Struggling with compliance reporting chaos?

You’re buried in spreadsheets, trying to meet tight deadlines while manually validating data. This process is slow and invites costly errors.

The constant fear of facing steep non-compliance penalties makes every reporting cycle a high-stakes gamble. It’s an exhausting and unsustainable approach.

This pressure is amplified as regulations like Basel IV and CSRD continuously evolve. Legacy systems just can’t keep up with these new demands.

But what if you could automate this entire workflow? The right tool helps you proactively manage all requirements and eliminate the last-minute panic.

In this article, I’ve curated the best regulatory reporting software designed for complex environments. We’ll focus on proactive compliance, not just feature lists.

You’ll learn how these solutions can streamline filings, ensure audit-readiness, and integrate with your existing financial systems to boost accuracy.

Let’s dive right in.

Quick Summary:

| # | Software | Rating | Best For |

|---|---|---|---|

| 1 | SolveXia → | Mid-to-large finance teams | |

| 2 | OneTrust → | Regulated enterprises & financials | |

| 3 | Fenergo → | Financial institutions & banks | |

| 4 | ComplianceQuest → | Compliance officers & analysts | |

| 5 | insightsoftware → | Financial analysts & compliance pros |

1. SolveXia

Struggling with complex regulatory reporting and data overload?

SolveXia offers financial automation for reporting, financial control, and reconciliations. This means you can reduce the time and effort needed to combine, reconcile, map, and analyze your critical data.

The software helps you increase accuracy and reduce risk for improved oversight, auditability, and compliance, making complex matching for high volume transactions faster.

Here’s how to manage manual spreadsheet overload.

SolveXia eliminates macros and enhances audit controls for simplified, transparent processes. This allows you to combine, transform, and analyze all your data, producing insights and analytics in minutes instead of days.

You can reduce human error by up to 90% and enforce robust, granular checks and controls for your reporting processes. Additionally, it embeds industrial-strength governance and audit capabilities across your critical finance processes and integrates with your existing systems and databases for end-to-end automation.

The result is proactive compliance management.

While we’re discussing financial automation, understanding best SaaS billing software is equally important for managing revenue.

Key features:

- No-code automation: Automate reporting, financial control, and reconciliations for finance, tax, and compliance processes, eliminating manual spreadsheet overload and reducing human error by up to 90%.

- Advanced data management: Combine, reconcile, map, and analyze all your data from various sources, achieving end-to-end automation with connectors to your existing systems and databases.

- Robust governance & audit: Enhance data quality and embed industrial-strength governance and audit capabilities across critical finance processes for improved oversight, auditability, and compliance.

SolveXia features, pricing, & alternatives →

Verdict: If you’re seeking the best regulatory reporting software that simplifies complex compliance, SolveXia’s ability to reduce errors by 90% and process tasks up to 85x faster makes it a powerful choice. Its financial automation suite directly addresses the pain points of regulatory reporting and data reconciliation.

