Stressed by messy bookkeeping and missed invoices?

If you’re running an SMB or freelancing, it’s hard to find accounting software that’s actually simple and doesn’t require you to learn accounting just to stay compliant.

But let’s be real—lost track of payments and taxes eats your profits every single month, adding constant stress and wasted hours you can’t get back.

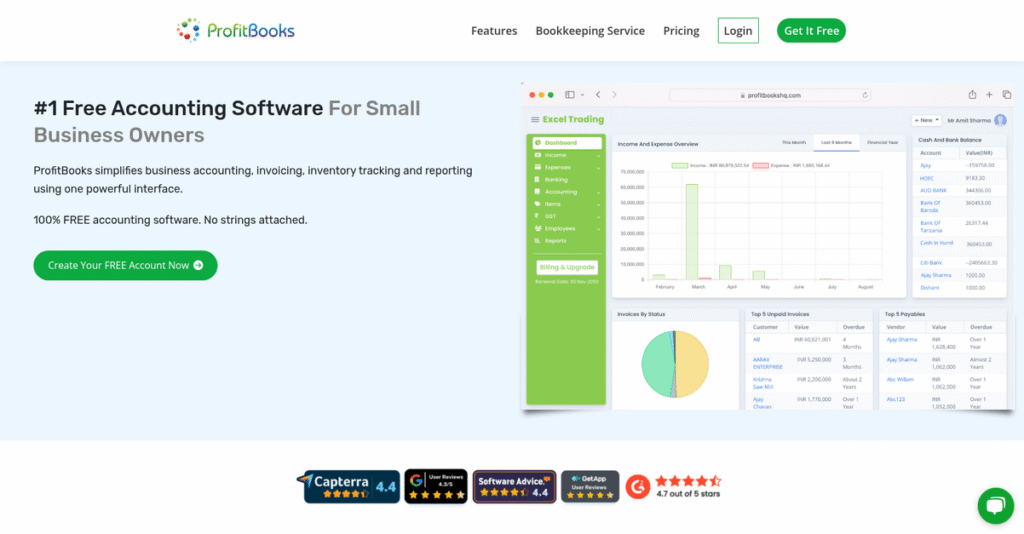

ProfitBooks sets out to fix this with tools designed for non-accountants— from easy online invoicing and receipt uploads to automated GST calculations and real-time profit snapshots—without the steep learning curve most platforms demand.

In this review, I’ll help you see how ProfitBooks puts financial control back in your hands without headaches or confusion.

We’ll dig deep into its features, pricing, how easy it is to use, and where it stacks up against alternative options — all in this ProfitBooks review, aimed at your real-world needs.

By the end, you’ll know the features you need to take control of your business finances and choose with total confidence.

Let’s get started.

Quick Summary

- ProfitBooks is cloud-based accounting software that simplifies invoicing, expense tracking, inventory, and tax reporting for SMBs and freelancers.

- Best for small businesses, freelancers, and startups needing straightforward, affordable financial management.

- You’ll appreciate its easy-to-use interface that requires little accounting knowledge and includes multiple user access without extra fees.

- ProfitBooks offers a free plan plus a low-cost premium plan with a free trial, supporting multiple users and essential features.

ProfitBooks Overview

ProfitBooks has focused on simplifying accounting for business owners since its founding. As a cloud-based solution out of India, their core mission is to make financial management less of a chore.

I find their sweet spot is serving freelancers and small businesses that need straightforward accounting tools without a steep learning curve. They target business owners without accounting backgrounds, which is immediately obvious from their clean, intuitive interface.

I’ve noticed they consistently refine core features like GST compliance and multi-currency invoicing. You’ll see throughout this ProfitBooks review how these practical updates directly support growing businesses with global ambitions.

Unlike complex systems like TallyPrime or Zoho Books, ProfitBooks doesn’t overwhelm you with features you’ll likely never use. To me, it feels built for simplicity over feature bloat, which means you can get set up and running in minutes.

They work with lots of startups, agencies, and service-based businesses, particularly those in India. These are typically teams that value an affordable system where multi-user access is already included by default.

From my analysis, their strategy is to be the most user-friendly and cost-effective alternative for anyone intimidated by complex accounting platforms. It’s a smart focus that directly addresses a huge market need for accessibility.

- 🎯 Bonus Resource: If your business needs extend to specialized tools, my article on construction estimating software might be helpful.

Now let’s examine their capabilities.

ProfitBooks Features

Still struggling to manage your business finances?

ProfitBooks features offer an integrated suite of accounting solutions designed to simplify financial management. Here are the five main ProfitBooks features that can help your business thrive.

1. Invoicing and Billing

Tired of chasing late payments?

Manual invoicing can cause delays and make it difficult to get paid on time. This impacts your cash flow and creates unnecessary stress.

