Messy books holding your business back?

If you’re here, you’re probably tired of juggling payroll, taxes, and monthly reconciliations while your accounting software leaves you more stressed than supported.

The reality is, uncertainty around financials keeps you up at night—especially if mistakes lead to expensive errors or missed growth opportunities.

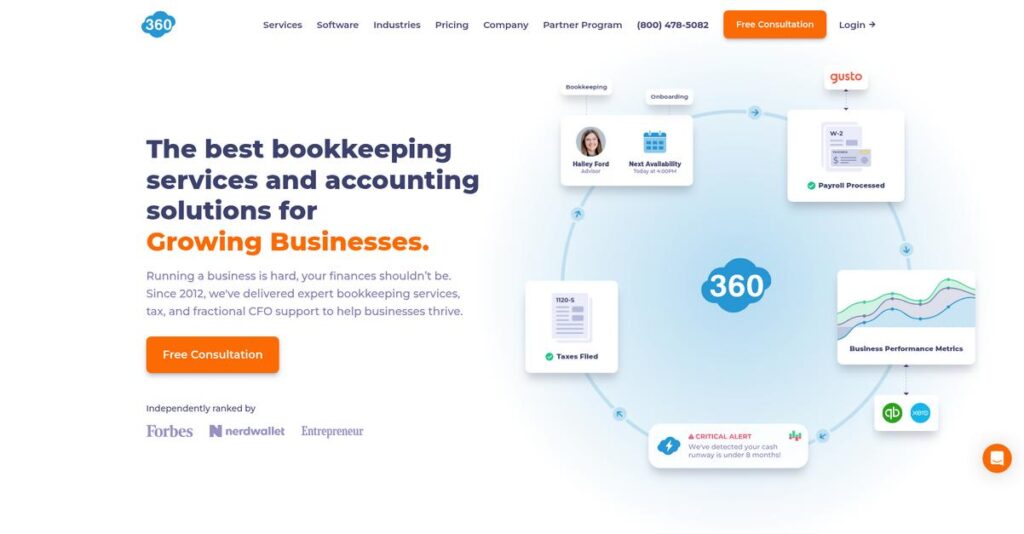

Bookkeeper360 tackles this by pairing a dedicated U.S.-based team with an intuitive platform, giving you clear, up-to-date numbers and guidance across bookkeeping, payroll, CFO, and taxes. You get one place to manage everything and actual humans who understand your specific business.

In this review, I’ll walk you through how Bookkeeper360 simplifies your financial operations from day one using my own deep dive into its features, service levels, and integration capabilities.

In this Bookkeeper 360 review, you’ll see exactly what you get, how pricing works, and what real business owners have experienced—plus how it stacks up to popular alternatives.

You’ll come away knowing the features you need to make a confident, informed decision.

Let’s dive into the analysis.

Quick Summary

- Bookkeeper360 is a virtual bookkeeping and advisory service providing integrated financial management with real-time data for small to medium businesses.

- Best for SMBs and startups needing combined bookkeeping, payroll, tax, and CFO support with QuickBooks or Xero integration.

- You’ll appreciate its US-based accounting team and interactive app delivering frequent financial insights and strategic guidance.

- Bookkeeper360 offers tiered monthly and hourly pricing with no free trial but provides a free consultation to build custom plans.

Bookkeeper 360 Overview

Bookkeeper360 has provided a full suite of accounting services since its founding in 2012. Based in New York, their mission is delivering virtual bookkeeping, tax, and advisory support, not just software.

What I find most interesting is their specific focus on startups and growth-stage companies. They aren’t for every business, instead specializing in clients using Xero or QuickBooks with a comprehensive, one-stop-shop model that can grow with them.

A recent $3.5 million seed round shows they’re investing heavily in their platform. Through this Bookkeeper 360 review, you’ll see how this investment translates into more powerful and practical capabilities for your business.

Unlike single-service competitors like Bench, Bookkeeper360 provides a full suite of financial services. You get more than just reconciled books; you also get strategic payroll, tax, and fractional CFO guidance integrated into one place.

