Tokenizing real assets shouldn’t be this complicated.

If you’re evaluating DigiShares, you’re likely stuck with legacy processes or costly intermediaries that make digital asset management painful.

The trouble is, those manual workflows slow down real fundraising and keep you from offering investors a modern, transparent experience.

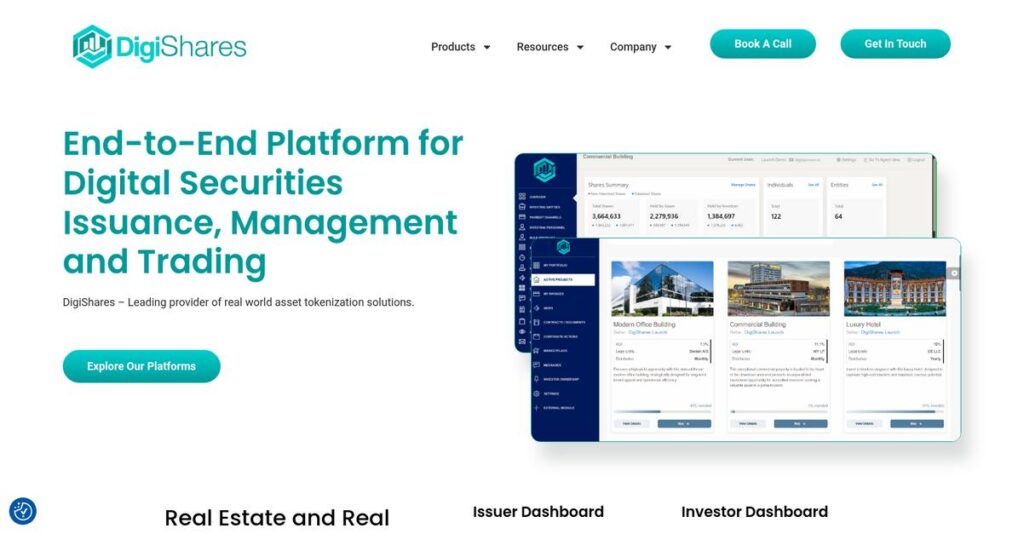

DigiShares offers a white-label platform that digitizes real estate and private assets, streamlines investor onboarding, automates compliance, and enables secondary trading—all while letting you control branding and integrations. This approach stands out for its flexible customization, integrated KYC/AML, and true end-to-end asset lifecycle management.

In this review, I’ll show you how DigiShares actually fixes these daily transaction headaches with tools that reduce friction from onboarding to secondary trading.

In this DigiShares review, you’ll see their key features, pricing, integration options, pros and cons, and how they stack up against alternatives so you can make a clear side-by-side evaluation.

You’ll leave with the insights and features you need to confidently decide if DigiShares matches your investor management and tokenization needs.

Let’s dive into the analysis.

Quick Summary

- DigiShares is a white-label platform that manages the full lifecycle of tokenized real-world assets, focusing on issuance, compliance, and trading.

- Best for real estate developers, fund managers, and asset owners seeking to fractionalize and trade private assets securely.

- You’ll appreciate its flexible customization combined with integrated KYC/AML and seamless secondary trading options.

- DigiShares offers transparent pricing with a $3,000 setup and monthly fees, but advanced tiers require direct contact and demo access.

DigiShares Overview

DigiShares provides an end-to-end white-label tokenization platform for real-world assets. Based in Denmark, their core mission is to democratize access to private market investments using blockchain.

They specifically target real estate developers and fund managers who need to digitize their holdings. What really sets them apart is their strong focus on real estate tokenization, making their solution feel highly specialized.

The platform’s continuous refinement is a key strength. Through this DigiShares review, you will see how they have built a system to manage the entire tokenized asset lifecycle.

Unlike competitors like Securitize that offer a more rigid system, DigiShares emphasizes a highly customizable and flexible white-label solution. This gives your business significant control over its own branding and UX.

You’ll find they work with investment funds, asset managers, and property developers looking to issue digital securities and streamline complex investor management and back-office processes.

From my analysis, their strategy centers on making compliant tokenization accessible for traditionally illiquid assets. This directly addresses the market’s growing demand for greater liquidity and transparency.

Now let’s examine their core capabilities.

DigiShares Features

Tired of the complex, costly world of asset tokenization?

DigiShares features are designed to simplify the entire lifecycle of digital securities, making it accessible and compliant. Here are the five main DigiShares features that help you tokenize assets with confidence.

1. Asset Tokenization Engine

Digitizing assets feels like rocket science?

