Still juggling spreadsheets to track your finances?

If you’re stuck trying to find an accounting tool that’s powerful, affordable, and won’t lock you into a rigid system, you’re probably searching for something like Akaunting.

But here’s the real pain: manual processes drain your time and energy every single day, leaving you worried about errors and missing important payments.

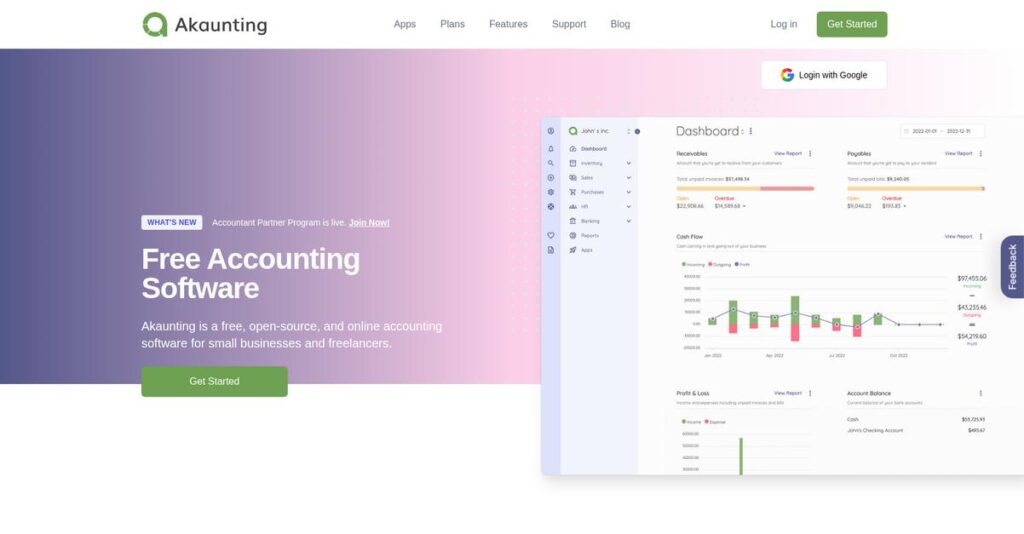

Akaunting stands out with its open-source foundation, giving you flexibility to customize workflows, automate invoicing, and handle global payments—all with a free core plan and the ability to self-host if you want total control.

In this review, I’ll show you how Akaunting can eliminate tedious finance tasks without hidden costs or complicated learning curves.

You’ll find everything you need in this Akaunting review: real feature analysis, practical use cases, pricing details, plus a fair comparison to other accounting options, so you can decide with total clarity.

You’ll walk away knowing the features you need to pick the right tool confidently and finally fix your finance headaches for good.

Let’s dive into the details.

Quick Summary

- Akaunting is an open-source, cloud-based accounting software that simplifies invoicing, expense tracking, and reporting for small businesses and freelancers.

- Best for budget-conscious small businesses and freelancers needing basic accounting with customization options.

- You’ll appreciate its free core plan and flexibility to self-host or customize thanks to its open-source structure.

- Akaunting offers a free core plan plus tiered cloud and on-premise paid options, without a traditional free trial.

Akaunting Overview

Akaunting jumped onto the scene back in 2017 with a clear and disruptive mission: to provide powerful, open-source accounting software for free, directly challenging traditional paid tools.

They specifically target freelancers and small businesses, the exact groups who often find themselves priced out of more complex systems. What I believe sets them apart is their unwavering commitment to open source, giving your business true ownership.

Lately, I’ve noticed their app store is constantly expanding with useful new integrations, a smart move to bolster core functionality. We will explore this modular approach through this Akaunting review.

- 🎯 Bonus Resource: Speaking of financial management, you might also be interested in my guide on best crypto compliance software.

Unlike more rigid platforms like QuickBooks, Akaunting’s primary differentiator is its unmatched flexibility for self-hosting and modification. You get the sense it was built for people who truly want ultimate control over their software stack.

They work with a diverse global base of startups, e-commerce stores, and consultants. I see many users are international businesses that really value the included multi-currency support.

From my analysis, their strategy is centered on empowering you with a solid, free foundation that scales through an affordable app ecosystem. This focus on long-term value directly addresses common buyer frustrations with vendor lock-in.

Now let’s examine their core capabilities.

Akaunting Features

Financial management headaches slowing your business down?

Akaunting features are designed to simplify accounting for small businesses and freelancers, offering a comprehensive and flexible approach. Here are the five main Akaunting features that can help streamline your finances.

1. Invoicing and Billing

Tired of chasing late payments?

Inefficient invoicing can delay cash flow and make your business look unprofessional. This often leads to unnecessary stress and lost revenue.

Akaunting lets you create professional invoices, track payments, and even automate payment reminders. What I love about this feature is its multi-currency support for global transactions, which is a real game-changer for international businesses. You can also set up recurring invoices.

