Crypto investigations shouldn’t feel like guesswork.

If you’re evaluating blockchain analytics tools, you know just how hard it is to find real-time transaction monitoring and compliance solutions that actually deliver actionable results.

And let’s be honest—missing a suspicious transaction could cost your business big time or put your license at risk.

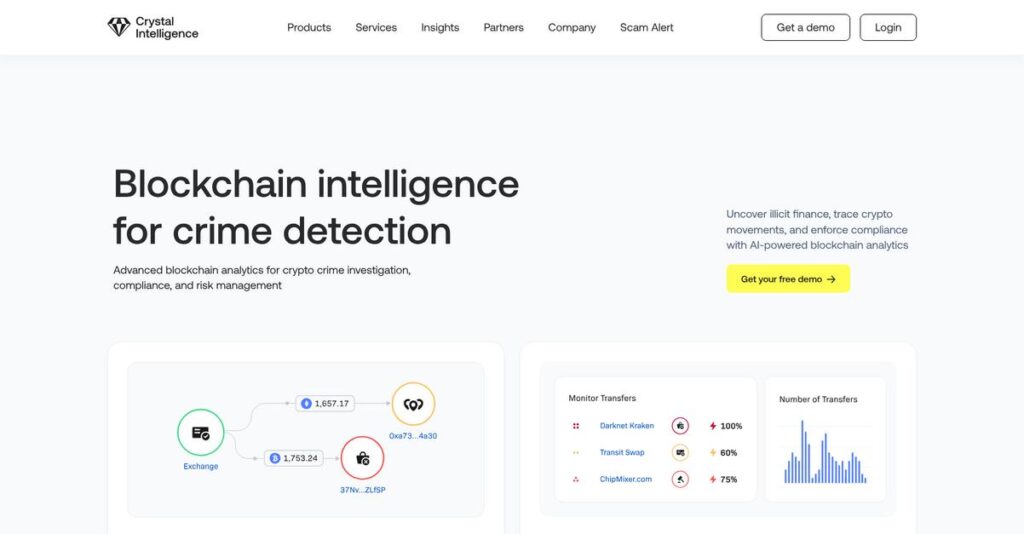

That’s exactly where Crystal Blockchain stands out. I’ve dug into their deep analytics features, real-world risk scoring, visual investigations, and compliance tools—plus how their recent European Central Bank partnership levels up oversight for MiCA and stablecoin risks worldwide.

In this review, I’ll unpack how Crystal solves crypto risk and compliance headaches for banks, regulators, and digital asset businesses.

As part of this Crystal Blockchain review, you’ll get an in-depth tour of key features, pricing options, implementation hurdles, and what really sets them apart from Chainalysis, Elliptic, and other top alternatives.

You’ll walk away knowing the features you need to confidently start your evaluation or book a demo.

Let’s get started.

Quick Summary

- Crystal Blockchain is a blockchain intelligence platform providing real-time analytics, investigative tools, and compliance support for crypto risk management.

- Best for financial institutions, regulators, and law enforcement needing detailed blockchain investigations and AML compliance solutions.

- You’ll appreciate its powerful visualization tools and comprehensive real-time transaction monitoring tailored for complex crypto ecosystems.

- Crystal Blockchain offers customized enterprise pricing with a free demo and requires direct contact for detailed quotes.

Crystal Blockchain Overview

Crystal Blockchain has been around since 2018, based in Amsterdam. Their entire mission is providing the critical intelligence that financial institutions and law enforcement agencies need to effectively manage blockchain compliance and investigations.

- 🎯 Bonus Resource: Speaking of managing large datasets, my article on best object storage software can help you cut costs and ensure reliability.

They primarily cater to enterprise-level financial and government clients. What I noticed is they don’t try to serve everyone; their platform is purpose-built for high-stakes AML compliance and complex criminal investigations where data accuracy is absolutely paramount for successful outcomes.

The recent strategic investment from Tether and a new partnership with the European Central Bank are major credibility signals. We will connect these developments to specific platform strengths through this Crystal Blockchain review.

