Finding safe, high yields is tough.

You’re sorting through countless platforms. Hidden risks like smart contract vulnerabilities make every choice feel like a huge gamble.

The biggest fear is choosing the wrong platform. You could watch your hard-earned capital disappear overnight due to a volatile asset or security flaw.

Confusing APY calculations and high transaction fees often eat into your profits. This makes it nearly impossible to tell what your actual returns will be. It’s frustrating.

But what if you had a clear guide to navigate these complexities safely? This is exactly what you need to find reliable opportunities.

In this guide, I’m breaking down the best yield farming platform options. I’ll help you compare them on security, returns, and ease of use.

You’ll learn how to spot credible platforms and avoid common pitfalls, helping you invest with more confidence and maximize your passive income.

Let’s get started.

Quick Summary:

| # | Software | Rating | Best For |

|---|---|---|---|

| 1 | Aave → | Risk-averse DeFi professionals | |

| 2 | Compound → | Stable yield seekers | |

| 3 | Curve Finance → | Stablecoin-focused investors | |

| 4 | Uniswap → | Decentralized exchange users | |

| 5 | Yearn → | Diversified DeFi strategists |

1. Aave

Seeking stable, high-yield passive income strategies?

Aave’s non-custodial liquidity protocol addresses the challenge of securing returns in DeFi. This means you can supply and borrow assets while maintaining control over your funds.

The result? Reduced anxiety for evaluators needing transparency and control.

Aave unlocks the full power of DeFi.

You can earn interest by supplying your assets to liquidity pools, or borrow against your collateral across multiple networks. You’ll also find it easy to swap any ERC-20 token, even those already borrowed or supplied. Additionally, the GHO stablecoin, native to the Aave Protocol, offers an overcollateralized, decentralized option for stable value.

Plus, you can easily track the risk level of your borrow positions with their Health Factor.

While we’re discussing digital asset management, you might find my analysis of SharePoint migration tools helpful for compliant data handling in traditional enterprise environments.

Key features:

- Non-Custodial Control: You maintain full control over your funds during supplying and borrowing, ensuring security and mitigating risk.

- Multi-Network Support: Deployable on any EVM compatible network, offering flexibility and broader access to liquidity across chains.

- Transparent & Secure: Open-source protocol with publicly visible transactions, extensive audits, and a bug bounty program for peace of mind.

Learn more about Aave features, pricing, & alternatives →

Verdict: Aave stands out as a strong contender for the best yield farming platform by offering robust security, transparency, and non-custodial control over your assets, which directly addresses the needs of risk-averse DeFi professionals.

