Struggling with crypto compliance and fraud?

As a compliance officer or IT lead, you’re constantly battling sophisticated illicit activities that put your financial institution or tech firm at risk.

Choosing the wrong platform means failing to meet regulatory requirements, leading to hefty fines, operational disruptions, and severe reputational damage.

According to TRM Labs, over $45 billion in illicit crypto transactions occurred in 2024. This staggering figure proves that manual oversight alone is no longer enough.

Speaking of gaining insights, my guide on best marketing analytics tools offers strategies for optimizing your campaigns.

But the right analysis platform can solve this by giving you clear visibility into complex on-chain data, simplifying your fraud detection efforts.

In this guide, I’ll cut through the vendor hype and review the best blockchain analysis tools to help you secure your operations and meet your compliance needs.

You’ll discover how to find a solution that offers real-time fraud alerts, automated audits, and easy integration with your existing systems.

Let’s dive in.

Quick Summary:

| # | Software | Rating | Best For |

|---|---|---|---|

| 1 | Chainalysis → | Enterprise financial firms | |

| 2 | Elliptic → | Global compliance teams | |

| 3 | TRM Labs → | Regulated crypto firms | |

| 4 | Scorechain → | Crypto businesses & banks | |

| 5 | Crystal Blockchain → | Mid-sized tech firms |

1. Chainalysis

Struggling to track illicit blockchain activity effectively?

Chainalysis provides the tools to uncover real-world services behind complex blockchain transactions.

This means you can understand the entire flow of funds from source to destination, visualizing illicit networks to combat crypto crime proactively.

This shifts your approach from reactive to proactive.

Chainalysis helps you manage risky exposure by enabling continuous, real-time screening of crypto transactions. You can tailor risk settings, assess deposits, and audit suspicious user activity for compliance.

Its AI-powered fraud detection identifies scammers before they meet victims, reducing payments-related fraud and building customer trust. Additionally, the platform provides enterprise-grade security to prevent cyber exploits and financial risks for protocols, chains, and asset managers. This results in confident scalability and security for your decentralized applications.

The outcome is enhanced operational efficiency.

While focusing on digital security and compliance, you might also be interested in my guide on patient engagement software solutions.

Key features:

- Trace illicit activity: Visualize and analyze networks to understand the entire flow of funds, identify leads, and combat crypto crime across chains and Web3.

- Monitor and manage risk: Screen crypto transactions in real-time, tailor risk settings, and audit suspicious user activity to ensure compliance and prevent illicit acts.

- Harden Web3 security: Leverage enterprise-grade security to prevent cyber exploits, scams, and financial risks for protocols, asset managers, and exchanges.

Learn more about Chainalysis features, pricing, & alternatives →

Verdict: Chainalysis helps IT directors and compliance officers balance security with scalability by providing comprehensive cross-chain tracing and AI-powered fraud detection. With over $12.6 billion in illicit funds frozen, it’s a robust solution for those seeking the best blockchain analysis tools for regulatory compliance and fraud prevention.

2. Elliptic

Struggling with complex crypto compliance and fraud detection?

Elliptic provides enterprise-grade solutions for every stage of your compliance lifecycle. This means you can confidently manage risk from onboarding to ongoing monitoring.

Their robust VASP screening and automated transaction monitoring help you meet critical AML regulatory requirements easily.

Here’s how to simplify your crypto operations.

Elliptic helps you tackle fraud detection and ensure regulatory adherence with its comprehensive suite of tools. For instance, their Discovery and Lens products provide VASP screening and real-time multi-asset wallet screening, crucial for financial institutions.

Additionally, Navigator offers fully automated crypto transaction monitoring, while Investigator delivers single-click cross-chain investigations to uncover illicit activity. Elliptic’s analytics provide visualizations for exposure trend analysis, giving you actionable insights. Plus, their AI Copilot boosts your team’s efficiency in handling compliance workflows.

