Struggling to make sense of modern investing platforms?

If you’re trying to manage a portfolio, the sheer number of options and complexity can turn what should be straightforward into a stressful research project.

After digging deep into eToro, I found that confusing interfaces actually cost you real investment opportunities by slowing down your decision-making process and increasing risk.

eToro approaches this differently by combining a user-friendly platform with unique features like CopyTrader, Smart Portfolios, and an integrated virtual account—making trading accessible and less intimidating, even if you lack experience or time for research.

In this review, I’ll explain how eToro can simplify your entire investing journey and help you build confidence regardless of your background.

You’ll discover in this eToro review exactly how the platform’s features, pricing, and alternatives actually stack up, so you can confidently compare your options.

You’ll get the insights and practical breakdown you need to choose the features you need to invest smarter and avoid unnecessary hassle.

Let’s dive into the analysis.

Quick Summary

- eToro is a social investment platform offering stocks, crypto, and CFDs with a focus on copy trading and easy portfolio management.

- Best for beginner and passive investors looking to copy experienced traders and access diverse asset classes on one platform.

- You’ll appreciate its CopyTrader feature, which lets you replicate successful investors’ trades automatically in real time.

- eToro offers commission-free stock trading with a permanent free virtual portfolio demo; beware of withdrawal and currency conversion fees.

eToro Overview

I’ve researched eToro and found they’ve been a major player since 2007. Based in Tel Aviv, their mission is making complex financial investing genuinely accessible.

What stood out during my research is their specific focus on new and intermediate retail investors. They uniquely blend a full-featured brokerage with a social media feel, which I find makes the entire experience much less intimidating for you.

It’s important for this eToro review to note their recent strategic shift. After calling off a major SPAC merger, they’ve doubled down on achieving sustainable profitability and driving organic product growth.

Unlike hardcore trading platforms that can feel overwhelming, eToro’s biggest differentiator remains its famous CopyTrader social investing feature. This powerful tool lets you directly mimic the trading strategies of proven investors.

I was surprised to learn they serve over 30 million registered users globally. Their platform is primarily adopted by individuals looking to build diversified portfolios across stocks, ETFs, and cryptocurrencies.

From my evaluation, their current strategy is all about creating an integrated ecosystem. With tools like eToro Money, they want you to manage everything from funding to trading in one place.

Now let’s examine their capabilities.

eToro Features

Navigating complex financial markets is overwhelming.

eToro features are designed to make investing accessible, even if you’re a beginner. This platform simplifies market entry. Here are the five main eToro features that can empower your investment decisions.

1. CopyTrader

Wish you had more investment time?

Lack of market knowledge or time often holds you back. You miss opportunities or make costly mistakes.

CopyTrader automatically replicates trades of experienced investors, solving that. Here’s what I found: their detailed performance metrics help you choose wisely. This eToro feature empowers you to participate without deep analysis.

This means you gain market exposure and learn from others. Your portfolio grows hands-off, even with a busy schedule.

2. Smart Portfolios

Unsure how to diversify investments?

Building a diversified, long-term portfolio around specific market trends is complex. You risk missing key sectors.

- 🎯 Bonus Resource: Speaking of specialized solutions, my guide on best applied behavior analysis software covers tools for specific care and reporting needs.

Smart Portfolios are curated, thematic investment bundles managed by eToro experts. What impressed me most is how they automatically rebalance and adjust holdings. This feature offers a hands-off way to invest in emerging industries.

This means you get a professionally managed, diversified portfolio without the stress. You invest easily in big ideas.

3. Multi-Asset Investing

Tired of juggling multiple platforms?

Accessing various asset classes often requires separate accounts, complicating diversification. You waste time managing different logins.

eToro provides access to real stocks, ETFs, and cryptocurrencies all on one platform. From my testing, the commission-free stock trading makes diversifying across assets much easier. This feature simplifies portfolio management.

This means you easily build a diversified portfolio from one dashboard. Your investment journey becomes streamlined and efficient.

4. Virtual Portfolio

Fear losing money while learning?

Starting with real money in volatile markets is intimidating. You risk significant losses while learning.

eToro provides a $100,000 virtual portfolio. This lets you practice trading and test features like CopyTrader using real market data risk-free. From my evaluation, building confidence before committing capital is critical.

This means you build skills and familiarity without financial pressure. You gain confidence to invest wisely.

