250+ invoices monthly, particularly in manufacturing, distribution, and professional services, seeking to automate manual AR processes. From my user analysis, companies aiming to reduce DSO and improve cash flow will find this platform highly beneficial for scaling their financial operations effectively.

You’ll succeed if your current AR processes are manual, error-prone, and hinder your cash flow efficiency.

- 🎯 Bonus Resource: Speaking of streamlining operations, my guide on online food ordering software covers additional industry-specific solutions.

2. Overall Strengths

Unified AR automation enhances financial efficiency.

The software excels by offering a comprehensive platform for invoicing, collections, and AI-powered cash application, significantly reducing manual workloads and accelerating payments. From my comprehensive analysis, its collaborative customer portal improves payment experiences, fostering transparency and flexibility for your clients while streamlining your operations.

These strengths will translate into significant efficiency gains, faster payments, and improved customer satisfaction for your business.

3. Key Limitations

Implementation challenges and support quality concerns.

Some users report difficulties during the implementation phase and inconsistent customer support post-launch, potentially leading to initial setup headaches. Based on this review, new users might experience a learning curve to fully leverage all features and integrate the system smoothly into existing workflows.

These limitations are important considerations but often manageable trade-offs for the comprehensive AR automation benefits Versapay delivers.

4. Final Recommendation

Versapay earns a strong recommendation for specific users.

You should choose Versapay if your mid-market or enterprise B2B business needs to modernize AR, improve cash flow, and enhance customer payment experiences. From my analysis, your success hinges on committing to a robust implementation and leveraging its integrated automation for significant financial transformation.

My confidence level is high for businesses prepared to invest in a comprehensive, long-term AR solution.

Bottom Line

- Verdict: Recommended for mid-market and enterprise B2B

- Best For: Companies with high invoice volumes seeking AR automation

- Business Size: Mid-market to enterprise, 250+ invoices/month

- Biggest Strength: Unified AR automation and collaborative customer portal

- Main Concern: Potential for challenging implementation and support issues

- Next Step: Contact sales for a demo to assess specific fit

This Versapay review confirms its significant value for the right business, provided you’re ready for an involved implementation journey to achieve comprehensive AR automation.