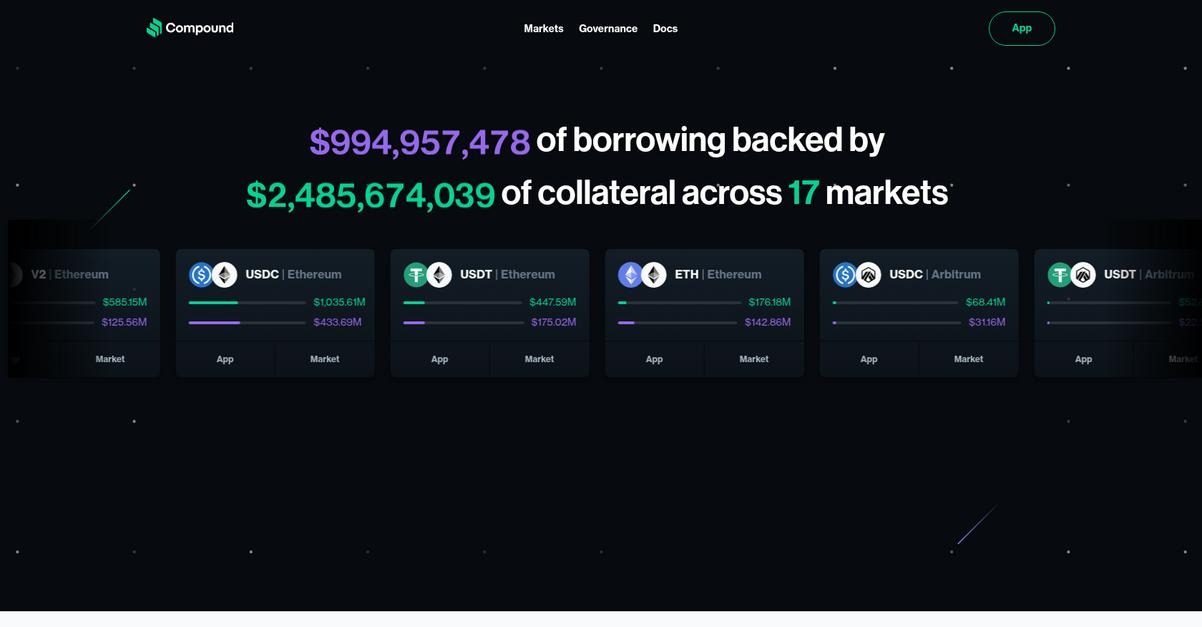

2. Compound

Struggling to navigate the complex world of yield farming?

Compound Finance simplifies this by letting you supply crypto assets to earn interest. This means you can easily generate passive income.

You can also borrow crypto by supplying collateral, providing flexibility for your investment strategies.

So, how does Compound help you achieve stable, high yields?

Compound provides transparent, algorithmically determined interest rates. This allows you to clearly understand your potential returns.

You can interact with the protocol directly from your wallet, ensuring a seamless experience. This direct interaction removes intermediaries, making the process more efficient.

Additionally, Compound’s open-source protocol allows for integration with other DeFi applications, giving you extensive diversification options and enhancing your overall long-term investment efficiency.

Maximize your returns with confidence.

While we’re discussing ensuring operational stability and managing your investments securely, understanding how business continuity management software can protect your assets is also key.

Key features:

- Earn interest on crypto: Supply supported cryptocurrencies to the Compound protocol and automatically start earning passive income through transparent, algorithmically determined interest rates.

- Borrow against your assets: Securely borrow cryptocurrencies by providing collateral, allowing you to leverage your existing holdings without selling them, enhancing your operational flexibility.

- Open-source and composable: Benefit from a fully open-source protocol that fosters innovation and allows for seamless integration with a wide array of other DeFi applications, expanding your investment possibilities.

Learn more about Compound features, pricing, & alternatives →

Verdict: Compound stands out as a strong contender for the best yield farming platform by offering a secure, transparent, and flexible way to earn passive income or borrow crypto. Its open-source nature and clear interest rates address core pain points for professionals seeking stable, high-yield opportunities while mitigating risks.

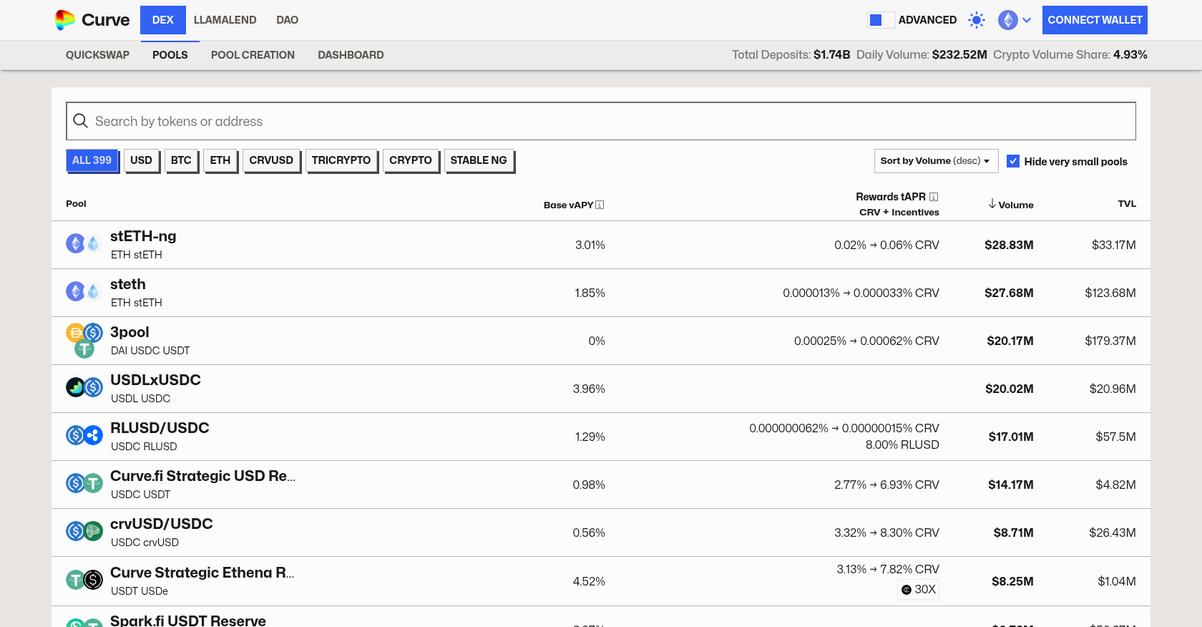

3. Curve Finance

Struggling to find secure, high-yield opportunities?

