Manual finance processes driving you up the wall?

If you’re facing endless hours of invoice matching, chasing late payments, or piecing together cash flow forecasts from a mess of spreadsheets, you’re not alone—these are the daily struggles that have many looking for a better way. That’s probably why HighRadius is already on your radar.

After researching dozens of finance automation tools, I actually established that manual finance work destroys productivity and introduces costly errors—problems that slow down your whole team and chip away at margins.

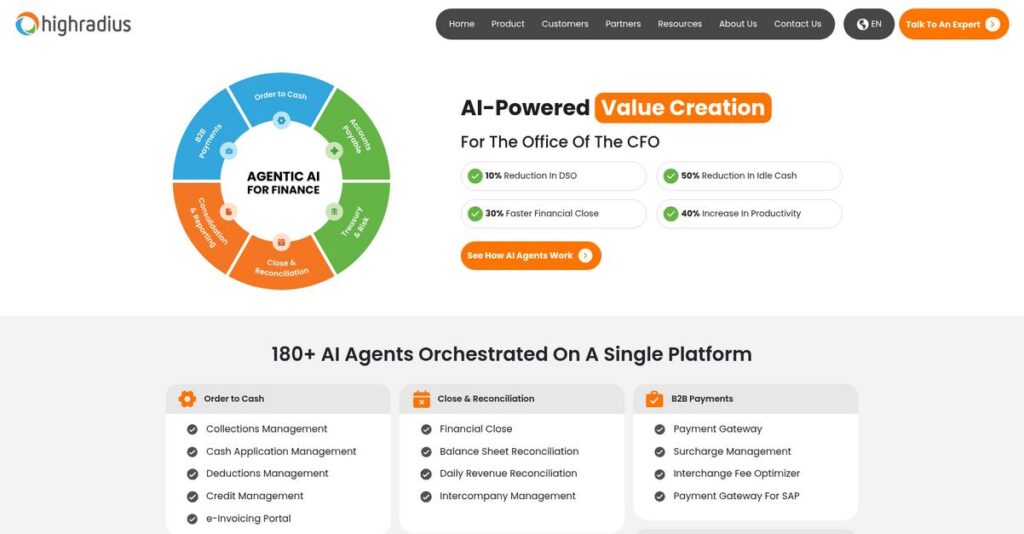

That’s where HighRadius stands apart. Its AI-driven platform automates cash application, collections, deductions, credit checks, and treasury management, all within one cohesive suite. My analysis shows it’s not just the automation but the way these modules connect that makes HighRadius different.

In this review, I’ll show you exactly how HighRadius frees up your finance experts and streamlines your A/R cycle.

Here’s what you’ll find in this HighRadius review: a deep dive into core features, unbiased look at pricing, implementation must-knows, and what sets this solution apart from alternatives—so you can evaluate with confidence.

You’ll come away with the insights and clarity you need to match the features you need to real outcomes.

Let’s dig into the details.

Quick Summary

- HighRadius is an AI-powered platform that automates the complete Order-to-Cash and Treasury processes for finance teams.

- Best for mid-market and large enterprises with complex A/R workflows and high invoice volumes.

- You’ll appreciate its leading cash application and collections automation that drastically reduces manual work and lowers DSO.

- HighRadius offers custom enterprise pricing with no free trial; demos are available by contacting sales.

HighRadius Overview

HighRadius has been around since 2006, based in Houston. From my research, their core mission is to build AI-driven autonomous software specifically for finance teams.

My analysis shows they target mid-market and large enterprise companies. Their specialization is AI-powered Order-to-Cash automation, where they help you transform your finance department from a tedious cost center into a strategic business partner.

Recent acquisitions like Cforia and Validis show their aggressive growth trajectory. It’s a key point for this HighRadius review, significantly strengthening their O2C and treasury offerings for you.

Unlike the basic tools in your ERP, HighRadius positions itself on its deep focus on AI automation. My evaluation shows this provides far more advanced, predictive insights than what you’d typically get out-of-the-box.

They work with hundreds of global enterprises, including many recognizable Fortune 1000 brands. You’ll find them well-established in complex sectors like manufacturing, consumer goods, and technology.

What impressed me most is their strategic push towards “Autonomous Software.” This clear vision aims to automate entire finance lifecycles, not just discrete tasks, aligning with your need for a more strategic function.

Now let’s examine their core capabilities in detail.

HighRadius Features

Frustrated with inefficient finance operations?

