Worried about a surprise audit?

Manual invoicing is full of hidden risks, from data entry mistakes to compliance gaps that can lead to costly fines and payment delays.

As your business grows, keeping track of every invoice becomes nearly impossible, putting your cash flow and reputation on the line.

This isn’t a new problem. ResearchAndMarkets.com highlights how manual processes have long lacked standardization, leading to errors. This forces regulators to mandate more secure digital methods.

The right software helps you achieve audit-proof compliance while automating the entire invoicing workflow, saving your team countless hours.

To further enhance your audit readiness, my article on best compliance management software is a valuable resource.

In this guide, I’ll review the best e invoicing software for growing businesses. I’ll show you tools that simplify compliance and integrate with your existing systems.

You’ll learn how to streamline payments, reduce manual entry, and gain a clear view of your company’s financial health.

Let’s get started.

Quick Summary:

| # | Software | Rating | Best For |

|---|---|---|---|

| 1 | FreshBooks → | Growing SMEs | |

| 2 | Zoho → | Businesses scaling operations | |

| 3 | Xero → | Growing SMEs | |

| 4 | QuickBooks → | Growing SMEs | |

| 5 | Bill.com → | SMEs needing AP automation |

1. FreshBooks

Tired of manual invoice processing headaches?

FreshBooks offers an all-in-one billing and accounting solution designed to streamline your finances. This means you can automate tasks, track expenses, and manage your books from anywhere.

For finance directors, this addresses the pain point of scattered financial data, providing real-time insights and effortless collaboration.

Let’s solve your invoicing problems today.

FreshBooks helps you create professional invoices in minutes, automatically adding tracked time and expenses. This significantly reduces manual entry and ensures accuracy, critical for compliance and audit-proofing. You can even automate recurring invoices, online payments, and late payment reminders, freeing up your team’s time.

Additionally, FreshBooks empowers you to keep track of expenses with mobile receipt scanning and automated categorization, integrating seamlessly with your bank accounts. This ensures you know your exact financial standing in real-time, helping you make informed decisions. Plus, your accountant gains easy access for collaborative bookkeeping.

The result? Save up to 553 hours annually and avoid costly audit issues.

While we’re discussing time efficiency, my guide on best time off tracking software offers insights into managing employee leave.

Key features:

- Automated Invoicing: Create professional invoices quickly, automatically including time and expenses, calculating taxes, and offering customizable payment options.

- Integrated Billing & Payments: Accelerate cash flow with recurring invoices, online payment acceptance, and automated late payment reminders for efficient revenue collection.

- Comprehensive Expense Tracking: Effortlessly manage costs using mobile receipt scanning, bank imports, and automated categorization to maintain accurate financial records.

FreshBooks features, pricing, & alternatives →

Verdict: FreshBooks stands out as a best e invoicing software solution for growing SMEs, offering powerful automation and robust accounting features. With capabilities like automatic tax calculation, integrated payment processing, and detailed financial reports, it streamlines operations and helps save your business up to $7000 in billable hours annually.

2. Zoho

Struggling with complex invoicing and compliance challenges?

Zoho offers a powerful software suite designed to transform your work. This means you can easily manage business operations.

This unified cloud software helps break down departmental silos, significantly increasing your organizational efficiency.

It’s time to streamline your finances.

Zoho’s comprehensive platform helps you manage invoicing requirements, sales, and marketing. This allows you to unify all your data into one platform, making business growth easier to track.

You can automate processes to improve efficiency tenfold, reducing reliance on manual data entry. Additionally, Zoho’s robust operating system functions as a collective memory for your entire business. Plus, it’s highly customizable for your specific needs, saving time and money.

It simplifies accounting, ensuring audit-proofing.

Before diving deeper, you might find my analysis of a best Tally Partner helpful for business growth.

Key features:

- Comprehensive business management for sales, marketing, and invoicing, helping you unify data and track growth efficiently.

- Automated processes to improve efficiency tenfold and eliminate manual data entry, allowing your business to scale without hindrance.

- Customizable and robust operating system that serves as a collective business memory, providing autonomous control and significant cost savings.