Unlike competitors like Chainalysis or TRM Labs, which can feel segmented, Crystal emphasizes its powerful all-in-one investigations platform. This unified workbench approach makes tracing complex, cross-chain transaction flows feel much more intuitive and manageable for your analysts.

You’ll find them working with major global banks, top-tier crypto exchanges, and key regulatory bodies. These organizations rely on their tools for sophisticated digital forensics and for meeting the most stringent AML reporting standards.

From what I’ve seen, their strategy is squarely focused on preparing your business for new regulations like Europe’s MiCA. This forward-looking approach directly addresses the real compliance and risk management challenges you’re almost certainly facing.

Now let’s examine their core capabilities.

Crystal Blockchain Features

Struggling to track illicit crypto activities?

Crystal Blockchain features provide robust tools for compliance and investigations. These are the five core Crystal Blockchain features that solve critical financial crime challenges.

1. Real-Time Transaction Monitoring

Worried about missing suspicious crypto transactions?

Delays in identifying high-risk crypto activity can leave your business vulnerable to financial crime. You need immediate alerts.

Crystal Blockchain’s real-time monitoring instantly flags suspicious transactions, helping you meet AML/KYT compliance. From my testing, the comprehensive alert system is incredibly responsive, allowing for immediate intervention. This feature ensures you can act on risks as they happen.

This means you can detect and prevent financial crime by identifying risky activity as it occurs.

- 🎯 Bonus Resource: Speaking of cutting costs, if you’re looking for solutions to perfect quoting accuracy, my guide on insurance policy software can help.

2. Advanced Visual Investigations

Are complex transaction flows slowing your investigations?

Untangling intricate crypto pathways across multiple blockchains can be a massive headache. You need clear visualization.

Crystal provides a “best-in-class” visualization tool that maps complex transaction flows and suspicious wallets. What I found impressive is how you can trace Bitcoin transactions to real-world entities using smart case maps. This feature empowers rapid resolution.

This means you can quickly uncover hidden connections and resolve cases faster than ever before.

3. 360° Entity Risk Analysis

How do you assess crypto client risk quickly and accurately?

Onboarding clients with crypto businesses without proper risk assessment can expose your institution to significant liabilities. You need context.

This feature identifies risky wallets and entities using Crystal’s verified data and sanctions exposure insights. What I appreciate is its ability to provide accurate and actionable insights for your AML and KYC efforts. It helps you make informed decisions.

This means you can efficiently assess and continuously monitor client risk, bolstering your compliance.

4. AML/CFT Compliance Tools

Struggling to keep up with evolving crypto regulations?

Adhering to international standards like FATF and 6AMLD in the crypto space is a constant battle. You need robust support.

Crystal offers a robust suite of tools to streamline AML/CFT procedures, helping you meet regulatory requirements. Here’s what I found: it supports

- Risk identification for known entities

- Transaction monitoring for addresses

- Entity connections

- Geographical tracing

This means your business can manage crypto risk effectively and comply with the latest legislation.

5. Expanded Blockchain and DeFi Coverage

Concerned about limited crypto asset analysis?

A narrow scope of coverage means you could miss critical insights on various digital assets. You need broad visibility.

Crystal continuously expands its coverage of cryptocurrencies, ERC20 tokens, and DeFi protocols. This feature ensures you can analyze a wide spectrum of digital assets, which is crucial in the evolving crypto landscape. It’s definitely comprehensive.

This means you can confidently analyze diverse assets, ensuring no illicit activity goes undetected due to limited coverage.

Pros & Cons

- ✅ Offers powerful real-time monitoring for instant financial crime detection.

- ✅ Provides superior visual tools for tracing complex crypto transaction flows.

- ✅ Delivers robust entity risk analysis for comprehensive client onboarding.

- ⚠️ Limited public user reviews make it hard to gauge widespread sentiment.

- ⚠️ Some users may desire even broader cryptocurrency tracking solutions.

