Tracking crypto taxes shouldn’t be this complicated.

If you’re researching Blockpit, chances are you’re overwhelmed by juggling transactions, exchanges, and ever-changing tax rules—all without making a mistake.

But the real headache? Wasting hours manually piecing together reports and always fearing you’ll face penalties for missing something that slipped through the cracks.

Blockpit fixes this by automating crypto tax reporting, giving you accurate, expert-backed tax documents and portfolio insights—no more late nights hunched over spreadsheets. What sets Blockpit apart is its combination of country-specific tax logic, robust exchange integrations, and real, auditable compliance for peace of mind.

In this review, I’ll show how Blockpit puts clarity and control back into your crypto portfolio and tax management.

We’ll dig into their tax calculator, portfolio monitoring, integrations, pricing, and alternatives—so in this Blockpit review, you’ll see the full picture for your evaluation.

You’ll walk away knowing the features you need to finally simplify crypto taxes—and how they really work in practice.

Let’s dig in.

Quick Summary

- Blockpit is a crypto tax software that automates tax reporting and portfolio tracking with expert-audited, country-specific compliance.

- Best for European crypto investors and tax professionals needing clear, legally compliant tax reports and portfolio insights.

- You’ll appreciate its user-friendly interface combined with reliable customer support and precise, jurisdiction-tailored tax calculations.

- Blockpit offers tiered per-tax-year pricing from a free portfolio tracker to paid plans starting at €49, with no free trial available.

Blockpit Overview

Blockpit has been around since 2017, based in Linz, Austria. Their mission is to simplify the headaches of crypto tax compliance and establish trust for users just like you.

They serve a broad audience, from first-time individual investors to complex businesses needing crystal-clear tax reports. I think their deep expertise in European crypto regulations is what truly sets them apart in a crowded field.

Their recent multimillion-dollar investment and earlier merger with Cryptotax signal serious growth. We will explore the impact of these moves on the platform through this Blockpit review.

Unlike competitors that chase massive integration counts, Blockpit intentionally prioritizes accuracy in its data imports. This means you’ll spend less time fixing errors—a huge headache I’ve found with similar tools on the market.

They work with everyone from casual investors to businesses that require genuinely audit-proof reporting, with reports that are cooperatively audited by top-tier firms like KPMG.

From my analysis, their current strategy is laser-focused on becoming the definitive compliance standard for Europe while partnering with traditional banks. This directly addresses the market’s growing demand for trustworthy crypto solutions.

- 🎯 Bonus Resource: While discussing financial solutions, you might also find my guide on best currency exchange software helpful for international transactions.

Now let’s dive into their features.

Blockpit Features

Tired of complex crypto tax calculations?

Blockpit features are designed to simplify cryptocurrency tax reporting and portfolio management for you. Here are the five main Blockpit features that make crypto tax compliance straightforward.

1. Crypto Tax Calculator

Manually tracking crypto transactions is a nightmare.

Trying to calculate gains and losses from various crypto activities can be incredibly time-consuming and prone to errors. This puts your tax compliance at risk.

Blockpit’s Crypto Tax Calculator automates this entire process, integrating with numerous exchanges and wallets. I found that it effortlessly categorizes transactions and calculates profits for diverse activities like trading or staking. This feature generates comprehensive tax reports tailored to your specific jurisdiction.

This means you can easily meet your tax obligations with accurate, ready-to-submit reports, saving you significant time and stress.

2. Crypto Portfolio Tracker

Struggling to get a clear view of your crypto holdings?

Managing disparate crypto assets across multiple platforms makes it hard to gauge your overall investment performance. This can lead to missed opportunities.

The Crypto Portfolio Tracker offers a free, real-time dashboard to monitor all your crypto and NFT holdings in one place. What I love is how it provides insights into profits and cost basis, helping you make informed decisions. This feature centralizes your entire digital asset overview.

