Budgeting tools eating up your team’s time?

If you’re evaluating FP&A software, you’re probably struggling with messy spreadsheets, scattered data, and non-stop back-and-forth just to build a decent forecast.

And let’s be honest—that constant manual wrangling makes every reporting cycle a headache for you and your finance team.

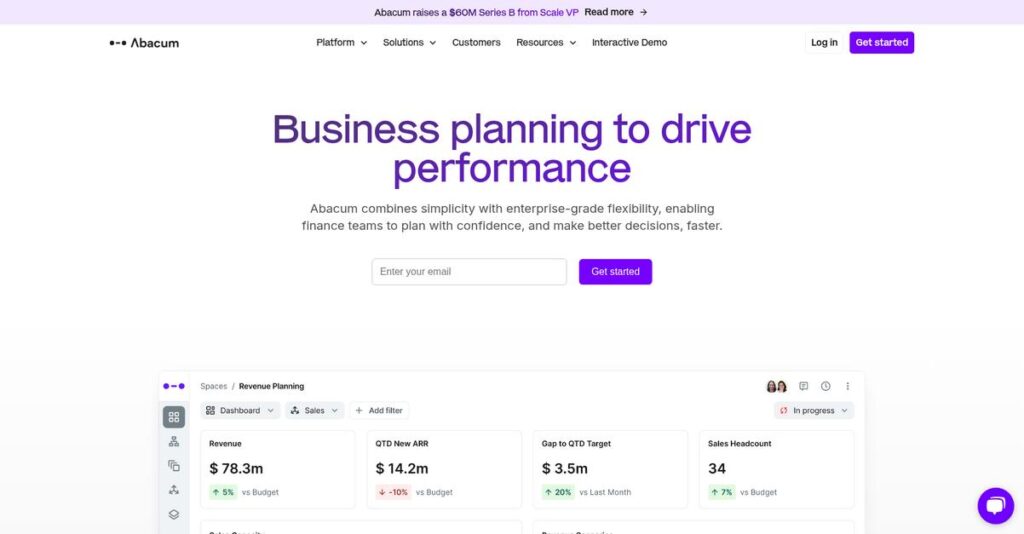

Abacum promises a smarter way to automate budgeting, centralize your numbers, and unlock insights—using AI and real-time collaboration—instead of weeks spent chasing down files and emails.

In this review, I’ll show you how Abacum helps you finally get ahead, giving your finance team back time and clarity with purpose-built automation.

Here’s what I’ll cover in this Abacum review: a hands-on look at features, user experience, integrations, pricing, limitations, and how it stacks up to alternatives—so you know if it fits your evaluation checklist.

By the end, you’ll have the details and features you need to confidently decide if Abacum is right for your next financial planning platform.

Let’s dive into the analysis.

Quick Summary

- Abacum is a financial planning and analysis platform that automates budgeting, forecasting, and real-time reporting for finance teams.

- Best for mid-market finance teams seeking to replace spreadsheets with collaborative and automated FP&A workflows.

- You’ll appreciate its strong automation capabilities and easy integrations that help reduce manual reporting and speed decision-making.

- Abacum offers custom pricing with no free trial but provides personalized demos to explore its features before buying.

Abacum Overview

Founded by former CFOs in 2020, Abacum is a New York-based FP&A platform. Their mission is to elevate your finance team into a truly strategic business partner.

They are squarely focused on mid-market companies with 200-2,000 employees that are struggling with disconnected financial and operational data. This specific specialization keeps their platform refreshingly focused compared to much larger, more generic enterprise tools.

Their recent $60M Series B funding is fueling major US expansion and advanced AI product development. You will see this forward-thinking investment reflected throughout this Abacum review.

Unlike competitors that build on top of Excel, Abacum is a standalone platform. They’re designed to replace spreadsheet-based planning entirely, an approach that feels conceived by people who have actually felt the pain of manual data consolidation.

You’ll find them working with growing organizations that have hit the ceiling with manual workflows. Their impressive revenue tripling over the last year, while maintaining team size, validates this market fit.

- 🎯 Bonus Resource: Speaking of management software, my guide on festival management software might be helpful if you are involved in event planning.

From my analysis, their core strategy is using AI to automate tedious planning cycles and deliver actionable, real-time insights. This is meant to help your team transition from reactive reporting to proactive business guidance.

Now, let’s examine their core capabilities.

Abacum Features

Manual financial planning taking too long?

Abacum features focus on transforming your FP&A process, helping finance teams become more strategic. Here are the five main Abacum features that streamline financial operations.

1. Automated Budgeting & Forecasting

Is your budgeting process still a chaotic mess?

