Tired of inaccurate credit wrecking your plans?

If you’re here, you’re likely frustrated by errors and negative marks on your credit report making financial progress feel impossible.

The real issue? So many tools out there leave you stuck wasting time battling credit bureaus and not seeing real improvements, which is hurting your daily peace of mind.

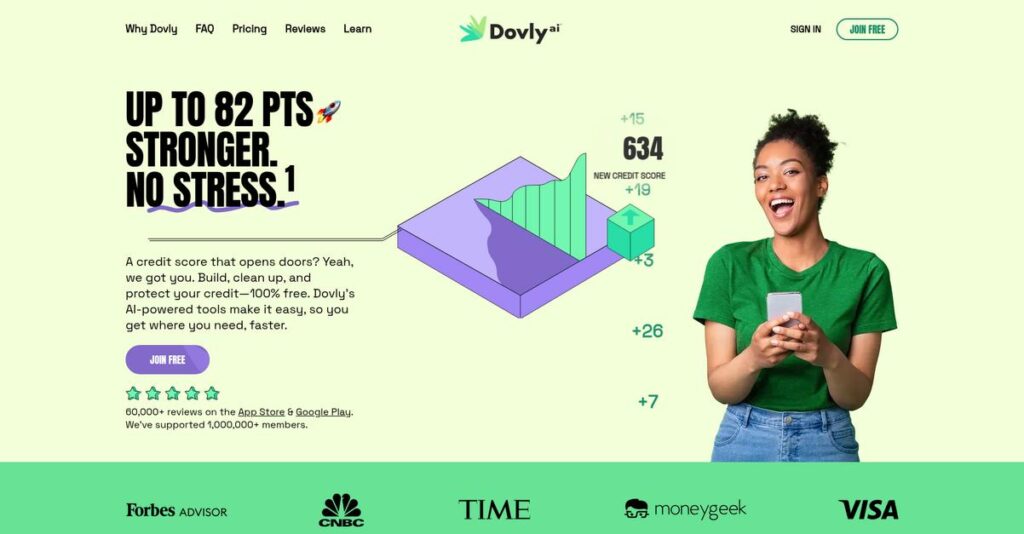

Dovly uses AI-powered automation to find and dispute credit report mistakes fast, adds credit monitoring, and helps you build long-term credit success—removing most of the frustrating legwork that holds you back.

In this review, I’ll show you how Dovly can actually improve your credit with its integrated features, transparent process, and real user experience.

You’ll see a full Dovly review of core features, pricing plans, AI dispute technology, what sets it apart, plus a quick look at the top alternatives so you can decide with confidence.

You’ll walk away knowing exactly the features you need to make a smarter decision about repairing your credit.

Let’s dive in and take a closer look.

Quick Summary

- Dovly is an AI-powered platform that automates identifying and disputing credit report errors to help improve your credit score.

- Best for individuals looking for an affordable, automated credit repair solution with continuous credit monitoring.

- You’ll appreciate its ability to save time by automating dispute letters and delivering personalized action plans for credit improvement.

- Dovly offers a free plan with basic features plus a premium subscription starting at $8.33/month billed annually with trial-free signup.

Dovly Overview

Dovly has been tackling credit repair with a technology-first approach since its 2018 founding, operating from its Phoenix headquarters. I find their core mission is making the credit improvement process genuinely accessible.

They aren’t a traditional, stuffy law firm. Instead, Dovly specifically targets individuals who want an automated, tech-first solution without the hefty price tag associated with legal teams. You’ll see this practical focus reflected in their user experience.

Recent partnerships with financial wellness apps like Grow Credit and Arro were a smart strategic move to broaden their ecosystem. We’ll explore the benefits for you through this Dovly review.

- 🎯 Bonus Resource: Speaking of automated solutions, if you’re interested in keeping other systems running smoothly, my guide on best system monitoring software covers essential tools.

Unlike competitors like Lexington Law that depend on expensive, human-led services, Dovly’s key advantage is its fully automated AI dispute engine. This feels like a platform built by people who value modern efficiency over billable hours.

They work with a broad base of everyday consumers, from people just starting their financial journey to those needing to clean up several frustrating inaccuracies on their credit reports without breaking the bank.

From my analysis, their entire business strategy centers on making credit repair much less intimidating. This “set-it-and-forget-it” model using smart automation is perfect if you want an effective, low-effort, and affordable solution.

Now let’s examine their capabilities.

Dovly Features

Struggling with bad credit holding you back?

Dovly features are designed to tackle credit repair head-on using AI, helping you improve your financial standing. Here are the five main Dovly features that work to fix your credit.