Zoho features, pricing, & alternatives →

Verdict: Zoho is an excellent choice for businesses seeking the best E Invoicing Software. Its integrated platform automates processes, enhances efficiency, and ensures compliance, as evidenced by users reporting up to 80% productivity increases. This robust system helps you overcome data fragmentation and costly manual errors, providing an all-in-one solution for your financial needs.

3. Xero

Struggling with complex invoice processing and compliance?

You’re seeking software that centralizes finances and automates tasks, reducing manual entry and ensuring accurate records. This means you can streamline your operations.

Xero offers paperless record-keeping and automated features to save you time, from reconciling bank transactions to sending invoice reminders. This frees your team for strategic work.

Make confident business decisions.

Xero centralizes your finances within safe, secure cloud accounting software. This solution captures data automatically, pulling bills and receipts into Xero, which minimizes manual entry and potential errors.

You can gain smart data and insights, with trend analysis and simple, customizable reporting that supports confident business decisions. This offers a clear view of your financial health. Additionally, Xero provides access to onboarding specialists during your first 90 days, ensuring you get set up faster and maximize the software’s benefits.

Manage finances, control cash flow.

Key features:

- All-in-one, paperless record-keeping: Centralizes your finances in a secure cloud environment, eliminating the need for physical documents and simplifying audit trails.

- Automated features to save time: From bank reconciliation to invoice reminders, Xero automates routine tasks, significantly reducing manual effort and processing time.

- Smart data and insights: Provides trend analysis and customizable reporting, empowering you to make confident business decisions based on clear financial data.

Xero features, pricing, & alternatives →

Verdict: Xero is a strong contender for the best E Invoicing Software, especially for growing SMEs, by offering automated features and smart insights to reduce manual entry and ensure audit-proofing. Its ability to centralize finances and provide 24/7 online support makes it ideal for streamlining your invoice processing.

4. QuickBooks

Struggling to automate your invoicing processes?

QuickBooks offers powerful invoicing and payment features, designed to help your growing SME get paid fast, with less back-and-forth. This means your finance team can streamline invoice processing time and enhance payment tracking.

You can securely import transactions and categorize expenses automatically, which directly addresses your need for integrating new tools while maintaining compliance. The result is a system that automates bookkeeping to cut down on tedious tasks.

Here’s how to manage your finances.

QuickBooks simplifies your financial operations, acting as one integrated platform to manage money in and out, accept payments, and run your business. Plus, AI-powered invoicing and automated reminders help you get paid 45% faster, or an average of 5 days faster, according to QuickBooks.

Additionally, you can customize estimates, accept mobile signatures, and convert estimates into invoices. This reduces manual entry and minimizes the learning curve for your team, making workflows more efficient. The system also supports bill management, allowing you to organize and track business bills online, ensuring financial clarity and audit-proofing.

This ensures you’re always on top of your financials.

Key features:

- AI-powered invoicing and payments: Automates invoice creation and sends reminders, helping your business get paid up to 5 days faster on average.

- Automated bookkeeping and expense tracking: Securely imports transactions, categorizes receipts on the go, and automates tedious tasks for increased efficiency.

- Integrated financial management platform: Tracks income and expenses, manages cash flow, and offers comprehensive reports for informed decision-making.

QuickBooks features, pricing, & alternatives →

Verdict: QuickBooks stands out as a best e invoicing software solution for SMEs, offering robust features like AI-powered invoicing and automated reminders, which can help you get paid 45% faster. Its comprehensive financial management capabilities streamline processes and ensure audit-proofing for your growing business.