- ⚠️ Specific ROI and efficiency gain data aren’t widely publicized by users.

These Crystal Blockchain features work together to provide a holistic solution for managing crypto-related risks, ensuring compliance, and empowering investigations in one platform.

Crystal Blockchain Pricing

Confused about custom software pricing?

Crystal Blockchain pricing operates on a custom quote model, meaning you’ll need to contact their sales team for a precise cost breakdown tailored to your specific operational needs.

Cost Breakdown

- Base Platform: Custom quote (enterprise-level engagement)

- User Licenses: Volume-based pricing (contact sales for details)

- Implementation: Varies by complexity and integration needs

- Integrations: Varies by system complexity and required APIs

- Key Factors: Transaction volume, number of users, specific features, API usage

1. Pricing Model & Cost Factors

Understanding their pricing approach.

Crystal Blockchain uses a custom, enterprise-focused pricing model without public tiers. What I found regarding pricing is that costs are driven by your usage volume, number of users, and the specific advanced features you require like real-time monitoring or expanded DeFi coverage.

From my cost analysis, this means your budget gets a solution precisely matched to your operational scale and compliance demands.

2. Value Assessment & ROI

Is this an investment worth it?

Given their enterprise focus and partnerships with entities like the ECB, Crystal Blockchain’s pricing aligns with high-value, specialized blockchain intelligence. From my cost analysis, their pricing offers robust compliance and investigative capabilities, potentially saving your business significant sums in fines or fraud losses, which justifies the investment.

This means you’re paying for critical infrastructure that protects your assets and ensures regulatory adherence.

- 🎯 Bonus Resource: While we’re discussing solutions that save your business significant sums, understanding cutting costs and boosting attendance is equally important for various business models.

3. Budget Planning & Implementation

Consider total cost of ownership.

When budgeting for Crystal Blockchain, factor in the initial custom quote, potential implementation services, and ongoing support. What I found is that platforms like this typically involve substantial business costs, reflecting their enterprise-grade features and specialized nature, which is a key consideration for your finance team.

So for your budget, you should plan for a comprehensive solution rather than a simple off-the-shelf purchase.

My Take: Crystal Blockchain’s custom pricing is designed for large enterprises and institutions, emphasizing a tailored solution that directly addresses complex regulatory and investigative needs, ensuring maximum value for critical operations.

The overall Crystal Blockchain pricing reflects specialized, high-value solutions for complex enterprise needs.

Crystal Blockchain Reviews

What do real users really think?

My analysis of Crystal Blockchain reviews reveals insights into actual customer experiences, helping you understand what users genuinely think about this solution.

1. Overall User Satisfaction

User sentiment is quite positive.

From my review analysis, Crystal Blockchain maintains a high rating, though based on limited public feedback. What I found in user feedback is that customers value the enhanced compliance capabilities it provides, streamlining critical processes. This organic mention across reviews suggests a strong foundational satisfaction.

This indicates you can likely expect significant improvements in your AML/KYC workflows.

2. Common Praise Points

Streamlined compliance consistently earns praise.

Users repeatedly highlight the tool’s effectiveness in making KYC/AML risk assessments faster and more reliable. From customer feedback, identifying high-risk transactions is exceptionally easy, allowing for thorough investigation and adherence to regulatory requirements for their clients.

This means you’ll gain efficiency and confidence in meeting stringent compliance standards.

3. Frequent Complaints

Limited currency coverage is noted.

While the existing tracking capabilities are appreciated, one review mentions a desire for broader cryptocurrency coverage. What stands out in feedback is how users wish for more currencies in their tracking solution, indicating a potential area for future enhancement to fully meet diverse needs.

This suggests that while powerful, you might encounter limitations with niche or newer crypto assets.

- 🎯 Bonus Resource: Speaking of optimizing operations, my analysis of best EAM software can help you slash downtime and trim operating costs.