1. AI-Powered Dispute Resolution

Tired of manually disputing credit report errors?

Dealing with inaccurate items on your credit report can be a huge headache and a major time sink. This often feels like fighting a never-ending battle.

Dovly’s AI engine analyzes your credit report to find inaccuracies and automatically generates custom dispute letters for the major credit bureaus. From my testing, this automation really cuts down on effort, making the dispute process much less daunting. This feature simplifies what is usually a complex task.

This means you can finally challenge those negative items without drowning in paperwork or endless research.

- 🎯 Bonus Resource: Speaking of simplifying complex tasks, if you’re also looking to boost efficiency, my guide on hotel front desk software can help.

2. Comprehensive Credit Monitoring

Worried about unexpected changes to your credit score?

Not knowing what’s happening on your credit report can lead to nasty surprises and delayed responses to issues. You need to stay informed constantly.

Dovly provides continuous credit monitoring, alerting you to any new accounts, inquiries, or negative items immediately. What I love about this approach is how it keeps you truly in the loop on your credit health. Premium members even get weekly TransUnion reports and scores.

So you get peace of mind and the ability to quickly address potential problems as they arise.

3. Personalized Action Plans

Confused about how to actually improve your credit?

Understanding what specific actions will boost your credit score can feel like a mystery. You need clear, actionable guidance tailored to you.

Dovly’s AI creates a personalized action plan with tailored steps and product recommendations based on your unique credit profile. Here’s what I found: this really demystifies the credit improvement process, showing you exactly what’s impacting your score. This feature turns complex data into simple steps.

This means you receive a clear roadmap, empowering you to make smart financial decisions that impact your future.

4. Credit Building Tools

Need to establish or rebuild positive credit history?

Just removing negative items isn’t enough if you lack positive credit activity. You need ways to actively build a stronger financial foundation.

Beyond repair, Dovly offers tools and recommendations for credit builder accounts or other financial products designed to help you establish new credit. This is where Dovly shines; it doesn’t just fix, it helps you build. This feature provides avenues to create a healthier credit footprint.

This means you gain the ability to proactively create a positive payment history, paving the way for better financial opportunities.

5. Identity Theft Protection

Concerned about your financial identity being compromised?

Identity theft is a growing threat, and the consequences can be devastating for your financial well-being. You need robust protection beyond just credit repair.

Dovly includes identity theft alerts and up to $1 million in identity theft insurance as part of its premium offerings. I appreciate how this adds an essential layer of security to your financial life. This feature offers critical peace of mind in an uncertain digital world.

This means you’re protected not just from credit errors, but also from the potentially catastrophic impact of identity theft.

Pros & Cons

- ✅ Automated AI disputes significantly reduce user effort and save time.

- ✅ Users consistently report substantial credit score improvements.

- ✅ User-friendly interface simplifies complex credit repair processes.

- ⚠️ Automated process limits direct user control over disputes.

- ⚠️ Free plan has strict limitations on dispute frequency.

- ⚠️ Some users report challenges with billing and refund policies.

These Dovly features work together to create a holistic credit improvement platform, ensuring you have the tools to repair and build your financial standing.

Dovly Pricing

Worried about software costs hiding behind opaque pricing pages?

Dovly pricing is refreshingly transparent, with clear plans that make it easy to understand your credit repair investment.

| Plan | Price & Features |

|---|---|

| Dovly Free | Free • Monthly TransUnion credit report & score • Manually dispute one item/month (TransUnion) • No credit card required |

| Dovly AI Premium (Monthly) | $39.99 per month • Up to three disputes/month (all 3 bureaus) • Weekly TransUnion credit reports & scores • Enhanced credit monitoring • $1M identity theft insurance |

| Dovly AI Premium (Annual) | $99 per year ($8.33/month equivalent) • Up to three disputes/month (all 3 bureaus) • Weekly TransUnion credit reports & scores • Enhanced credit monitoring • $1M identity theft insurance |

1. Value Assessment

Great value for your money.

What I found regarding pricing is how Dovly offers a robust free tier, allowing you to begin credit repair without any upfront commitment. The premium plans then deliver significant value through automated multi-bureau disputes and enhanced monitoring, which saves you considerable time and effort compared to manual methods.

Budget-wise, this means your investment can directly translate into tangible credit score improvements over time.

- 🎯 Bonus Resource: While we’re discussing financial investments, understanding best takeoff software can be equally crucial for business growth.

2. Trial/Demo Options

Flexible options for evaluation.

