Tired of tracking crypto across five apps?

If you’re juggling assets on multiple wallets and exchanges, it’s easy to lose sight of what your portfolio is actually worth—let alone which trades made or lost money.

After digging into dozens of platforms, my research shows fragmented tracking wastes hours and leads to bad decisions when you can’t see the full picture of your crypto holdings.

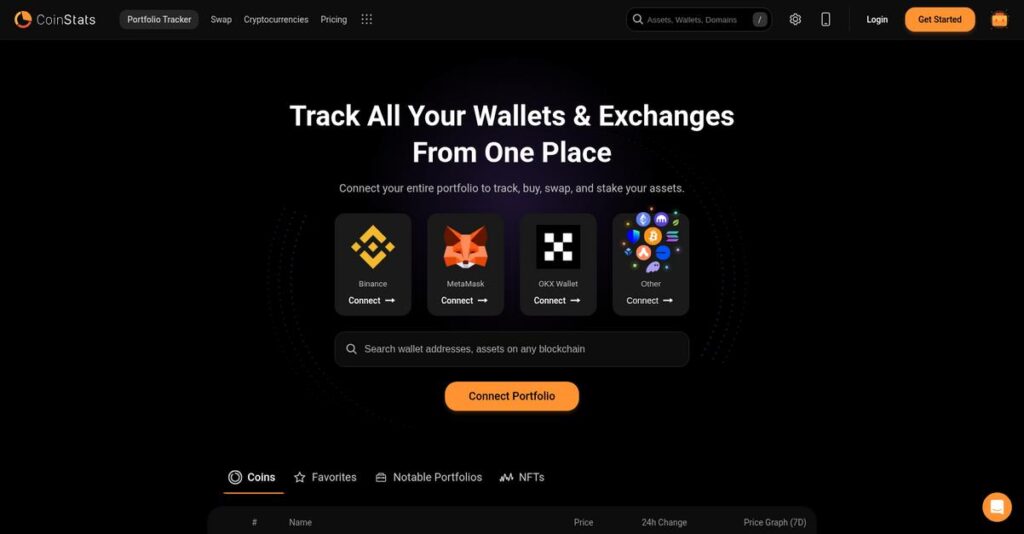

CoinStats takes a different approach by pulling all your coins, tokens, NFTs, and DeFi earnings into one dashboard. From automated P&L analysis to a self-custody wallet and direct DeFi integrations, my evaluation reveals how their interconnected tools streamline daily crypto management.

So if you want to see your whole crypto universe in one place, this review will give you the facts you need, from features to price and standout alternatives.

In this CoinStats review, I’ll break down what actually works, what’s unique, pros and cons, pricing, and how CoinStats compares to similar portfolio tools—so you can decide with confidence.

You’ll walk away knowing the features you need to finally manage your crypto investments the smart way.

Let’s dive into the analysis.

Quick Summary

- CoinStats is a crypto portfolio manager that unifies tracking across exchanges, wallets, and NFTs for clear investment insights.

- Best for active crypto investors managing assets on multiple platforms and exploring DeFi opportunities.

- You’ll appreciate its extensive integrations combined with intuitive P&L analysis and embedded DeFi earning tools.

- CoinStats offers a free tier and a Premium plan starting at $8.99/month with a 7-day free trial available.

CoinStats Overview

I found CoinStats has been around since 2017. Based in Yerevan, its core mission is giving you one unified hub to track every digital asset you own across all platforms.

My analysis shows they serve the full spectrum of retail investors. Their real strength is helping you manage complex multi-platform portfolios, uniting your coins, NFTs, and DeFi stakes from countless sources into one clear, usable dashboard.

Their recent $3.2 million funding round was a smart move. In preparing this CoinStats review, I see it directly accelerating the advanced DeFi features your modern portfolio needs.

Unlike competitors focusing only on tax (Koinly) or pure DeFi (Zerion), CoinStats positions itself as the all-in-one crypto command center. I find it’s built for active daily management, not just annual tax reporting.

They work with investors who are overwhelmed by spreadsheets and manual tracking. You’ll see beginners and seasoned DeFi pros alike using the platform for total portfolio clarity and control.

What impressed me most is their strategic push for a complete, self-contained ecosystem. They want you to research, track, swap, and earn interest without ever leaving their application, directly solving crypto’s huge fragmentation problem.

Now, let’s examine their core capabilities.

CoinStats Features

Crypto portfolio chaos got you down?