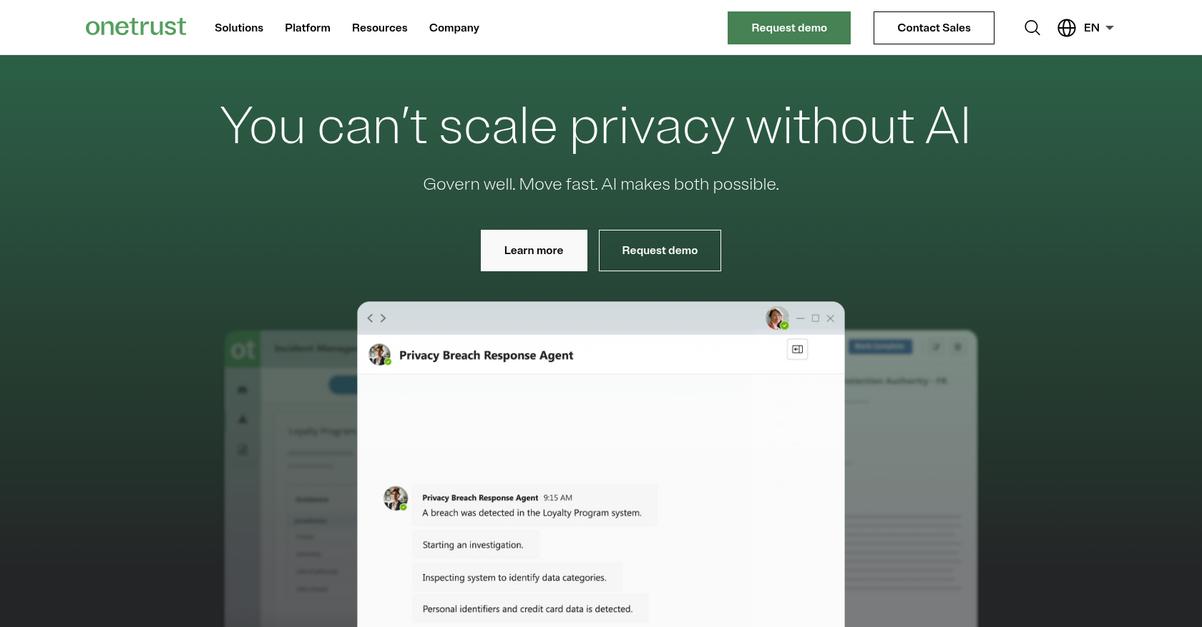

2. OneTrust

Struggling with complex regulatory compliance and data management?

OneTrust helps streamline privacy automation and third-party management, crucial for robust regulatory reporting. This means you can proactively manage risk and enforce policies effectively.

OneTrust empowers your teams to collect data with purposeful consent and manage risks holistically, from privacy to IT vulnerabilities.

Achieve proactive compliance management with ease.

OneTrust streamlines risk management, enforces compliance, and optimizes data strategies for innovation, all while meeting regulatory and customer demands. You can transparently collect data, manage risk holistically across privacy, IT vulnerabilities, and third-party sharing, and enforce policies and controls for AI-ready data.

This unified platform offers end-to-end data management, helping your team tackle challenges like GDPR, DORA, and the EU AI Act, simplifying compliance and improving operational efficiency. It also features the industry’s broadest set of integrations, allowing you to easily add data management to your existing application workflows.

The result is increased transparency across global operations and reduced audit preparation time.

Key features:

- Privacy Automation: Simplify compliance and improve operational efficiency by enabling responsible data use throughout the entire data lifecycle.

- Third-Party Management: Automate the entire third-party lifecycle, from intake and risk assessment to mitigation, ongoing monitoring, and comprehensive reporting.

- AI Governance: Embed compliance and control directly across the artificial intelligence lifecycle, ensuring responsible use and adherence to emerging regulations like the EU AI Act.

OneTrust features, pricing, & alternatives →

Verdict: If you’re looking for the best regulatory reporting software that goes beyond basic compliance to offer comprehensive data and AI governance, OneTrust is a strong contender. Its ability to automate third-party management and embed compliance across the AI lifecycle makes it invaluable for financial institutions and regulated enterprises navigating complex regulations like DORA and the EU AI Act.

