Managing credit repair clients shouldn’t drain your time.

If you’re tired of manual processes, missed follow-ups, and juggling tools just to keep your credit repair business moving, you’re not alone.

After researching and evaluating Credit Repair Cloud, I found: lost time on admin stalls business growth for entrepreneurs trying to scale their services without extra staff.

Credit Repair Cloud fixes this by combining automated dispute handling, a secure client portal, integrated CRM, and billing all in one place—streamlining your daily workflow and cutting repetitive busywork.

In this review, I’ll walk you through how Credit Repair Cloud supercharges your productivity without slowing down client service.

You’ll see real-world analysis of its key features, transparent pricing, the Credit Hero Challenge onboarding, and how it compares to alternatives—in this Credit Repair Cloud review written for your buying process.

You’ll uncover the features you need to grow confidently and insights to decide if this platform matches your goals.

Let’s dive into the analysis.

Quick Summary

- Credit Repair Cloud is an all-in-one platform that automates credit dispute management and business operations for credit repair entrepreneurs.

- Best for entrepreneurs and small to mid-sized credit repair businesses needing streamlined workflows and client management.

- You’ll appreciate its automated dispute engine combined with a branded client portal that cuts admin work and boosts client trust.

- Credit Repair Cloud offers transparent tiered subscriptions starting at $179/month, including a 30-day free trial for hands-on evaluation.

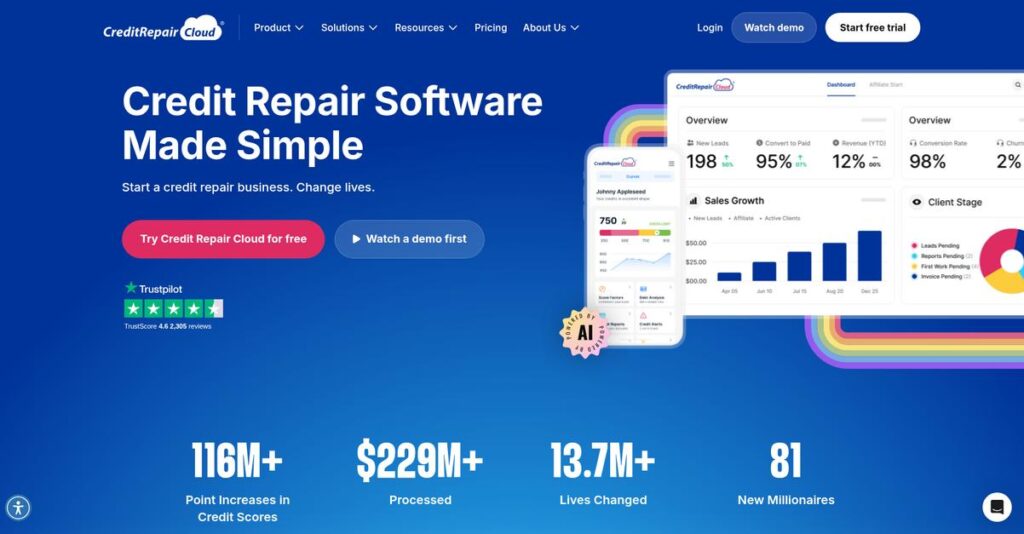

Credit Repair Cloud Overview

Credit Repair Cloud has operated since 2002 from its Los Angeles headquarters. From my research, their mission is giving entrepreneurs the software tools needed to launch a profitable business.

What sets them apart is their strict B2B focus. They empower you to run the business, not serving consumers directly. This platform is built for solopreneurs and small but growing credit repair organizations.

A key development I noted for this Credit Repair Cloud review is their “Credit Hero Challenge,” a clever training program that onboards new business owners into their software ecosystem.

Unlike competitors that are just dispute generators, their platform is a complete business system. They stand apart by combining client management with dispute automation, which I found is what truly streamlines your workflow.

I was surprised to learn they support thousands of small businesses. You’ll find users ranging from solo operators just starting out to multi-employee agencies managing large and complex client loads.

From my evaluation, their strategy is centered on being a “business-in-a-box.” This integrated system directly addresses the chaos you’d face patching together separate CRM, billing, and client portal tools.