The result is enhanced operational efficiency and compliance.

While we’re discussing comprehensive compliance solutions, understanding HR compliance software is equally important for holistic risk management.

Key features:

- Comprehensive Compliance: Offers VASP screening, wallet and transaction monitoring, and configurable risk rules to automate your AML and compliance efforts.

- Powerful Investigations: Provides single-click cross-chain investigations, bulk wallet analysis, and custom threat intelligence datasets to thwart crypto crime.

- Unmatched Coverage: Supports over 50 blockchains, processing over 211 million transfers daily to give you 99% market coverage and zero blind spots.

Learn more about Elliptic features, pricing, & alternatives →

Verdict: Elliptic is one of the best blockchain analysis tools for organizations prioritizing robust fraud detection and compliance. With over 700 customers across 29 countries and 99% global trading volume covered, it streamlines crypto compliance at scale, reducing risk and operational costs.

3. TRM Labs

Struggling with complex blockchain fraud and compliance?

TRM Labs provides robust blockchain intelligence, allowing you to investigate, monitor, and detect crypto and digital asset fraud effectively. This means you can gain critical oversight.

It offers a comprehensive set of risk indicators, crucial for maintaining the highest standards for AML/CFT compliance. This allows your team to easily set custom risk scoring criteria.

Here’s how TRM Labs helps.

The platform provides extensive asset coverage, supporting over 200 million assets across 35+ blockchains, including industry-leading NFT coverage and DeFi protocols. This broad visibility helps you trace the flow of funds.

You can also leverage its cross-chain analytics, which allows you to seamlessly move between Bitcoin, Ethereum, and more than a dozen other blockchains. This enables building cohesive visualizations for detailed forensic analysis. The new data standard gives you access to the largest and fastest-growing database of illicit activity, built from proprietary threat intelligence and advanced data science, crucial for real-time fraud detection.

The result is enhanced operational efficiency.

While TRM Labs focuses on blockchain data, if you’re also exploring how to unify your devices, my article on best IoT software provides comprehensive insights.

Key features:

- Extensive Asset Coverage: Supports over 200 million assets across 35+ blockchains, including NFTs and DeFi protocols, to provide comprehensive visibility and analysis.

- Cross-Chain Analytics: Enables seamless tracing of funds across multiple blockchains like Bitcoin and Ethereum, building cohesive visualizations for detailed investigations.

- 150+ Risk Categories: Offers a comprehensive set of risk indicators, including FATF’s money laundering predicate offenses, allowing you to set custom risk scoring criteria for compliance.

Learn more about TRM Labs features, pricing, & alternatives →

Verdict: TRM Labs provides comprehensive blockchain intelligence for investigating, monitoring, and detecting crypto fraud. Its extensive asset coverage, cross-chain analytics, and 150+ risk categories make it one of the best blockchain analysis tools for bolstering fraud detection and compliance for your firm.

4. Scorechain

Is your firm struggling with crypto compliance and fraud detection?

Scorechain offers real-time transaction monitoring and wallet screening to tackle suspicious activity head-on, ensuring bulletproof compliance for your crypto business or financial institution. This means you can confidently make decisions and meet regulatory requirements.

This advanced blockchain analytics platform empowers you to stay one step ahead of risky transactions, streamlining your AML and risk management efforts. You’ll gain crucial insights while navigating complex regulations.

Here’s how to simplify your crypto compliance.

Scorechain provides an all-in-one platform for your digital asset compliance needs. This solution simplifies the process of assessing risk and protecting your assets, whether you’re a crypto business or a traditional financial institution expanding into digital assets.

It delivers automated wallet analysis, powered by on-chain intelligence and risk indicators, alongside an exploration tool for mastering blockchain transaction investigation. This includes tracking fund flows and identifying counterparties, which is critical for due diligence. Additionally, you can easily create Know Your Transaction (KYT) and Know Your Address (KYA) reports, vital for compliance and audits.