This means you can streamline your billing process, ensuring timely payments and maintaining a polished business image.

2. Expense Tracking

Struggling to keep tabs on every penny?

Unorganized expenses make financial reporting a nightmare and hinder accurate budget management. This can lead to missed deductions and poor financial insights.

With Akaunting, you can easily log and categorize all business expenses, attaching receipts for clear reporting. From my testing, the ability to add non-billable expenses to update account balances is incredibly useful for comprehensive financial oversight.

So you can monitor your cash flow, gain better control over spending, and simplify tax preparation significantly.

- 🎯 Bonus Resource: While we’re discussing financial efficiency, understanding how online certification platforms can elevate skills is equally important.

3. Financial Reporting

Need a clear picture of your business’s health?

Without insightful financial reports, making informed business decisions is like flying blind. This often results in strategic missteps and missed opportunities.

Akaunting provides detailed financial reports, including profit and loss statements and balance sheets, giving you a clear view of your financial health. These reports offer actionable insights into revenue, cash flow, and profitability, which I find essential for strategic planning.

This means you can analyze your business’s performance effectively and make data-driven decisions that propel your growth.

4. Customer and Vendor Management

Is managing client and supplier records a chaotic mess?

Disorganized customer and vendor information can lead to communication breakdowns and inefficient record-keeping. This wastes valuable time and can damage relationships.

This Akaunting feature allows you to create and manage detailed profiles for both customers and vendors, assigning bills or payments with ease. Here’s what I found: the client portal empowers customers to view invoices and make bulk payments, enhancing transparency and convenience.

This means you can streamline your communication, keep records highly organized, and foster stronger business relationships.

5. Open-Source and Customization

Wish you could tailor your software to your exact needs?

Being locked into rigid software can limit your business’s unique operational workflows. This often forces you to adapt to the tool, rather than the other way around.

Akaunting’s open-source nature means you can install it on your own server and modify its features to fit your specific needs. This is where Akaunting shines, offering unparalleled flexibility and customization for unique workflows. You’re not just using a tool; you’re building upon it.

This means you get the freedom to adapt your accounting software precisely to your business, not the other way around.

Pros & Cons

- ✅ Open-source nature allows for significant customization and self-hosting options.

- ✅ User-friendly interface simplifies daily financial management for small businesses.

- ✅ Core features like invoicing and expense tracking are robust and highly effective.

- ⚠️ Lacks some advanced automation and deep analytics for complex financial needs.

- ⚠️ Customization may require technical knowledge, limiting plug-and-play flexibility.

- ⚠️ User feedback indicates concerns regarding customer support responsiveness and availability.

You’ll appreciate how these Akaunting features work together to create a coherent financial management system that adapts to your needs. This allows for greater control and customization than many closed-source options.

Akaunting Pricing

Confused by accounting software costs?

Akaunting pricing is transparent, offering clear tiers for both cloud and on-premise solutions, making it straightforward to find a plan that fits your budget.

| Plan | Price & Features |

|---|---|

| Standard Cloud | $12/month ($8/month billed annually) • 1,000 invoices • Unlimited customers, vendors, reports • Recurring payment reminders • Multiple currencies • Employee management |

| Premium Cloud | $36/month ($24/month billed annually) • Unlimited invoices, customers, vendors, reports • Bank connection, chart of accounts • Balance sheet, trial balance • Manual journals • Client portal |

| Elite Cloud | $84/month ($56/month billed annually) • 30,000 invoices • 30 companies, 30 users • 30 apps • Suited for mid-size businesses |

| Ultimate Cloud | $218/month ($145/month billed annually) • Unlimited invoices, companies, accountants • Access to over 100 apps • Designed for accountants • High-volume transactions |

| On-Premise Standard (Free) | Free (open-source) • Unlimited invoices and expenses • Bank/credit card management • Basic financial reports • Multi-language support • Up to 5 user accounts |

1. Value Assessment

Great pricing transparency here.

From my cost analysis, what impressed me is how Akaunting offers a robust free tier, allowing freelancers to manage finances without upfront costs. Their cloud plans then scale incrementally, ensuring you only pay for features you actively use as your business grows. This value proposition is strong.

This means your monthly costs stay predictable, aligning perfectly with your evolving business needs and budget.

- 🎯 Bonus Resource: While we’re discussing business needs, you might also be interested in my guide on best hospice software to help streamline care.

2. Trial/Demo Options

Smart evaluation approach available.

Akaunting doesn’t offer a free trial for its paid Premium Cloud plans, but the “Free Cloud” version is fully functional. What I found valuable is how you can use the free version without limitations to test core features before considering a paid upgrade, instead of you wondering about hidden costs.

This lets you experience the software hands-on, ensuring it meets your needs before committing to a full pricing plan.