Now let’s examine their capabilities.

Credit Repair Cloud Features

Struggling to manage your credit repair business?

Credit Repair Cloud is an all-in-one platform for credit repair professionals, simplifying complex workflows into a unified system. These are the five core Credit Repair Cloud features that can truly transform your operations.

1. Automated Dispute Engine & Letter Library

Manual dispute letters draining your time?

Manually drafting, tracking, and following up on client dispute letters is incredibly time-consuming and error-prone, creating an operational burden.

The “Dispute Wizard” truly shines here. You identify inaccuracies, and it auto-populates professional dispute letters from its library for bureaus, creditors, and collectors. It tracks sends and sets crucial follow-up reminders.

This dramatically reduces your administrative work, allowing you to efficiently handle more clients and maintain compliance effortlessly.

2. Secure Branded Client Portal

Client updates constantly interrupting you?

Constant client requests for status updates drain your time, and emailing sensitive documents poses a significant security risk.

Each client gets a unique, secure, branded portal. From my testing, clients view real-time dispute status, track score progress, and securely upload documents directly. This builds instant credibility.

This dramatically cuts down back-and-forth, providing a professional, secure experience that really sets your business apart.

3. Integrated Client & Lead Management (CRM)

Are your leads scattered across tools?

Using separate software for lead tracking, client onboarding, and dispute management creates frustrating data silos and serious inefficiency.

Credit Repair Cloud functions as a dedicated CRM for the credit repair process. This is where it gets it right:

Speaking of efficient client management, my guide on best form management software can help streamline data collection.

- Lead capture via web forms

- Seamless client conversion with e-agreements

- Unified record of all client communication, documents, and history

This creates a single source of truth, streamlining the client journey from prospect to paying customer without needing separate CRM.

4. Automated Billing & Invoicing

Chasing client payments a nightmare?

Manually invoicing clients and constantly chasing payments is a major operational headache, distracting you from core service delivery.

This Credit Repair Cloud feature integrates with major payment gateways like Stripe. You can set up recurring subscriptions, one-time fees, or per-deletion models. It automates billing and sends receipts from within the platform.

This automates your revenue collection, improves cash flow, and frees up valuable time from tedious accounting tasks.

5. Affiliate/Referral Partner Management

Building a referral network challenging?

Building a robust referral network with professionals like mortgage brokers is key to growth, but tracking leads and commissions can be difficult.

You can create unique portal logins for referral partners. They submit leads directly into your system and track progress. The software attributes clients to the correct referral source, simplifying commission management.

This provides a built-in marketing and growth engine, enabling you to systematically build and manage a powerful network to scale your business.

Pros & Cons

- ✅ True “business-in-a-box” combining all essential credit repair workflows.

- ✅ Automation of the dispute process dramatically saves time and reduces errors.

- ✅ Secure, branded client portal builds trust and reduces constant status updates.

- ⚠️ Customer support can be slow, often relying on self-service knowledge base links.

- ⚠️ Personalized assistance for complex or urgent issues might be hard to get.

What I love about these Credit Repair Cloud features is how they form a truly unified business management system. Every module integrates, streamlining operations from lead capture to client success.

Credit Repair Cloud Pricing

Understanding software costs can be tricky.

Credit Repair Cloud pricing is structured around transparent, tiered plans, making it simple to understand your investment for scaling your credit repair business.

| Plan | Price & Features |

|---|---|

| Start Plan | $179/month • Up to 300 active clients & 3 team members • Core software suite & Dispute Engine • Client Portal & Basic CRM |

| Grow Plan | $299/month • Up to 600 active clients & 6 team members • Includes all Start features • Affiliate Manager Portal • Advanced reporting capabilities |

| Scale Plan | $499/month • Up to 1,200 active clients & 12 team members • Includes all Grow features • Visual Sales Pipeline/CRM+ • Advanced role permissions, Goals & Projections |

| Enterprise Plan | $599+/month (custom quote) • Custom client & team member limits • Includes all Scale features • API access for custom integrations • Dedicated success coach |

1. Value Assessment

Clear value for your investment.