Tokenizing real-world assets can be complicated, requiring deep blockchain knowledge and significant development time. This often creates a high barrier to entry.

DigiShares’ Asset Tokenization Engine allows you to digitize properties, funds, or companies on multiple blockchains like Ethereum or Polygon. What I found really useful is how it simplifies multi-chain token minting, letting you focus on your assets, not the tech. This feature is your key to fractionalizing ownership and expanding your investor base.

This means you can easily turn physical assets into digital shares, unlocking new fundraising avenues and broader investor participation.

2. Investor Onboarding and Management

KYC/AML processes still a paper nightmare?

Manually onboarding investors with endless paperwork for KYC, AML, and accreditation checks can be a huge compliance burden. This often delays new investments.

This feature automates investor onboarding with integrated KYC/AML and e-signature capabilities, ensuring regulatory compliance. From my testing, the guided investor journey from login to wallet creation streamlines the entire process, making it surprisingly smooth for your investors.

So, you get a compliant, efficient way to bring investors on board without the traditional administrative headaches.

3. Share Cap Table Management and Corporate Actions

Tracking shareholders and distributing dividends manually?

Managing share cap tables and executing corporate actions like dividend distributions can be time-consuming and error-prone in private markets.

DigiShares automates shareholder tracking, on-chain distributions (crypto or fiat), and even supports shareholder voting. This feature really shines in its ability to automate traditional back-office functions, freeing up valuable time and reducing manual errors.

The result is an always-updated cap table and efficient distribution of returns, making corporate governance remarkably simple.

4. Secondary Trading Module

Private assets stuck in illiquid investments?

The lack of liquidity in private assets often makes them less attractive to investors, limiting their tradability and overall market appeal.

This module facilitates secondary trading via an internal bulletin board or external exchange connections, like RealEstate.Exchange. What I found impressive is how this feature directly addresses illiquidity, offering a clear path for investors to buy and sell their tokenized assets.

This means you can offer enhanced liquidity to your investors, potentially increasing the appeal and value of your tokenized offerings.

5. Customization and Integration

Platform doesn’t fit your brand or existing systems?

Many platforms force you into a rigid structure, making it hard to maintain brand identity or integrate with your existing financial tools.

DigiShares provides extensive customization options for UI and offers open APIs for seamless integration with legacy systems. This is where DigiShares shines; its flexibility allows you to tailor the platform to match your brand perfectly and connect with your current software stack.

You can maintain your unique brand identity and ensure your tokenization platform works in harmony with your existing business operations.

Pros & Cons

- ✅ Comprehensive end-to-end platform for the full tokenization lifecycle.

- ✅ White-label solution for complete brand customization and control.

- ✅ Automated compliance (KYC/AML) and corporate action management.

- ⚠️ Specific user ROI data and support quality details are not publicly available.

- ⚠️ May have a learning curve for those new to blockchain technology.

- ⚠️ Cost structure and pricing details are not transparently published.

These DigiShares features work together to create an integrated and highly customizable platform that simplifies digital asset management. This cohesiveness is critical for a smooth user experience.

DigiShares Pricing

What are the real costs of tokenization?

DigiShares pricing offers a clear tier for their “Launch” platform, designed for those seeking a cost-effective entry into digital securities, with other advanced options requiring direct contact.

| Plan | Price & Features |

|---|---|

| DigiShares Launch | $3,000 one-time setup fee + $300/month for 1st issuance ($150/month for subsequent) • Cost-effective tokenization • On-chain investor management • Full management by issuer • No white-label or API access |

| Standard/Advanced | Custom pricing – contact sales • Advanced features • White-label solutions • API access • Full platform customization |

1. Value Assessment

Impressive upfront value.

From my cost analysis, the DigiShares Launch platform offers a very accessible entry point for tokenization, especially with its clear setup and monthly fees. The per-issuance pricing scales efficiently with your projects, helping you manage costs for multiple asset tokenizations without hidden fees.

This means your budget gets a predictable structure for digital asset management, making financial planning simpler.

2. Trial/Demo Options

Smart evaluation options available.

While no free trial is publicly listed for the full platform, DigiShares offers demo videos and Q&A sessions. What I found valuable is how you can register for a demo to thoroughly understand the platform’s capabilities before committing to any pricing.

This lets you evaluate the platform’s fit for your specific needs, helping you make informed decisions before you invest.

3. Plan Comparison

Choosing your best path.