HighRadius offers an integrated suite of autonomous software solutions designed to automate and streamline your entire Order-to-Cash, Treasury, and Record-to-Report cycles. These are the five core HighRadius solutions that transform your finance department into a strategic powerhouse.

1. Cash Application Automation

Tired of manually matching payments?

Dealing with missing remittance data or countless unapplied cash can slow your entire cash flow to a crawl. This creates a huge drain on your team’s time.

Here’s what I found: HighRadius’s AI-powered engine automatically matches payments to invoices with reported hit rates as high as 90-95%. It learns from your corrections, drastically reducing manual data entry. This solution allows your A/R specialists to focus solely on exceptions.

This means you can accelerate cash posting, improve balance accuracy, and free up your team for higher-value tasks.

Speaking of managing important information, you might find my guide on Android Data Recovery Software useful.

2. Collections Management

Struggling with reactive collections?

Working from outdated aging reports leads to wasted effort, causing avoidable delays in collecting overdue payments. This negatively impacts your Days Sales Outstanding (DSO).

This is where HighRadius shines. The platform uses AI to predict delinquencies and automatically generates prioritized worklists for your collectors. It also automates sending personalized dunning emails. From my testing, this proactive approach significantly improves collection efficiency.

This ensures your team focuses on the most critical accounts, leading to a measurable reduction in DSO and past-due receivables.

3. Deductions Management

Are customer deductions eating into your profits?

Manually researching and resolving short-pays is a huge administrative burden and a significant source of revenue leakage for your business.

HighRadius’s solution automatically identifies and categorizes deductions, streamlining the entire resolution process. It:

- Pulls together all necessary backup documentation instantly.

- Uses predefined workflows to route disputes efficiently.

- Significantly shortens the deduction resolution cycle. This helps you recover more revenue.

The result is a direct positive impact on your bottom line by reducing invalid write-offs and speeding up claim processing.

4. Credit Management

Slow credit reviews bottleneck your sales?

Manual credit application processes can create frustrating delays for new customers and introduce inconsistent risk assessments. This impacts your customer onboarding.

What I love about this HighRadius solution is how it automates the entire credit process, including online applications and AI-based risk scoring. You can set rules for automatic approvals, freeing up your credit team for complex cases. This accelerates customer onboarding.

This means you can onboard new customers faster, reduce credit risk with real-time data, and ensure consistent policy application.

5. Treasury Management

Lacking real-time cash visibility?

Without accurate, real-time insights into your cash position and future flows, strategic financial decisions become incredibly challenging. This can hinder growth.

HighRadius centralizes data from banks, ERPs, and its own O2C solutions, providing a precise, real-time view of your global cash. Its AI-driven forecasting models leverage historical data for more accurate predictions. From my evaluation, this significantly reduces manual consolidation efforts.

This enables your finance leaders to make more informed decisions about investments, debt, and working capital with confidence.

Pros & Cons

- ✅ Automates over 90% of cash application for significant efficiency gains.

- ✅ AI-driven collections module measurably reduces Days Sales Outstanding (DSO).

- ✅ Centralized platform offers a single source of truth for all A/R activities.

- ⚠️ Implementation is a heavy lift requiring dedicated internal resources and time.

- ⚠️ User interface can feel dated or unintuitive, with a steep learning curve.

What I love about these HighRadius solutions is how they share data and AI insights to create a truly integrated and autonomous finance workflow. This platform cohesion means less manual work and more strategic financial operations for your team.

HighRadius Pricing

If you’re also looking into broader software solutions for specialized areas, my article on Applied Behavior Analysis Software covers essential tools for care and reports.

Unsure what you’ll really pay for enterprise software?

HighRadius pricing isn’t publicly listed, reflecting its enterprise-grade, custom-tailored solutions. You’ll need to engage their sales team for a personalized quote, tailoring costs to your specific needs. This approach sets the context for a detailed pricing analysis.

Cost Breakdown

- Base Platform: Custom quote (high five figures to seven figures annually)

- User Licenses: Based on modules, transaction volume, and business units

- Implementation: Substantial one-time fee (separate from subscription)

- Integrations: Varies by ERP instances and complexity

- Key Factors: Modules, transaction volume, ERP integrations, business units

1. Pricing Model & Cost Factors

Complexity demands a tailored approach.