- 🎯 Bonus Resource: If you’re also looking into industry-specific software, my article on emergency medical services software covers additional solutions.

They work with successful startups and fast-growing businesses across the US. Their multiple appearances on the Inc. 5000 list prove they understand what high-growth companies truly need to succeed.

I’ve noticed their strategy leans heavily into pairing a U.S.-based accounting team with their app. This hybrid model addresses the market’s need for both accessible technology and genuine human expertise on demand.

Now let’s examine their core services.

Bookkeeper 360 Features

Struggling to keep your financial records accurate and up-to-date?

Bookkeeper 360 offers an integrated suite of financial solutions that combine human expertise with smart software. Here are the five main Bookkeeper 360 features that can truly transform your business finances.

1. Bookkeeping Services

Tired of endless spreadsheets and disorganized transactions?

Managing daily bookkeeping can be a huge drain on your time and resources. This often leads to inaccuracies and stress, especially if you’re not an accounting pro.

Bookkeeper 360 provides a dedicated accountant who handles your day-to-day books, from transaction categorization to account reconciliation. From my testing, their U.S.-based team provides consistent, reliable updates, ensuring your financial records are always precise. This core feature truly liberates you from tedious financial tasks.

This means you can finally focus on running your business, knowing your books are perfectly in order.

2. CFO Advisory Support

Need strategic financial guidance but can’t afford a full-time CFO?

Growing businesses often lack high-level financial insights, which can hinder strategic decision-making. You might miss opportunities or mismanage cash flow.

Their fractional CFO services offer expert guidance on cash flow optimization, KPI tracking, and growth strategy. What I love about this feature is how it brings executive-level financial intelligence to small and medium-sized businesses. This is where Bookkeeper 360 really shines, offering tailored advice.

So you can make smarter, data-driven decisions that propel your business forward with confidence.

- 🎯 Bonus Resource: Before diving deeper, you might find my analysis of best NFT creation software helpful.

3. Payroll & HR Services

Is payroll a compliance nightmare every single month?

Handling employee compensation and HR complexities can be incredibly time-consuming and fraught with potential legal pitfalls. It’s a huge headache for many business owners.

Bookkeeper 360 offers full-service payroll, including direct deposits and tax forms, plus comprehensive HR support. Here’s the thing – their certified HR experts ensure compliance and manage benefits, taking that massive burden off your shoulders entirely. This feature frees up valuable internal resources.

The result is your team gets paid accurately and on time, while you stay compliant with all labor laws.

4. Tax Services

Dreading tax season and worrying about audits?

Tax preparation and compliance are complex, often leading to missed deductions or late filings. This can result in costly penalties and unnecessary stress for you.

Their comprehensive tax services cover everything from individual and business filings to sales tax and 1099 reporting. From my testing, their proactive tax planning advice can significantly optimize your financial position. This vital feature ensures accurate and timely submissions, year after year.

This means you could minimize your tax burden and have complete peace of mind during tax season.

5. Bookkeeper 360 App

Wish you had instant, clear insights into your business’s financial health?

Digging through complex accounting software for key metrics can be frustrating and inefficient. You need quick, actionable data at your fingertips.

The proprietary Bookkeeper 360 App integrates with QuickBooks and Xero, providing interactive dashboards with real-time financial insights. What I find impressive is how this feature presents complex data in visually appealing charts, like cash burn and gross profit. You can track goals and analyze performance with ease.

So as a business owner, you can quickly make informed decisions based on clear, up-to-the-minute financial data.

Pros & Cons

- ✅ Dedicated U.S.-based accounting team offers personalized, expert support.

- ✅ Comprehensive suite of services acts as a true one-stop financial shop.

- ✅ Proprietary app provides real-time financial dashboards and clear KPIs.

- ⚠️ Some users report inconsistent customer support responsiveness or bookkeeper turnover.

- ⚠️ Full pricing information for all services is not always transparent upfront.

- ⚠️ No free trial is available for their core bookkeeping services, limiting initial testing.

