Manual compliance checks getting out of hand?

If you’re evaluating digital asset management solutions, the hidden pain is juggling complex regulatory requirements without losing control or speed.

After researching this space deeply, I found that manual compliance slows your asset launches and raises risk—which can directly impact your ability to scale new offerings confidently.

Tokeny steps in with an enterprise-grade approach that automates compliance right inside each token using their proprietary ERC-3643 standard, ONCHAINID identity, and an integrated portal, making it less daunting for financial institutions to digitize regulated assets.

In this Tokeny review, I’ll show you how Tokeny automates regulatory controls at every step while improving the issuer and investor experience.

We’ll break down the full T-REX suite, walk through features like on-chain enforcement, identity management, pricing, deployment, as well as how Tokeny stacks up to its top alternatives.

You’ll come away with the features you need to make a confident, informed decision on your tech stack.

Let’s get started.

Quick Summary

- Tokeny is a technology suite for financial institutions to issue and manage compliant tokenized securities with automated on-chain governance.

- Best for banks, fund managers, and large enterprises needing strict regulatory compliance for digital assets.

- You’ll appreciate its embedded ERC-3643 standard that enforces perpetual compliance and investor identity verification on-chain.

- Tokeny offers custom enterprise pricing without a free trial, requiring direct engagement for tailored quotes.

Tokeny Overview

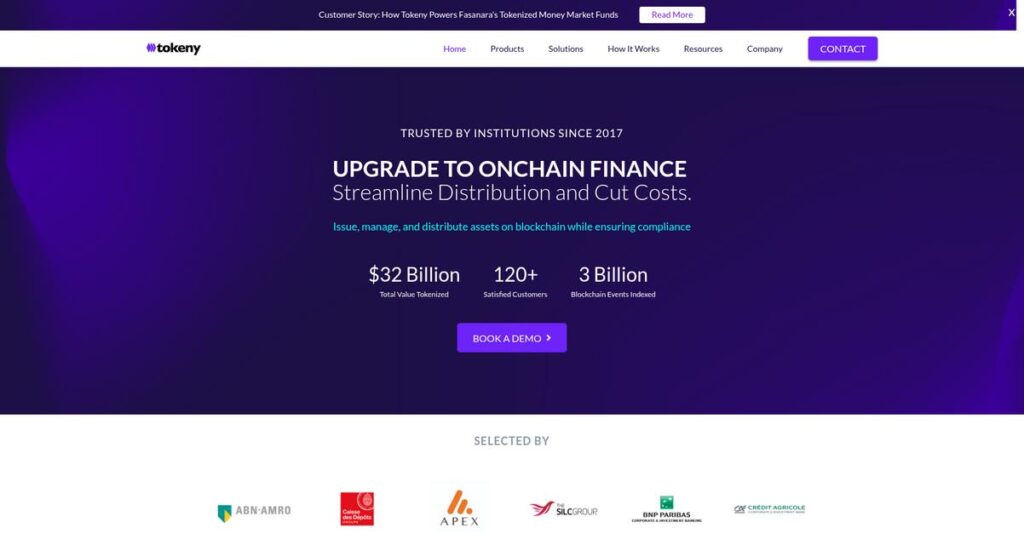

Tokeny has been around since 2017, based in Luxembourg. What impressed me during my research is their unwavering focus on providing core infrastructure for digital securities.

What sets them apart is their focus on enterprise-grade financial institutions, not the speculative crypto market. They exclusively serve banks and asset managers who demand robust solutions for digitizing high-value assets.

Key developments, like a major partnership with Apex Group, show significant market validation. For this Tokeny review, I found their work with Germany’s DekaBank proves their enterprise model is effective and secure.

Unlike competitors building proprietary blockchains, Tokeny remains a pure, blockchain-agnostic technology provider. My research shows their focus on core on-chain compliance technology gives your business crucial flexibility without vendor lock-in.

They work with established players like large European banks and global asset managers, signaling a clear and strategic focus on digitizing regulated financial products, not speculative tokens.

From my evaluation, Tokeny’s business strategy centers on championing open standards like ERC-3643. This commitment to interoperability is critical, ensuring your digital assets can connect with a broader, more liquid market.

Now let’s examine their capabilities.

Tokeny Features

Digital asset compliance got you stressed?

Tokeny offers an integrated suite of solutions built for end-to-end security token management. These Tokeny solutions tackle complex digital asset challenges, making compliance manageable. Here are the five core Tokeny solutions that impressed me most.