CoinStats features are actually a comprehensive suite designed to give you a unified view of your entire crypto portfolio. Here are the five main CoinStats features that solve critical digital asset management problems.

1. Portfolio Tracking & Aggregation

Juggling multiple crypto apps?

Constantly logging into various exchanges and wallets just to see your total holdings is a massive time sink. This fragmentation creates a headache for every crypto investor.

CoinStats eliminates this by connecting your accounts via secure, read-only API keys or public wallet addresses. From my testing, it pulls real-time data from over 300 sources, automatically showing your balances and values. This feature consolidates everything instantly.

This means you get an instant, at-a-glance dashboard of your net worth, saving significant time and enabling better decisions.

2. Advanced Profit & Loss (P&L) Analysis

Confused about true crypto gains?

Simply seeing your balance isn’t enough; you need to understand your actual investment performance, factoring in fees and initial costs. This can be complex and opaque otherwise.

The platform analyzes your transaction history to calculate metrics like all-time P&L and average buy/sell prices for each asset. What I love about this is the “Realized vs. Unrealized Gains” feature, which simplifies complex performance. This feature provides deep insights into your trades.

This means you can clearly see which investments are working, empowering more strategic rebalancing and simplifying your tax planning.

3. CoinStats Earn

DeFi yield farming too complex?

Navigating the decentralized finance (DeFi) world for passive income can be intimidating, requiring deep technical know-how across many platforms. This often means missing out on opportunities.

CoinStats vets and lists various DeFi earning protocols, displaying their Annual Percentage Yields (APYs). Here’s what I found: it dramatically lowers the barrier to entry for earning passive income. This feature allows direct deposits from within the app.

This means you gain a curated, user-friendly gateway to generate passive income on your crypto assets without navigating confusing DeFi websites.

4. Integrated CoinStats Wallet

Need one place to manage and trade?

While tracking is essential, needing separate apps to swap, buy, or store your assets breaks up your workflow. This creates friction in an already fast-moving market.

CoinStats provides a native, self-custodial Web3 wallet, allowing you to buy, swap, and store directly within the app. This is where CoinStats shines; it aggregates liquidity for the best swap rates. This feature truly unifies your asset management.

This means you can research a coin, acquire it, swap it, and send it to a yield farm—all within a single, seamless application.

- 🎯 Bonus Resource: While we’re discussing managing assets efficiently, understanding leave visibility and error reduction for your team is equally important.

5. NFT Tracking

Is your NFT collection invisible?

As NFTs grow in popularity, a complete net worth calculation must include their value, yet many portfolio trackers ignore them or handle them poorly. This leaves a gap in your financial overview.

By connecting your Ethereum, Solana, or other supported blockchain wallets, CoinStats automatically discovers and displays your NFT collections. From my evaluation, it pulls floor price data from marketplaces like OpenSea, giving accurate estimated values. This feature provides comprehensive asset visibility.

This means you get a true, holistic view of your entire digital asset portfolio by incorporating the value of your NFT holdings alongside your cryptocurrencies.

Pros & Cons

- ✅ Intuitive UI/UX for simplified portfolio overview.

- ✅ Vast integrations across hundreds of exchanges and wallets.

- ✅ All-in-one functionality including tracking, DeFi, and wallet.

- ⚠️ Occasional data syncing delays for less common transactions.

- ⚠️ Complex DeFi transactions may require manual P&L adjustments.

What I love about these CoinStats features is how they work together to create a complete digital asset ecosystem for investors.

CoinStats Pricing

Finding transparent crypto pricing is key.

CoinStats pricing is refreshingly clear, with a freemium model that offers a capable free plan and a comprehensive premium subscription for advanced users. This straightforward approach simplifies your budget planning for crypto portfolio management.

| Plan | Price & Features |

|---|---|

| **Free Plan** | **$0** • Connect up to 10 exchanges/wallets • Track up to 1,000 transactions • Basic portfolio tracking • NFT tracking included |

| **Premium Plan** | **$8.99 per month (billed monthly)** **$3.49 per month (billed annually at $41.88)** • Unlimited connected exchanges/wallets • Track up to 100,000 transactions • Advanced Portfolio Analytics & P&L • Order Fill Notifications & Price Alerts • Coin Insights & Priority Support |

1. Value Assessment

Real value, clear costs.

From my cost analysis, what impressed me is how the annual Premium plan includes everything serious investors need without forcing you into oversized plans. The annual Premium plan delivers incredible value, offering a significant discount while unlocking critical features like unlimited connections and advanced P&L analysis that serious crypto investors need for better decision-making.