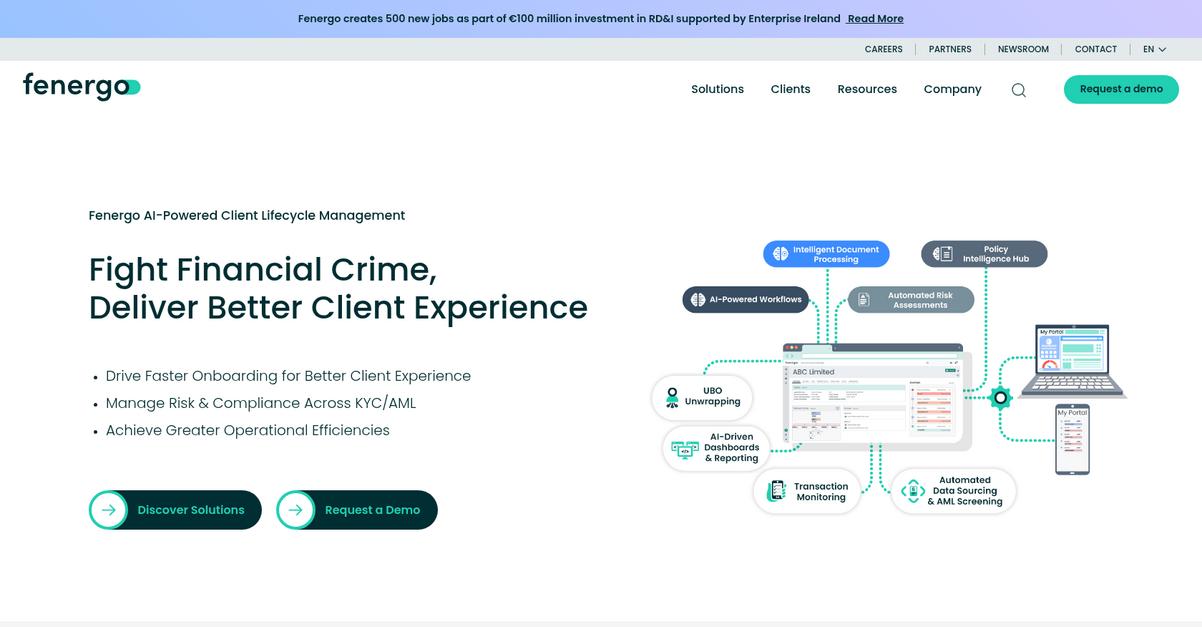

3. Fenergo

Struggling with complex regulatory compliance and manual reporting?

Fenergo’s AI-powered Client Lifecycle Management (CLM) can help your team streamline operations.

This means you can efficiently manage risk and compliance across KYC/AML, eliminating manual data entry. It simplifies due diligence with pre-packaged KYC rules and workflows.

Here’s how Fenergo helps.

Fenergo offers an end-to-end suite of SaaS solutions for client lifecycle management, from onboarding to ongoing reviews. You can automate client onboarding journeys, including risk assessment and sanctions screening.

It simplifies and automates due diligence, transforming transaction monitoring effectiveness and reducing false positives. Its Intelligent Document Processing also automates document management. Additionally, you can simplify compliance with global regulations including ESG, Tax, and Investor Protection, accelerating client and counterparty classifications.

The result is increased operational efficiencies and reduced operating costs.

While we’re discussing various management systems, you might also find my guide on best clinical trial management systems helpful.

Key features:

- AI-Powered FinCrime OS: Unifies onboarding, KYC, screening, ID verification, and transaction monitoring on a single platform for comprehensive financial crime fighting.

- Client Lifecycle Management (CLM): Provides an end-to-end suite of solutions, including automated client onboarding, KYC, and regulatory compliance, ensuring efficient client management.

- Intelligent Document Processing: Leverages AI to automate document management processes, boosting operational efficiencies and significantly reducing your operating costs.

Fenergo features, pricing, & alternatives →

Verdict: Fenergo’s focus on AI-powered Client Lifecycle Management (CLM), including robust KYC and transaction monitoring, positions it as a strong contender for the best regulatory reporting software. Its ability to automate critical compliance processes, like client onboarding and intelligent document processing, helps organizations proactively manage complex regulatory demands while improving client experience.