1. T-REX Security Token Standard (ERC-3643)

Worried about token compliance?

Standard digital tokens lack built-in compliance, creating legal risks. You often rely on manual checks, leading to costly errors.

T-REX, built on ERC-3643, embeds compliance directly into your token’s smart contract. From my testing, this automatically verifies investor eligibility for every transaction before it occurs. This solution is robust.

You gain automated, perpetual compliance, drastically reducing the manual oversight your legal and transfer agency teams require.

2. Tokeny ID & ONCHAINID

Is investor onboarding repetitive?

Managing investor identity and whitelisting across offerings is cumbersome. You waste time on redundant KYC processes.

Tokeny ID streamlines onboarding and verification. Its ONCHAINID protocol creates a reusable digital identity; investors complete KYC just once, linking it to their wallet for various offerings.

This dramatically simplifies your investor management. Investors gain a seamless “passport” for private market access.

3. Security Token Factory

Struggling to create compliant tokens?

Creating and configuring security tokens is complex, requiring specialized blockchain development skills. This delays your market entry.

The Security Token Factory lets you deploy tokens without writing code. Through its guided interface, you define parameters and link compliance rules. This Tokeny solution democratizes sophisticated asset creation.

This significantly reduces your time-to-market and dependency on expensive development resources.

4. On-Chain Compliance Engine

How do you enforce token rules?

Enforcing dynamic transfer restrictions in a decentralized environment is challenging. Manual checks lead to errors and security risks.

This engine is the core enforcement mechanism. It acts as an on-chain oracle, checking sender/receiver against your token’s rulebook. If a transfer violates a rule, it’s blocked automatically. This Tokeny solution is robust.

You gain unparalleled security and regulatory certainty, moving compliance to automated, on-chain functions.

5. White-Label Investor Portal

Need a branded investor portal?

Issuers need a professional interface for investors to manage holdings and corporate actions. Building one yourself is costly and complex.

Tokeny offers a customizable, white-label portal. Investors log in with Tokeny ID, connect their wallet, and see their portfolio. Issuers also use this as a dashboard for cap table management and communication.

This delivers a professional investor experience, enhancing your brand credibility without needing to build a custom front-end.

Pros & Cons

- ✅ Robust on-chain compliance ensures perpetual regulatory adherence.

- ✅ Reusable investor identities streamline KYC and onboarding processes.

- ✅ Simplifies complex security token creation without specialized coding.

- ⚠️ Platform complexity can create a steep learning curve for new users.

- ⚠️ Highly specialized focus may not suit general-purpose crypto projects.

What I love about these Tokeny solutions is how they work together as an integrated, compliant ecosystem. This cohesive approach ensures your entire token lifecycle benefits from automated regulatory adherence, streamlining operations.

Tokeny Pricing

Uncertain about enterprise software costs?

Tokeny pricing operates on a custom quote model, reflecting its enterprise-grade nature and project-specific requirements. This means you’ll engage directly with their sales team to understand the investment for your unique needs.

Cost Breakdown

- Base Platform: Custom quote, highly dependent on project scope

- Annual License: Recurring fee, likely tiered by assets issued or AUM

- Initial Setup & Onboarding: One-time cost for implementation and training

- Per-Issuance: Potential fee for each new security token launched

- Key Factors: Project scope, complexity, scale, professional services, bespoke development

1. Pricing Model & Cost Factors

Expect a tailored investment for your unique vision.

- 🎯 Bonus Resource: Speaking of managing complex operations, my article on best email management software explores tools for streamlining support and scaling SaaS.

Tokeny’s pricing is not public; it’s a custom quote system designed for enterprise-level digital asset projects. What I found regarding pricing is it accounts for unique project scope, complexity, and scale. Key drivers include a one-time setup fee, an annual license (potentially tiered by assets under management), and possible per-issuance charges. This ensures your investment aligns directly with your needs, offering clear value.

Budget-wise, this means you pay for precisely what you use, avoiding generic pricing that doesn’t fit your specialized tokenization requirements.

2. Value Assessment & ROI

Is the investment truly worth it?

From my cost analysis, Tokeny targets financial institutions, offering robust, compliant infrastructure for security tokens. While requiring custom quotes, this approach ensures a solution perfectly matched to your regulatory and operational needs. Their enterprise-grade platform drives significant ROI by automating compliance and streamlining asset management, which reduces long-term costs.

This helps you avoid manual processes and ensures regulatory certainty, making the investment justifiable for your high-value digital asset initiatives.