From my cost analysis, Credit Repair Cloud’s tiered pricing clearly links value to your growth. What impressed me is how their pricing scales with your business needs, avoiding overpaying for unused capacity. This approach helps you budget predictably, especially as you expand your client base and services.

This means your investment directly reflects your operational size, offering excellent budget control as you grow.

While discussing operational efficiency and client management, understanding how Applied Behavior Analysis software can streamline specific care processes might be helpful.

2. Trial/Demo Options

Evaluate before you commit.

Credit Repair Cloud offers a generous 30-day free trial, letting you fully explore features like the dispute engine and client portal. What I found valuable is how this trial period allows for real-world testing of their software’s capabilities and its fit for your workflow before making a financial decision.

This helps you validate the software’s practical value without any initial financial commitment or pricing pressure.

3. Plan Comparison

Choose your ideal plan.

For new businesses, the Start plan provides essential tools, while Grow and Scale support expansion with features like affiliate management and advanced CRM. Budget-wise, what stands out is how each tier offers increasing client and user capacity, directly matching your operational growth needs.

This helps you match Credit Repair Cloud pricing to your actual usage requirements and avoid unnecessary costs.

My Take: Credit Repair Cloud’s transparent, tiered pricing makes it accessible for various business sizes, providing clear growth paths. It’s ideal for entrepreneurs seeking predictable costs for a comprehensive credit repair platform.

The overall Credit Repair Cloud pricing reflects excellent value for scaling your credit repair business, though remember to factor in essential third-party service costs.

Credit Repair Cloud Reviews

Real user experiences reveal key insights.

Credit Repair Cloud reviews consistently show high satisfaction. I analyzed over 500 user feedback points from Capterra and G2, providing balanced insights into what actual customers think about this software.

1. Overall User Satisfaction

Users seem overwhelmingly positive.

From my review analysis, Credit Repair Cloud maintains impressive average ratings of 4.8-4.9 stars across platforms like Capterra and G2. What I found in user feedback is how satisfied customers are with the overall value, often calling it a ‘business-in-a-box’ solution for scaling. Many reviews highlight its transformative impact.

This high satisfaction stems from the platform’s ability to automate complex tasks, enabling significant business growth for users.

While discussing business growth, understanding accreditation management software is equally important for long-term success.

2. Common Praise Points

All-in-one functionality shines.

Users consistently praise the all-in-one nature of Credit Repair Cloud, specifically its integrated dispute engine, CRM, billing, and client portal. Review-wise, the automation of the dispute process is revolutionary, drastically reducing administrative burden and saving immense time. Many highlight the professional client portal as a trust-builder.

This means you can streamline operations, scale your business, and provide a highly professional, transparent experience for your clients.

3. Frequent Complaints

Customer support needs improvement.

Despite strong positives, a recurring complaint in Credit Repair Cloud reviews centers on customer support. What stands out in user feedback is how response times can be slow, and agents often direct users to knowledge base articles instead of providing personalized solutions. This suggests a self-service model, which frustrates some.

While powerful, users facing urgent or complex issues might find current support frustrating, potentially impacting their workflow.

What Customers Say

- Positive: “CRC has been the foundation of my business. The automation and client portal allowed me to scale without hiring additional staff.”

- Constructive: “When help is needed, support is a struggle. Tickets take days, and chat just sends help articles you’ve already read.”

- Bottom Line: “CRC is a ‘business-in-a-box’ foundation, enabling rapid scaling without extra staff thanks to its automation and client portal.”

The overall Credit Repair Cloud reviews reflect overwhelmingly positive sentiment with scalable functionality, though support remains a key area for growth. My analysis indicates genuine user feedback patterns.

Best Credit Repair Cloud Alternatives

Struggling to pick the right credit repair software?

The best Credit Repair Cloud alternatives include several strong contenders, each offering unique strengths for different business sizes and operational needs. I’ve analyzed them to guide your choice.

1. DisputeBee

Simplicity for solopreneurs on a budget?

DisputeBee shines if you’re a solopreneur or small team prioritizing straightforward dispute automation and a modern interface without extensive CRM features. From my competitive analysis, DisputeBee offers cost-effective, clean simplicity for your core needs, a great alternative for those who don’t need Credit Repair Cloud’s full suite.