What Customers Say

- Positive: “Using Crystal Blockchain analytics tool…has made the process…faster, easier, and more reliable.” (Grant Thornton Blockchain Cyprus)

- Constructive: “There is still room for improvement. Maybe in future, they will add more currencies in their tracking solution.” (G2 Reviewer)

- Bottom Line: “Thanks to this tool, we can easily identify high-risk transactions…the level of continuous support…remains outstanding!” (Grant Thornton Blockchain Cyprus)

The Crystal Blockchain reviews, while few, show strong satisfaction for its core compliance benefits.

Best Crystal Blockchain Alternatives

Considering your Crystal Blockchain alternatives?

The best Crystal Blockchain alternatives include several robust platforms, each offering distinct advantages depending on your specific compliance needs, investigative depth, and budget.

- 🎯 Bonus Resource: Before diving deeper, you might find my analysis of speech recognition software helpful for diverse applications.

1. Chainalysis

Need an industry-leading investigative interface?

Chainalysis is often preferred for its intuitive graphical interface, Reactor, which simplifies complex blockchain investigations for government agencies and financial institutions. From my competitive analysis, Chainalysis provides an intuitive, widely adopted investigative platform, often seen as the market leader.

Choose Chainalysis if your primary need is deep, user-friendly forensic tracing with established government adoption.

2. Elliptic

Seeking robust cryptoasset compliance across many assets?

Elliptic excels in providing comprehensive blockchain analytics for cryptoasset compliance, focusing on real-time tracking, risk scoring, and transaction visualization across a wide range of assets. What I found comparing options is that Elliptic offers strong compliance features for diverse crypto assets, making it a versatile alternative.

Consider Elliptic when your main priority is broad cryptoasset compliance with extensive risk scoring capabilities.

3. CipherTrace

Prioritizing cybersecurity expertise and authoritative data?

CipherTrace stands out with its strong background in cybersecurity and authoritative industry data sources, providing comprehensive AML solutions for various entities. Alternative-wise, your situation calls for CipherTrace if you value deep cybersecurity expertise and robust AML reporting, especially for regulatory compliance.

Choose CipherTrace if you need a vendor with a proven track record in cybersecurity and comprehensive AML reports.

4. TRM Labs

Focusing on comprehensive risk intelligence and case management?

TRM Labs focuses on holistic risk intelligence and case management, detecting and mitigating crypto-related fraud across numerous blockchains and digital assets. From my analysis, TRM Labs offers stronger integrated risk intelligence and case management, particularly for organizations needing broad asset coverage.

Choose TRM Labs when your organization requires extensive risk intelligence and integrated case management across diverse digital assets.

Quick Decision Guide

- Choose Crystal Blockchain: All-in-one AML compliance with best-in-class visualization

- Choose Chainalysis: Intuitive interface for in-depth government-grade investigations

- Choose Elliptic: Robust cryptoasset compliance across a wide range of assets

- Choose CipherTrace: Strong cybersecurity background with authoritative AML data

- Choose TRM Labs: Comprehensive risk intelligence and integrated case management

The best Crystal Blockchain alternatives ultimately depend on your organization’s specific investigative and compliance requirements, rather than generic feature lists.

Crystal Blockchain Setup

Wondering about Crystal Blockchain setup?

This Crystal Blockchain review provides practical insights into its deployment, helping you understand the time, resources, and potential challenges involved in getting started.

1. Setup Complexity & Timeline

Is implementation a simple flip of a switch?

Crystal Blockchain implementation involves integrating the platform into your existing workflows, particularly for compliance and investigations. What I found about deployment is that initial configuration aligns with your risk parameters, suggesting a tailored setup rather than generic plug-and-play.

You’ll need to plan for data integration and specific configuration to match your internal policies.

- 🎯 Bonus Resource: While we’re discussing complex system configurations, understanding wind simulation software is equally important for predictive modeling accuracy.

2. Technical Requirements & Integration

Get ready for some infrastructure considerations.