5. eToro Money

Frustrated by slow, costly withdrawals?

Traditional banking links cause delays and expensive currency conversion fees. Your funds get held up.

eToro Money (primarily UK/EU) is an integrated digital wallet, sometimes with a Visa debit card. From my evaluation, it speeds up deposits and withdrawals while potentially cutting conversion fees. This feature streamlines cash management.

This means your funds move quickly and efficiently, reducing your portfolio management costs. You gain better control.

Pros & Cons

- ✅ Intuitive design makes the platform exceptionally easy for beginners to navigate.

- ✅ CopyTrader enables passive investing by replicating successful, experienced traders.

- ✅ Broad access to stocks, ETFs, and cryptocurrencies on a single platform.

- ⚠️ Users frequently complain about unexpected withdrawal and currency conversion fees.

- ⚠️ Customer support often receives criticism for being slow and unhelpful via ticketing.

What I love about these eToro features is how they work together to create a cohesive investing ecosystem. They simplify complex markets, giving you accessible tools to manage your financial growth consistently.

eToro Pricing

Worried about hidden trading costs?

eToro pricing isn’t a traditional subscription, but rather a dynamic model based on various fees and spreads, which means understanding each component is key for your budget.

Cost Breakdown

- Trading Operations: Spread (Stocks/ETFs/CFDs), 1% (Crypto)

• Overnight/Weekend Fees (CFDs) - Account Fees: Flat $5 withdrawal fee, $10/month inactivity fee

- Currency Conversion: 0.5% – 1.5% on non-USD deposits/withdrawals

- Minimum Deposit: Varies by country, typically $50-$200 first-time

- Key Factors: Asset type, trade volume, leveraged positions, currency, login activity

1. Pricing Model & Cost Factors

Understanding eToro’s fee structure is crucial.

eToro pricing primarily revolves around spreads on trades (for stocks, ETFs, CFDs) and a flat 1% fee for cryptocurrencies. What I found regarding pricing is that costs are embedded into your transaction activity, meaning you pay as you trade. Factors like asset type, market volatility (affecting spreads), and holding leveraged CFD positions (incurring overnight fees) directly impact your total outlay.

This means your overall costs fluctuate with your trading frequency and strategy, offering a pay-as-you-go model rather than a fixed subscription.

2. Value Assessment & ROI

Is eToro’s value worth the fees?

eToro offers immense value through its social trading features like CopyTrader and Smart Portfolios, which can provide a significant ROI for beginners. From my cost analysis, these features help you navigate markets effectively, potentially offsetting some fees by aiding in better trade decisions. What stood out is how their unique social features add tangible value, especially for those learning the ropes and wanting a diversified approach.

This platform’s unique value proposition for social and multi-asset investing helps you justify the fees by enhancing your investment strategy.

- 🎯 Bonus Resource: While we’re discussing enhancing your investment strategy, understanding best collaboration software is equally important.

3. Budget Planning & Implementation

Mind those non-trading fees.

Beyond trading costs, you need to account for non-trading fees like the $5 withdrawal fee and potentially significant currency conversion fees (0.5% to 1.5%) if you don’t use USD. Budget-wise, what I found is that these conversion fees can really add up if your primary currency isn’t USD. The $10 monthly inactivity fee after 12 months without login also needs monitoring.

So for your budget, remember to factor in these operational costs alongside your trading activity to understand your true total cost of ownership.

My Take: eToro’s pricing structure, though complex, supports accessible social trading. It’s ideal for retail investors seeking diversified portfolios and social learning, provided you manage currency conversions effectively.

Overall, eToro’s pricing model demands attention to its various fee types, but its value for social investing is clear. Understand the fee structure, especially non-trading costs, for informed budgeting and your financial goals.

eToro Reviews

Uncovering real eToro user experiences.

To understand what actual customers think, I delved into thousands of eToro reviews across various platforms. This analysis provides balanced insights into common praise points and frequent complaints.

1. Overall User Satisfaction

Most users feel positive.

From my review analysis, eToro generally garners positive sentiment, evidenced by its “Great” 4.3 out of 5-star Trustpilot rating from over 21,000 reviews. What I found in user feedback is how satisfied many beginners are with the platform’s ease of use, despite some common issues. This broad positive trend is consistent.

This indicates eToro largely succeeds in making investing accessible, especially for new investors seeking simplicity.