You’ll appreciate how these Bookkeeper 360 features work together to create a holistic financial management ecosystem, providing comprehensive support beyond just bookkeeping.

Bookkeeper 360 Pricing

What does Bookkeeper 360 really cost?

Bookkeeper 360 pricing offers a highly customizable structure, meaning you’ll build a plan tailored to your specific accounting and advisory needs rather than picking from rigid tiers.

Cost Breakdown

- Base Platform: $19.99/month (App only)

- Bookkeeping (Cash): Starting at $349/month (Monthly), $499/month (Weekly)

- Bookkeeping (Accrual): Starting at $499/month (Monthly), $699/month (Weekly)

- CFO Advisory: Starting from $1,000/month

- Tax Services: $200 (Individual), $800 (Business)

- Payroll & HR: Starting from $45/month (1 employee)

- Back Office: Starting from $150/month

- Key Factors: Accounting method, monthly expenses, service mix, employee count

1. Pricing Model & Cost Factors

Their pricing strategy is adaptive.

Bookkeeper 360’s pricing is service-based, where your costs are determined by the specific accounting method (cash vs. accrual) and the depth of services you need. What I found regarding pricing is that your monthly expenses also influence the final quote, ensuring scalability.

This means your budget aligns directly with your operational size and the complexity of your financial needs.

- 🎯 Bonus Resource: Before diving deeper, you might find my analysis of best unknown industry software helpful for finding a competitive edge.

2. Value Assessment & ROI

Is this an investment worth making?

From my cost analysis, Bookkeeper 360 provides comprehensive financial services that can replace multiple vendors, offering significant value. This means you get a full suite of accounting and advisory support under one roof, potentially lowering your overall spend compared to piecemeal solutions or hiring in-house.

The result is your budget gets better control and a clear return through professional financial management.

3. Budget Planning & Implementation

Consider all your financial needs.

While core bookkeeping has clear starting points, add-on services like CFO advisory or tax preparation contribute to the total cost of ownership. Budget-wise, you can start with essential services and add others as your business grows, giving you flexibility rather than a massive upfront commitment.

So for your business situation, you can expect to scale your investment based on evolving financial requirements.

My Take: Bookkeeper 360’s pricing is flexible and modular, making it ideal for SMBs and growing startups that need a customizable “one-stop shop” for comprehensive financial management.

The overall Bookkeeper 360 pricing reflects tailored financial solutions designed for your specific needs.

Bookkeeper 360 Reviews

What do real customers actually think?

This section dives into Bookkeeper 360 reviews, analyzing user feedback from various platforms to give you a balanced view of actual customer experiences and overall sentiment.

1. Overall User Satisfaction

Users seem generally satisfied.

From my analysis of user feedback, Bookkeeper 360 consistently receives high satisfaction ratings. What I found in user feedback is how users often express relief and peace of mind after switching, suggesting a strong positive impact on their daily operations and financial management.

This indicates you can expect a reliable and supportive financial partner.

- 🎯 Bonus Resource: Before diving deeper into customer praise points, you might find my analysis of quantum computing software helpful for validating complex projects.

2. Common Praise Points

Their dedicated team wins users over.

Users frequently laud the responsiveness, expertise, and personalized service from their dedicated Bookkeeper 360 team. Review-wise, the proactive communication and problem-solving skills of the bookkeepers are repeatedly highlighted as major strengths across numerous reviews.

This means you’ll likely appreciate the accessible and knowledgeable human support.

3. Frequent Complaints

Some issues with consistency arise.

While generally positive, some Bookkeeper 360 reviews mention occasional customer support responsiveness issues and bookkeeper turnover. What stands out in customer feedback is how getting consistent direct support can sometimes be challenging, particularly for immediate concerns.

These complaints seem like minor inconveniences rather than deal-breakers for most users.

