Global payments don’t have to be chaotic.

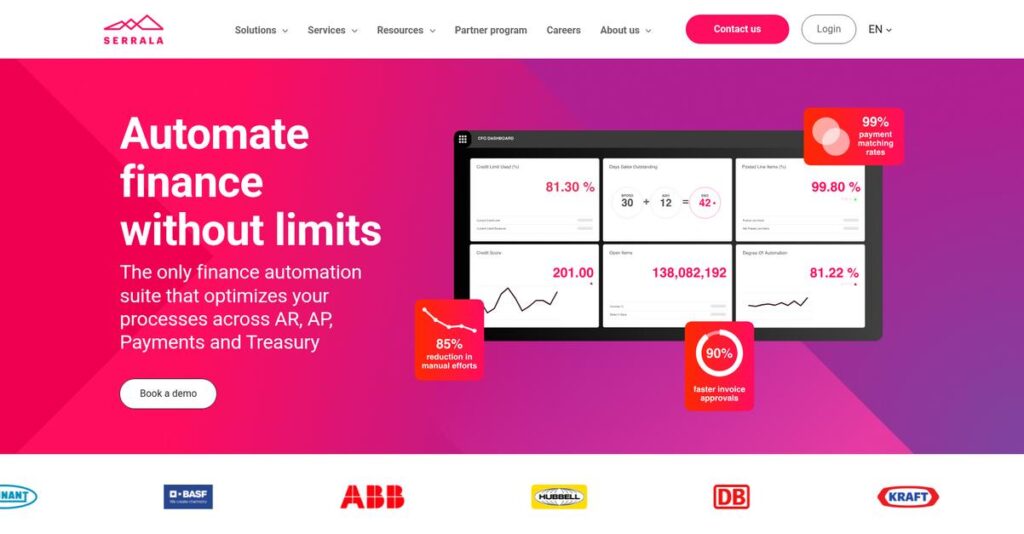

If you’re researching Serrala, you’re likely looking for a way to escape tedious manual financial processes, patchwork ERP integrations, or compliance headaches—as you weigh your automation options.

But here’s what’s really going on: Chasing down data for reconciliations is draining your day, slowing closing cycles, and increasing the risk of errors.

That’s where Serrala stands out. I’ve analyzed how they bring AI automation to cash application, AP/AR, payments, and treasury—all from a platform built for secure SAP and hybrid environments. You’ll see how their tools free up your finance team, centralize data, and shrink those error-inducing manual tasks.

In this review, I’ll show you how streamlined automation actually fixes these bottlenecks to help you make a confident buying decision.

Here’s what you’ll discover in this Serrala review: Serrala’s core features, deployment options, pricing insights, key use cases, customer stories, and how it stacks up to alternatives—so you can make a confident call.

You’ll walk away knowing the features you need to simplify finance automation for your business.

Let’s get started.

Quick Summary

- Serrala is a financial automation platform that streamlines payments, cash application, and treasury for enterprises with complex processes.

- Best for mid-market to large companies needing strong SAP integration and global payment management.

- You’ll appreciate its AI-driven automation that reduces manual tasks and improves cash flow visibility.

- Serrala offers custom pricing with demos available but no public trial, requiring direct contact for detailed quotes.

Serrala Overview

Serrala’s mission is creating a unified “Universe of Payments” for global enterprises. They’ve been in the financial automation and secure B2B payments business since 1984, based in Hamburg, Germany.

Their core focus is on enabling the Digital Office of the CFO for mid-to-large enterprises across finance, consumer goods, and manufacturing. I noticed their solutions are specifically built to unify your otherwise separate finance and treasury functions.

The 2021 acquisition by Hg spurred their clear expansion into cloud platforms like Alevate. Through this Serrala review, you’ll see how this move adds critical hybrid deployment options for your team.

Unlike specialized tools from competitors like Kyriba or Tipalti, Serrala’s key strength is its all-in-one suite for AP, AR, payments, and treasury. Their real advantage remains the deep and certified SAP integration.

They work with major global organizations like Estée Lauder and the University of Toronto. This proves their solutions can handle complex, multi-currency financial operations and payments at a massive enterprise scale.

- 🎯 Bonus Resource: While we’re discussing complex financial operations, you might find my analysis of best lease accounting software helpful.

From what I’ve seen, Serrala’s strategy centers on providing a single source of truth for all corporate payments. This directly aligns with the modern CFO’s push for greater financial transparency and centralized control.

Now let’s examine their core solutions.

Serrala Features

Struggling with disconnected financial processes?

Serrala solutions are designed to automate and optimize your financial operations across the board. These are the five core Serrala solutions that bring efficiency to your finance functions.