- 🎯 Bonus Resource: Speaking of customer interactions, my guide on automatic call distribution software explores tools to improve support efficiency.

2. Common Praise Points

Intuition and social features shine.

Users consistently praise eToro’s intuitive, clean interface, often citing it as ideal for beginners. Review-wise, the CopyTrader feature also receives widespread acclaim, with many reporting positive investment experiences. What stands out is how users appreciate the simplicity of replicating successful trades and the broad asset variety.

This means you can expect a user-friendly experience and a unique opportunity to learn and grow your portfolio passively.

3. Frequent Complaints

Fees and support are pain points.

Frequent complaints revolve around hidden fees, particularly withdrawal and currency conversion charges, which users find opaque. During market volatility, wide spreads also frustrate traders, impacting profitability. What stands out in customer feedback is how slow and unhelpful customer support often leaves users stranded when issues arise, adding to frustration.

These issues, while significant, primarily relate to transactional costs or support speed, rather than core platform functionality, but are crucial to your experience.

What Customers Say

- Positive: “The ability to copy successful traders is a game changer for someone like me who doesn’t have time to research stocks all day. The platform is super easy to navigate.”

- Constructive: “The platform is intuitive, but the fees are a killer. The $5 withdrawal fee is annoying, but the currency conversion fee on every deposit and withdrawal really adds up.”

- Bottom Line: “eToro is great for beginners and social trading, but be prepared for some fees and potential support delays.”

Overall, eToro reviews reveal a strong, beginner-friendly platform with innovative social features. However, transparency around fees and customer service responsiveness remain consistent areas for improvement.

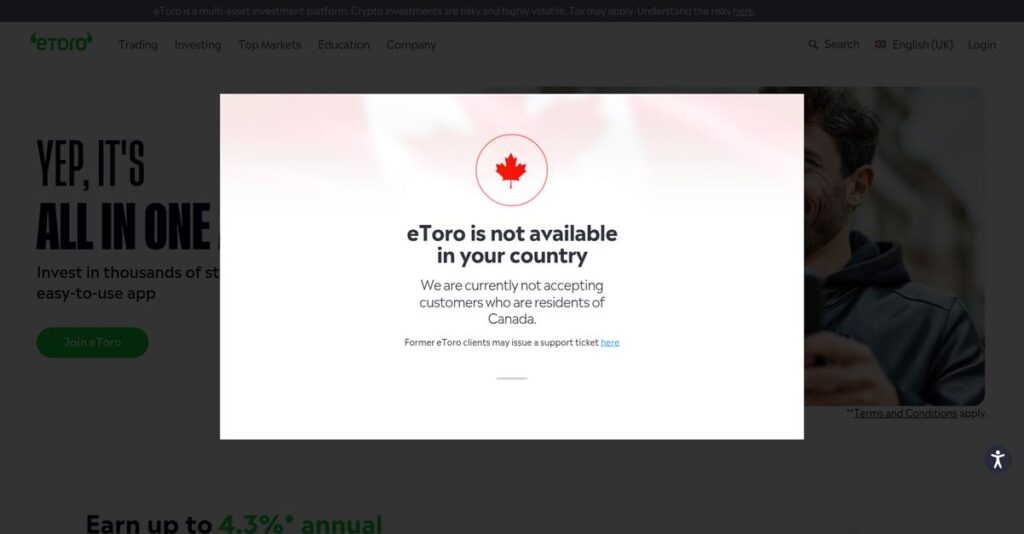

Best eToro Alternatives

Navigating investment platform choices can be tricky.

The best eToro alternatives include strong contenders, each tailored to different trading styles, regional needs, and investment priorities. I’ll help you choose wisely.

1. Robinhood

Seeking simplicity for US stock trading?

Robinhood is a top alternative if you’re in the US and prioritize a straightforward, commission-free platform for US stocks, options, and crypto. From my competitive analysis, it’s ideal for no-frills US trading, lacking eToro’s social features but simplifying your direct investing experience.

Choose Robinhood when your focus is a simple, low-cost US-centric platform without the social trading emphasis.

2. Webull

Need advanced tools for active trading?

Webull provides more sophisticated charting tools, technical indicators, and in-depth market data, making it a stronger alternative for active, technically-minded traders. What I found comparing options is that Webull offers superior analytical capabilities, unlike eToro’s more beginner-friendly, social investing interface.