Fragmented spreadsheets and endless email chains can make budgeting and forecasting a nightmare. This often leads to outdated plans and wasted time.

Abacum transforms this into a collaborative, structured workflow, allowing you to build driver-based models and update forecasts instantly. From my testing, reducing reporting cycles by up to 73% is a massive win. This feature makes budgeting a seamless and accountable process.

This means you can finally ditch the manual work and focus on strategic financial planning instead.

- 🎯 Bonus Resource: While we’re discussing business operations, understanding part quality and programming tools is equally important.

2. Real-time Reporting & Analytics

Stuck with outdated financial reports?

Siloed data sources make it impossible to get a single, accurate view of your financial health. This can lead to poor decision-making.

Abacum centralizes all your financial and operational data, providing real-time access to customizable dashboards and reports. I found the ability to easily filter and compare against targets incredibly useful. This feature gives you immediate insights into performance.

The result is your team gets clear, current financial insights that drive smarter, faster business decisions.

3. AI-Powered Insights (Abacum Intelligence)

Wish your financial data could give you proactive advice?

Sifting through vast amounts of data for hidden patterns is time-consuming and often misses key trends. This means you might react too late to critical shifts.

Abacum Intelligence leverages AI to generate forecasts, answer questions, classify data, and detect anomalies automatically. What I love about this approach is how it uncovers hidden patterns and enhances decision-making. This feature gives you a smart assistant for your finance team.

So you could anticipate business needs and make more informed decisions, freeing up valuable analytical time.

4. Collaborative Workflows

Tired of endless back-and-forth emails for approvals?

Getting department heads to contribute to financial planning can be a struggle, leading to delays and miscommunication. This frustrates everyone involved.

Abacum provides collaborative workflows, forecast templates, and approval requests to make planning a true team sport. Here’s the thing – proactive analysis with business partners within one platform makes a huge difference. This feature ensures everyone is on the same page.

This means your finance team can work seamlessly with stakeholders, fostering transparency and accountability.

5. Financial Statement Modeling

Struggling to build robust three-statement models?

Manually creating P&L, Balance Sheet, and Cash Flow models can be complex and error-prone. This creates a high risk of inaccuracies in your financial outlook.

Abacum offers templates and workflows to build comprehensive three-statement models, with actuals easily imported via integrations. While the hybrid SQL/Excel syntax has a learning curve, the power here is undeniable. This feature handles your core financial statements.

So you can maintain accurate and integrated financial models, gaining a holistic view of your company’s performance.

Pros & Cons

- ✅ Automates manual reporting, reducing significant time spent on consolidation.

- ✅ Offers flexible models and reports tailored to specific company needs.

- ✅ Intuitive interface praised for its modern look and ease of use.

- ⚠️ Limited advanced scenario planning compared to established competitors.

- ⚠️ Modeling language has a steeper learning curve for non-technical users.

- ⚠️ Fewer integrations than some larger, more mature FP&A platforms.

These Abacum features work together to create an integrated business planning platform that centralizes data and empowers your finance team.

Abacum Pricing

What’s the real cost of robust FP&A software?

Abacum pricing follows a custom quote model, which means you’ll need to contact sales but also get pricing tailored to your specific needs.

Cost Breakdown

- Base Platform: Custom quote

- User Licenses: Not specified, likely included in custom quote

- Implementation: Not specified, likely included in custom quote

- Integrations: Varies by complexity (over 50 systems supported)

- Key Factors: Team size, specific feature needs, organizational complexity, dedicated support

1. Pricing Model & Cost Factors

Their pricing can feel opaque.

Abacum does not publish pricing, instead offering custom quotes based on your specific requirements. This means your final cost depends on your team size, desired features (like advanced modeling or dedicated support), and overall organizational complexity. From my cost analysis, you won’t find flat rates here.

Budget-wise, you can expect the cost to reflect the depth of functionality your finance team needs.

2. Value Assessment & ROI

Is Abacum worth the investment?

- 🎯 Bonus Resource: While we’re discussing financial planning, understanding how to generate documents efficiently is equally important.

Abacum targets mid-market companies with 200-2,000 employees, suggesting it’s built for scale and significant financial planning automation. While a higher-priced solution (rated “$$$$$” on G2), it aims to deliver strong ROI by transforming finance into a strategic growth engine. This helps you avoid manual errors and speeds up reporting cycles.

This means your budget gets a tool designed to enhance decision-making and drive performance, justifying the premium.

3. Budget Planning & Implementation

Consider total cost of ownership carefully.