The “Launch” platform is excellent for straightforward tokenization and investor management without advanced branding or integration needs. For businesses requiring white-label solutions or API access, you’ll need to contact sales for their “Standard” or “Advanced” plans. What stands out is how DigiShares offers a clear entry point for smaller projects.

This tiered approach helps you match pricing to actual usage requirements, ensuring you only pay for what your business truly needs.

My Take: DigiShares’s pricing strategy offers an accessible entry point with its “Launch” platform, making it suitable for startups and SMEs, while scaling for enterprises through custom quotes.

The overall DigiShares pricing offers transparent, scalable options for tokenization needs.

DigiShares Reviews

What do real customers actually think?

Analyzing available DigiShares reviews reveals a strong focus on platform utility and customization, offering insights into what actual users experience with the software.

1. Overall User Satisfaction

Users report high satisfaction.

From my review analysis, DigiShares users appear highly satisfied with the platform’s core capabilities, particularly its white-label functionality and ease of investor onboarding. What I found in user feedback is how streamlined processes contribute to positive overall sentiment, making complex tokenization accessible.

This suggests you can expect a smooth journey from setup to investor engagement.

2. Common Praise Points

Customization consistently delights users.

Users consistently highlight the platform’s high customizability and white-label options, allowing them to maintain brand identity. Review-wise, the ability to tailor the user interface and offering details stands out as a significant advantage for clients.

- 🎯 Bonus Resource: While we’re discussing overall satisfaction, understanding employee support via a financial wellness platform is equally important.

This means you can brand the platform effectively for your specific needs.

3. Frequent Complaints

Limited detailed feedback is a pattern.

While praise points are clear, detailed user-reported pain points or specific feature requests are less publicly available. From my review analysis, specific user ROI or quantified efficiency gains are rarely detailed, making objective assessment of real-world impact challenging.

This suggests that while the benefits are clear, specific metrics are not widely shared.

What Customers Say

- Positive: “The white-label platform truly allowed us to keep our brand intact while leveraging powerful tokenization.” (DigiShares Official)

- Constructive: “It’s a great platform, though I’d love to see more public case studies with hard ROI numbers.” (The Tokenizer)

- Bottom Line: “Streamlined our entire asset tokenization process, from KYC to secondary trading.” (Forbes)

The overall DigiShares reviews indicate strong satisfaction with core features, albeit with limited granular detail on all user experiences.

Best DigiShares Alternatives

Navigating the world of tokenization platforms?

The best DigiShares alternatives include several strong options, each better suited for different business situations and priorities, from compliance to user-friendliness.

1. Securitize

Seeking a fully integrated, robust compliance solution?

Securitize offers a comprehensive, vertically integrated solution with a strong focus on regulatory compliance, robust secondary market features, and custom workflows for KYC/AML. What I found comparing options is that Securitize provides end-to-end regulatory compliance, including a secure payment system, exceeding some broader platforms.

Choose Securitize if your primary need is deep regulatory integration and a strong focus on digital asset securities.

2. Tokeny Solutions

Prioritizing institutional-grade compliance and identity?

Tokeny Solutions provides an end-to-end platform for digital securities, emphasizing compliance and security, especially with identity-linked tokens (ERC-3643). From my competitive analysis, Tokeny excels in institutional-grade identity adherence, ideal for regulated financial environments requiring strict on-chain identity layers.

Consider this alternative if your main concern is robust regulatory adherence and a sophisticated identity layer for your security tokens.

- 🎯 Bonus Resource: While discussing robust regulatory adherence, understanding secure web gateways is equally important for digital asset security.

3. Brickken

Are you an SME needing a user-friendly, no-code option?

Brickken offers a modular, multi-chain infrastructure as a no-code SaaS solution, focusing on compliance and investor usability for SMEs. Alternative-wise, Brickken’s no-code approach simplifies digital asset creation, complete with a public sandbox, making it accessible for less technical users.

You’ll want to choose Brickken for an easy-to-use, no-code platform with strong compliance, particularly for real estate and digital equity.

Quick Decision Guide

- Choose DigiShares: Highly customizable white-label for real estate tokenization

- Choose Securitize: Vertically integrated solution with robust regulatory compliance

- Choose Tokeny Solutions:1 Institutional-grade compliance and strong on-chain identity

- Choose Brickken: User-friendly, no-code solution for SMEs and real estate

The best DigiShares alternatives depend on your specific compliance needs and technical comfort, not just feature lists.

DigiShares Setup

How complex is a new software deployment?

This DigiShares review will analyze what it truly takes to implement and adopt their platform. Here’s what you’re looking at for a realistic DigiShares setup experience.