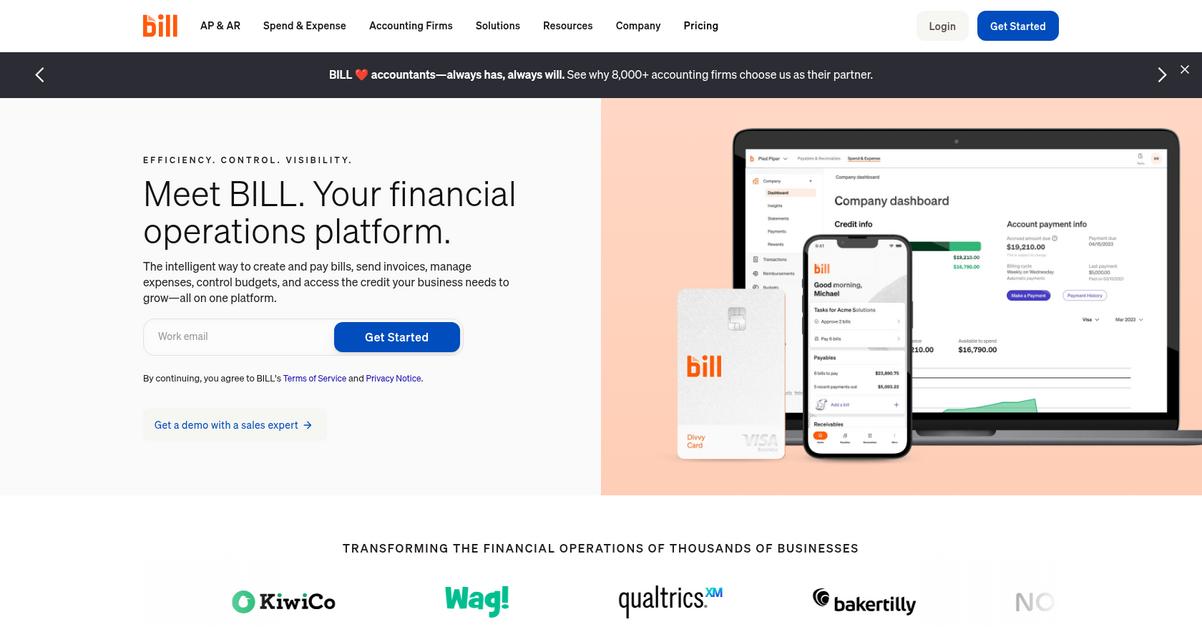

5. Bill.com

Struggling with complex financial operations?

Bill.com offers an integrated platform to simplify how you pay and get paid, including robust invoicing. This means you can easily streamline your accounts payable and receivable processes.

You’ll gain greater efficiency, control, and visibility over your finances, helping to automate invoices and ensure audit-proofing without hassle. This platform is designed to transform your financial operations.

Here’s how you can streamline your process.

Bill.com automates your entire AP process, from bill creation to approvals and payments, while also handling your accounts receivable efficiently. You can confidently manage your AP, AR, spend and expense all from one platform.

The system features simple integration into your existing tech stack, with one login and automatic sync with leading accounting software like QuickBooks and Oracle NetSuite. This minimizes learning curves for your finance team and reduces manual data entry.

Additionally, you get features like ACH payments, international payments, and robust payment approvals, ensuring secure and controlled transactions. Plus, mobile app access means you can manage expenses, budgets, and track spend on the go, providing the flexibility growing SMEs need.

Ultimately, you achieve greater financial confidence and control.

Key features:

- Integrated AP & AR: Streamlines your entire accounts payable process from bill creation to approvals and payments, alongside efficient accounts receivable management.

- Accounting Software Integration: Provides automatic, seamless synchronization with leading accounting software, including QuickBooks, Sage Intacct, and Oracle NetSuite.

- Payment Controls & Approvals: Offers robust security measures, flexible approval workflows, and multiple payment options like ACH and international payments for enhanced financial control.

Bill.com features, pricing, & alternatives →

Verdict: Bill.com stands out as a best E Invoicing Software for SMEs, offering comprehensive AP and AR automation, tight integration with major accounting systems, and robust payment controls. You can save 12 hours monthly on average, according to surveyed users, drastically reducing manual processing and audit risks.

6. Tipalti

Struggling with invoice processing and compliance chaos?

Tipalti’s end-to-end Accounts Payable (AP) automation simplifies your entire payables process. This means eliminating manual work and time-consuming reconciliation.