Given Abacum’s custom pricing and enterprise focus, expect significant upfront discussions to define scope and cost. What I found regarding pricing is that deals often exceed $50K, indicating this is a substantial investment for your organization. The lack of a free plan means you’ll rely on demos to assess fit.

So for your business, plan for a consultative sales process to ensure the solution perfectly matches your budget and needs.

My Take: Abacum’s custom pricing focuses on delivering tailored FP&A solutions for growing mid-market enterprises, ensuring you pay for features truly relevant to your complex financial operations.

The overall Abacum pricing reflects a tailored enterprise solution for complex finance needs.

Abacum Reviews

What do real customers actually think?

These Abacum reviews analyze real user feedback from various platforms, offering a balanced perspective on what actual customers experience with this FP&A software.

1. Overall User Satisfaction

Users seem quite pleased overall.

From my review analysis, Abacum maintains a strong 4.8 out of 5 stars on G2, indicating high user satisfaction. What impressed me about the user feedback is how positive reviews consistently highlight significant time savings, a critical factor for finance teams.

This suggests you can expect a highly positive experience, especially regarding efficiency gains.

- 🎯 Bonus Resource: While we’re discussing management and efficiency, my guide on jobsite management software covers project optimization.

2. Common Praise Points

Its flexibility and support truly shine.

Users consistently praise Abacum for its flexible modeling capabilities and intuitive interface, making it an excellent choice for those transitioning from Excel. From customer feedback, the quality of support receives incredibly high marks, described as responsive and knowledgeable in reviews.

This means you’ll likely find the system adaptable and get excellent assistance when needed.

3. Frequent Complaints

Some users find limitations in advanced features.

While generally positive, some reviews identify Abacum as more of a “reporting-first software” than a full FP&A solution. What stands out in feedback is how the modeling language can have a steeper learning curve for non-technical users, requiring some adjustment.

These issues are typically minor for most users, but important to consider for complex needs.

What Customers Say

- Positive: “Thanks to Abacum, we’ve automated our monthly reporting, reducing manual consolidation time by three to four days every month.” – Jeroen Moonemans

- Constructive: “The modeling language… can present a steeper learning curve for non-technical users.”

- Bottom Line: “Abacum has transformed our financial reporting, making it seamless and efficient.” – Vicky Van Asbroeck

The overall Abacum reviews reveal strong user satisfaction with practical considerations regarding advanced functionality.

Best Abacum Alternatives

Which Abacum alternative truly fits your needs?

The best Abacum alternatives include several strong options, each better suited for different business situations and priorities in financial planning and analysis.

- 🎯 Bonus Resource: Before diving deeper into financial software, you might find my analysis of [best speech to text software](https://nerdisa.com/best-speech-to-text-software/) helpful for improving efficiency.

1. Pigment

Seeking highly visual and customizable dashboards?

Pigment excels if your business requires more dynamic and customized FP&A workflows, extensive scenario planning, and highly interactive dashboards. From my competitive analysis, Pigment offers robust scenario planning capabilities that allow you to model complex financial situations with ease, providing a compelling Abacum alternative.

Choose Pigment if your priority is deep visual customization and powerful, flexible scenario planning.

2. Vena Solutions

Heavily reliant on existing Excel workflows?

Vena’s primary strength is its Excel-native approach, minimizing the learning curve for finance professionals already comfortable with spreadsheets. What I found comparing options is that Vena integrates seamlessly with Microsoft Excel, offering more customization in financial modeling than Abacum’s more structured system.

Consider this alternative when your team prefers to enhance their familiar spreadsheet environment with advanced FP&A.

3. Runway

Startup with a focus on cash-based planning?

Runway is built specifically for startups and high-growth companies that need cash-focused financial planning and simplified financial modeling. From my analysis, Runway emphasizes real-time daily/weekly reporting for tracking emerging financial trends, which can be critical for fast-moving businesses as an alternative.

Choose Runway if you’re a high-growth company prioritizing intuitive cash flow management and simplicity.

Quick Decision Guide

- Choose Abacum: Modern, self-serve FP&A with strong AI features

- Choose Pigment: Deep customization, interactive dashboards, and advanced scenarios

- Choose Vena Solutions: Excel-native comfort with enhanced FP&A capabilities

- Choose Runway: Cash-focused planning for startups and high-growth companies

The best Abacum alternatives depend on your specific business size and operational preferences, not just features.

Abacum Setup

What about Abacum implementation?

Abacum implementation is generally straightforward, focusing on efficient data integration and user adoption for quick wins. This Abacum review section will help you set realistic expectations for your deployment.

1. Setup Complexity & Timeline

Getting up and running quickly is possible.