This means your monthly costs stay predictable as you grow, with clear upgrade paths when you need more functionality.

- 🎯 Bonus Resource: Before diving deeper, you might find my analysis of applied behavior analysis software helpful.

2. Trial/Demo Options

Try before you commit.

CoinStats offers a generous 7-day free trial for their Premium plan, allowing you to thoroughly test all advanced features like unlimited connections and deep P&L analytics. What impressed me is how this trial period lets you validate the ROI before any financial commitment, ensuring it meets your specific portfolio tracking needs.

This lets you evaluate whether the advanced functionalities align with your trading volume before committing to full pricing.

3. Plan Comparison

Choosing your perfect plan.

For new users or those with minimal holdings, the Free plan is a solid starting point for basic tracking and NFT management. However, if you’re an active trader or manage a complex, multi-platform portfolio, the Premium plan’s unlimited connections and advanced analytics significantly enhance your insights. It directly supports more sophisticated investment strategies.

This tiered approach helps you match pricing to actual usage requirements rather than overpaying for unused capabilities.

My Take: CoinStats’ pricing strategy is highly competitive, catering effectively to both casual users and serious investors with clear, value-packed tiers. From my cost analysis, it’s a strong contender for predictable crypto portfolio management.

The overall CoinStats pricing reflects exceptional value for comprehensive crypto portfolio management.

CoinStats Reviews

Real user experiences tell the full story.

To understand what customers genuinely think, I’ve analyzed numerous CoinStats reviews from platforms like Trustpilot and app stores, offering you balanced insights into real-world user feedback patterns.

1. Overall User Satisfaction

Users are highly satisfied.

From my review analysis, CoinStats consistently receives exceptionally high ratings, boasting averages like 4.7/5 on Trustpilot and 4.8/5 on the Apple App Store. What I found in user feedback is how the platform instills confidence through its reliability, especially for daily portfolio tracking.

This widespread satisfaction suggests you can expect a stable, well-regarded tool that genuinely meets the needs of most crypto investors.

- 🎯 Bonus Resource: While discussing financial management, understanding payroll accounting software can also help streamline audits.

2. Common Praise Points

UI and vast integrations shine.

Users consistently laud CoinStats for its intuitive UI/UX and comprehensive integrations across hundreds of exchanges and wallets. Review-wise, its all-in-one functionality garners significant praise, allowing you to manage diverse assets—from crypto to NFTs—in one unified dashboard.

This means you can streamline your crypto management, saving time and gaining a complete, real-time overview of your entire digital net worth.

3. Frequent Complaints

Syncing and P&L can frustrate.

Despite high praise, some common pain points emerge in CoinStats reviews, primarily around occasional data syncing delays and challenges with complex DeFi P&L calculations. What stands out is frustration from users on the free plan regarding customer support response times.

For your situation, these are generally minor annoyances rather than deal-breakers, often resolvable with patience or a paid plan upgrade.

What Customers Say

- Positive: “I can connect insane numbers of exchanges and wallets. For the first time, I can see my entire net worth in one place.”

- Constructive: “Love the UI, it’s beautiful and simple. My only gripe is transactions from less popular exchanges can take a while to sync.”

- Bottom Line: “The P&L analysis is brilliant. Manual edits needed for some DeFi transactions, but once set up, it’s incredibly powerful.”

Overall, CoinStats reviews reveal a highly valued tool with strong core functionality. The platform consistently delivers on its promises, reflecting genuinely positive user experiences despite minor syncing quirks.

Best CoinStats Alternatives

Feeling lost in the crypto software maze?

Choosing the best CoinStats alternatives can feel overwhelming with many options available. I’ll guide you through specific scenarios where other platforms might better suit your unique crypto management needs.

1. Koinly

Primarily focused on crypto tax reporting?

Koinly truly excels when your top priority is generating accurate, compliant crypto tax reports for authorities like the IRS. From my competitive analysis, Koinly offers superior tax reporting features compared to CoinStats, which focuses more on active portfolio management. This alternative treats tracking as a means to tax compliance, not the end.

Choose Koinly if your most critical need is meticulous, audit-proof tax report generation for complex crypto transactions.

2. Delta

Prioritizing mobile-first tracking and alerts?

Delta offers a sleek, mobile-optimized experience with a strong emphasis on real-time asset price tracking and customizable alerts. What I found comparing options is that Delta provides a superior mobile UI and alerts for active traders. However, this alternative offers less depth in DeFi integrations or web-based desktop power than CoinStats.