This comprehensive solution takes AP from manual to meaningful, offering improved visibility and control over your finances, ensuring you stay up-to-date and protected automatically.

This transitions your finance operations to a more efficient, growth-focused model.

Tipalti allows you to streamline invoice management using AI, automating the entire process from creation to approval. This dramatically reduces errors and processing time, freeing your team for strategic work.

You can scale globally with cross-border payments to over 200 countries in 120 currencies using 50+ payment methods. Additionally, their automated tax compliance instantly captures accurate supplier tax information and proactive fraud prevention identifies unusual patterns. Plus, pre-built integrations with major ERPs like NetSuite and QuickBooks ensure a seamless connection with your existing systems, minimizing learning curves and enabling a holistic, end-to-end payables experience.

The result is enhanced transparency, efficiency, and significant cost savings across your entire spend.

Key features:

- Automated Invoice Management: Uses AI to streamline invoice processing, from creation to approval, significantly reducing manual effort and potential errors.

- Global Payments Capabilities: Supports cross-border payments to 200+ countries in 120 currencies with 50+ methods, making international transactions quick and easy.

- Automated Tax & Compliance: Instantly captures accurate supplier tax information and offers built-in payment protections and enterprise-grade controls for audit-proofing.

Tipalti features, pricing, & alternatives →

Verdict: If you are a finance director at a growing SME needing to automate invoices, simplify global payments, and ensure robust audit-proofing, Tipalti stands out as the best e invoicing software. It provides the controls and compliance needed to scale, as seen with customers like GoDaddy who reported significant ROI by not having AP involved in outbound partner payments.

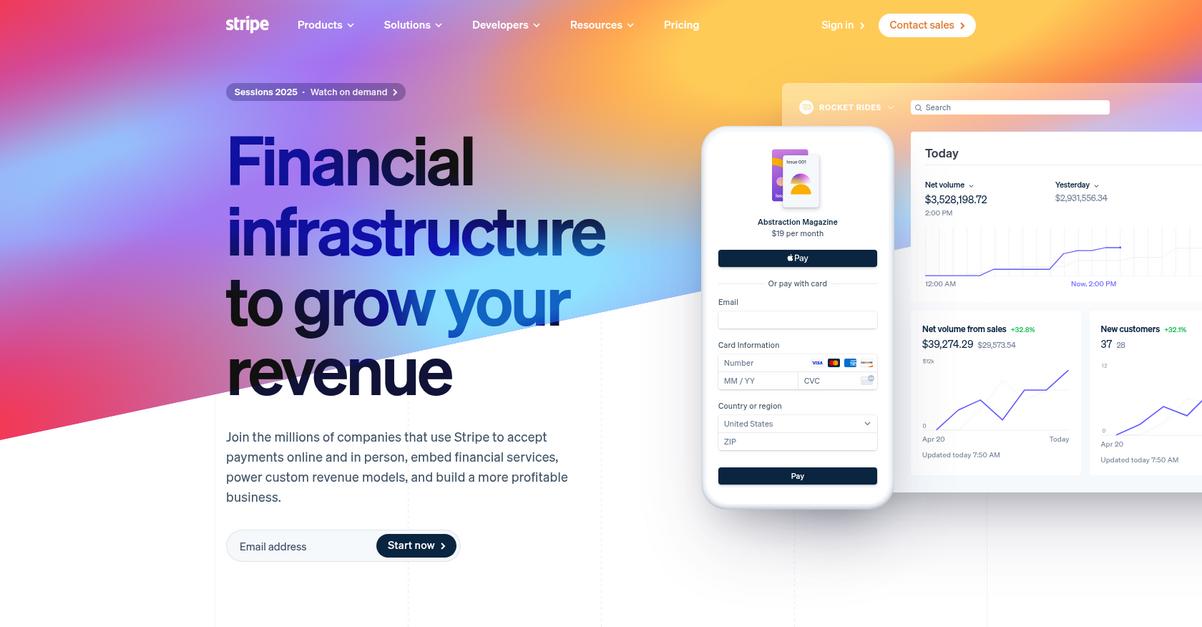

7. Stripe

Tired of manual invoice processing headaches?