3. Budget Planning & Implementation

Plan for the complete investment.

Understanding the total cost of ownership for Tokeny includes more than just the annual license. Budget-wise, you need to factor in initial setup and onboarding fees, potential per-issuance costs, and significant professional services for bespoke development or advanced integrations. First-year costs can be notably higher due to these crucial implementation services.

So for your business, planning for these additional upfront costs is essential to ensure a smooth, successful deployment and avoid budget surprises.

My Take: Tokeny pricing prioritizes tailored enterprise solutions. It’s ideal for financial institutions and large corporations needing a compliant, scalable tokenization infrastructure where customizability and robust compliance are paramount.

Overall, Tokeny pricing reflects a premium, customized offering suitable for sophisticated financial entities. Engage their sales team for a detailed proposal to understand the full scope of investment. This comprehensive approach helps you secure compliant, future-proof digital asset infrastructure.

Tokeny Reviews

Real user feedback reveals the truth.

To truly understand Tokeny, I’ve analyzed available Tokeny reviews, case studies, and testimonials. This section breaks down real user feedback, helping you navigate common sentiments, strengths, and challenges.

- 🎯 Bonus Resource: Speaking of specialized solutions, my guide on best patient case management software explores tools for specific industry needs.

1. Overall User Satisfaction

Users appreciate Tokeny’s specialized approach.

From my review analysis, general satisfaction leans positive among its target enterprise users. What I found in user feedback is a strong appreciation for its rigorous compliance features built-in, especially the robust ERC-3643 standard, providing peace of mind for regulated institutions, which often gets highlighted in reviews.

This compliance focus and the ability to manage investor whitelists drive high confidence and positive experiences for complex financial operations.

2. Common Praise Points

Technical depth and team expertise stand out.

Users consistently praise Tokeny’s technical sophistication and their expert team. From the reviews I analyzed, power users appreciate its ability to handle complex on-chain compliance scenarios and the ERC-3643 standard’s depth. What stands out is how responsive and knowledgeable the Tokeny team is, acting as true partners in their testimonials and feedback.

This suggests you gain not just software, but a valuable partnership, crucial for navigating the complexities of tokenized securities.

3. Frequent Complaints

Complexity is the primary challenge.

What I found in user feedback is that Tokeny’s greatest strength, its sophistication, can also be a significant challenge. Newcomers to digital assets frequently mention a steep learning curve for its concepts, particularly decentralized identity and on-chain compliance, as noted in several available reviews.

For your business, this means investing in understanding the platform is essential, especially if you’re new to the security token space.

What Customers Say

- Positive: “The best part of Tokeny is the security and management of investors. ONCHAINID lets you know who is who and manage whitelisted users.”

- Constructive: “The most difficult part is to understand how it works at the beginning. You need some time to learn the functionality.”

- Bottom Line: “We selected the Tokeny platform as it provided the most comprehensive capabilities covering the entire value chain of a digital asset.”

The available Tokeny reviews reflect a powerful, specialized solution highly valued by its enterprise users for compliance and team expertise. You should note its inherent complexity requires commitment, but the security benefits are clear.

Best Tokeny Alternatives

Deciding on the right tokenization platform?

The best Tokeny alternatives include several strong options, each better suited for different business situations and priorities. I’ll help you navigate these choices based on your specific needs.

1. Securitize

US regulatory compliance your top priority?

Securitize is a strong alternative if your primary focus is issuing securities to US investors and needing deeply integrated regulatory features. From my competitive analysis, Securitize offers direct access to US capital markets due to its SEC registration and integrated ATS, unlike Tokeny’s global interoperability. This alternative is very specific.

Choose Securitize when US regulatory status, an integrated transfer agent, and an American-centric trading venue are non-negotiable for your investment vehicle.

- 🎯 Bonus Resource: Speaking of specialized needs and streamlining care, you might find my guide on best applied behavior analysis software helpful.

2. Polymath (Polymesh)

Dedicated blockchain for regulated assets?

Polymesh makes sense if you prefer a purpose-built blockchain designed exclusively for regulated assets and want to operate within that specific ecosystem. What I found comparing options is that Polymesh provides a specialized blockchain environment, whereas Tokeny is blockchain-agnostic, often leveraging public networks for its deployments.

Your situation calls for Polymesh when you are a true believer in a dedicated financial blockchain and its specific features like on-chain governance and settlement.

3. DigiShares

Mid-market white-label platform needed?