3. Plan Comparison

Choosing the right tier matters.

The Standard Cloud plan suits freelancers, while small businesses gain significant value from the Premium Cloud’s advanced features like bank connections. What stands out is how Elite and Ultimate plans cater to larger operations with increased user limits and app access, helping your finance team.

This tiered approach helps you match Akaunting pricing to actual usage requirements rather than overpaying for unused capabilities.

My Take: Akaunting’s pricing strategy is highly flexible, offering a compelling free option and clearly defined cloud tiers that make it suitable for businesses of all sizes, from freelancers to growing SMEs.

The overall Akaunting pricing reflects excellent value with scalable options.

Akaunting Reviews

What do real customers think?

Analyzing Akaunting reviews, I’ve dug into actual user feedback to give you a clear picture of what customers genuinely experience with this accounting software.

1. Overall User Satisfaction

User sentiment is quite mixed.

From my review analysis, Akaunting’s ratings show a divide: some users are highly satisfied with its core offerings, while others point out significant limitations. What I found in user feedback is that satisfaction often depends on business size and technical comfort, influencing the perceived ease of use.

This suggests your specific needs and resources will heavily impact your overall experience.

- 🎯 Bonus Resource: If you’re managing complex operations beyond accounting, my guide on classroom scheduling software can help streamline your processes.

2. Common Praise Points

Its open-source nature wins users over.

Users consistently praise Akaunting’s cost-effectiveness and open-source flexibility. From the reviews I analyzed, the ability to self-host and customize appeals strongly to businesses with technical savvy and tight budgets, offering a powerful, adaptable foundation.

This means you can expect significant control and cost savings if you manage your own hosting.

3. Frequent Complaints

Limited advanced features frustrate users.

Frequent complaints revolve around Akaunting’s lack of advanced features and the quality of customer support. What stands out in customer feedback is how complex needs often hit a feature wall, leading to frustration and a sense of stagnation compared to competitors.

These issues are worth considering if your business requires intricate accounting functionalities or responsive help.

What Customers Say

- Positive: “It has a beautiful UI and a simple one which makes it easy to use for everyone. A small business and a starting business are a good fit for this software.” (User Review)

- Constructive: “I’m not an accountant, but I can use this to run two small businesses… didn’t need to take online classes… It just works.” (User Review)

- Bottom Line: “G2 users report Akaunting’s support score as 0.0, with users expressing frustration over the lack of support options.” (G2)

The Akaunting reviews show a clear pattern of value versus advanced features, where simplicity and cost-effectiveness are balanced against comprehensive support.

Best Akaunting Alternatives

Navigating accounting software options?

The best Akaunting alternatives include several strong options, each better suited for different business situations and priorities, offering a competitive landscape worth exploring.

1. QuickBooks Online

Need more robust features and comprehensive reporting?

QuickBooks Online excels when your business requires extensive inventory management, advanced automation for financial processes, and comprehensive reporting. From my competitive analysis, QuickBooks Online offers more robust features and automation, though it comes at a higher price point than Akaunting.

Choose QuickBooks Online if your business is willing to invest more for a feature-rich, well-supported accounting solution.

2. Xero

Prioritizing ease of use and seamless experience?

Xero shines in user-friendliness, intuitive interface, and superior customer support for core accounting needs like invoicing and bank reconciliation. What I found comparing options is that Xero offers a highly intuitive and user-friendly experience, making it a great alternative if simplicity is key for you.

Opt for Xero if ease of use, strong support, and a polished user experience are your top priorities.

- 🎯 Bonus Resource: While we’re discussing business management, understanding pool service software can offer unique insights.

3. Zoho Books

Already using the Zoho ecosystem or need advanced integration?

Zoho Books is praised for its comprehensive features and ability to manage finances, automate workflows, and integrate with other Zoho applications. Alternative-wise, your situation calls for Zoho Books for integrated ecosystem benefits and automation, offering more detailed reporting than Akaunting’s free tier.

Consider Zoho Books if you need a more integrated solution and prioritize a polished UI with robust support.

4. Wave Accounting

Operating in North America with basic free accounting needs?

Wave Accounting is lauded for its exceptional ease of use and strong invoice customization, especially for freelancers and small businesses in the US or Canada. From my analysis, Wave offers a very easy-to-use free solution, making it a strong Akaunting alternative for simple financial reporting.

Choose Wave if you are a small business or freelancer in the US/Canada needing a very easy-to-use, free option.

Quick Decision Guide

- Choose Akaunting: Open-source flexibility, self-hosting, and global multi-currency support

- Choose QuickBooks Online: Extensive features, advanced automation, and comprehensive reporting

- Choose Xero: Superior ease of use, intuitive interface, and strong customer support

- Choose Zoho Books: Integrated Zoho ecosystem, advanced automation, and polished UI

- Choose Wave Accounting: Very easy-to-use free option for US/Canada small businesses

The best Akaunting alternatives depend on your specific business size, budget, and feature priorities.