Choose Webull if you’re an active trader requiring robust analysis tools and don’t prioritize social investing features.

3. Interactive Brokers (IBKR)

Seeking professional-grade global market access?

Interactive Brokers (IBKR) is a professional-grade alternative offering unparalleled global market access, ultra-low commissions for high-volume traders, and sophisticated tools. Alternative-wise, IBKR provides institutional-grade trading power, though it features a significantly steeper learning curve than eToro’s user-friendly platform.

Choose IBKR when you’re an experienced, high-volume trader needing institutional-grade tools and direct market access.

- 🎯 Bonus Resource: While we’re discussing digital tools and essential information, my analysis of best Android data recovery software can help protect your crucial data.

4. Trading 212

Based in UK/EU, valuing custom portfolios?

Trading 212 is a strong UK/EU alternative with commission-free trading and unique ‘Pies’ for building custom portfolios, similar to eToro’s Smart Portfolios. From my competitive analysis, it excels in diversified portfolio building, but its social trading features are far less developed than eToro’s.

Choose Trading 212 if you’re in the UK/EU and prioritize building custom portfolios over copying other traders.

Quick Decision Guide

- Choose eToro: For social investing, copy trading, and multi-asset diversification.

- Choose Robinhood: If you need simple, low-cost US stock and option trading.

- Choose Webull: When you are an active trader needing advanced analytical tools.

- Choose Interactive Brokers: For professional-grade global access and high-volume trading.

- Choose Trading 212: If you’re in UK/EU and prioritize custom portfolio building.

The best eToro alternatives truly depend on your specific trading style and investment goals, not just a feature list. Evaluate your priorities carefully.

Setup & Implementation

Considering eToro? Understand the setup.

My eToro review delves into what it truly takes to get started and use the platform effectively. This section provides a practical look at eToro’s deployment and adoption challenges, setting realistic expectations for your journey.

1. Setup Complexity & Timeline

Initial setup is quick, then comes verification.

The eToro signup is instant, but the crucial Know Your Customer (KYC) verification process isn’t. You’ll submit ID and proof of address, which can take hours to several days. What I found about deployment is that delays in this verification are common, impacting your timeline before you can even deposit funds. Proper eToro implementation requires patience here.

Plan for verification delays; have all documents ready. This initial hurdle is your first real test before active trading can begin.

2. Technical Requirements & Integration

Minimal technical fuss, maximum accessibility.

eToro is a web-based platform, meaning there are virtually no complex technical requirements on your end beyond a stable internet connection and a device. From my implementation analysis, it avoids demanding IT infrastructure, making it highly accessible for individual users or small businesses without dedicated tech teams. Your implementation burden here is very low.

Ensure reliable internet access. No special software or hardware needed, which simplifies your operational readiness significantly for trading.

3. Training & Change Management

Intuitive platform, easy user adoption.

The platform’s user-friendly interface makes the learning curve gentle, especially with its virtual portfolio. eToro Academy offers guides and webinars. From my analysis, user adoption is generally high due to platform design, requiring minimal formal training for basic trading functions. Your team will adapt quickly.

Encourage new users to leverage the virtual portfolio and eToro Academy. Focus on understanding trading concepts, not just platform navigation.

4. Support & Success Factors

Support can be a critical bottleneck.

eToro’s customer support primarily uses a ticketing system, with live chat reserved for club members. What I found about deployment is that slow response times are a frequent user complaint, so don’t expect immediate hands-on help during your initial setup or ongoing issues. This directly impacts implementation success if you encounter hurdles.

Plan to resolve most common issues independently using their academy. For critical problems, submit detailed tickets and factor in potential delays.

Implementation Checklist

- Timeline: Few hours to several days for KYC verification

- Team Size: Individual investor or self-managed small business

- Budget: Beyond trading capital, factor in withdrawal/conversion fees

- Technical: Stable internet connection and compatible device

- Success Factor: Patience during verification and independent problem-solving

Overall, eToro implementation is largely self-service, demanding patience during verification and proactive learning. Your success hinges on understanding its operational realities beyond initial signup convenience.

Who’s eToro For

Is eToro right for your investing journey?

This eToro review provides a clear analysis of who the platform serves best, helping you determine if its features align with your specific investment goals and portfolio management style.