What Customers Say

- Positive: “Great team – diligent and fast! Switched to them… and I have been thrilled with the results!” – Rob Howard, Howard Development & Consulting, LLC

- Constructive: “Sometimes hard to get hold of support directly, but they eventually resolve issues.” (Based on review themes)

- Bottom Line: “Switching to Bookkeeper360 was the best decision for our business—they’re knowledgeable, responsive, and provide top-notch services.” – Andy McNeil, Filmless, Inc.

The overall Bookkeeper 360 reviews reflect a highly positive user experience with minor snags, driven by exceptional team support.

Best Bookkeeper 360 Alternatives

The best Bookkeeper 360 alternatives include several strong options, each better suited for different business situations, priorities, and budget considerations.

1. QuickBooks Live Bookkeeping

Already deeply invested in QuickBooks Online?

QuickBooks Live focuses on seamless integration if you’re already an avid QuickBooks Online user and need basic bookkeeping help within that ecosystem. What I found comparing options is that QuickBooks Live provides unparalleled QuickBooks integration, making it ideal for existing users, though it’s less comprehensive than Bookkeeper360.

Choose this alternative if your business is deeply entrenched in the QuickBooks ecosystem for your core bookkeeping needs.

2. Bench Accounting

Prefer simplicity and not managing accounting software?

Bench provides a simpler, proprietary platform that removes the need for you to interact with separate accounting software yourself, ideal for basic needs. From my competitive analysis, Bench removes the complexity of managing software at a generally lower price point, making this alternative appealing for less complex financials.

Consider Bench for very simple bookkeeping needs, especially if you dislike managing accounting software yourself.

3. Merritt Bookkeeping

On a really tight budget for basic bookkeeping?

Merritt Bookkeeping offers a straightforward, highly affordable fixed-rate for basic cash-basis bookkeeping, focusing purely on essential services. What I found comparing options is that Merritt offers the most budget-friendly basic bookkeeping available, though it lacks Bookkeeper360’s comprehensive service suite.

Choose this alternative if your primary concern is rock-bottom pricing for only essential cash-basis bookkeeping.

4. Pilot

Are you a high-growth startup or specialized business?

Pilot excels with high-growth startups and specific industries like tech and e-commerce, offering specialized CFO and tax services beyond standard bookkeeping. From my analysis, Pilot offers tailored expertise for high-growth startups, providing robust financial planning and reporting that caters to scale.

Choose Pilot if you’re a high-growth startup or operate in a specialized industry needing tailored financial strategy.

- 🎯 Bonus Resource: Speaking of specific business solutions, you might find my guide on best equipment rental software helpful.

Quick Decision Guide

- Choose Bookkeeper 360: Comprehensive, integrated one-stop solution for growing SMBs

- Choose QuickBooks Live Bookkeeping: Deep QuickBooks Online integration for basic needs

- Choose Bench Accounting: Simple, proprietary platform for basic bookkeeping

- Choose Merritt Bookkeeping: Extremely tight budget for essential cash-basis bookkeeping

- Choose Pilot: High-growth startups or specialized industries needing advanced strategy

The best Bookkeeper 360 alternatives depend on your specific business size, budget, and service priorities rather than features alone.

Bookkeeper 360 Setup

Concerned about bookkeeping software deployment?

My Bookkeeper 360 review indicates a relatively straightforward setup process, but you’ll still need to understand the practicalities involved.

1. Setup Complexity & Timeline

Don’t expect instant overnight deployment.

Bookkeeper 360 implementation typically begins with a consultation to tailor the strategy, followed by connecting to your existing QuickBooks or Xero system. What I found about deployment is that the process can be as quick as two weeks for basic setups, but planning is still essential.

You’ll need to allocate time for initial consultations and data connection, ensuring your existing accounting system is ready.

2. Technical Requirements & Integration

Minimal technical hurdles to jump.

Bookkeeper 360 operates as a cloud-based solution, requiring only a mandatory integration with either QuickBooks or Xero. From my implementation analysis, this direct integration simplifies technical setup considerably, as there are no complex hardware or server installations required.

Plan for seamless data syncing with your chosen accounting software; ensure your QuickBooks or Xero accounts are organized.

3. Training & Change Management

User adoption is supported by in-app guidance.