Their customizable and predictive alerts boost your AML and risk management, helping you detect and prevent potential sanctions breaches, as seen with Coinumm and EXMO. With over 30 blockchains covered and 350,000+ entities labeled, Scorechain offers comprehensive due diligence and secure engagement with digital assets.

The result is robust risk management and regulatory alignment.

Key features:

- Wallet Transaction Screening & Monitoring: Provides real-time insights and automated analysis of crypto wallets to ensure bulletproof compliance and risk management.

- Know Your Address and Know Your Transaction Reports: Enables one-click generation of essential KYA and KYT reports for comprehensive compliance, audits, and deep-dive investigations.

- Customisable and Predictive Alerts: Boosts AML and risk management by proactively identifying potential risks and suspicious activities through advanced, configurable alerts.

Learn more about Scorechain features, pricing, & alternatives →

Verdict: Scorechain is engineered to deliver confident decision-making and seamless regulatory compliance for your organization. Its real-time transaction monitoring, predictive alerts, and comprehensive reporting capabilities make it one of the best blockchain analysis tools for firms aiming to enhance fraud detection and streamline compliance workflows.

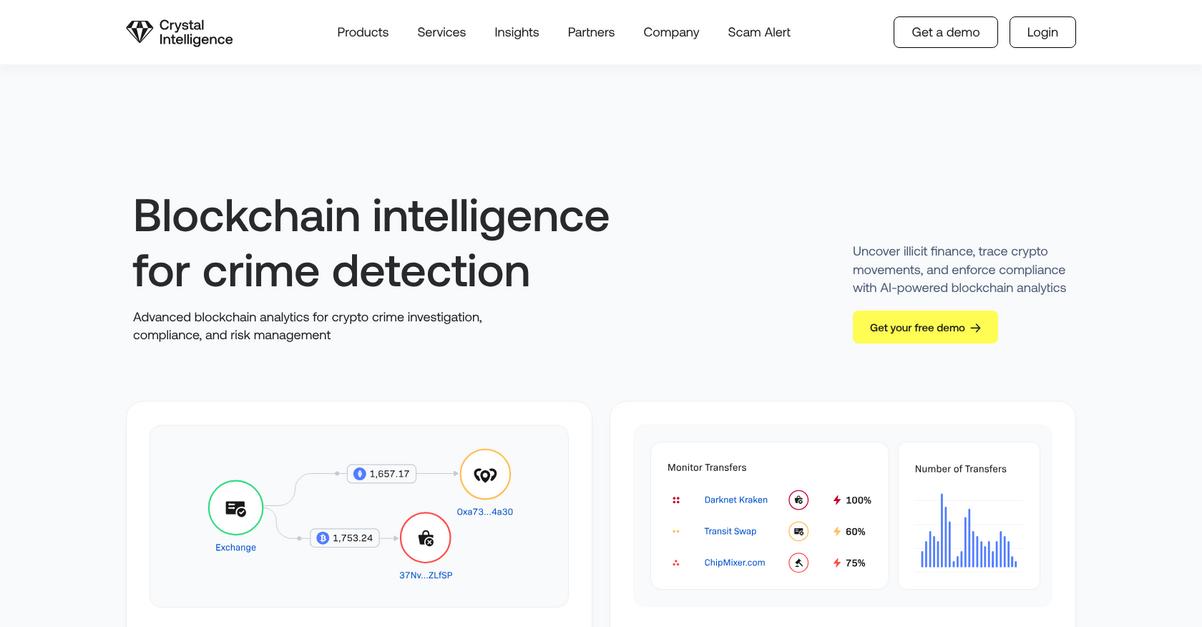

5. Crystal Blockchain

Struggling to find clarity in complex blockchain data?

Crystal Blockchain offers advanced analytics to uncover illicit finance and trace crypto movements.

This means you can enforce compliance with AI-powered blockchain analytics and accelerate your KYC processes.