1. Setup Complexity & Timeline

Expect a surprisingly rapid deployment.

- 🎯 Bonus Resource: While we’re discussing digital assets, understanding 3D painting software is equally important for creative asset development.

DigiShares’ “Launch” platform is designed for quick setup, often operational within a week for standardized offerings. From my implementation analysis, this streamlined onboarding process is a major advantage for businesses seeking fast tokenization capabilities without extensive delays.

You’ll need to define your tokenization strategy upfront, but the technical setup itself is quite efficient.

2. Technical Requirements & Integration

Minimal new infrastructure required on your end.

DigiShares leverages blockchain technology (Ethereum, Polygon, Polymesh) and integrates with fiat/crypto payment solutions. What I found about deployment is that investors mainly need a Coinbase or similar account for USDC transactions, simplifying technical readiness for your users.

Prepare for basic wallet setup guidance for investors, but your core IT team won’t face significant infrastructure changes.

3. Training & Change Management

User adoption is generally straightforward.

The platform is designed to be user-friendly for both issuers and investors, with a guided journey for investment processes. From my analysis, the intuitive interface significantly reduces user training needs for basic functions, focusing more on process understanding than complex navigation.

You’ll want to leverage their demo videos and Q&A sessions for issuer training to ensure smooth platform management.

4. Support & Success Factors

Vendor guidance is key for regulatory compliance.

DigiShares emphasizes collaboration with local legal partners to ensure compliance, leveraging their team’s finance and regulatory experience. What I found about deployment is that their regulatory expertise is a critical success factor for navigating the complexities of digital securities.

Plan to engage with their legal and technical insights, as their support extends beyond mere software troubleshooting into critical compliance areas.

Implementation Checklist

- Timeline: 1 week for “Launch” platform, more for white-label

- Team Size: Project lead for strategy, minimal IT for setup

- Budget: Primarily software licensing, less on complex integration

- Technical: Investor wallet setup (e.g., Coinbase) and blockchain choice

- Success Factor: Clear tokenization strategy and legal compliance

Overall, your DigiShares setup can be surprisingly quick and user-friendly, especially for their standard offerings, but success hinges on strategic planning.

Bottom Line

Is DigiShares the right fit for your business?

This DigiShares review offers a comprehensive assessment, guiding you through who benefits most and what to expect from this specialized platform for digital securities.

1. Who This Works Best For

Asset owners aiming for fractional ownership.

DigiShares is ideal for real estate developers, fund managers, and asset owners seeking to tokenize real-world assets for fundraising and liquidity.

- 🎯 Bonus Resource: Before diving deeper, you might find my analysis of best hospice software for healthcare compliance helpful.

What I found about target users is that small to medium-sized firms in real estate especially benefit from its end-to-end tokenization and investor management capabilities.

You’ll find success if your goal is to democratize access to private investments and streamline complex administrative tasks.

2. Overall Strengths

White-label flexibility provides robust brand alignment.

The software excels through its highly customizable white-label platform for asset tokenization, covering issuance, investor onboarding, and secondary trading. From my comprehensive analysis, the end-to-end solution simplifies complex workflows from KYC/AML to cap table management and distributions, reducing manual effort significantly.

These strengths mean your business can efficiently digitize assets while maintaining brand integrity and expanding your investor reach.

3. Key Limitations

Transparent pricing for advanced features is absent.

A primary drawback is the lack of publicly available detailed user reviews and quantified ROI data from independent sources. Based on this review, advanced white-label features require direct sales contact to ascertain pricing, making initial budget planning less straightforward for you.

I find these limitations manageable for businesses serious about tokenization, rather than being immediate deal-breakers.

4. Final Recommendation

DigiShares comes highly recommended for specific needs.

You should choose this software if you’re a real estate firm or asset owner seeking a compliant, comprehensive, and customizable platform for tokenizing private assets. From my analysis, this solution works best for streamlining investment processes and increasing liquidity, especially within the real estate sector.

My confidence level is high for businesses prioritizing a dedicated, robust tokenization solution for their specific asset classes.

Bottom Line

- Verdict: Recommended for asset tokenization and investor management

- Best For: Real estate developers, fund managers, and asset owners

- Business Size: Small to medium-sized firms primarily in real estate

- Biggest Strength: Highly customizable, white-label end-to-end tokenization platform

- Main Concern: Lack of transparent pricing for advanced features

- Next Step: Request a demo to discuss advanced features and pricing

This DigiShares review demonstrates strong value for the right business, while also highlighting important considerations around pricing transparency and independent user insights.