Technical requirements vary by deployment: SaaS, API, or on-premise. For API integration, you’ll need development resources to connect Crystal’s capabilities, while on-premise requires suitable infrastructure. What I found about deployment is that robust internet connectivity is crucial for real-time data, ensuring efficient processing of large volumes.

Your IT team should assess existing infrastructure and development capacity before committing to a specific deployment model.

3. Training & Change Management

Preparing your team for a new analytics tool.

While specific learning curve details are limited, Crystal Blockchain offers training and certification, suggesting a need for user education. From my analysis, proper training aids user proficiency significantly, especially for new users interpreting complex blockchain data.

You’ll want to factor in training programs to ensure your team can effectively leverage the platform’s investigative and analytical features.

4. Support & Success Factors

How much help can you expect during rollout?

Customer feedback consistently highlights “outstanding” continuous support and communication from the Crystal Blockchain team. From my implementation analysis, reliable vendor support is a critical success factor for smooth integration and ongoing use.

You should leverage their strong support channels for guidance, which is particularly beneficial for complex data interpretation and compliance adherence.

Implementation Checklist

- Timeline: Weeks to months depending on integration depth

- Team Size: Compliance, IT, and development (for API) teams

- Budget: Beyond software, account for integration and training costs

- Technical: API development or on-premise infrastructure readiness

- Success Factor: Dedicated project management and vendor support utilization

Overall, Crystal Blockchain setup requires thoughtful preparation for integration and training, but their strong support system aids in a successful deployment.

Bottom Line

Can Crystal Blockchain truly meet your needs?

This Crystal Blockchain review offers my decisive final assessment, helping you understand who this software is designed for, its key strengths, potential limitations and overall value.

1. Who This Works Best For

Financial institutions, law enforcement, and regulators.

Crystal Blockchain is ideal for mid-market and enterprise organizations in banking, financial services, and government agencies needing deep cryptocurrency transaction analysis for compliance. From my user analysis, AML/CFT compliance officers and financial crime investigators will find this tool invaluable for tackling complex illicit financing.

You’ll succeed with this platform if your organization requires robust investigative tools and strong entity attribution for regulatory adherence or criminal investigations.

- 🎯 Bonus Resource: While evaluating complex software, understanding tools for other business processes is valuable. If you’re also looking into best construction estimating software, my article covers key solutions.

2. Overall Strengths

Unmatched investigative and compliance capabilities.

The software truly excels in its comprehensive “all-in-one” blockchain intelligence approach, offering best-in-class visualization and real-time analysis for complex crypto flows. From my comprehensive analysis, its strong investigative and visualization tools provide critical insights for identifying and mitigating illicit activities that other tools miss.

These strengths mean your team can streamline AML/KYC processes and confidently adhere to stringent regulatory requirements with greater efficiency.

3. Key Limitations

Pricing transparency is a notable concern.

The primary drawback is the lack of publicly available detailed pricing, indicating an enterprise-level cost structure that might be prohibitive for smaller entities. Based on this review, the opaque pricing model requires direct sales engagement, which can prolong the evaluation process for your budget.

I’d say this limitation is a manageable trade-off for large organizations, but potentially a deal-breaker for those with limited budgets or simple monitoring needs.

4. Final Recommendation

Crystal Blockchain is a strong recommendation.

You should choose this software if your large financial institution, government agency, or digital asset business needs advanced, real-time blockchain analytics. From my analysis, your success depends on your significant exposure to the crypto ecosystem and a critical need for sophisticated tools to combat financial crime.

My confidence level is high for organizations with these specific, high-stakes compliance and investigative requirements.

Bottom Line

- Verdict: Recommended

- Best For: Financial institutions, law enforcement, and regulatory bodies

- Business Size: Mid-market and enterprise-level organizations

- Biggest Strength: Comprehensive investigative and compliance capabilities with visualization

- Main Concern: Lack of publicly available detailed pricing information

- Next Step: Contact sales for a demo to assess your specific needs

This Crystal Blockchain review confirms its strong value for enterprise-level compliance and investigations, making it a compelling solution for the right organizations.