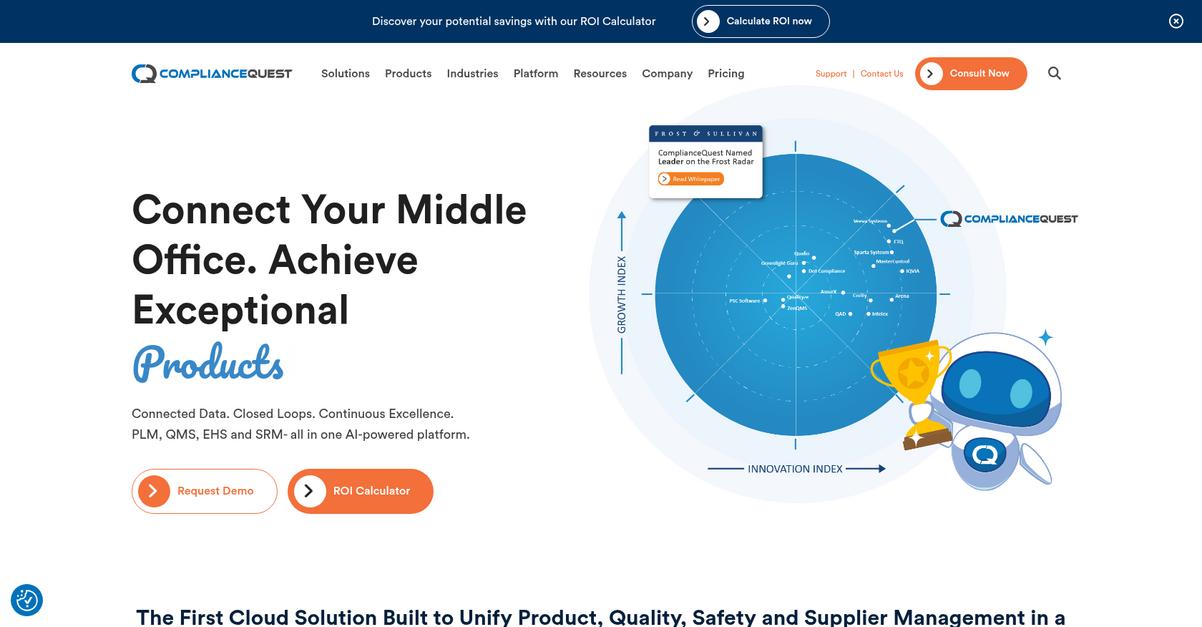

4. ComplianceQuest

Struggling with complex regulatory reporting requirements?

ComplianceQuest offers an AI-powered Middle Office Platform that unifies product, quality, safety, and supplier management into a single, intelligent solution. This means you can gain full visibility over processes.

This integrated approach helps you overcome the overwhelming complexity of multiple jurisdictions and provides automated data validation and audit-ready documentation. It’s about achieving proactive compliance.

Here’s how ComplianceQuest helps.

Their platform is built on Salesforce, ensuring trusted security, always-on availability, and performance at scale. This allows you to modernize processes with connected document, training, and change management, eliminating paper and manual errors.

You can transform customer complaints into valuable insights with smart automations and integrated regulatory reporting, and enable risk-based thinking throughout your quality processes. Plus, AI agents automate tasks, reduce errors, and save significant time. For example, the Complaints Agent sorts, classifies, and categorizes complaints, and the NC Agent quickly structures reported details. This dramatically reduces audit preparation time.

Key features:

- AI-Powered Middle Office Platform: Unifies product lifecycle, quality, safety, and supplier management for end-to-end operational excellence and compliance.

- Automated Regulatory Reporting: Transforms complaints into insights with smart automations and integrates regulatory reporting for proactive compliance management.

- Integrated Risk Management: Enables risk-based thinking across quality processes with a fully integrated solution for simplified regulatory filings.

ComplianceQuest features, pricing, & alternatives →

Verdict: ComplianceQuest provides a comprehensive, AI-powered solution that helps compliance officers and financial analysts achieve proactive compliance management. Its unified platform and automated features make it an excellent choice for the best regulatory reporting software, simplifying complex filings and reducing manual effort.

5. insightsoftware

Struggling with complex regulatory reporting and compliance?

insightsoftware offers solutions like Certent Disclosure Management for accurate narrative reporting. This enables you to proactively manage compliance across multiple jurisdictions.

Their platform, featuring Lineos AI, helps you see what matters and make smarter decisions from your financial and operational data. This facilitates proactive compliance management.