Dovly’s “Free” plan acts as a perpetual trial, allowing you to experience the core functionality and even dispute an item. This no-cost entry point significantly reduces your risk, letting you understand the platform’s efficacy before considering a premium subscription. You get to see real results first without any financial commitment.

This helps you evaluate the service’s fit for your financial goals before committing to full pricing.

3. Plan Comparison

Choosing your best path.

The Dovly Free plan is perfect for individuals wanting to test the waters, focusing on a single bureau. However, for serious credit improvement, the Dovly AI Premium plans offer far more comprehensive, multi-bureau dispute capabilities and monitoring. The annual premium plan is clearly the best value, cutting your effective monthly cost significantly.

This helps you match pricing to actual usage requirements, whether for basic monitoring or aggressive repair.

My Take: Dovly’s pricing strategy offers accessible entry points and clear value progression, making it an excellent choice for individuals serious about credit repair, especially with the cost-effective annual premium option.

The overall Dovly pricing reflects transparent value for credit improvement.

Dovly Reviews

What do real customers actually think?

This section dives into Dovly reviews, analyzing real user feedback to give you a balanced perspective on what actual customers think about this credit repair software.

- 🎯 Bonus Resource: Speaking of specialized tools, if you’re looking into residential construction estimating software, my guide can help.

Users are generally very pleased.

From my review analysis, Dovly consistently receives high marks, with users often reporting significant improvements to their credit scores. What I found in user feedback is how the product delivers on its core promise of credit repair, making a tangible difference for many.

This indicates you can expect positive outcomes if you stick with the program.

Users love the automation and results.

Customers frequently highlight the ease of use and the AI-powered dispute process, which saves considerable time and effort. Review-wise, its effectiveness in boosting credit scores is a recurring theme, with many reporting increases of 60 to over 100 points.

This means you get a powerful, hands-off solution for improving your financial standing.

Some limitations and billing issues emerge.

While generally positive, some Dovly reviews mention limited control due to the automated nature, and a slight learning curve for new users. What stands out in customer feedback are isolated reports of billing discrepancies or issues with the free plan’s limited dispute options.

These issues seem to be exceptions rather than widespread deal-breakers for most users.

What Customers Say

- Positive: “Excellent app! Excellent free building your credit! Low monthly fee or a one-time yearly payment does exactly what they claim to do plus more!” (Ray C.)

- Constructive: “The free plan only allows one dispute per month with TransUnion, which may not be sufficient for individuals with multiple errors.”

- Bottom Line: “Helped my credit go up over 100 points in less than 3 months, it’s legit, it works.”

Overall, Dovly reviews reflect strong user satisfaction with practical results, though some minor issues exist.

Best Dovly Alternatives

Considering other options for credit repair?

The best Dovly alternatives offer diverse approaches to credit improvement, allowing you to choose based on your budget, desired involvement, and the complexity of your credit issues.

1. Lexington Law

Prefer a human-led, traditional approach?

Lexington Law offers a more hands-on, attorney-backed service for complex credit disputes, directly engaging with bureaus and creditors on your behalf. From my competitive analysis, Lexington Law provides direct legal expertise that Dovly’s AI-driven automation doesn’t, although it comes at a significantly higher monthly cost.

Choose Lexington Law if you value human intervention and direct legal support for your credit repair needs.

2. Credit Versio

Want to actively manage your DIY credit repair?

Credit Versio is ideal if you prefer a more hands-on, do-it-yourself approach to credit repair, with AI providing guidance rather than full automation. What I found comparing options is that Credit Versio empowers user-driven dispute processes, making it a strong alternative for those wanting direct control over their credit journey.

Consider this alternative when you want to be actively involved in the dispute process with AI assistance.

- 🎯 Bonus Resource: Speaking of improving systems, my guide on best IDE software can boost your coding speed.

3. Credit Karma/Credit Sesame

Just need free credit monitoring and educational insights?

Credit Karma and Credit Sesame primarily offer free access to credit scores and reports, along with financial education tools and personalized offers. From my analysis, these platforms excel in free monitoring and insights, but unlike Dovly, they don’t actively dispute errors or offer automated repair processes.

Choose them if your primary need is monitoring credit health and accessing educational resources without active repair.

Quick Decision Guide

- Choose Dovly: Affordable, AI-powered automation for hands-off credit repair

- Choose Lexington Law: Human-led legal expertise for complex credit issues

- Choose Credit Versio: AI-assisted DIY approach for active user involvement

- Choose Credit Karma/Credit Sesame: Free credit monitoring and financial education

The best Dovly alternatives depend on your desired level of involvement and specific financial needs.