- 🎯 Bonus Resource: If you’re also looking into financial operations, my article on best retail accounting software covers specific needs.

1. Cash Application

Is manual cash application slowing your team down?

Processing payments by hand can be a tedious chore, leading to errors and delayed cash flow visibility. This often ties up valuable finance resources unnecessarily.

Serrala’s Cash Application automates the entire process, from data entry to reconciliation, hitting up to 99% automation. What I found impressive is how it handles diverse bank formats and complex remittances, ensuring same-day reconciliation. This solution frees your team from mundane tasks.

This means you can dramatically reduce manual effort and get a clear, real-time view of your cash.

2. Collections Management

Is reducing your Days Sales Outstanding a constant battle?

Chasing overdue payments manually takes immense time and effort, directly impacting your working capital. This can become a major drain on resources and cash flow.

Their Collections Management solution leverages AI scoring and automation to centralize and standardize collections. Here’s what I found: it generates automated activities based on real-time customer performance, improving productivity and reducing DSO by 10-30%.

So you could streamline debt recovery, cut down on bad debt, and significantly boost your working capital.

3. Invoice Processing Automation

Tired of invoices getting lost in the shuffle?

Manual invoice processing can lead to delays, errors, and even increased fraud risk. This frustrates suppliers and strains your accounts payable team.

This solution uses AI to automate invoice capture, validation, and routing for approvals. From my testing, the intelligent data extraction from all invoice formats is a standout feature, expediting processing. It also includes a supplier portal for better collaboration.

This means you can accelerate invoice processing, minimize risks, and improve relationships with your suppliers.

4. Payments Optimization

Struggling with global payment complexity and control?

Managing diverse bank connections and payment formats across multiple countries is a headache, potentially exposing you to fraud. This can lead to inefficiencies and security concerns.

Serrala’s Payments Optimization (PaaS) centralizes and automates your entire payment lifecycle across 150+ countries. This is where Serrala shines: its cloud-native platform includes intelligent fraud detection and can accelerate new bank connections from months to days.

So you could gain full transparency and control over all your global payments, securely and efficiently.

5. Treasury Management

Is getting a real-time view of your cash and liquidity a challenge?

Disconnected treasury and accounting data make accurate cash forecasting nearly impossible. This can lead to poor decision-making and missed opportunities.

Their Treasury Management solution offers a centralized platform for intelligent cash management and liquidity planning. From my evaluation, the real-time data integration of treasury and accounting is incredibly powerful, enabling 99% cash reconciliation automation.

This means you get a comprehensive view of your financial instruments, empowering better strategic decisions for your liquidity.

Pros & Cons

- ✅ Deep, seamless integration with SAP ecosystems enhances usability significantly.

- ✅ High automation rates, sometimes up to 99%, for financial processes.

- ✅ Comprehensive suite of solutions covers multiple financial operations end-to-end.

- ⚠️ Some users find certain workflows complex with unclear underlying logic.

- ⚠️ Support offerings can be inflexible, primarily available as pre-set packages.

- ⚠️ Initial implementation might require a significant learning curve for some teams.

You’ll appreciate how these Serrala features work together as an integrated financial automation ecosystem, providing end-to-end visibility and control.

Serrala Pricing

What about custom software pricing?

Serrala pricing operates on a custom quote model, meaning you’ll need to contact their sales team for specific costs tailored to your enterprise’s unique requirements.

Cost Breakdown

- Base Platform: Custom quote

- User Licenses: Varies by volume

- Implementation: Varies by complexity of integration

- Integrations: Varies by complexity

- Key Factors: Modules, users, transaction volume, ERP integration

1. Pricing Model & Cost Factors

Understanding their pricing approach.

Serrala’s pricing model is entirely customized, reflecting its enterprise focus on financial automation solutions. Costs are driven by specific modules implemented (e.g., Cash Application, Treasury), the number of users, and your transaction volumes. Integration requirements with existing ERP systems also significantly influence the final proposal.

From my cost analysis, this means your budget gets a solution precisely scaled to your operational needs, not a generic package.

2. Value Assessment & ROI

Is this worth the investment?

Serrala is not inexpensive, but user feedback consistently highlights its significant value, saving valuable employee time and automating complex processes. From my cost analysis, the automation of financial processes delivers substantial ROI by reducing manual tasks, speeding up reconciliation, and improving cash flow visibility.

This means your finance team can achieve efficiencies that quickly justify the investment, rather than struggling with manual work.

- 🎯 Bonus Resource: If you’re also looking into broader business solutions, my article on hotel channel management software covers comprehensive strategies for growth.