You’ll want to consider Delta if a beautiful, responsive mobile app for price tracking is your main requirement.

3. CoinTracker

Are high-volume trades complicating your taxes?

CoinTracker also specializes in robust crypto tax software, particularly strong for high-volume traders needing precise tax-loss harvesting and meticulous lot accounting. Alternative-wise, CoinTracker ensures audit-proof tax lot accounting for complex trading strategies. Its focus on detailed tax implications makes it a specialized solution compared to CoinStats’ broader features.

For your specific needs, choose CoinTracker if you’re a frequent trader in a high-tax jurisdiction requiring advanced tax optimization.

4. Zerion

Is your portfolio primarily DeFi-centric?

Zerion is a DeFi-native portfolio tracker, excelling at managing complex on-chain positions, LP tokens, and staking rewards across decentralized protocols. From my analysis, Zerion offers unparalleled insights into DeFi holdings, making it a strong alternative for Web3 enthusiasts. It has weaker support for centralized exchange assets, however.

You should choose Zerion when your primary focus is tracking self-custody wallets and intricate DeFi investments.

- 🎯 Bonus Resource: While we’re discussing specific management needs, my guide on best patient case management software could offer insights for other industries.

Quick Decision Guide

- Choose CoinStats: For unified tracking, advanced P&L, DeFi earn, and native wallet.

- Choose Koinly: When detailed, compliant crypto tax reporting is your top priority.

- Choose Delta: If you prioritize a mobile-first app with superior price alerts.

- Choose CoinTracker: For high-volume trading and advanced tax-loss harvesting.

- Choose Zerion: When your portfolio consists mainly of on-chain DeFi assets.

Ultimately, the best CoinStats alternatives depend on your specific portfolio mix and primary needs. Evaluate if tax, mobile, or DeFi focus outweighs CoinStats’ comprehensive suite.

Setup & Implementation

Dreading complex software implementation?

My CoinStats review provides insights into its deployment process. This section offers practical guidance, setting realistic expectations for your CoinStats implementation and what you’ll encounter during setup and adoption.

1. Setup Complexity & Timeline

Is CoinStats setup a breeze or a beast?

Initial CoinStats setup is remarkably quick for basic portfolios, often taking under an hour. However, for users managing extensive assets across numerous exchanges or complex DeFi positions, the CoinStats implementation timeline extends significantly due to manual API key generation and data verification. Expect rapid deployment for simple needs.

You’ll want to gather all exchange API keys and wallet addresses upfront to streamline this initial data aggregation process effectively.

2. Technical Requirements & Integration

What technical hurdles will you face?

CoinStats operates purely as a web or mobile application, meaning your technical requirements are minimal. There’s no specialized software or hardware needed beyond a modern browser or smartphone. What I found about deployment is that your existing devices are fully compatible, simplifying infrastructure planning compared to traditional enterprise software that demands significant IT setup.

Ensure you have read-only API access configured for all your centralized exchanges and your public wallet addresses ready for quick connection.

- 🎯 Bonus Resource: While we’re discussing team adoption, my guide on best workforce planning software helps forecast talent needs.

3. Training & Change Management

Will your team adopt it easily?

CoinStats boasts a highly intuitive UI, minimizing the need for extensive formal training for basic tracking. The primary learning curve for CoinStats implementation involves mastering manual adjustments for complex transactions like obscure airdrops or intricate DeFi activities. From my analysis, user adoption is generally high and rapid due to its familiar interface.

Plan for a short period of experimentation to understand manual transaction editing, especially if you engage in complex crypto activities.

Implementation Checklist

- Timeline: 15 minutes to a few hours, depending on portfolio complexity

- Team Size: Individual user with basic technical literacy

- Budget: Minimal beyond software subscription (if applicable)

- Technical: Read-only API keys and public wallet addresses ready

- Success Factor: Accurate manual entry for complex, unsynced transactions

Overall, CoinStats implementation is remarkably straightforward for most users, prioritizing rapid setup over complex enterprise features. For success, prepare for manual data refinement with complex portfolios, ensuring accurate long-term tracking.

Who’s CoinStats For

Is CoinStats the right fit for your crypto portfolio?

This CoinStats review dives into who truly benefits from this platform. I’ll help you quickly assess if its features align with your specific crypto investment profile, team needs, and use case requirements.

- 🎯 Bonus Resource: While we’re discussing assessing needs and gaining advantages, my guide on online reputation management software offers insights into leveraging feedback.