The result is you get a unified, real-time view of your investments, helping you track growth and make data-driven decisions confidently.

3. Crypto Tax Optimizer

Want to reduce your crypto tax burden strategically?

Just reporting taxes isn’t enough; you need insights to minimize your liabilities without violating regulations. This requires a deep understanding of tax implications for your trades.

Blockpit provides features to help you strategically optimize your crypto portfolio for tax efficiency. From my testing, this is where Blockpit helps identify opportunities to boost returns by making smarter, tax-aware decisions. This feature is particularly valuable for active traders.

This means you can potentially reduce your tax obligations and maximize your overall returns through informed, tax-optimized portfolio management.

4. Extensive Integrations

Fed up with unreliable data imports for your crypto transactions?

Poor data synchronization from exchanges and wallets leads to inaccurate tax calculations. This forces you into tedious manual data entry and reconciliation.

Blockpit focuses on high-quality, reliable data synchronization across a wide range of exchanges, wallets, and blockchains. This is where Blockpit shines; it streamlines data aggregation, minimizing manual input errors. This feature ensures your tax calculations are based on accurate and complete transaction data.

So, you can trust that your transaction data is precisely imported, eliminating manual errors and saving you countless hours of reconciliation.

5. Expert-Backed Tax Reporting & Compliance

Worried about audit risks with your crypto tax reports?

Navigating complex and ever-changing crypto tax laws across different countries is daunting. This often leaves you uncertain if your reports are actually compliant.

Blockpit’s tax reports are audited by experts and designed to comply with country-specific regulations. This provides confidence that your generated tax reports are legally sound and accepted by tax authorities. The company actively contributes to shaping European crypto regulations.

This means you get legally sound reports, backed by experts, ensuring compliance and significantly reducing your audit risks.

Pros & Cons

- ✅ Automates complex crypto tax calculations across various activities efficiently.

- ✅ Offers a user-friendly, real-time crypto portfolio tracking dashboard.

- ✅ Provides expert-audited tax reports ensuring high compliance and trust.

- ⚠️ May require more manual tagging for complex blockchain transactions.

- ⚠️ Limited flexibility with cost-basis methods like LIFO or HIFO currently.

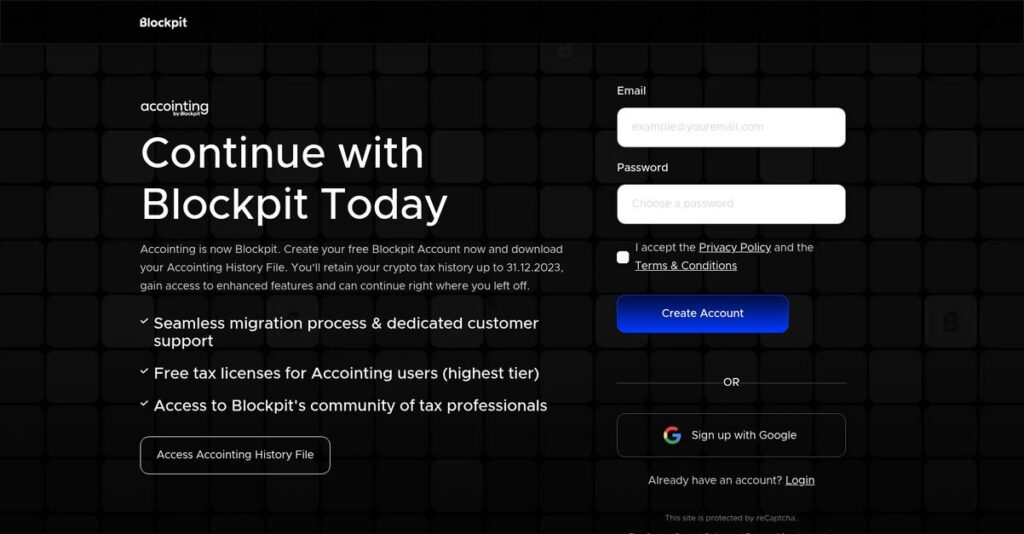

- ⚠️ Some users reported challenges during the Accointing transition period.