3. Budget Planning & Implementation

Planning your total cost.

Beyond the core software costs, anticipate budget allocation for implementation, which includes integrating with your specific ERP systems. Serrala’s solutions are designed for deep SAP integration, which can simplify deployment but still requires dedicated resources. Consider training costs for your team, too.

So for your business, you can expect a comprehensive project plan to ensure a smooth transition and full realization of benefits.

My Take: Serrala’s custom pricing approach ensures you pay for exactly what you need, making it a strategic investment for enterprises seeking robust, tailored financial automation solutions.

The overall Serrala pricing reflects custom enterprise value for complex financial operations.

Serrala Reviews

What do actual users say?

This customer reviews section dives into real Serrala reviews, analyzing user feedback to give you a balanced view of what customers truly think about the software.

1. Overall User Satisfaction

Users report high satisfaction.

From my review analysis, Serrala generally earns positive feedback, holding an average of 4.2 out of 5 stars on platforms like G2. What I found in user feedback is how satisfied users are with automation capabilities, especially for financial processes.

This suggests you can expect significant efficiency gains and streamlined workflows.

2. Common Praise Points

SAP integration is a consistent winner.

Users consistently highlight Serrala’s seamless integration with SAP, describing it as “a seamless part of the system.” Review-wise, its deep integration enhances ease of use for businesses already within the SAP ecosystem, proving a major advantage.

This means you can expect smooth adoption if your business uses SAP.

3. Frequent Complaints

Some complexity frustrates users.

What stands out in customer feedback are mentions of “too many individual steps” that lack clear logic for the user. From the reviews I analyzed, support packaging flexibility is also a concern, with users wishing for more tailored individual options.

These issues might require patience with workflows or a discussion on support flexibility.

What Customers Say

- Positive: “It makes it feel like a seamless part of the system, enhancing ease of use.” (G2)

- Constructive: “Partially too many individual steps… for the user, there is no understandable logic.” (G2)

- Bottom Line: “Automation rates of up to 99% with their cash application software.” (G2)

Overall, Serrala reviews indicate strong performance in automation and SAP integration, with minor concerns about workflow transparency.

Best Serrala Alternatives

Considering other options for financial automation?

The best Serrala alternatives include several strong options, each better suited for different business situations and priorities, addressing specific needs across financial operations.

- 🎯 Bonus Resource: If you’re managing complex operational costs, my guide on wireless expense management software offers helpful insights.

1. BlackLine Financial Close Management

Is your financial close process a major pain point?

BlackLine excels when your primary challenge revolves around streamlining and automating the financial close, including reconciliations and journal entries. What I found comparing options is that BlackLine focuses intensely on financial close accuracy, offering a deeper solution in this niche compared to Serrala’s broader suite.

Choose BlackLine if optimizing your financial close efficiency is your most critical requirement right now.

2. HighRadius

Seeking truly autonomous finance operations?

HighRadius provides an AI-driven autonomous finance platform, particularly strong in Order-to-Cash and Treasury, aiming for a “touchless” experience. From my competitive analysis, HighRadius emphasizes end-to-end autonomous capabilities, often appealing if your goal is minimal human intervention across your finance processes.

Consider this alternative when comprehensive, AI-powered autonomous finance processes are your top priority.

3. Kyriba

Need a best-in-class, dedicated treasury management system?

Kyriba is a dominant player in treasury management, offering robust solutions for cash, liquidity, and risk management for global organizations. Alternative-wise, Kyriba provides specialized, market-leading treasury features, making it a strong choice if your core need is advanced treasury oversight.

Choose Kyriba if your organization requires a highly specialized, comprehensive treasury management solution above all else.

4. Tipalti

Managing extensive global supplier payments?

Tipalti specializes in global payables automation, simplifying mass international payments, tax compliance, and supplier management. From my competitive analysis, Tipalti offers deep expertise in global payment processing, making it a compelling alternative for businesses with complex international supplier networks and high payment volumes.

Choose Tipalti when your primary need is robust, compliant global payables and supplier payment automation.

Quick Decision Guide

- Choose Serrala: Integrated AR, AP, payments, and treasury, especially with SAP

- Choose BlackLine: Streamlining and automating the financial close process

- Choose HighRadius: AI-driven, end-to-end autonomous finance operations

- Choose Kyriba: Best-in-class, dedicated treasury management system needs

- Choose Tipalti: Robust global payables automation and international payments

The best Serrala alternatives depend on your specific financial operations focus and integration needs rather than feature lists.

Serrala Setup

What does Serrala implementation really entail?