Ready to simplify regulatory compliance?

Crystal Blockchain allows you to investigate crypto crime in seconds, tracing wallets and visualizing transaction flows. This enhances operational efficiency by streamlining your fraud detection efforts.

You can identify risky wallets and entities with Crystal’s verified data, providing 360-degree entity risk analysis and instant alerts on suspicious activity. Additionally, it helps you strengthen platform security by detecting and blocking fraud threats. The result is maintaining security integrity and scalability for your growing decentralized applications.

Protecting the future of global financial growth.

Key features:

- Investigate Crypto Crime: Trace wallets and visualize transaction flows with interactive network maps, helping your team resolve cases with smart case maps and actionable threat alerts.

- Monitor Risk & Classify Entities: Flag risky flows instantly, prioritize threats, and identify risky wallets and entities by accessing Crystal’s verified data.

- Real-Time Risk Monitoring: Receive instant alerts on suspicious activity and track live transactions, integrating compliance alerts seamlessly to automate compliance at scale.

Learn more about Crystal Blockchain features, pricing, & alternatives →

Verdict: Crystal Blockchain excels at providing real-time fraud detection and robust compliance features. Trusted by global companies, it has flagged over 11M+ transfers and verified 100K+ entities, making it one of the best blockchain analysis tools for mid-sized tech firms and financial institutions.

6. Dune

Struggling to navigate complex blockchain data for insights?

This means you need powerful tools to transform raw blockchain data into actionable intelligence.

It’s clear that understanding blockchain activity for fraud detection and compliance is critical for your organization.

Here’s how you can gain clarity.

Dune empowers you to quickly extract meaningful insights from vast blockchain datasets. This helps you monitor transactions, identify suspicious patterns, and maintain regulatory compliance.

You can analyze over 35 different blockchains, including Ethereum, Bitcoin, Polygon, and Solana, all within a single platform, enhancing your cross-chain analytical capabilities. Additionally, Dune provides access to a wealth of public data and a community of analysts, giving you the edge in detecting fraud and ensuring robust compliance. This allows you to build comprehensive dashboards tailored to your specific needs.

The result is unparalleled data visibility.

Key features:

- Comprehensive blockchain coverage across 35+ chains like Ethereum and Bitcoin, enabling you to conduct cross-chain analysis for robust fraud detection.

- Public data access and community insights allow you to leverage shared knowledge and pre-built queries to accelerate your compliance and investigative efforts.

- Customizable dashboard creation lets you visualize complex blockchain data, helping your team quickly identify suspicious activity and make informed decisions.

Learn more about Dune features, pricing, & alternatives →

Verdict: Dune’s extensive blockchain coverage and customizable dashboards make it one of the best blockchain analysis tools for IT directors and compliance officers. It effectively addresses challenges in real-time fraud detection and regulatory compliance by transforming raw data into actionable insights, enhancing operational efficiency for your team.