HighRadius operates on a custom, subscription-based pricing model, often involving multi-year contracts. What I found regarding pricing is that costs are significantly driven by your specific modules, transaction volume, and the number of ERP instances integrated. This ensures you’re paying for what your enterprise truly consumes.

From my cost analysis, this tailored approach means your budget aligns precisely with your operational scale, avoiding overpayment for unused features.

2. Value Assessment & ROI

Is the investment justified?

This premium HighRadius pricing reflects its enterprise-grade automation capabilities for Order-to-Cash, offering substantial ROI through reduced manual work and improved cash flow. What stood out about their pricing approach is how it delivers transformative efficiency gains, potentially offsetting the initial investment rapidly by tackling complex finance operations.

Budget-wise, this means you’re investing in automation that eliminates manual bottlenecks, leading to measurable cost savings and operational enhancements.

3. Budget Planning & Implementation

Plan for total ownership.

Beyond the annual subscription, your budget must account for substantial one-time implementation fees covering project management, configuration, and ERP integration. What makes their pricing complex initially is that first-year costs include these significant setup expenses. This helps you avoid surprising your finance team with unexpected additional charges.

So for your business, factor in a robust upfront investment, ensuring comprehensive deployment and maximum benefit from the HighRadius platform.

My Take: HighRadius pricing is built for large enterprises seeking deep automation and significant ROI, demanding a serious budget commitment. This is an investment in strategic finance transformation, not a quick fix.

Overall, HighRadius pricing reflects a strategic, enterprise-level investment in finance automation. While requiring a custom quote, it promises transformative value for complex, high-volume operations.

HighRadius Reviews

User experiences reveal key insights.

To truly understand HighRadius, I’ve analyzed numerous reviews from real customers on platforms like G2, Capterra, and Gartner. This section dives deep into their actual experiences.

1. Overall User Satisfaction

Users generally feel very positive.

From my review analysis, HighRadius consistently earns high marks, averaging around 4.6 out of 5 stars across major platforms. What stands out in these reviews is a strong sense of value for transformative automation. This overall high sentiment suggests that most users find the software delivers on its core promises effectively.

This robust satisfaction stems from significant efficiency gains and tangible improvements in key financial metrics, like reduced DSO and manual effort.

2. Common Praise Points

Users consistently love the automation and its impact.

Users overwhelmingly praise HighRadius for its powerful automation, particularly cash application and collections. What I found in user feedback is how dramatically auto-match rates improve, often exceeding 90%, freeing significant team capacity. The centralized platform also earns high marks in reviews.

This translates directly into reduced manual effort, faster cash posting, and tangible improvements in critical financial metrics like Days Sales Outstanding.

While optimizing financial operations, understanding contract analysis software can help master compliance and mitigate risk.

3. Frequent Complaints

Implementation presents recurring hurdles.

Despite its strengths, common complaints center on implementation complexity and UI. Review-wise, you’ll find consistent mentions of a heavy implementation lift requiring significant internal resources. Users also describe the interface as ‘clunky’ or ‘dated,’ suggesting a steep learning curve.

These are typical challenges for complex enterprise software, indicating you need a robust implementation plan and dedicated resources for success.

What Customers Say

- Positive: “The cash application tool is best in class. We’ve automated over 90% of cash receipts, freeing our team for value-added activities.”

- Constructive: “Implementation was a heavier lift than anticipated. You need dedicated project management and IT resources; it’s not a turn-key solution.”

- Bottom Line: “This is powerful automation software, but expect a significant implementation effort and a learning curve with the user interface.”

Overall, HighRadius reviews show a powerful solution for complex financial operations, provided you’re prepared for the implementation journey. My analysis confirms these user insights are highly credible for potential buyers.

Best HighRadius Alternatives

Navigating AR automation choices can be tricky.

Finding the best HighRadius alternatives means understanding diverse needs. I’ve analyzed options based on business size, budget, and specific automation priorities to guide your decision-making effectively in the competitive landscape.

While we’re discussing financial operations, my guide on payroll accounting software covers additional compliance strategies.

1. Esker

Seeking unified A/P and A/R automation?

Esker is a direct competitor, offering a robust, AI-driven suite for both Order-to-Cash and Procure-to-Pay. From my competitive analysis, Esker offers a stronger, integrated P2P and O2C suite with a generally more modern user interface. This alternative provides a cohesive platform if you seek broader finance automation.

Choose Esker if a modern, unified P2P and O2C platform is your priority for both accounts payable and receivable operations.