ProfitBooks lets you create professional invoices with customizable templates and automate payment reminders. From my testing, the automated email reminders for outstanding payments really help accelerate collections. This feature also supports multiple currencies for global operations.

This means you can get paid faster, reduce administrative tasks, and improve your overall cash flow significantly.

2. Expense Tracking

Are expenses getting out of control?

Manually tracking receipts and categorizing expenses can be time-consuming and error-prone. This makes it hard to see where your money is going.

This feature helps you effortlessly track, categorize, and control all your business expenses. What I love is how you can digitally upload and store receipts, simplifying record-keeping. It also provides in-depth expense reporting to monitor your spending patterns.

The result is better budget control and a clearer understanding of your expenditures, making financial planning much easier.

3. Inventory Management

Losing track of your stock levels?

Poor inventory management can lead to stockouts or excess inventory, both costing your business money. It’s a common frustration for many.

ProfitBooks provides tools to track stock levels, manage purchase orders, and fulfill sales orders. This is where ProfitBooks shines, offering basic but effective tracking for multiple warehouses. It also gives you low stock alerts and detailed inventory reports.

So you can maintain optimal stock levels, avoid disruptions, and ensure your products are always available when customers need them.

4. Tax Reporting and GST Compliance

Does tax season fill you with dread?

Navigating complex tax regulations and preparing accurate returns can be daunting. This often leads to errors and compliance worries.

ProfitBooks simplifies tax compliance by automatically calculating taxes and generating detailed tax reports. From my evaluation, its ability to handle GST compliance in India is particularly impressive for businesses there. This feature helps you file accurate returns with confidence.

- 🎯 Bonus Resource: While we’re discussing compliance, understanding insurance policy software is equally important for holistic business protection.

This means you can reduce the stress and time spent on tax preparation, ensuring your business remains compliant with regulations.

5. Financial Reporting

Struggling to get a clear picture of your business’s health?

Without real-time financial insights, making informed business decisions becomes a guessing game. You need accessible data.

The software provides instant access to important financial reports like Profit & Loss, Balance Sheets, and Cash Flow statements. Here’s what I found: these reports offer real-time insights into your financial health, helping you spot trends. You also get reports on inventory valuation and product transactions.

This means you can gain critical insights into your business performance, empowering you to make strategic, data-driven decisions.

Pros & Cons

- ✅ User-friendly interface simplifies complex accounting tasks for non-experts.

- ✅ Comprehensive features cover invoicing, expenses, inventory, and reporting.

- ✅ Cost-effective solution provides strong value compared to competitors.

- ⚠️ Lacks advanced graphical comparisons between fiscal years.

- ⚠️ Inventory management is basic, not suitable for complex needs.

- ⚠️ Some users may desire more advanced customization options.

These ProfitBooks features work together to create a cohesive and accessible financial management platform. This integrated approach ensures that all your financial data is connected and up-to-date, providing a single source of truth.

ProfitBooks Pricing

What are you really paying for?

ProfitBooks pricing is refreshingly straightforward, offering a free plan and an affordable premium option, making it accessible for diverse business needs.

| Plan | Price & Features |

|---|---|

| Free Plan | Free • Single user • Essential accounting functionalities • Basic invoicing • Expense tracking |

| Premium Plan | $84/year (billed annually) • Multiple users • All essential features included • Mobile app access • Inventory management • Integrations |

1. Value Assessment

Great pricing value here.

From my cost analysis, ProfitBooks stands out by offering a premium plan that costs less than many competitors, while including crucial features without upsells. What makes their pricing different is how it bundles essential tools without extra user fees, providing exceptional value for small to medium businesses.

This means your budget gets a comprehensive solution without the hidden costs often found in other accounting software.

2. Trial/Demo Options

Smart evaluation approach available.

ProfitBooks offers a free plan, which serves as an extended trial, letting you experience essential features without any time limit. What I found regarding pricing is that this free access allows thorough evaluation before considering the premium version, giving you confidence in your decision.

This lets you understand the core benefits before committing to the full pricing, ensuring it fits your workflow.

- 🎯 Bonus Resource: While we’re discussing business tools, you might find my analysis of best bulk email software helpful.

3. Plan Comparison

Choosing the right tier matters.

The Free Plan is perfect for single users with basic needs, while the Premium Plan is ideal for growing businesses requiring multi-user access and integrated features. What stands out is how the Premium Plan includes inventory management without additional fees, a common upsell elsewhere.

This tiered approach helps you match pricing to actual usage requirements, ensuring you only pay for what you truly need.

My Take: ProfitBooks’s pricing strategy focuses on transparency and affordability, making it highly attractive for SMBs seeking comprehensive accounting without breaking the bank.