1. Ideal User Profile

For the active, multi-platform investor.

CoinStats is tailor-made for retail crypto investors managing assets across many exchanges, wallets, and DeFi protocols. From my user analysis, you’ll thrive if your portfolio spans diverse platforms like Coinbase, Binance, and Ledger. This tool empowers individuals seeking a singular, comprehensive overview.

You’ll successfully consolidate fragmented holdings, gaining clear insights into your entire digital asset net worth in one dashboard.

2. Business Size & Scale

Your portfolio’s scale and complexity.

This isn’t about traditional business size, but rather the complexity of your personal crypto operations. CoinStats best serves individuals with a substantial number of connections and transactions, often spread across multiple CEX, DeFi, and NFT platforms. What I found about target users is that the more scattered your assets, the more value you gain.

You’ll know it’s a good fit if managing your diverse crypto holdings currently feels overwhelming or fragmented.

3. Use Case Scenarios

Unified tracking and performance insights.

CoinStats excels when your primary goal is a single, unified portfolio view and detailed performance tracking. The software shines for investors needing P&L analysis beyond simple spreadsheets and exploring DeFi without excessive complexity. From my analysis, it simplifies managing multi-chain DeFi investments significantly.

You’ll benefit greatly if you’re tired of checking multiple apps and desire comprehensive, actionable insights into your digital assets.

4. Who Should Look Elsewhere

When CoinStats isn’t the best fit.

If your primary need is solely advanced crypto tax reporting, or if you hold assets on only one or two platforms, CoinStats might be overkill. From my user analysis, basic users or those focused on specialized tax features may find it more comprehensive than necessary. Syncing occasional delays for complex transactions can also be a minor frustration.

Consider dedicated tax software or simpler portfolio trackers if your needs are minimal or hyper-focused on specific compliance reporting.

Best Fit Assessment

- Perfect For: Active, multi-platform crypto investors and traders

- Business Size: Not applicable; individuals with complex, diversified portfolios

- Primary Use Case: Unified portfolio tracking, P&L analysis, DeFi exploration

- Budget Range: Users valuing premium comprehensive tracking features

- Skip If: Basic users, single-platform holders, or solely tax-focused

Ultimately, who should use CoinStats depends on your portfolio’s complexity and desire for unified insights. This CoinStats review confirms it’s a powerful tool for active, multi-platform crypto investors seeking comprehensive management.

Bottom Line

CoinStats delivers a powerful crypto tracking experience.

My comprehensive CoinStats review reveals a robust portfolio management platform offering extensive integrations and powerful insights for active investors seeking a unified view of their digital assets.

1. Overall Strengths

Intuitive design meets vast connectivity.

CoinStats excels with its clean, modern interface and impressive integration with hundreds of exchanges and wallets. This allows users to centralize diverse crypto assets effortlessly. From my comprehensive analysis, its all-in-one functionality truly streamlines management for varied and complex portfolios.

These strengths translate directly into significant time savings and provide you with a clearer, more holistic overview of your entire digital asset portfolio.

- 🎯 Bonus Resource: While we’re discussing insightful data, my guide on best nutrition analysis software covers tools for diverse information.

2. Key Limitations

A few areas need refinement.

Despite its strengths, CoinStats occasionally faces syncing issues, especially with less popular exchanges, potentially leading to temporary portfolio inaccuracies. Furthermore, complex DeFi transactions may require manual adjustments for accurate P&L calculations, as extensive user feedback confirms.

These drawbacks are generally manageable for most users, representing minor inconveniences rather than fundamental flaws, given the platform’s overall value.

3. Final Recommendation

My clear recommendation for you.

You should choose CoinStats if you’re an active retail or “prosumer” crypto investor needing a centralized, comprehensive portfolio tracker. Based on this review, it offers unparalleled integration for diverse assets, providing actionable insights without overwhelming complexity or excessive cost.

Your decision to adopt CoinStats will be a confident one, especially if seamless multi-platform tracking and a clear overview are your top priorities.

Bottom Line

- Verdict: Recommended

- Best For: Active retail & prosumer crypto investors

- Biggest Strength: Vast integrations & intuitive all-in-one platform

- Main Concern: Occasional syncing issues & complex DeFi P&L

- Next Step: Try the free tier to test integrations

This CoinStats review confirms its status as a top-tier crypto portfolio manager, offering exceptional value for its target audience. I have high confidence in this assessment for your decision.