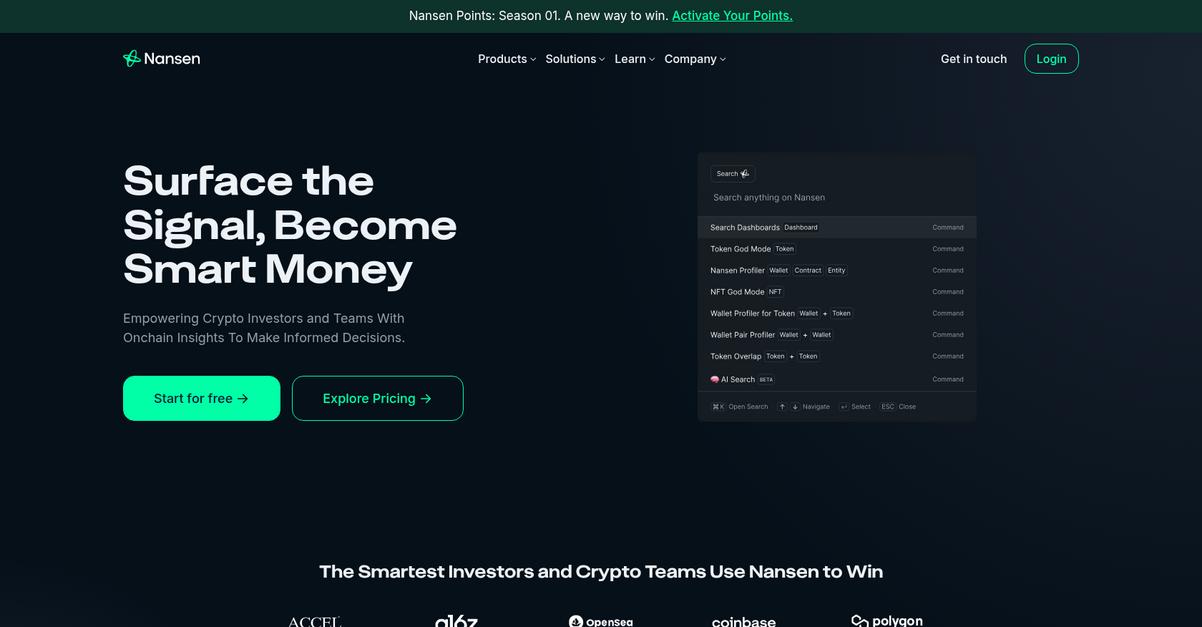

7. Nansen

Are you struggling with unvetted blockchain analysis tools?

Nansen helps you cut through the noise with its powerful wallet labeling and on-chain insights. This means you can spot opportunities and defend your portfolio.

Their platform offers real-time dashboards and alerts, helping you make informed decisions and detect potential fraud or suspicious activity early.

Here’s how you can gain an edge.

Nansen empowers crypto investors and teams with on-chain insights, allowing you to stay ahead by tracking Smart Money movements. You can uncover what’s happening on your favorite blockchain across 12+ chains.

Nansen’s Smart Alerts notify you of specific on-chain activities, helping you avoid costly mistakes. For instance, some users saved millions by detecting early UST Curve pool drains. This tool equips you to verify hunches and manage your holdings.

Additionally, with Nansen Query, you can programmatically access on-chain data blazingly fast, and Nansen Research Portal provides professionally researched insights to enhance your due diligence. It truly consolidates everything you need.

The result is amplified insights, not increased workload.

Key features:

- Advanced wallet labeling: Gain clarity on who or what each wallet is, distinguishing top investors from potential rug pullers.

- Real-time Smart Alerts: Receive instant notifications about critical on-chain activities, allowing proactive fraud detection and risk mitigation.

- Multi-chain portfolio tracking: Manage and monitor your personal or organizational crypto holdings across multiple blockchains in one dashboard.

Learn more about Nansen features, pricing, & alternatives →

Verdict: Nansen is an all-in-one platform providing comprehensive on-chain analytics with features like 300M labeled addresses and Smart Alerts. This makes Nansen one of the best blockchain analysis tools for IT directors and compliance officers seeking robust fraud detection and scalable solutions in high-regulation industries.