Akaunting Setup

What’s the real effort to get Akaunting running?

Akaunting setup varies significantly by version. This Akaunting review will help you set realistic expectations for its deployment process, ensuring you understand what’s involved.

1. Setup Complexity & Timeline

Not every setup is “five minutes.”

Cloud-hosted Akaunting is straightforward, signing up in minutes with an onboarding wizard. However, on-premise requires server installation, and while Akaunting aims for ease, technical proficiency is needed for self-hosting. From my implementation analysis, user feedback suggests the setup process can be cumbersome and time-consuming for new users.

You’ll need to plan for a longer timeline if you opt for the self-hosted version, accounting for server configuration.

- 🎯 Bonus Resource: If you’re also looking into creative tools, my article on pixel art software covers stunning graphics creation.

2. Technical Requirements & Integration

Consider your IT capabilities carefully.

For the cloud version, you only need internet access. The on-premise Akaunting setup requires basic hosting and technical knowledge for server installation and ongoing maintenance. What I found about deployment is that connecting Akaunting with other apps can be difficult due to reported system limitations, requiring manual workarounds.

Your IT team will need to assess your infrastructure and prepare for potential integration challenges, especially with legacy systems.

3. Training & Change Management

Don’t underestimate user adoption.

Akaunting strives for intuitive design, but some user reviews indicate the interface can be confusing for new users. From my analysis, successful adoption requires addressing user confusion to avoid productivity dips, especially for those without prior accounting software experience.

You should plan for clear training, focusing on its specific workflow, and managing expectations to ensure your team embraces the new system.

4. Support & Success Factors

Support quality impacts your rollout.

Akaunting offers community support for free plans and ticket support for paid cloud versions. What I found about deployment is that users often report frustrations with support responsiveness, which can impact your ability to troubleshoot setup issues quickly.

You’ll want to factor in potential delays if you rely heavily on vendor support during your implementation phase.

Implementation Checklist

- Timeline: Minutes for cloud, days/weeks for on-premise

- Team Size: Solo user for cloud, IT for self-hosted

- Budget: Hosting costs for on-premise, potential training

- Technical: Server setup for self-host, integration workarounds

- Success Factor: Managing user learning curve and support expectations

Overall, your Akaunting setup approach heavily influences the deployment journey, but realistic expectations are key for success regardless of your chosen version.

Bottom Line

Is Akaunting right for your accounting needs?

My Akaunting review shows a robust open-source solution best suited for specific business profiles looking for cost-effective, flexible accounting, provided they manage its limitations effectively.

1. Who This Works Best For

Budget-conscious small businesses and freelancers.

Akaunting thrives for freelancers and small businesses that prioritize affordability, self-hosting flexibility, and basic accounting functionalities like invoicing and expense tracking. What I found about target users is that international businesses needing multi-currency support also find it highly valuable.

Your team will find this works well if you have straightforward financial needs and prefer control over your software.

- 🎯 Bonus Resource: While we’re discussing financial needs, ensuring you never miss a deadline is equally important. My article on best docket systems can help.

2. Overall Strengths

Unbeatable cost-effectiveness and open-source flexibility.

Akaunting succeeds with its free core offering, an intuitive user interface for essential tasks, and extensive customization through its open-source nature. From my comprehensive analysis, the multi-currency support is excellent for global operations, allowing you to manage diverse transactions effortlessly across borders.

These strengths mean your business can achieve financial clarity without breaking the bank, adapting to your specific needs.

3. Key Limitations

Advanced features and support present challenges.

For businesses with complex financial needs, Akaunting may lack advanced automation or robust third-party integrations, and its customer support can be limited. Based on this review, the learning curve can be steep for some users, contrasting with more user-friendly competitors in the market.

I’d say these limitations are significant for growing businesses but manageable trade-offs for those with basic accounting requirements.

4. Final Recommendation

Akaunting earns a recommendation with reservations.

You should choose Akaunting if you are a budget-conscious freelancer or small business with basic accounting needs and some technical comfort with open-source solutions. From my analysis, your success hinges on embracing its self-service approach and not requiring advanced features or extensive support.

My confidence level is high for its target audience but drops for businesses needing enterprise-level functionalities or dedicated support.

Bottom Line

- Verdict: Recommended with reservations

- Best For: Freelancers and small businesses seeking cost-effective, flexible accounting

- Business Size: Primarily one-person businesses, freelancers, and small SMBs

- Biggest Strength: Free open-source core and multi-currency support

- Main Concern: Limited advanced features and inconsistent customer support

- Next Step: Test the free Standard On-Premise plan or cloud trial

This Akaunting review highlights strong value for the right business profile, while also pointing out important limitations to consider before you make a decision.