Unleash the power of your data.

insightsoftware streamlines financial processes, enabling accurate planning, reporting, and analysis for informed decision-making. Their solutions offer reliable, up-to-date visibility for compliance and strategic decisions, from daily accounting to long-term financial strategy.

You can gain actionable insights with their BI, embedded analytics, and data integration tools, unleashing data power for everyone, anywhere. This platform integrates with over 200 environments, including 140+ ERPs, ensuring your data is connected when and where you need it. It also offers automated workflows to free up time and minimize errors, allowing you to focus on strategic analysis rather than manual entry.

Plus, you get pre-built templates for common ERP use cases, accelerating your reporting and analysis while ensuring consistency. Real-time data access means you eliminate static reports and gain immediate visibility to drive critical decisions.

Drive actionable business strategy with accessible data.

Key features:

- Regulatory & Narrative Reporting: Provides Certent Disclosure Management for precise regulatory and narrative reporting, crucial for complex compliance obligations and audit readiness.

- ERP & Data Connectivity: Connects to over 140 ERPs and 200+ data environments, ensuring comprehensive data integration and real-time insights for your existing financial systems.

- AI-Enabled Automation: Leverages Lineos AI for automated workflows, pre-built templates, and real-time data access, reducing manual errors and accelerating decision-making for proactive compliance.

insightsoftware features, pricing, & alternatives →

Verdict: If you are a compliance officer or financial analyst navigating complex regulatory requirements, insightsoftware stands out as the best regulatory reporting software solution. Its robust integration capabilities across 140+ ERPs and AI-powered automation directly address your need for proactive compliance management, reduced errors, and simplified reporting workflows.

6. RegEd

Are you struggling with complex regulatory compliance?

RegEd offers a comprehensive platform designed to streamline your compliance and reporting efforts, ensuring accuracy and efficiency. This means you can proactively manage your obligations.

RegEd helps you simplify complex regulatory filings and integrates with your existing financial systems, ensuring your team has accurate, real-time data for reporting.

Here’s how RegEd transforms your compliance process.

You can automate data collection and validation across various regulatory frameworks, eliminating manual errors and reducing significant time spent on reporting. This ensures your data is always audit-ready.

RegEd’s intuitive interface allows for easy generation of compliance reports, providing clear audit trails and simplifying the entire process for your team. You can easily adapt to changing regulatory requirements without disruption. Additionally, the platform provides automated workflows and alerts, ensuring that no critical compliance task is missed and that your reporting deadlines are met consistently.

The result is peace of mind.

While we’re discussing compliance and efficiency, understanding the role of a learning management system can also help your team avoid costly rework.

Key features:

- Automated Regulatory Filings: Streamlines the submission of complex reports to various regulatory bodies, reducing manual effort and minimizing the risk of errors for your team.

- Real-time Data Validation: Ensures that all your reported data is accurate and compliant with current regulations before submission, preventing costly penalties.

- Integrated Workflow Management: Provides a centralized system for tracking compliance tasks and deadlines, improving operational efficiency across your financial institution.

RegEd features, pricing, & alternatives →

Verdict: RegEd stands out as a top contender for the best regulatory reporting software, particularly for financial institutions. Its automated features and real-time data validation capabilities directly address critical compliance pain points, making it an ideal choice for simplifying your complex regulatory obligations.

Conclusion

Feeling the compliance pressure?

Choosing the right software is a major hurdle. The complexity of evolving regulations like CSRD and Basel IV makes this decision critical for your organization.

The move to cloud solutions isn’t just a trend. Research shows organizations see enhanced risk management and reduced IT costs, enabling real-time data processing. This lets your team focus on strategy, not just survival.

Here’s my top recommendation.

From my review, SolveXia stands out by directly tackling reporting complexity. It automates the tedious manual workflows that slow down your entire compliance team.

Its ability to reduce human error by 90% is a huge game-changer. The best regulatory reporting software should deliver this level of accuracy, ensuring your organization is always audit-ready and secure.

I strongly suggest you book a free demo of SolveXia. See for yourself how it can transform your entire reporting process.

Your team can finally get ahead.