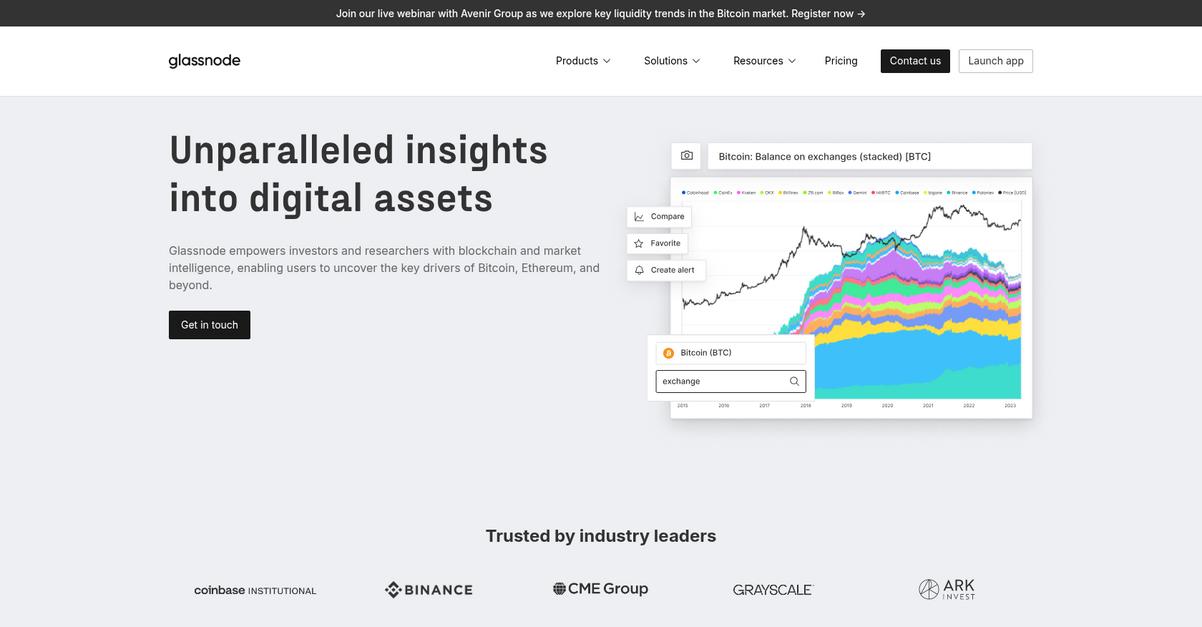

8. Glassnode

Are you struggling with unvetted blockchain analysis tools?

Glassnode provides unparalleled insights into digital assets, empowering your team.

This means you can uncover the key drivers of Bitcoin, Ethereum, and beyond, streamlining analysis with curated analytics.

Gain a definitive view.

Glassnode delivers on-chain metrics alongside off-chain spot and derivatives market data through a robust analytics suite. This helps you understand novel asset fundamentals, follow capital flows precisely, and gauge true market sentiment. You can track liquidity, supply, and profit and loss dynamics with market metrics, all through an intuitive interface and API. Additionally, their bespoke research and on-demand education provide in-depth reports and expert commentary, ensuring you stay ahead with market updates and collaborate with experts to refine your strategies.

This comprehensive approach supports crucial fraud detection and compliance efforts.

While we’re discussing comprehensive analytics, understanding API security testing tools is also vital for robust system integrity.

Key features:

- Comprehensive Analytics Suite: Visualize and analyze blockchain and financial metrics with customizable charts and dashboards, offering a comprehensive view of digital assets.

- High-Performance API Access: Seamlessly connect high-fidelity on- and off-chain data via a robust API, delivering rapid access to support trading strategies and models.

- Expert Research & Education: Gain unique knowledge through specialist newsletters, expert research, and bespoke reports, helping you stay ahead of market trends.

Learn more about Glassnode features, pricing, & alternatives →

Verdict: Glassnode equips IT directors and compliance officers with sophisticated tools and innovative data to form a definitive view of digital assets. Its pioneering on-chain analysis and institutional DNA make it a top choice among the best blockchain analysis tools for enhancing fraud detection, ensuring compliance, and gaining market understanding you can act on.

9. Coin Metrics

Struggling with blockchain analysis overload?

Coin Metrics offers foundational data and intelligence crucial for your fraud detection and compliance efforts. This means you gain critical clarity.

You can finally navigate the complex blockchain landscape with confidence, ensuring your team has accurate, reliable insights for informed decisions.

Here’s how you gain control.