Dovly Setup

How complex is implementing Dovly?

For a Dovly review, the implementation process is remarkably straightforward, designed for quick user onboarding. This analysis sets realistic expectations for your Dovly setup.

- 🎯 Bonus Resource: While we’re discussing financial management, understanding the best money transfer services can help maximize your savings and clarity.

1. Setup Complexity & Timeline

Starting with Dovly is genuinely simple.

The sign-up process takes less than two minutes, requiring basic personal details and security questions to finalize your account. What I found about deployment is that it avoids a hard credit pull, ensuring no negative impact on your credit score during setup.

You can expect to be set up and running almost immediately, with automated credit report reviews beginning right away.

2. Technical Requirements & Integration

Minimal technical demands for your team.

Dovly operates as an online platform and mobile app, accessible on standard iOS and Android devices, requiring no special hardware or complex integrations. From my implementation analysis, Dovly requires virtually no IT intervention, as it’s a self-contained service.

Plan for simple app downloads and web access; there are no server installations or deep system integrations necessary on your end.

3. Training & Change Management

User adoption is intuitive and well-supported.

The platform’s AI-powered automation significantly reduces manual effort, and educational resources help users understand credit concepts. What I found about deployment is that Dovly’s user-friendliness minimizes the learning curve, even for those new to credit repair.

Focus on reviewing the provided guides and leveraging the AI chatbot to maximize your understanding and platform utilization.

4. Support & Success Factors

Strong support ensures a smooth journey.

Dovly offers live U.S.-based member services and support during business hours, noted by users for excellent customer care and responsiveness. From my implementation analysis, responsive support directly contributes to user success and overall satisfaction with the platform.

Factor in leveraging their accessible support team and educational content as key components for your ongoing success with credit improvement.

Implementation Checklist

- Timeline: Less than 2 minutes for account setup

- Team Size: Individual user with no dedicated team needed

- Budget: No setup costs beyond subscription fee

- Technical: Internet access, web browser or mobile device

- Success Factor: Engaging with educational resources and support

Overall, your Dovly setup is exceptionally user-friendly and requires minimal effort for significant results.

Bottom Line

Is Dovly the right credit repair tool for you?

This Dovly review explores the platform’s ability to help you improve your credit score, offering a detailed assessment for different user needs and expectations.

1. Who This Works Best For

Individuals aiming for automated credit repair.

Dovly excels for consumers new to credit repair or those preferring a hands-off, automated approach to identify and dispute credit report errors. What I found about target users is that people with specific credit report inaccuracies will find this software particularly beneficial for improving their scores efficiently.

You’ll succeed with Dovly if you’re seeking an affordable, user-friendly platform that simplifies complex credit repair tasks without extensive personal involvement.

2. Overall Strengths

AI-powered automation delivers exceptional score improvements.

The software succeeds by leveraging AI to efficiently identify and dispute credit report inaccuracies, leading to reported average score increases for users. From my comprehensive analysis, Dovly’s automated dispute process saves significant time and effort compared to manual credit repair methods or more human-intensive services.

These strengths translate into a practical and impactful path to better credit, making it an excellent value for your financial improvement journey.

- 🎯 Bonus Resource: While we’re discussing financial improvement, understanding best plumbing software is equally important for various industries.

3. Key Limitations

Automated process offers less direct user control.

While powerful, the platform’s automated nature means you have less granular control over the dispute process, which some users might prefer. Based on this review, the free plan’s single-bureau dispute limit may not be sufficient for individuals with multiple errors across different credit reporting agencies.

I’d say these limitations are manageable trade-offs for the convenience and effectiveness you gain, rather than fundamental barriers to success.

4. Final Recommendation

Dovly earns a strong recommendation for specific users.

You should choose this software if you’re looking for an affordable, technology-driven solution to boost your credit score, especially if you have report inaccuracies. From my analysis, your success depends on embracing its automated approach rather than seeking a highly personalized, hands-on credit repair service.

My confidence level is high for individuals wanting an accessible, user-friendly, and effective automated credit repair solution.

Bottom Line

- Verdict: Recommended for automated credit repair and score improvement

- Best For: Individuals new to credit repair or seeking AI-powered automation

- Business Size: Individual consumers (personal credit repair)

- Biggest Strength: AI-powered automation for efficient credit score improvement

- Main Concern: Less direct user control over dispute process

- Next Step: Explore the free plan or premium options to see feature fit

This Dovly review demonstrates significant value for those embracing automation, while also highlighting crucial considerations regarding personal control and plan limitations.