Curve Finance provides deep liquidity, crucial for navigating volatile markets and ensuring stable returns. This means you can trade large volumes of stablecoins with minimal slippage.

You’ll find it’s easier to manage risk while still accessing competitive APYs, directly addressing your need for reliable, low-risk strategies.

Here’s how Curve Finance helps you.

Curve Finance’s innovative stableswap algorithm minimizes impermanent loss, a common pain point for yield farmers. This lets you focus on maximizing your passive income, not worrying about asset depreciation.

Its focus on stablecoin swaps provides a safer foundation for your yield farming activities, reducing exposure to high volatility. Plus, with its support for multiple chains, you gain the flexibility to diversify your investments across a broader ecosystem.

This platform offers a powerful solution for those seeking consistent and secure returns, providing the transparency and efficiency you need to make informed decisions and maintain operational flexibility.

Maximizing your DeFi returns has never been simpler.

Key features:

- Deep Liquidity Pools: Facilitates large-volume stablecoin trades with minimal price impact, ensuring efficient and secure transactions for your diversified investments.

- Stableswap Algorithm: Minimizes impermanent loss and slippage, allowing you to maximize your passive income through stable, high-yield strategies that align with your risk aversion.

- Multi-Chain Support: Provides the flexibility to access various blockchain networks, enhancing your ability to diversify assets and integrate with existing workflows for operational efficiency.

Learn more about Curve Finance features, pricing, & alternatives →

Verdict: Curve Finance is undeniably the best yield farming platform for professionals prioritizing stable, high-yield opportunities. Its deep liquidity and stableswap algorithm directly address pain points like impermanent loss and slippage, making it ideal for maximizing passive income safely.

4. Uniswap

Struggling to find safe, high-yield farming opportunities?

You’re seeking platforms that balance high APYs with crucial security and compliance needs. Uniswap offers a decentralized solution to address these core concerns.

This means you can access a wide range of tokens directly, bypassing traditional intermediaries. This simplifies the process for managing your diversified crypto assets effectively.

So, how does Uniswap deliver this?

Uniswap solves the problem of navigating complex APY calculations and filtering unreliable options. It provides a straightforward interface for liquidity provision, directly enhancing your passive income.

You can swap, earn, and build on the Uniswap Protocol, simplifying your DeFi strategy. This allows for diversified, low-risk approaches while maintaining operational flexibility, crucial for meeting client expectations.

Additionally, as a leading decentralized exchange, Uniswap provides transparency in transactions. This multi-chain support and emphasis on user education directly mitigate risks, enhancing your long-term investment efficiency and aligning with regulatory compliance.

Maximize your returns with confidence.

Key features:

- Decentralized exchange: Enables direct peer-to-peer token swaps, eliminating intermediaries and enhancing security for your yield farming activities.

- Liquidity provision: Allows you to contribute assets to liquidity pools and earn a share of trading fees, directly generating passive income for you.

- Transparent transactions: Provides clear, on-chain data for all operations, offering visibility and peace of mind when assessing your yield farming strategies.

Learn more about Uniswap features, pricing, & alternatives →

Verdict: Uniswap stands out as a strong candidate for the Best Yield Farming Platform, offering essential features like decentralized swapping and transparent liquidity provision. Its focus on user education and security addresses core pain points for professionals seeking to maximize returns safely and align with compliance needs.

5. Yearn

Struggling to maximize crypto returns safely?

Yearn offers DeFi’s most battle-tested yield aggregator, helping you earn on your crypto.

Its compounding vaults leverage diverse DeFi opportunities to give you the best risk-adjusted yields without constant manual oversight.

Unlock passive income through diversified strategies.

Yearn simplifies yield farming by automating strategies, allowing you to optimize returns effortlessly.

Their “Security First” approach includes thorough contract audits and bug bounties, ensuring your assets are protected against vulnerabilities and exploits.

Additionally, a growing app ecosystem and extensive integrations with partners like Cove and Superform expand your yield opportunities, while also providing user education and FAQs to address common concerns and enhance long-term investment efficiency.

Maximize your returns with confidence.