Coin Metrics empowers you to overcome unvetted options by providing institutional-grade data and analytics. This directly addresses your anxiety about selecting tools with insufficient compliance features.

You can access comprehensive data to support real-time fraud detection and enhance your operational efficiency. Their offerings streamline your workflow, reducing manual oversight and supporting robust regulatory compliance. This allows for scalable and secure decentralized applications.

Additionally, their intelligence helps distinguish between niche tools and comprehensive platforms, ensuring you select a solution that truly meets your enterprise-grade support needs and integration requirements.

While we’re discussing robust regulatory frameworks, understanding HIPAA compliance software is equally important for specific data protection needs.

Your path to confident compliance.

Key features:

- Institutional-grade data: Provides trusted, foundational blockchain data and intelligence, critical for making informed decisions in high-regulation industries.

- Comprehensive analytics: Offers a robust suite of tools that support real-time fraud detection and bolster your overall regulatory compliance framework.

- Scalable solutions: Designed to integrate smoothly with existing protocols, helping your organization maintain security integrity and scalability for growing decentralized applications.

Learn more about Coin Metrics features, pricing, & alternatives →

Verdict: Coin Metrics provides the foundational data and intelligence necessary to elevate your fraud detection and compliance efforts, addressing key pain points for IT directors and compliance officers. Its focus on institutional-grade data makes it one of the best blockchain analysis tools for mid-sized tech firms and financial institutions.

10. CipherTrace

Is your organization battling undetected crypto fraud?

You can identify and eliminate fraud with CipherTrace’s comprehensive blockchain analytics. This means you can pinpoint illicit activities.

It helps you trace billions in illicit cryptocurrency, keeping your funds safe. You gain complete transparency into financial transactions.

So, how does CipherTrace help?

CipherTrace provides unparalleled visibility into complex crypto transactions. This means you can track funds across various blockchains.

You can easily monitor suspicious activity and meet your regulatory obligations, ensuring compliance and preventing financial crime. This also helps you identify high-risk entities quickly.

Additionally, CipherTrace helps you protect your business by proactively detecting fraud and money laundering schemes before they impact your operations. This protects your reputation and prevents significant financial losses. You maintain strong security integrity.

Protect your assets and ensure compliance.

While discussing compliance, you might also find my guide on best form management software helpful for streamlining related processes.

Key features:

- Comprehensive Crypto Intelligence: Gain insights into billions in illicit crypto transactions, improving your ability to detect and investigate fraud and money laundering attempts.

- Enhanced Fraud Detection: Identify suspicious activities and high-risk entities across multiple blockchains, providing real-time alerts and enabling proactive threat mitigation.

- Regulatory Compliance: Streamline your anti-money laundering (AML) and know-your-customer (KYC) processes with automated tools that ensure adherence to global financial regulations.

Learn more about CipherTrace features, pricing, & alternatives →

Verdict: CipherTrace excels as one of the best blockchain analysis tools for identifying and preventing crypto fraud. Its ability to trace billions in illicit cryptocurrency and provide comprehensive transaction visibility helps overcome compliance anxiety and ensures enhanced operational efficiency for your team.

Conclusion

Still struggling with crypto fraud?

Choosing the right tool is overwhelming for your tech firm. You need a platform that balances security, scalability, and compliance without breaking the bank.

According to scoop.market.us, over 60% of fraud detection systems will use AI by 2025. This decisive shift to AI analytics makes manual oversight obsolete, pushing you to adapt or fall behind.

Here is the tool I trust.

From my experience, Chainalysis is the clear winner here. It directly tackles your biggest challenge: balancing enterprise-grade security with the scalability your firm demands.

Its AI-powered fraud detection is a game-changer, identifying illicit activity before it can cause harm. I believe it’s one of the best blockchain analysis tools available.

I suggest you book a free demo of Chainalysis. See for yourself how its powerful analytics can protect your operations and build trust.

You’ll achieve true operational efficiency.