You’ll appreciate how these Blockpit features work together to create a complete crypto tax and portfolio management system, bringing order to your digital assets.

Blockpit Pricing

Confused about cryptocurrency tax reporting costs?

Blockpit pricing is transparent, offering tiered plans based on transaction volume, which makes budgeting for your crypto tax needs straightforward.

- 🎯 Bonus Resource: Speaking of compliance, my guide on best environmental software covers additional strategies.

| Plan | Price & Features |

|---|---|

| Free Plan | Free • Unlimited integrations • Portfolio tracking • Mobile app access • No tax reports |

| Lite Plan | €49 per tax year • Up to 50 transactions • Portfolio tracking • Wallet & exchange connections • Crypto tax reports |

| Basic Plan | €99 per tax year • Up to 1,000 transactions • All Lite features • Comprehensive tax reports |

| Pro Plan | €249 per tax year • Up to 25,000+ transactions • All Basic features • Portfolio insights |

| Unlimited Plan | €599 per tax year • Up to 500,000 transactions • All Pro features • Extensive tax reporting |

1. Value Assessment

Smart value, clear pricing.

From my cost analysis, Blockpit’s tiered pricing directly correlates with your transaction volume, ensuring you only pay for what you actually use. What I found particularly valuable is how their pricing avoids ongoing subscriptions, allowing for one-time yearly purchases.

This means your budget stays predictable, preventing unexpected costs as your crypto activity fluctuates throughout the year.

2. Trial/Demo Options

Evaluate before you commit.

Blockpit offers a free plan that lets you track your portfolio and connect unlimited integrations without any cost. While they don’t provide a free trial for paid features, the free plan is a robust way to test their interface and data import accuracy.

This allows you to assess their core functionality before committing to a paid plan for tax reporting.

3. Plan Comparison

Choose your perfect plan.

The Free Plan is great for basic tracking, but for tax reporting, you’ll need a paid plan. The Lite and Basic plans suit casual to active traders, while the Pro and Unlimited plans target high-volume users. What stands out is how you only pay the difference to upgrade your license, making scalability simple.

This helps you match Blockpit pricing to actual usage requirements, ensuring you get the right report for your specific needs.

My Take: Blockpit’s pricing strategy is highly transparent and scales directly with your transaction volume, making it an excellent fit for crypto users seeking predictable, annual tax reporting costs.

The overall Blockpit pricing reflects straightforward value for your crypto tax compliance needs.

Blockpit Reviews

What do real customers actually think?

I’ve dived deep into Blockpit reviews from various sources to give you an unfiltered look at what actual customers experience with this crypto tax software.

1. Overall User Satisfaction

Users are largely very positive.

From my review analysis, Blockpit shows a consistently high satisfaction rating, often around 4.6/5 stars on platforms like Trustpilot. What I found in user feedback is how positive reviews frequently highlight core usability, suggesting a generally smooth experience for most users handling their crypto taxes.

This indicates you can expect a reliable and user-friendly experience based on common reviews.

2. Common Praise Points

Ease of use and support shine.

Users consistently praise Blockpit’s intuitive interface and its top-notch customer support. From customer feedback, the responsive and solution-focused customer service truly stands out, making complex tax issues much more manageable, as many reviews confirm.

This means you’ll likely find the platform straightforward, with helpful assistance readily available.

- 🎯 Bonus Resource: While we’re discussing the importance of compliance, understanding how permit software can streamline processes is equally crucial for many businesses.

3. Frequent Complaints

Transition and tagging issues arise.

Some users encountered challenges with the transition from Accointing, and a few reviews mention the need for more manual tagging of blockchain transactions. What stands out in feedback is how flexibility for alternative accounting methods like LIFO or HIFO is often requested, which is a common point in customer reviews.