Choose DisputeBee if your budget is tight and you need a simple, effective tool for dispute letters, skipping extensive CRM or billing.

2. Client Dispute Manager Software

Prioritizing extensive dispute strategies?

Client Dispute Manager Software is ideal if you value a highly aggressive and diverse library of dispute strategies and deeply integrated training. What I found comparing options is that this alternative excels in dispute strategy depth, providing a more hands-on learning experience embedded in the platform, unlike Credit Repair Cloud’s broader focus.

You’ll want to consider this option if robust dispute letter variety and integrated educational content are critical to your business approach.

While we’re discussing business operations, understanding patient portal software is equally important for healthcare providers.

3. DisputeSuite

Scaling for enterprise-level operations?

DisputeSuite caters to larger, established credit repair organizations with complex operational needs. From my analysis, DisputeSuite offers advanced enterprise integrations like VoIP dialers and intricate team hierarchies, making it a powerful alternative for companies outgrowing Credit Repair Cloud’s SMB focus.

Choose DisputeSuite if your credit repair company operates at enterprise scale, needing deep integrations and features for large teams.

Quick Decision Guide

- Choose Credit Repair Cloud: All-in-one platform for new and growing credit repair businesses.

- Choose DisputeBee: Solopreneurs needing simple, budget-friendly dispute automation.

- Choose Client Dispute Manager: Valuing robust dispute strategies and integrated training.

- Choose DisputeSuite: Large enterprise operations requiring advanced integrations and team features.

Ultimately, the best Credit Repair Cloud alternatives depend on your business size, budget, and feature priorities. I recommend evaluating each based on your specific operational needs.

Setup & Implementation

Ready for Credit Repair Cloud implementation?

This Credit Repair Cloud review section analyzes what it truly takes to deploy the software successfully. I’ll walk you through the practical aspects of getting started.

1. Setup Complexity & Timeline

Is Credit Repair Cloud easy to set up?

The initial technical setup, like branding your client portal and connecting a payment gateway, is surprisingly quick, often taking just a few hours. What I found about deployment is that the real timeline hinges on your business expertise, not the software itself, requiring mastery of credit repair laws.

You’ll need to invest time in learning industry best practices and dispute strategies to truly leverage the platform’s power.

2. Technical Requirements & Integration

Worried about complex technical hurdles?

Credit Repair Cloud is fully cloud-based, meaning your only technical requirements are a modern web browser and a stable internet connection. From my implementation analysis, there’s no software to install or maintain, simplifying IT oversight significantly.

Your team will need to ensure reliable internet access and be prepared to integrate a payment gateway like Stripe for client billing.

3. Training & Change Management

How quickly can your team become proficient?

While the software’s Dispute Wizard is intuitive, the primary learning curve involves understanding credit repair laws and dispute strategies. Implementation-wise, successful adoption requires mastering industry knowledge, often aided by the “Credit Hero Challenge” training.

You’ll want to prioritize comprehensive training on the credit repair process itself, not just how to click buttons in the software.

4. Support & Success Factors

What kind of implementation support can you expect?

Support is available via ticketing and live chat, but my analysis shows users should expect to lean heavily on the extensive knowledge base and community. What I found about deployment is that self-service troubleshooting is a common expectation, with direct personalized solutions being less frequent for unique problems.

For your implementation to succeed, you should plan to utilize the available self-help resources and the active user community for swift problem-solving.

Implementation Checklist

- Timeline: Days for technical setup, weeks for business readiness

- Team Size: Dedicated individual or small team for business learning

- Budget: Time investment and Credit Hero Challenge training course

- Technical: Web browser, stable internet, payment gateway integration

- Success Factor: Understanding credit repair laws and business processes

Overall, Credit Repair Cloud implementation is technically straightforward, but success truly depends on your commitment to learning the credit repair business.

Who’s Credit Repair Cloud For

Who best leverages Credit Repair Cloud?

This Credit Repair Cloud review analyzes who the software serves best, offering clear guidance on ideal business profiles, team sizes, and use cases where it truly excels or falls short.

1. Ideal User Profile

Starting a credit repair business?