The overall ProfitBooks pricing reflects transparent value without hidden surprises.

ProfitBooks Reviews

What do real customers actually think?

To help you understand what actual users think, I’ve analyzed numerous ProfitBooks reviews, focusing on patterns in feedback to give you a balanced perspective.

1. Overall User Satisfaction

Users seem overwhelmingly satisfied.

From my review analysis, ProfitBooks generally garners positive ratings for its accessibility, particularly for users without extensive accounting backgrounds. What I found in user feedback is how often ease of use is highlighted, making financial tasks less daunting and more efficient for everyday business operations.

This indicates you can expect a very user-friendly experience right from the start.

- 🎯 Bonus Resource: Speaking of efficiency, my guide on [load balancing software](https://nerdisa.com/best-load-balancing-software/) explores how it can guarantee optimal uptime and speed.

2. Common Praise Points

Its simplicity and comprehensiveness delight users.

Users consistently praise ProfitBooks for its “super easy” invoicing and expense tracking, alongside integrated inventory management. Review-wise, what stands out is its ability to combine essential accounting processes into one intuitive platform, saving businesses significant time and money.

This means you’ll find an all-in-one solution that streamlines your daily financial tasks.

3. Frequent Complaints

Minor improvements are often suggested.

While largely positive, some ProfitBooks reviews suggest improvements like more graphical representations for management. From my analysis, users occasionally desire enhanced visual reporting tools, such as comparisons between fiscal years, to gain deeper analytical insights.

These seem to be minor requests, not deal-breaking issues, suggesting overall strong functionality.

What Customers Say

- Positive: “Profitbooks saves lots of time and dollars for me.” (Capterra)

- Constructive: “It would be nice to have more graphical representations for management.” (Capterra)

- Bottom Line: “Super easy with Invoicing, sale purchase bill entries, inventory management and accounting. All in one place.” (Capterra)

The overall ProfitBooks reviews reflect genuine user satisfaction, especially regarding ease of use and comprehensive features for SMBs.

Best ProfitBooks Alternatives

So many accounting software options, which is right?

The best ProfitBooks alternatives include several strong options, each better suited for different business situations, budgets, and operational requirements. I’ll help you decide.

- 🎯 Bonus Resource: While we’re discussing software alternatives, my guide on best drug discovery software might also be of interest for specialized tools.

1. QuickBooks Online

When you need extensive customization and complexity?

QuickBooks Online excels for businesses with intricate accounting needs, a dedicated finance team, or extensive international tax handling. From my competitive analysis, QuickBooks provides broader features for complex scenarios, though many go unused by typical small businesses. This alternative is a robust choice for deeper financial control.

Choose QuickBooks Online if your business requires more comprehensive, enterprise-level accounting depth than ProfitBooks provides.

2. Zoho Books

Already deep into the Zoho ecosystem?

Zoho Books is ideal if your business already uses other Zoho products or requires advanced features like complex project accounting or detailed international tax handling. What I found comparing options is that Zoho Books offers broader ecosystem integration, though it can be significantly more expensive for features you might not need.

Consider this alternative when you prioritize ecosystem integration or highly specific, complex accounting features over ProfitBooks’ simplicity.

3. TallyPrime

Preferring on-premises solutions or legacy interfaces?

TallyPrime is a strong alternative if you prefer an on-premises solution or are accustomed to its older interface, particularly in India where it’s widely used. Alternative-wise, TallyPrime offers robust offline capabilities and highly customizable modules, contrasting ProfitBooks’ modern cloud-first design.

Choose TallyPrime if you need an on-premises option or highly specific industry customization, and are comfortable with its interface.

4. Marg ERP

Running a retail business with complex inventory?

Marg ERP excels for retail businesses, especially pharmacies or FMCG, requiring advanced inventory features like batch tracking, expiry dates, and manufacturing capabilities. From my analysis, Marg ERP provides robust inventory and offline options, while ProfitBooks focuses on simpler, cloud-based inventory.

Choose Marg ERP if your business heavily relies on advanced, customizable inventory control or requires offline operational capabilities.

Quick Decision Guide

- Choose ProfitBooks: Simplicity, affordability, and essential cloud-based features

- Choose QuickBooks Online: Complex accounting needs, dedicated staff, broad features

- Choose Zoho Books: Existing Zoho ecosystem or advanced project/international needs

- Choose TallyPrime: On-premises preference or highly customized industry modules

- Choose Marg ERP: Advanced inventory control, retail focus, or offline capabilities

The best ProfitBooks alternatives depend on your specific business needs and budget priorities, not just feature counts.

ProfitBooks Setup

Worried about a complicated accounting software setup?

This ProfitBooks review section provides a practical look at what it takes to get this accounting software up and running, helping you set realistic expectations for your deployment.