Stripe offers specialized features for online invoices, encompassing creation, collection, and tracking to streamline your financial operations. This means you can cut down on time spent chasing payments.

Their Invoicing solution, part of their broader Revenue and Finance Automation suite, simplifies creating and managing online invoices.

So, how does Stripe tackle these problems for your business?

Stripe enables you to streamline your invoice processing time and enhance payment tracking, directly addressing common finance department pain points. You can also leverage their Billing feature to manage various pricing models, including subscriptions and usage-based billing.

This automates crucial financial operations, minimizing churn and ensuring you capture recurring revenue effortlessly. Additionally, their Revenue Recognition and Tax solutions automate accounting and handle sales tax/VAT, making sure your books are always audit-ready. The result is a unified platform that simplifies complex financial tasks and provides custom reports.

This leads to greater efficiency and compliance for your team.

Key features:

- Online Invoicing: Create, collect, and track online invoices to reduce manual entry and improve payment tracking for your finance team.

- Revenue & Finance Automation: Automate revenue recognition, sales tax, and VAT for audit-proofing and accurate financial reporting, minimizing compliance risks.

- Custom Reporting (Sigma): Generate custom financial reports without SQL knowledge, providing clear insights into revenue and operational performance.

Stripe features, pricing, & alternatives →

Verdict: Stripe is a strong contender for the best e invoicing software, especially for growing SMEs. Its integrated suite of financial automation tools, including comprehensive invoicing and revenue recognition, directly addresses the need for streamlined processes and audit-proofing, ensuring robust compliance and efficiency for your finance team.

8. Wave

Need to simplify your invoicing and accounting?

Wave helps small business owners create professional invoices and accept online payments easily. This means you can reduce manual entry and get paid faster.

You can effortlessly track income and expenses, manage cash flow, and access reporting that helps you make smart business decisions for your growing SME.

Simplify your money management.

Wave lets you create beautiful invoices and estimates in just a few clicks, making your business look polished. This helps you streamline your invoice processing time significantly.

Additionally, Wave offers secure online payments, allowing your customers to pay by credit card, bank transfer, or Apple Pay, enhancing your payment tracking capabilities. Plus, with bookkeeping and tax time solutions designed to be small biz friendly, you can manage everything from tracking expenses to accessing important reports, even on-the-go with their mobile app.

The result: peace of mind.

Key features:

- Easy Invoicing: Create professional invoices and estimates quickly, reducing manual entry and ensuring accurate billing for your growing business.

- Secure Online Payments: Accept various payment methods like credit card, bank transfer, and Apple Pay to get paid faster and improve cash flow.

- Integrated Accounting: Track income and expenses, manage cash flow, and access reports, simplifying bookkeeping and tax preparation.

Wave features, pricing, & alternatives →

Verdict: Wave excels as a top contender for the best e invoicing software, particularly for finance directors at growing SMEs. Its combination of easy invoicing, secure online payments, and integrated accounting simplifies complex financial tasks, ensuring audit-proofing and reducing administrative burden, as over 350,000 small businesses already trust them.

Conclusion

Still worried about surprise audits?

Choosing the right tool is tough when every vendor sounds the same. Many solutions overpromise on integration and compliance, leaving your growing enterprise exposed to risk.

According to BillingBee, e-invoicing adoption enables faster payment processing and reduces administrative burdens. This level of automation frees your finance team from tedious tasks, letting them focus on what truly matters for your startup’s growth.

Here’s what I recommend.

From my in-depth review, FreshBooks is the top choice. It directly solves the challenge of automating invoices while ensuring your business stays audit-proof and compliant.

If you’re also evaluating other critical business software, my guide on best self-hosted help desk software can help secure your support operations.

Their platform helps you save up to 553 hours annually by automating tasks. Choosing the best e invoicing software like this one simplifies compliance and lets you focus on growth.

I highly recommend you check out FreshBooks pricing and see how it fits your budget. It’s an investment that pays for itself in efficiency.

You’ll gain complete financial clarity.