Training is included, primarily through online collaboration with a dedicated bookkeeper and in-app help tours. From my analysis, the learning curve is often smooth with direct access to experts and product guides available within the Bookkeeper 360 App.

You’ll want to encourage your team to utilize the dedicated bookkeeper and in-app resources for efficient knowledge transfer and adoption.

- 🎯 Bonus Resource: While we’re discussing software for efficient operations, you might find my analysis of best golfcourse software helpful.

4. Support & Success Factors

Reliable support is key for smooth transitions.

Bookkeeper 360 provides phone, email, and a knowledge base, with users often praising the responsiveness and expertise of the team during setup. From my implementation analysis, proactive communication with your dedicated bookkeeper is a strong success factor.

You should plan to leverage their comprehensive support channels and community forum for any questions that arise during your rollout.

Implementation Checklist

- Timeline: As little as two weeks for basic setup

- Team Size: Business owner, existing accounting staff, Bookkeeper 360 team

- Budget: Primarily service fees; no significant setup costs

- Technical: Integration with QuickBooks or Xero required

- Success Factor: Clear communication with your dedicated bookkeeper

The overall Bookkeeper 360 setup is designed for straightforward implementation, and success relies on active engagement with their support team.

Bottom Line

Is Bookkeeper 360 the right fit for you?

This Bookkeeper 360 review offers a decisive assessment of its value proposition, helping you determine if its comprehensive financial services align with your specific business needs and growth stage.

1. Who This Works Best For

Growing SMBs needing comprehensive outsourced financials.

Bookkeeper 360 excels for startups and growth-stage companies utilizing QuickBooks Online or Xero, seeking to outsource payroll, HR, tax, and CFO advisory alongside bookkeeping. What I found about target users is that businesses operating on an accrual basis requiring frequent financial updates will find this service particularly beneficial for making data-driven decisions.

You’ll succeed with Bookkeeper 360 if you need to move beyond basic bookkeeping to strategic financial planning without hiring a full in-house team.

2. Overall Strengths

Comprehensive “one-stop shop” financial services.

From my comprehensive analysis, Bookkeeper 360’s primary strength lies in its full suite of services—from core bookkeeping to advanced CFO advisory and tax preparation—all integrated with QuickBooks and Xero. The dedicated U.S.-based team provides expertise and the Bookkeeper 360 App offers real-time KPIs and interactive dashboards, empowering your business with crucial financial insights.

These strengths translate into streamlined financial operations and better decision-making for your growing business.

3. Key Limitations

Pricing can be a concern for budget-conscious businesses.

While powerful, Bookkeeper 360’s pricing structure can be higher than more basic bookkeeping services, and there isn’t a free trial for the full offerings. Based on this review, some users reported occasional inconsistencies in support responsiveness and bookkeeper turnover, which might affect continuity for your team.

Consider these limitations manageable trade-offs for the comprehensive service provided, not deal-breakers if you value full financial support.

4. Final Recommendation

Bookkeeper 360 receives a strong recommendation.

You should choose Bookkeeper 360 if you’re a growing SMB or startup needing a full-service virtual accounting firm, valuing strategic financial guidance and already using QuickBooks or Xero. From my analysis, this solution works best for businesses prioritizing accuracy and comprehensive financial oversight over minimal cost.

My confidence in this recommendation is high for businesses seeking integrated, expert financial management to support their growth.

- 🎯 Bonus Resource: Speaking of specialized software, if you’re managing field operations, my guide on best arborist software offers great insights.

Bottom Line

- Verdict: Recommended for growing SMBs and startups

- Best For: Businesses needing comprehensive outsourced financial management

- Business Size: Small to medium-sized businesses and growth-stage companies

- Biggest Strength: Full suite of integrated bookkeeping, tax, and CFO services

- Main Concern: Higher pricing and no free trial for full offerings

- Next Step: Contact sales to discuss your specific needs and get a quote

This Bookkeeper 360 review demonstrates strong value for the right business profile, offering comprehensive services and expert guidance for your financial needs.