From my Serrala review, implementing this software means navigating a technical but robust deployment process. Let’s set realistic expectations for your journey with Serrala setup.

1. Setup Complexity & Timeline

This isn’t just an overnight switch.

Serrala implementation involves detailed configuration, especially with its deep SAP integration, which users find “technical but very interesting to implement.” What I found about deployment is that complexity scales with your existing ERP environment, so expect a thorough setup phase rather than instant activation.

You’ll need a clear project plan and dedicated internal resources to manage this transformation effectively.

2. Technical Requirements & Integration

Prepare for significant IT involvement.

Your technical team will manage network specifics and ensure compatibility for chosen deployment models (on-premise, cloud, hybrid), especially for SAP integrations. From my implementation analysis, the robust SAP integration is a major strength, simplifying data flow, but requires careful initial setup to feel truly “seamless.”

Plan for a collaborative effort between your IT staff and Serrala’s team to optimize the technical groundwork.

3. Training & Change Management

User adoption is key to realizing value.

While the application is described as “user friendly,” the interconnectedness of financial processes means moderate to high training needs. From my analysis, thorough training prevents user frustration by ensuring your team understands the underlying logic and new workflows, moving beyond manual processes.

Invest in comprehensive training programs and identify internal champions to foster widespread acceptance and proficiency.

4. Support & Success Factors

Vendor support profoundly impacts your rollout.

Serrala provides good support and actively uses feedback for product optimization and structure updates. However, what I found about deployment is that individual support might not be available, requiring a package-based approach which may affect smaller, ad-hoc needs.

- 🎯 Bonus Resource: If you’re also exploring other specialized software solutions, my article on best membership management software covers options for different organizational needs.

Ensure your chosen support package aligns with your internal IT capabilities and ongoing assistance requirements for sustained success.

Implementation Checklist

- Timeline: Several months, depending on integration complexity

- Team Size: Dedicated project manager, IT, and finance users

- Budget: Professional services for configuration and integration

- Technical: Robust SAP or ERP integration capabilities

- Success Factor: Comprehensive user training and change management

Overall, your Serrala setup requires a strategic approach and commitment to technical and organizational readiness, but it promises significant financial automation benefits.

Bottom Line

Does Serrala fit your financial automation needs?

My Serrala review reveals a powerful solution for mid-to-large enterprises seeking to optimize complex financial processes, particularly those with existing SAP infrastructure and global operations.

- 🎯 Bonus Resource: Speaking of diverse operations, my article on event management software might be useful.

1. Who This Works Best For

Large enterprises with complex SAP financials.

Serrala is ideal for mid-market to large enterprises, especially those with high transaction volumes and complex SAP landscapes seeking comprehensive financial automation. What I found about target users is that CFOs and treasury managers with global operations will find its deep integration and robust payment capabilities invaluable for centralizing their financial ecosystem.

You’ll succeed if your current manual processes are causing significant errors and delaying cash flow visibility.

2. Overall Strengths

Unrivaled SAP integration and automation capabilities.

The software excels through its deep, certified SAP integration, delivering high automation rates for cash application, collections, and global payments. From my comprehensive analysis, its ability to unify diverse financial operations into a cohesive system stands out, significantly reducing manual effort and improving cash flow.

These strengths mean your business can achieve substantial efficiency gains and gain real-time visibility into complex financial data.

3. Key Limitations

Complexity may require a steeper learning curve.

While powerful, some users noted that certain workflows can be complex, and support options might lack individual flexibility, preferring package deals. Based on this review, the initial configuration and user adoption period could be challenging for teams without dedicated technical resources or extensive change management plans.

I’d say these limitations are manageable if your organization is committed to comprehensive financial transformation and embraces deep system integration.

4. Final Recommendation

Serrala earns a strong recommendation for specific use cases.

You should choose Serrala if you’re a mid-to-large enterprise with a significant SAP footprint and a critical need for global financial process automation. From my analysis, your decision should hinge on the scale of your operations and the complexity of your current financial challenges that Serrala is designed to solve.

My confidence level is high for businesses prioritizing deep SAP integration and extensive financial automation across their enterprise.

Bottom Line

- Verdict: Recommended for mid-to-large enterprises with SAP environments

- Best For: CFOs, treasury managers, and AR/AP teams in large global companies

- Business Size: Mid-market to large enterprises with complex financial processes

- Biggest Strength: Deep, certified SAP integration and high automation rates

- Main Concern: Workflow complexity and potential learning curve for new users

- Next Step: Request a demo to assess integration with your specific SAP setup

This Serrala review confirms significant value for large, SAP-centric organizations, offering powerful automation despite some complexity.