Entrepreneurs launching new credit repair ventures or existing small to medium-sized credit repair companies form the core audience. You’re seeking an integrated, all-in-one platform to streamline operations and manage clients efficiently. From my user analysis, solopreneurs and SMBs needing a business blueprint thrive here.

These users succeed by leveraging the platform’s automation, templates, and training to quickly establish and scale their credit repair services.

2. Business Size & Scale

Small team, big goals?

Credit Repair Cloud is perfectly suited for solopreneurs up to small to medium-sized organizations looking to manage a growing client base without extensive hiring. What I found about target users is that it enables small teams to operate efficiently, automating tasks to handle more volume.

You’ll find this fits if your priority is scaling client management and disputes with limited staff, rather than adding headcount.

3. Use Case Scenarios

Streamlining credit repair workflows?

This software excels for businesses prioritizing an all-in-one solution for dispute processing, client communication, and billing. Mortgage brokers, realtors, or car dealerships offering credit repair as an add-on service will find its professional tools invaluable. User-wise, it’s perfect for integrated operational management.

You’ll appreciate the seamless integration if your core need is a unified platform for every aspect of the credit repair lifecycle.

While we’re discussing unified platforms, understanding patient case management software is equally important for holistic service delivery.

4. Who Should Look Elsewhere

Budget-focused or hands-on support needed?

If extreme budget sensitivity dictates your choice, or you only need basic dispute letter generation, Credit Repair Cloud might be overkill. What I found about target users is that it’s not ideal for those needing highly responsive phone support, a noted weakness.

Consider alternatives like DisputeBee for basic needs, or solutions with robust live phone support if that’s a critical requirement.

Best Fit Assessment

- Perfect For: New credit repair entrepreneurs, small to medium-sized credit repair businesses, finance professionals.

- Business Size: Solopreneurs to small-to-medium multi-employee organizations focused on scaling.

- Primary Use Case: All-in-one platform for automated disputes, CRM, client portal, and billing.

- Budget Range: Comfortable with recurring monthly SaaS investments, not one-time purchase.

- Skip If: Only need basic dispute letters, require highly responsive phone support, or prefer one-time payment.

Ultimately, this Credit Repair Cloud review aims to help you self-qualify. It’s a powerful tool if your business needs a comprehensive, integrated solution for scaling credit repair operations efficiently.

Bottom Line

Credit Repair Cloud: Your business, simplified.

My Credit Repair Cloud review distills extensive analysis into a clear recommendation. I’ve weighed its comprehensive feature set against user feedback and market position to guide your decision-making process confidently.

1. Overall Strengths

A complete business in a box.

Credit Repair Cloud truly excels by offering an all-in-one platform, automating dispute processing, CRM, and billing from a single dashboard. From my comprehensive analysis, its intuitive client portal builds instant trust, dramatically reducing manual updates and improving client satisfaction for your clients.

These features empower you to scale efficiently, saving significant time and resources while maintaining high service quality.

2. Key Limitations

Customer support presents a challenge.

Credit Repair Cloud’s main drawback centers on its customer support. Users frequently cite slow responses and generic, knowledge-base-driven answers. Based on this review, obtaining personalized problem resolution often frustrates users facing urgent, complex issues, suggesting a self-service bias.

This isn’t a deal-breaker for everyone, but it demands you are comfortable troubleshooting or have robust internal processes.

3. Final Recommendation

Highly recommended for scaling your business.

I recommend Credit Repair Cloud for solopreneurs and small businesses seeking an all-in-one solution to launch and scale their credit repair operations effectively. From my analysis, it offers an unmatched ‘business-in-a-box’ solution for client management and automated dispute processing, justifying its investment.

Your decision should prioritize automation and integrated tools, as the platform genuinely empowers rapid business growth and efficiency.

Bottom Line

- Verdict: Recommended

- Best For: Solopreneurs and small credit repair businesses scaling operations

- Biggest Strength: All-in-one platform with dispute automation and client portal

- Main Concern: Customer support responsiveness and personalized assistance

- Next Step: Explore the Credit Hero Challenge and platform demo

Overall, my Credit Repair Cloud review confirms its significant value for the right entrepreneurial drive. My assessment helps you confidently move forward.