Abacum setup involves data aggregation, model configuration, and integration with your existing systems. From my implementation analysis, users report being fully operational for budget planning within four weeks, showcasing a remarkably efficient deployment process.

You’ll need to dedicate resources for initial data mapping and model building to leverage its capabilities efficiently.

2. Technical Requirements & Integration

Your tech stack will likely integrate smoothly.

Abacum’s robust data layer connects with various ERPs, CRMs, HRIS, and data warehouses, plus supports spreadsheet uploads. What I found about deployment is that its flexibility allows seamless connection to existing systems, making it a strong fit for diverse tech environments.

Plan for data source connectivity and ensure your IT team is ready to facilitate necessary API access for optimal integration.

3. Training & Change Management

User adoption hinges on understanding the modeling.

While generally intuitive, the hybrid SQL/Excel-like modeling language can present a steeper learning curve for non-technical users creating complex calculations. From my analysis, providing focused training on this modeling language is crucial for empowering your finance team beyond basic reporting.

Invest in targeted training for your team to master the modeling capabilities and truly unlock Abacum’s full potential for advanced analysis.

4. Support & Success Factors

High-quality support will guide your journey.

Abacum boasts exceptional support, with a G2 rating of 9.9/10, emphasizing responsiveness and knowledge in resolving issues. What I found about deployment is that their dedicated customer success teams provide critical guidance, often finding workarounds or adding feature requests to their roadmap.

Leverage Abacum’s strong support and active engagement with their team for successful implementation and ongoing optimization.

- 🎯 Bonus Resource: While focusing on financial precision, my analysis of best time and expense software can further boost your operational accuracy.

Implementation Checklist

- Timeline: As fast as 4 weeks for core budget planning

- Team Size: Finance lead, IT support for integrations

- Budget: Primarily software licensing, minimal hidden costs

- Technical: Data source integration, potential SQL/Excel modeling

- Success Factor: Dedicated training for modeling language mastery

Overall, Abacum setup is swift and user-friendly, providing a clear path to faster financial reporting with strong support.

Bottom Line

Does Abacum fit your FP&A needs?

This Abacum review synthesizes my comprehensive analysis, offering a decisive final assessment and clear recommendation to help you confidently determine if this FP&A solution is right for your business.

1. Who This Works Best For

Mid-market finance teams ready to modernize.

Abacum works best for mid-market companies (200-2,000 employees) with finance teams, CFOs, and FP&A managers looking to move beyond manual spreadsheets. What I found about target users is that your business will thrive if it needs to automate data consolidation and gain real-time insights to drive strategic decisions.

You’ll find success if your goal is to improve collaboration and streamline fragmented planning processes across departments.

2. Overall Strengths

Unmatched efficiency and collaborative power.

The software succeeds by automating manual reporting and data consolidation, centralizing financial data for real-time insights, and fostering strong cross-departmental collaboration. From my comprehensive analysis, its intuitive interface makes transitioning from spreadsheets easy for your finance team, saving significant time monthly.

These strengths translate directly into empowered finance teams, faster decision-making, and improved business performance for your organization.

3. Key Limitations

Pricing transparency and advanced modeling require consideration.

While powerful, Abacum uses custom pricing, requiring direct sales engagement, and its advanced scenario planning capabilities might not fully satisfy the most complex, niche enterprise needs. Based on this review, the SQL-like modeling syntax can present a learning curve for your non-technical finance users, despite overall ease of use.

I’d say these limitations are manageable trade-offs for mid-market efficiency gains, but they warrant careful evaluation for specific, highly complex requirements.

- 🎯 Bonus Resource: Before diving deeper into FP&A, you might find my analysis of speech therapy software helpful if you’re in that field.

4. Final Recommendation

Abacum earns a strong recommendation for its target market.

You should choose this software if your mid-market company needs to modernize FP&A, automate reporting, and enhance collaboration with real-time data visibility. From my analysis, this solution empowers finance teams to be more strategic partners, especially if you prioritize user-friendly interfaces over hyper-specialized features.

My confidence level is high for companies transitioning from manual processes, offering a robust platform for growth and efficiency.

Bottom Line

- Verdict: Recommended for mid-market FP&A modernization

- Best For: Finance teams transitioning from spreadsheet-heavy processes

- Business Size: Mid-market companies (200-2,000 employees)

- Biggest Strength: Automation, real-time insights, and user-friendly collaboration

- Main Concern: Custom pricing and learning curve for advanced modeling

- Next Step: Request a demo to assess fit for your specific team needs

This Abacum review clearly shows strong value for the right business profile, while also highlighting important considerations for your decision process.