2. BlackLine

Already invested in financial close solutions?

What I found comparing options is that BlackLine’s A/R automation is an extension of their market-leading Record-to-Report capabilities. If your finance team’s primary need is enhancing financial close processes, BlackLine provides an integrated R2R and A/R solution that might be a natural fit.

Select BlackLine when your core challenge is month-end close and you want to expand A/R from a leading R2R vendor.

3. Bill.com

Operating with a smaller budget and simpler needs?

For smaller businesses, Bill.com is a compelling alternative, providing straightforward A/P and A/R payment automation. Your team gets essential invoicing without the complexity of enterprise-level AI credit or deduction workflows. Alternative-wise, Bill.com keeps costs lower for basic automation needs.

Opt for Bill.com if you’re a smaller business needing basic invoice and payment automation without complex AI-driven O2C processes.

4. Native ERP Modules (SAP, Oracle NetSuite)

Preferring to leverage existing systems?

Your existing ERP modules (like SAP or NetSuite) offer a low-cost alternative for basic A/R functions. They integrate natively, avoiding new system implementation complexities. However, they lack HighRadius’s advanced, purpose-built AI for sophisticated O2C needs. This option is cheapest for simple A/R.

Choose native ERP modules if your A/R is simple, volume is low, and you prefer avoiding new system costs.

Quick Decision Guide

- Choose HighRadius: Comprehensive, AI-driven O2C for mid-to-large enterprises

- Choose Esker: Unified P2P and O2C platform with modern UI

- Choose BlackLine: Expanding A/R from a leading financial close system

- Choose Bill.com: Basic A/P/A/R automation for SMBs on a budget

- Choose Native ERP Modules: Simple A/R processes, low volume, existing systems

The best HighRadius alternatives depend on your specific operational scale, budget, and desired level of automation. I recommend evaluating your unique process complexity to find the ideal fit.

Setup & Implementation

HighRadius implementation requires strategic planning.

This HighRadius review delves into the practical aspects of deploying this powerful O2C platform. You’ll need realistic expectations for your HighRadius implementation, which isn’t a “plug-and-play” solution.

1. Setup Complexity & Timeline

This isn’t a simple “install and go.”

HighRadius implementation typically takes 3 to 9 months, varying with modules and ERP complexity. From my implementation analysis, proper upfront scoping is absolutely critical for setting realistic timelines and avoiding delays, involving deep discovery and detailed configuration.

You’ll need a dedicated internal project manager and subject matter experts to drive the process and ensure successful system alignment.

2. Technical Requirements & Integration

Technical setup and integration are crucial.

Your team will need direct IT access for robust ERP integration development and testing, a common bottleneck. What I found about deployment is that connecting multiple or customized ERPs adds considerable complexity, demanding careful planning for data flow and system stability.

Ensure your IT department allocates sufficient time and personnel for integration work, as this foundational step directly impacts overall system functionality.

While ensuring robust system stability, understanding user activity monitoring software is crucial for preventing breaches and staying compliant.

3. Training & Change Management

User adoption needs careful nurturing.

Given user feedback on the interface, expect a learning curve for new users, making thorough end-user training crucial. From my analysis, effective change management prevents resistance to new processes and ensures your teams fully leverage HighRadius’s automation capabilities for maximum ROI.

Invest in comprehensive training and identify internal champions early to guide your teams through the transition, ensuring widespread adoption.

4. Support & Success Factors

Internal drive is key to success.

While HighRadius provides an implementation team, clients must drive the project internally. What I found about deployment is that a proactive internal project manager is the single most critical factor for overcoming challenges and ensuring project milestones are met.

Beyond vendor support, success hinges on robust internal project management, clear communication, and unwavering executive sponsorship throughout deployment.

Implementation Checklist

- Timeline: 3-9 months, varying by modules and ERP complexity

- Team Size: Dedicated PM, A/R, credit, IT subject matter experts

- Budget: Professional services and significant internal resource allocation

- Technical: Direct IT access for critical ERP integration development

- Success Factor: Strong internal project management and client leadership

Overall, HighRadius implementation is a substantial undertaking, but its powerful automation offers significant ROI. Approaching your HighRadius implementation with realistic expectations and strong internal leadership is crucial for transformation.

Who’s HighRadius For

HighRadius targets specific finance transformation needs.

This HighRadius review helps you understand if this robust finance software aligns with your business profile. I’ll guide you through ideal users, suitable company sizes, and specific use cases to determine its fit for your organization.