1. Setup Complexity & Timeline

Getting started is surprisingly fast.

ProfitBooks is designed for quick setup, with many businesses reporting they can begin invoicing clients within 5 to 15 minutes of signing up. From my implementation analysis, the ease of setup minimizes upfront effort, especially for those transitioning from manual methods or spreadsheets, making the implementation timeline very short.

You’ll quickly move from initial sign-up to productive use without needing extensive planning or complex configuration.

2. Technical Requirements & Integration

Minimal technical hurdles to overcome.

As a cloud-based solution, ProfitBooks only requires internet access, eliminating manual installations and ensuring automatic updates. What I found about deployment is that it avoids hardware provisioning or complex IT infrastructure changes, fitting seamlessly into most existing business environments without additional software.

Your team will only need basic internet connectivity and a web browser or mobile device, simplifying technical readiness immensely.

- 🎯 Bonus Resource: While we’re discussing critical operational considerations, understanding legal hold software is equally important for compliance.

3. Training & Change Management

User adoption is remarkably straightforward.

ProfitBooks’s intuitive design and user-friendly interface mean the learning curve is minimal, often requiring less than 15 minutes to get comfortable. From my analysis, staff quickly adapt to the platform’s features like invoicing and expense tracking due to its clear, logical layout and strong accounting structure.

Expect a smooth transition for your team, as the software is built for accessibility even without extensive accounting knowledge.

4. Support & Success Factors

Excellent support accelerates your journey.

Customer support for ProfitBooks is frequently praised as “excellent, very fast, very friendly, very helpful,” which is crucial during initial setup and for ongoing questions. What I found about deployment is that responsive vendor support significantly eases the process, helping you navigate any challenges quickly and efficiently.

Plan to leverage their support, which acts as a key success factor, ensuring a smooth and confident deployment for your business.

Implementation Checklist

- Timeline: Minutes to a few hours for basic setup

- Team Size: Business owner/accountant, minimal IT involvement

- Budget: Primarily software subscription, minimal setup costs

- Technical: Internet access and web browser/mobile device

- Success Factor: Leveraging responsive customer support effectively

Overall, ProfitBooks setup is remarkably straightforward, offering quick deployment and high user adoption for small and medium businesses.

Bottom Line

Should ProfitBooks be your next accounting software?

My ProfitBooks review shows a compelling solution for businesses prioritizing simplicity and affordability over enterprise-level complexity in their financial management.

- 🎯 Bonus Resource: While we’re discussing business management solutions, understanding residential construction estimating software is equally important for specialized industries.

1. Who This Works Best For

Freelancers, solopreneurs, and small businesses.

ProfitBooks truly shines for independent professionals, service-based companies, and startups with 1-10 employees needing straightforward invoicing, expense tracking, and basic inventory. From my user analysis, businesses prioritizing ease of use and cost-effectiveness will find this software an excellent fit for their core financial operations.

You will achieve significant time savings if your focus is efficient, professional financial management without deep accounting expertise.

2. Overall Strengths

User-friendly interface simplifies complex accounting tasks.

The software succeeds by offering an incredibly intuitive design that makes invoicing, expense tracking, and basic inventory management accessible to non-accountants. From my comprehensive analysis, its robust free plan and affordable premium tiers provide exceptional value compared to many competitors, eliminating hidden costs.

These strengths mean you can manage your finances efficiently, focusing more on business growth and less on software complexities.

3. Key Limitations

Advanced inventory management and customization are limited.

While functional, ProfitBooks’ inventory features are basic compared to specialized solutions, and it lacks extensive customization or deep industry-specific functionalities. Based on this review, businesses with complex manufacturing or highly niche accounting needs might find its capabilities insufficient for their specific workflows and reporting requirements.

I find these limitations manageable if your needs are core accounting, but they could be deal-breakers for highly specialized operations.

4. Final Recommendation

ProfitBooks earns a strong recommendation for its niche.

You should choose this software if your business prioritizes simplicity, affordability, and efficient core financial management, especially if you’re a freelancer or small business. From my analysis, it’s an ideal alternative to more complex, expensive options when ease of use and cost are your primary drivers for software selection.

My confidence level is high for its target audience, ensuring a reliable and straightforward experience for your financial operations.

Bottom Line

- Verdict: Recommended for simplicity and affordability

- Best For: Freelancers, solopreneurs, and small businesses (1-10 employees)

- Business Size: Ideal for micro to small businesses with basic accounting needs

- Biggest Strength: Highly user-friendly interface and cost-effective plans

- Main Concern: Limited advanced features for complex inventory or customization

- Next Step: Explore the free plan or request a demo to assess your needs

This ProfitBooks review highlights strong value for the right business profile, offering a straightforward and affordable accounting solution that saves time and money.