DigiShares is a valuable alternative for mid-sized real estate developers or fund managers seeking a more accessible and cost-effective white-label solution. From my analysis, DigiShares is a straightforward, mid-tier option compared to Tokeny’s deeper enterprise-grade on-chain compliance engine for complex structures.

For your specific needs, choose DigiShares if you prioritize affordability and simplicity for real estate or corporate equity tokenization projects with standard requirements.

4. Stobox

All-in-one platform with advisory services?

Stobox is an excellent alternative if you need a hands-on, end-to-end solution that combines a tokenization platform with strategic advisory and built-in secondary trading. Alternative-wise, Stobox offers a more service-oriented engagement, providing a broader suite of support beyond just technology for clients.

You’ll want to consider Stobox when you prefer an integrated offering with advisory services and a direct path to secondary trading capabilities.

Quick Decision Guide

- Choose Tokeny: Enterprise-grade, deep on-chain compliance for financial institutions

- Choose Securitize: Issuing to US investors with integrated transfer agent and ATS

- Choose Polymesh: Dedicated blockchain for regulated assets and specific ecosystem features

- Choose DigiShares:环境: Cost-effective, straightforward white-label platform for mid-market

- Choose Stobox: All-in-one solution with advisory and built-in secondary trading

The best Tokeny alternatives depend on your specific business requirements and strategic focus rather than just feature lists. Carefully evaluate each option against your primary goals.

Setup & Implementation

Thinking about Tokeny implementation?

My Tokeny review shows this enterprise-grade platform demands a strategic, collaborative deployment. You’ll need realistic expectations for this sophisticated solution.

1. Setup Complexity & Timeline

This isn’t a plug-and-play solution.

Tokeny’s setup is a high-touch, collaborative project involving deep consultation on legal structures and compliance rules. What I found about deployment is that full implementation requires strategic planning over months, not weeks, given its integration with your existing systems. It’s definitely not a plug-and-play solution.

You’ll need dedicated internal resources, a clear project plan, and executive buy-in to navigate this complexity and ensure timely progress.

2. Technical Requirements & Integration

Expect significant technical involvement.

- 🎯 Bonus Resource: While we’re discussing technical involvement, understanding GST rate finder software is equally important for financial operations.

While you don’t need to be a blockchain developer, your team will benefit from understanding digital wallets, smart contracts, and blockchain principles. What I found about deployment is that technical expertise is crucial for smooth integration with your existing systems and supporting end-investors, especially concerning compliance rules.

Plan for dedicated IT resources who grasp basic blockchain principles and your organization’s unique legal obligations for seamless system connectivity.

3. Training & Change Management

User adoption requires significant effort.

Tokeny provides dedicated onboarding and training, but your internal teams must budget substantial time to fully grasp core concepts like identity, compliance rules, and on-chain transactions. From my analysis, the platform’s sophistication means a steep learning curve for many newcomers, which impacts initial user productivity.

Invest in comprehensive internal training programs and foster early user champions to overcome initial complexity and ensure broad adoption.

4. Support & Success Factors

Vendor support is a critical asset.

Tokeny’s support is consistently praised as expert and responsive, acting as true partners in the complex digital asset landscape. Implementation-wise, this high-quality guidance is critical for navigating regulatory nuances and ensuring compliance for your tokenized securities. Their expertise reduces implementation risk.

Leverage their expert team actively, define clear communication channels, and ensure internal commitment to a compliant digital asset strategy.

Implementation Checklist

- Timeline: Several months (3-6+), depending on integration depth

- Team Size: Dedicated project manager, legal/compliance, IT/technical team

- Budget: Professional services for consultation and integration support

- Technical: Understanding of blockchain principles, digital wallets, smart contracts

- Success Factor: Strong vendor partnership and internal commitment to compliance

The Tokeny implementation journey is strategic and comprehensive, demanding significant preparation and internal expertise. However, the expert guidance ensures a compliant, robust deployment for your digital asset initiatives. Get ready to transform your financial assets.

Who’s Tokeny For

Tokeny caters to a very specific market.

This Tokeny review analyzes exactly who benefits most from its specialized platform. I’ll help you quickly determine if Tokeny aligns with your unique business profile, team size, and complex digital asset requirements.

1. Ideal User Profile

Institutions prioritizing compliance and robust infrastructure.