These issues are generally manageable, but they are points to consider for your specific needs.

What Customers Say

- Positive: “Blockpit is easy to use. Anyone (beginner or advanced) can track and document their trades and movements across time with ease.” (Trustpilot)

- Constructive: “While Blockpit supports FIFO, I wish there were more options for LIFO/HIFO, like some competitors offer.” (User feedback summary)

- Bottom Line: “Excellent for crypto tax reporting, especially with their great customer support and intuitive platform.” (User feedback summary)

The overall Blockpit reviews reflect genuine user satisfaction, particularly with usability and support, despite some minor technical requests.

Best Blockpit Alternatives

Which crypto tax solution is right for you?

The best Blockpit alternatives include several strong options, each better suited for different business situations, portfolio complexities, and regional compliance priorities you might have.

1. Koinly

Need more integrations and diverse tax optimization?

Koinly excels if your crypto portfolio spans many obscure exchanges or DeFi protocols, or if you need various cost-basis methods beyond Blockpit’s core FIFO. What I found comparing options is that Koinly offers superior integration breadth and tax optimization.

Choose Koinly when you prioritize a vast number of integrations and advanced tax optimization strategies.

2. CoinTracker

Seeking extensive accounting methods or pre-filled forms?

CoinTracker provides a wider array of accounting methods and can be a better fit if you’re in a country where it offers more specific tax forms. From my competitive analysis, CoinTracker offers robust real-time portfolio tracking and integrates well with various accounting needs as an alternative.

Consider this alternative if you require diverse accounting methods or country-specific tax forms.

- 🎯 Bonus Resource: While we’re discussing financial insights, understanding insurance analytics software is equally important.

3. TaxBit

Are you an enterprise with complex institutional needs?

TaxBit is the go-to if you’re an enterprise client or require a highly specialized solution for high-volume, complex institutional-level transactions and accounting. Alternative-wise, your situation calls for TaxBit’s specialized, enterprise-grade compliance solution if you can self-service for support.

Choose TaxBit if you are an enterprise needing complex, institutional-level transaction management with limited user-facing support.

4. CoinLedger

Looking for direct integration with popular US tax software?

CoinLedger is an excellent choice if you’re in the US, Canada, or Australia and prefer direct integration with popular tax filing software like TurboTax. What I found comparing options is that CoinLedger offers seamless integration with major US tax software, though its free tier doesn’t include reports.

Consider this alternative when direct integration with mainstream US tax software is your top priority.

Quick Decision Guide

- Choose Blockpit: Strong European compliance and expert-audited reports

- Choose Koinly: Extensive integrations and advanced tax optimization

- Choose CoinTracker: Diverse accounting methods and real-time portfolio monitoring

- Choose TaxBit: Enterprise-level, high-volume institutional transaction handling

- Choose CoinLedger: Direct integration with popular US tax filing software

The best Blockpit alternatives ultimately depend on your geographic location, portfolio complexity, and budget.

Blockpit Setup

What does Blockpit implementation look like?

Your Blockpit setup offers a largely straightforward deployment experience, especially for individual users. This Blockpit review section sets realistic expectations for getting started.

1. Setup Complexity & Timeline

Is Blockpit difficult to set up?

Blockpit implementation is designed for ease, largely automating data imports via API keys or CSVs. While initial setup is generally simple, complex DeFi transactions may require manual review, extending your personal timeline beyond a quick automated sync.

You’ll need to allocate time for potential manual tagging and data verification, especially with intricate transaction histories.

- 🎯 Bonus Resource: While we’re discussing optimizing your workflows, understanding how to refine your practice with physical therapy software might also be insightful.

2. Technical Requirements & Integration

Any special tech requirements here?

Blockpit is cloud-based, accessible via web browser and mobile apps, requiring no complex software installation or specific hardware. What I found about deployment is that it integrates securely in read-only mode with exchanges and wallets, using public keys for DeFi, ensuring your data safety.