1. Ideal User Profile

Finance leaders seeking strategic transformation.

HighRadius is perfect for CFOs, Controllers, Treasurers, and Directors of Credit and AR who envision transforming their finance operations. From my user analysis, businesses with high transaction volumes and complex payment behaviors will benefit most by leveraging AI to reduce significant manual work and revenue leakage.

These leaders succeed by converting their finance departments into strategic, data-driven partners, automating A/R, and significantly reducing Days Sales Outstanding (DSO).

2. Business Size & Scale

Mid-market to large enterprise focus.

HighRadius is designed for mid-market to large enterprise companies, typically those with annual revenues exceeding $500 million. What I found about target users is that their complex operations justify the investment, making it ideal for finance teams in manufacturing, CPG, and distribution with high invoice volumes.

You’ll know your business size is a good fit if you have substantial A/R challenges and dedicated resources for a strategic finance transformation.

3. Use Case Scenarios

Automating complex Order-to-Cash cycles.

HighRadius excels where businesses struggle with high volumes of complex transactions, excessive manual work in A/R, and revenue leakage. User-wise, its cash application automation is transformative, often boosting auto-match rates from under 40% to over 90% and reducing DSO.

Your use case aligns if your priority is to reduce manual A/R effort, improve cash flow predictability, and gain centralized visibility across finance.

4. Who Should Look Elsewhere

Not for small businesses or simple A/R.

HighRadius is not suitable for small businesses or companies with straightforward, low-volume A/R processes. From my user analysis, the cost and implementation complexity would be prohibitive, offering features far beyond what a simpler operation needs to manage basic invoicing and collections efficiently.

Consider simpler, more affordable accounting software or basic invoicing tools if your A/R volume is low and processes are not complex.

Best Fit Assessment

- Perfect For: Mid-market to large enterprises seeking finance transformation

- Business Size: $500M+ annual revenue; complex A/R processes

- Primary Use Case: Automating Order-to-Cash, reducing DSO, enhancing cash application

- Budget Range: Requires substantial enterprise software investment

- Skip If: Small business or simple A/R operations, limited IT resources

This HighRadius review shows its strength lies in solving complex enterprise finance challenges. The answer to who should use HighRadius centers on your commitment to AI-driven finance transformation.

Bottom Line

HighRadius delivers on its automation promise.

My HighRadius review reveals a powerful automation platform for finance. I’ve synthesized its capabilities and user feedback to provide a clear, decisive assessment, helping you determine if it’s the right fit.

1. Overall Strengths

Automation ROI stands out significantly.

HighRadius excels in automating critical finance processes, particularly cash application where users report over 90% auto-match rates. Its Collections module significantly reduces Days Sales Outstanding (DSO) and boosts collector productivity. From my comprehensive analysis, its centralized platform provides unmatched visibility across all AR activities, streamlining operations.

These strengths directly translate into substantial efficiency gains, freeing your finance team for strategic tasks. This positively impacts your bottom line.

2. Key Limitations

Expect challenges during implementation.

Despite its power, implementation can be a heavy lift, requiring significant internal resources and project management. Users also describe the UI as ‘clunky’ or ‘not intuitive’, leading to a steep learning curve. Based on this review, customer support quality is inconsistent across users, potentially slowing issue resolution.

These limitations are common for complex enterprise systems. They are not deal-breakers if you plan adequately and commit necessary deployment resources.

Before diving deeper, you might find my analysis of Best Loan Servicing Software helpful, especially for managing complex financial products.

3. Final Recommendation

HighRadius is a strong enterprise choice.

You should choose HighRadius if you are a mid-market or large enterprise seeking significant automation across your Office of the CFO. It’s ideal for organizations ready to invest in a robust, transformative solution to streamline Order-to-Cash or Treasury. From my analysis, it offers best-in-class financial automation for complex operations.

Your decision hinges on your commitment to implementation and desire for profound, long-term efficiency. My recommendation is confident for the right profile.

Bottom Line

- Verdict: Recommended with reservations

- Best For: Mid-to-large enterprises automating O2C/Treasury

- Biggest Strength: AI-powered cash application and DSO reduction

- Main Concern: Implementation complexity and UI learning curve

- Next Step: Request a detailed demo and implementation plan

This HighRadius review provides a comprehensive look at a powerful platform. I’m highly confident in this assessment, guiding you to make an informed decision for your financial automation needs.