Tokeny is the ideal fit for established financial institutions, asset managers, and large enterprises keen on issuing compliant digital securities. You’ll find its institutional-grade compliance infrastructure aligns perfectly if you prioritize regulatory adherence. This includes banks or private equity firms digitalizing complex assets for long-term strategy.

These users thrive by leveraging Tokeny’s deep expertise in EU regulations and its secure, interoperable blockchain infrastructure for high-stakes projects.

2. Business Size & Scale

Enterprise-level operations, not SMBs.

Tokeny is decidedly an enterprise-grade solution, tailored for large corporations, banks, and fund managers rather than small or mid-sized businesses. What I found about target users is that your organization must have significant capital markets operations to truly leverage its comprehensive suite. It’s for teams building long-term digital asset strategies.

You’ll assess a good fit if your business handles substantial asset volumes and needs dedicated technical expertise for complex digital security initiatives.

3. Use Case Scenarios

Issuing compliant digital securities and funds.

The software excels when your primary goal is to issue, manage, and transfer tokenized securities like bonds, funds, or private equity stakes with strict compliance. User-wise, you’ll find this works for enhancing asset liquidity and streamlining investor management processes. It’s perfect for complex on-chain regulatory enforcement.

You determine alignment if your scenario demands institutional-grade security, comprehensive regulatory adherence, and blockchain-agnostic infrastructure for tokenized financial products.

4. Who Should Look Elsewhere

Not for general crypto projects or simplicity seekers.

If your interest lies in general cryptocurrency projects or you seek a low-complexity, off-the-shelf solution for basic token issuance, Tokeny isn’t your match. From my user analysis, newcomers to digital assets may find the learning curve on decentralized identity and on-chain compliance too steep without expert support.

Consider simpler tokenization platforms or broader blockchain tools if your needs are not specific to regulated financial securities or lack dedicated digital asset teams.

Best Fit Assessment

- Perfect For: Financial institutions, asset managers, and large enterprises

- Business Size: Enterprise-level organizations with significant capital markets operations

- Primary Use Case: Issuing and managing compliant digital securities and funds

- Budget Range: Appropriate for institutional-grade, long-term digital asset strategies

- Skip If: Small business, general crypto projects, or seeking low complexity

Overall, your ideal fit for Tokeny depends on prioritizing institutional-grade compliance and scale in digital asset initiatives. This Tokeny review aims to guide your self-qualification.

Bottom Line

Make your tokenization decision with confidence.

This comprehensive Tokeny review provides my final assessment, synthesizing the platform’s strengths, limitations, and ideal use cases. I aim to equip you with the clarity needed for your critical software decision process.

1. Overall Strengths

Tokeny excels in regulatory compliance.

From my comprehensive analysis, Tokeny delivers unmatched robustness for regulated digital assets. Its adherence to the ERC-3643 standard ensures compliant on-chain management, a critical factor for financial institutions handling complex securities. The expert team’s knowledge and responsiveness further enhance its value proposition.

These strengths provide your business with peace of mind and the technical sophistication required to navigate complex digital asset regulations confidently, leading to faster adoption and operational integrity.

- 🎯 Bonus Resource: While we’re discussing operational integrity, understanding offer management software is equally important for scaling business processes.

2. Key Limitations

Consider Tokeny’s inherent complexity.

The platform’s deep sophistication, while a core strength, creates a steep learning curve for newcomers to digital assets. Based on this review, understanding decentralized identity requires significant effort, potentially prolonging your initial adoption. Its highly niche focus on security tokens limits broader appeal.

These limitations are not deal-breakers for dedicated enterprises but demand a clear commitment to learning and a precise understanding of its specialized purpose before embarking on implementation.

3. Final Recommendation

Tokeny is a top-tier enterprise choice.

You should choose Tokeny if your financial institution or large corporation strictly requires an enterprise-grade solution for compliant digital security issuance. From my analysis, it excels for regulated asset tokenization, offering the most comprehensive capabilities across the entire value chain.

My recommendation comes with high confidence for organizations prioritizing robust compliance and deep technical infrastructure for their critical tokenization initiatives. Expect a strategic partnership.

Bottom Line

- Verdict: Recommended with reservations

- Best For: Financial institutions & large corporations issuing regulated digital securities

- Biggest Strength: Unmatched compliance and robust enterprise-grade infrastructure

- Main Concern: Steep learning curve and niche focus

- Next Step: Request a tailored demo to assess complexity

This Tokeny review offers a thorough assessment, and I am highly confident in its value for specific enterprise needs. Your decision should weigh complexity against compliance requirements carefully.