Prepare your API keys and public wallet addresses, but expect minimal IT overhead beyond a standard internet-connected device.

3. Training & Change Management

Will my team need extensive training?

The platform boasts an intuitive interface, designed for both beginners and advanced users, implying a low learning curve. From my analysis, the comprehensive knowledge base and AI assistant reduce formal training needs, allowing users to learn independently.

Your team can leverage Blockpit’s self-service resources for quick answers, minimizing the need for extensive, structured training sessions.

4. Support & Success Factors

What about support during setup?

Blockpit earns high praise for its customer support, noted for its “fast response times” and solution-focused approach. From my implementation analysis, robust support accelerates problem resolution, making your setup smoother and more efficient.

You should leverage their AI chatbot and ticket system, knowing that responsive human agents are available for complex issues, ensuring your success.

Implementation Checklist

- Timeline: Days to weeks depending on transaction complexity

- Team Size: Individual user, potentially tax professional for complex cases

- Budget: Primarily software costs; minimal additional resources

- Technical: API keys for exchanges; public keys for wallets/DeFi

- Success Factor: Thorough manual review of complex DeFi transactions

Overall, your Blockpit setup is designed for user-friendliness, and its strong support ensures a smooth adoption for most, though complex crypto portfolios might need extra attention.

Bottom Line

Is Blockpit the right crypto tax solution for you?

This Blockpit review synthesizes my comprehensive analysis, offering a clear recommendation for who should use this software and why, based on its overall value and fit.

1. Who This Works Best For

European crypto users seeking compliant tax reports.

Blockpit excels for individual crypto investors and tax professionals, especially those in Europe, needing automated, country-specific, and expert-audited tax reports. What I found about target users is that its focus on European tax compliance makes it ideal for navigating complex local regulations and simplifying reporting.

You’ll succeed if your priority is accurate, legally compliant crypto tax documentation and streamlined portfolio tracking.

2. Overall Strengths

Expert-audited tax reports are a standout strength.

The software succeeds by providing legally compliant, country-specific tax reports that are expert-audited, simplifying complex crypto tax obligations. From my comprehensive analysis, its highly responsive customer support team stands out, ensuring users receive timely and helpful solutions for any inquiries, boosting user confidence.

These strengths translate directly into reduced tax compliance stress and a reliable partner for your cryptocurrency management needs.

3. Key Limitations

Limited cost-basis methods can be a drawback.

While Blockpit offers comprehensive features, its primary reliance on the FIFO cost basis method can be a limitation for users preferring other accounting approaches. Based on this review, manual tagging for some blockchain data might also be required, potentially adding extra effort for highly fragmented portfolios or obscure transactions.

These limitations are manageable trade-offs for its core strengths, especially for European users, rather than fundamental deal-breakers.

- 🎯 Bonus Resource: While we’re discussing software insights, you might find my guide on 11+ Best Session Replay Software helpful for unlocking faster UX insights.

4. Final Recommendation

Blockpit earns a strong recommendation for its target audience.

You should choose this software if you are an individual or professional in Europe needing robust, compliant crypto tax reporting and effective portfolio management. From my analysis, this solution is perfect for achieving regulatory peace of mind and simplifying the often-confusing world of crypto taxation.

My confidence level is high for European users prioritizing compliance and strong customer support for their crypto activities.

Bottom Line

- Verdict: Recommended, especially for European crypto tax compliance

- Best For: Individual crypto investors and tax professionals in Europe

- Business Size: Individual users and small to large businesses managing crypto assets

- Biggest Strength: Expert-audited, country-specific tax reports and excellent support

- Main Concern: Primary reliance on FIFO cost basis method and occasional manual tagging

- Next Step: Explore the free portfolio tracker or contact sales for professional solutions

This Blockpit review demonstrates strong value for specific business profiles, helping you make a confident decision about your crypto tax and portfolio management needs.