1. Ideal User Profile

Perfect for new, hands-off investors.

eToro excels for individuals new to trading or those preferring a passive approach, benefiting from its simple interface and educational resources. From my user analysis, investors seeking simple, guided entry into markets will find eToro’s intuitive design and social features exceptionally helpful. It’s ideal for those new to trading.

You’ll succeed if you value learning from others, prefer automated strategies, and prioritize a user-friendly investment interface.

2. Business Size & Scale

Retail investors, not institutions.

Your scale on eToro is less about traditional business size and more about your personal investment activity. What I found about target users is that it thrives for individual retail investors managing their personal portfolios, particularly those focusing on diverse assets without requiring institutional-grade tools or high-frequency trading.

Assess your fit by considering if your investment activity is personal and benefits from social learning, not professional infrastructure.

3. Use Case Scenarios

Social investing and diversification.

eToro excels for specific workflows like replicating successful traders via CopyTrader or diversifying through Smart Portfolios. You’ll find this works well when your primary goal is passive wealth growth and access to a broad range of assets, including stocks, ETFs, and cryptocurrencies, from a single account without deep technical analysis.

If you prioritize learning from a community and building a diverse, accessible portfolio, your use case aligns perfectly.

- 🎯 Bonus Resource: Speaking of managing your presence and interactions online, my guide on best brand monitoring tools offers insights for protecting your online reputation.

4. Who Should Look Elsewhere

Not for day traders or pros.

If you’re an active day trader, high-frequency trader, or a professional requiring advanced charting tools and ultra-low latency execution, eToro isn’t your ideal choice. User-wise, its cost structure and spread volatility can hinder profitability for such intensive strategies, making it less suitable for these specific needs.

Consider specialized platforms like Interactive Brokers if your strategies demand precise execution, minimal spreads, and comprehensive analytical capabilities.

Best Fit Assessment

- Perfect For: Beginner or passive retail investors seeking asset diversity

- Business Size: Individual retail investors managing personal portfolios

- Primary Use Case: Copy trading, diversified asset access, social learning

- Budget Range: Entry-level to moderate personal investment amounts

- Skip If: Active day trading, high-frequency, or professional trading needs

The answer to who should use eToro centers on your investment style and comfort with social features rather than professional trading demands. This eToro review should help you decide.

Bottom Line

eToro offers accessible investing for many.

From my comprehensive eToro review, I’ll guide you through a balanced assessment. My final recommendation clarifies who benefits most from its unique features and where it falls short for specific user needs.

1. Overall Strengths

eToro excels in user accessibility.

eToro’s intuitive interface and diverse asset offerings make investing simple for beginners. Its standout CopyTrader feature allows you to replicate expert portfolios, providing a unique passive investment avenue. From my comprehensive analysis, the social trading aspect fosters community learning and lowers the barrier to market entry.

These capabilities empower new investors to engage with financial markets confidently, significantly reducing the steep learning curve associated with traditional trading platforms.

2. Key Limitations

Hidden costs and support issues persist.

While user-friendly, eToro presents notable challenges, particularly its often-hidden withdrawal and currency conversion fees. Users also frequently report wide spreads during volatile periods, impacting profitability. Based on this review, customer support responsiveness needs significant improvement for timely issue resolution.

These limitations are critical considerations; they can significantly impact your overall trading costs and user experience, warranting careful evaluation before committing.

- 🎯 Bonus Resource: While we’re discussing support for specific needs, my guide on best veterinary software explores tools for healthcare businesses.

3. Final Recommendation

eToro is ideal for specific investors.

You should choose eToro if you are a beginner or intermediate retail investor prioritizing ease of use and social investing features. My analysis shows it excels for those exploring diverse assets and leveraging community insights to guide their strategy rather than complex professional tools.

Your decision should align with these priorities, as eToro delivers strong value for its target audience despite its cost structure and support considerations.

Bottom Line

- Verdict: Recommended with reservations

- Best For: Beginner to intermediate retail investors seeking social trading

- Biggest Strength: User-friendly interface and unique CopyTrader functionality

- Main Concern: Potentially high hidden fees and slow customer support

- Next Step: Explore the platform with a demo account to understand costs

This eToro review provides a clear picture, highlighting its strengths for new investors while acknowledging its limitations. My assessment offers high confidence for its intended audience seeking accessible, social investment opportunities.