Speaking of efficient management, you might find my article on best hospice software helpful for streamlining care.

Key features:

- Compounding Vaults: Automatically optimize your crypto earnings through diverse DeFi opportunities, focusing on the best risk-adjusted yields with minimal effort.

- Security First Audits: Comprehensive contract audits and ongoing bug bounties ensure your digital assets are protected, addressing your security and compliance needs.

- Extensive Integrations: Access external Yearn vaults and collaborations with partners, broadening your yield opportunities and streamlining your investment workflows.

Learn more about Yearn features, pricing, & alternatives →

Verdict: Yearn’s “Security First” approach, coupled with its compounding vaults and broad integration ecosystem, makes it an excellent choice for any professional seeking the best yield farming platform. You can maximize your returns through diversified, low-risk strategies while maintaining operational flexibility, ensuring stable and high yield-generating integrations.

6. Beefy Finance

Struggling to find secure, high-yield farming platforms?

Beefy Finance is a multichain yield optimizer designed to help you earn the highest APYs with safety and efficiency. This means you can confidently navigate the complex DeFi space.

You can invest your tokens in single asset vaults, and Beefy then stakes them on external platforms to generate interest. This process directly addresses the challenge of filtering numerous options.

Here’s how to maximize your passive income.

Beefy Finance automates the reinvestment of your interest, purchasing more of the asset and compounding your returns. This process is regularly and automatically repeated, saving you time and fees.

You can stake BIFI in Beefy Maxi vaults to share in the platform’s revenue or in BIFI Earnings Pools to earn native tokens from platform earnings. Additionally, your BIFI tokens give you voting power in Beefy’s DAO, ensuring transparency and control. Plus, with a fixed supply of 80,000 BIFI, inflation is controlled, further securing your investment.

This comprehensive approach offers a structured comparison framework, mitigating the fear of missing superior opportunities.

The result is stable, high yield-generating integrations.

If you’re also looking into business solutions, my article on best conversational AI platforms covers how to boost support efficiency.

Key features:

- Automated compounding: Beefy automatically reinvests your interest, saving you time and fees while maximizing your yield farming returns across various chains.

- Multichain support: You can earn the highest APYs across 36 different chains, providing extensive diversification options and operational flexibility.

- Governance and revenue share: BIFI token holders can vote in Beefy’s DAO and share in the protocol’s revenue by staking their BIFI, aligning with transparency and control.

Learn more about Beefy Finance features, pricing, & alternatives →

Verdict: Beefy Finance stands out as a strong contender for the Best Yield Farming Platform, particularly for DeFi professionals prioritizing security and automated efficiency. Its automated compounding, multi-chain support across 36 chains, and robust governance structure directly address the pain points of information overload and risk aversion. The platform’s fixed BIFI supply further enhances its appeal for stable, high-yield strategies.

7. Harvest

Tired of endless crypto yield farming comparisons?

You want to maximize returns safely, and Harvest helps by auto-compounding your crypto. This means you can focus on strategy rather than constant manual adjustments.

Harvest simplifies the complex world of yield farming, allowing you to efficiently manage your diversified crypto portfolio. Plus, it addresses your need for automation.

Here’s a simpler way to grow your crypto.

Harvest introduces automated compounding, which is crucial for maximizing your passive income without constant oversight. It’s designed to streamline your investment process.

This feature ensures that your earnings are continually reinvested, compounding your returns over time and optimizing your yield farming efficiency. This is particularly valuable if you’re aiming for stable, high yield-generating integrations.

Additionally, the emphasis on auto-compounding frees up your time, reducing the need to manually re-stake your assets. This capability helps mitigate decision anxiety and supports long-term investment efficiency, aligning with your goals for diversified, low-risk strategies while maintaining operational flexibility.

The result is optimized passive income.

Key features:

- Auto-compounding crypto: Automatically reinvests your earnings to maximize your returns, removing the need for constant manual intervention and saving your valuable time.

- Simplified yield farming: Streamlines complex investment processes, making it easier to manage and grow your crypto assets efficiently without information overload.

- Focus on returns: Empowering you to maximize passive income through diversified, low-risk strategies, aligning with your desired outcomes for stable yield generation.

Learn more about Harvest features, pricing, & alternatives →

Verdict: Harvest excels as a Best Yield Farming Platform by offering automated crypto compounding, directly addressing the pain point of information overload and manual complexity. This tool provides a structured framework for maximizing passive income safely, crucial for fintech professionals seeking stable, high yield-generating integrations without constant oversight.

8. PancakeSwap

Struggling to find safe and profitable yield farming platforms?

PancakeSwap offers a decentralized exchange with a robust ecosystem to help you maximize your crypto returns. This means you can easily trade and earn.

You gain access to a platform that allows you to easily swap tokens, provide liquidity, and stake to earn rewards. This addresses the challenge of navigating complex DeFi options.

Here’s how you can achieve your goals.

PancakeSwap empowers you to earn passive income through various opportunities like farming CAKE, staking in Syrup Pools, and participating in lotteries. This provides diverse, low-risk strategies.

You can also earn CAKE and other tokens through yield farming, providing liquidity to earn trading fees, and participating in Initial Farm Offerings (IFOs) for new tokens. This flexibility enhances your investment efficiency.

Additionally, you can win big prizes in the PancakeSwap Lottery by buying tickets with CAKE, or participate in prediction markets. Plus, the NFT marketplace lets you collect unique digital assets, connecting multiple features to overall user success.

The result is transparent, high yield-generating integrations.

While optimizing your investments, understanding other crucial business tools like pattern making software can also be beneficial for entrepreneurs.

Key features:

- Decentralized Exchange (DEX) functionality: Swap tokens quickly and efficiently on a platform that ensures you maintain control over your assets, addressing security concerns.

- Yield Farming and Staking Pools: Earn high Annual Percentage Yields (APYs) by providing liquidity and staking your crypto, directly boosting your passive income potential.

- Gamified Earning Opportunities: Engage in lotteries and prediction markets for additional earning avenues, adding a fun element to maximizing your returns.

Learn more about PancakeSwap features, pricing, & alternatives →

Verdict: PancakeSwap stands out as a strong contender for the best yield farming platform by offering diverse earning opportunities, including high APY farms and staking pools. Its decentralized nature and gamified elements like lotteries provide unique ways to maximize your returns while maintaining operational flexibility.

9. Balancer

Are you seeking to maximize returns without sacrificing security?

Balancer offers a flexible, automated market maker (AMM) protocol designed to help you achieve your desired outcomes. This means you can create and manage liquidity pools tailored to your specific investment strategies.

You gain control over your portfolio, with capabilities for custom AMMs and liquidity pools, enabling you to efficiently manage multiple assets with dynamic fees.

This approach deepens your liquidity.

Balancer helps you solve the complexity of managing diverse crypto assets by providing a powerful platform for custom liquidity solutions. You can create pools with up to eight different tokens, allowing for incredibly diversified and capital-efficient strategies.

This flexibility is crucial for maximizing your passive income through diversified, low-risk approaches. Plus, Balancer’s customizable pool types, like Weighted Pools and Stable Pools, address various risk profiles and asset types, from volatile to correlated, ensuring you maintain operational flexibility and regulatory alignment.

It truly enhances your investment efficiency.

Key features:

- Customizable Liquidity Pools: Create pools with up to eight different assets, allowing you to diversify and manage risk across multiple token types.

- Dynamic Fee Structures: Implement flexible fees that adjust based on market conditions, optimizing returns for liquidity providers and traders.

- Multi-Asset Management: Gain precise control over your portfolio with options to create custom AMMs for varying risk profiles and investment goals.

Learn more about Balancer features, pricing, & alternatives →

Verdict: Balancer stands out as a strong contender for the Best Yield Farming Platform, offering unparalleled customization and control over your liquidity strategies. Its ability to handle up to eight assets per pool and dynamic fee structures empowers you to maximize returns while maintaining crucial operational flexibility and security.

Conclusion

Finding high, safe yields is hard.

You’re navigating a minefield of smart contract vulnerabilities and confusing APYs. It’s easy to feel like one wrong move could be disastrous.

Indeed, platforms like Yearn Finance show that automated aggregators can generate 20-30% annualized returns. But finding these reliable opportunities is the real challenge, as high yields mean nothing without top-tier security.

So where should you start?

After reviewing them all, I recommend Aave. It directly addresses the need for transparency and security, letting you invest with confidence.

If you’re also looking into optimizing your business operations, my guide on best vendors management software offers valuable insights.

Aave’s non-custodial protocol ensures you always control your funds, a critical feature for the best yield farming platform. This approach mitigates risk effectively.

I suggest you visit the Aave platform to see how its features can protect your capital while maximizing growth.

You’ll gain peace of mind.