Struggling to forecast your financials accurately?

You’re likely drowning in spreadsheets and manual data entry, which makes getting a clear, real-time view of your finances nearly impossible.

This leads to approval bottlenecks and cripples your ability to make confident decisions. It feels like you’re always one step behind your own numbers.

Without centralized data, you risk serious compliance issues and missed growth opportunities. This information overload often leads directly to decision paralysis for many business owners.

Speaking of streamlining operations, my guide on best dry cleaning software covers tools for that industry.

The right software solves this by centralizing your financial data, giving you a single source of truth for clear, actionable insights.

In this guide, I’ll help you cut through the noise. We’ll explore the best finance management software to replace your manual workflows and gain clarity.

You will discover tools that automate reporting, streamline budgeting, and integrate with your existing systems for a smooth transition and immediate control.

Let’s dive in.

Quick Summary:

| # | Software | Rating | Best For |

|---|---|---|---|

| 1 | Tipalti → | Growth-stage companies | |

| 2 | Xero → | Small & mid-sized businesses | |

| 3 | Intuit → | Growth-stage companies | |

| 4 | PocketSmith → | Growth-stage businesses | |

| 5 | Zoho → | Scaling small businesses |

1. Tipalti

Struggling with fragmented financial data and manual processes?

Tipalti offers a connected suite for accounts payable, mass payments, procurement, and expense management. This means you can centralize your financial data, automate tasks, and gain clear visibility.

You can streamline your entire accounts payable process, making it more efficient and controlled. This removes friction from time-consuming AP processes.

It’s time to take control of your financial operations.

Tipalti solves your pain points by automating tedious finance tasks. You can eliminate manual work and time-consuming reconciliation, gaining precise control over your corporate spend. Additionally, it simplifies global payouts to 200+ countries in 120 currencies via 50+ payment methods. For example, Matterport sped up their monthly close by 40%. Plus, AI-driven capabilities and intuitive design drive unprecedented efficiency by providing instant insights and proactive fraud prevention. The result is improved financial control and clearer forecasts. Speaking of financial control, understanding built-in tax compliance is equally important for seamless global operations.

This platform unifies spend management, onboarding, invoice management, payments, and reconciliation.

Key features:

- Accounts Payable Automation: Streamlines your entire AP process, including automated invoice management with AI, PO matching, and payment reconciliation for improved visibility.

- Global Mass Payments: Simplifies international payouts to over 200 countries in 120 currencies with built-in tax compliance and robust fraud prevention.

- Integrated Spend Control: Offers comprehensive procurement and expense management, ensuring real-time spend analytics and automated approval workflows for enhanced transparency.

Tipalti features, pricing, & alternatives →

Verdict: Tipalti stands out as the best finance management software for growth-stage companies needing to replace manual processes and gain real-time insights. Its comprehensive suite, proven by case studies like ServiceRocket cutting AP time by 80%, centralizes financial data, automates tasks, and simplifies global operations, ensuring greater control and efficiency for your finance team.

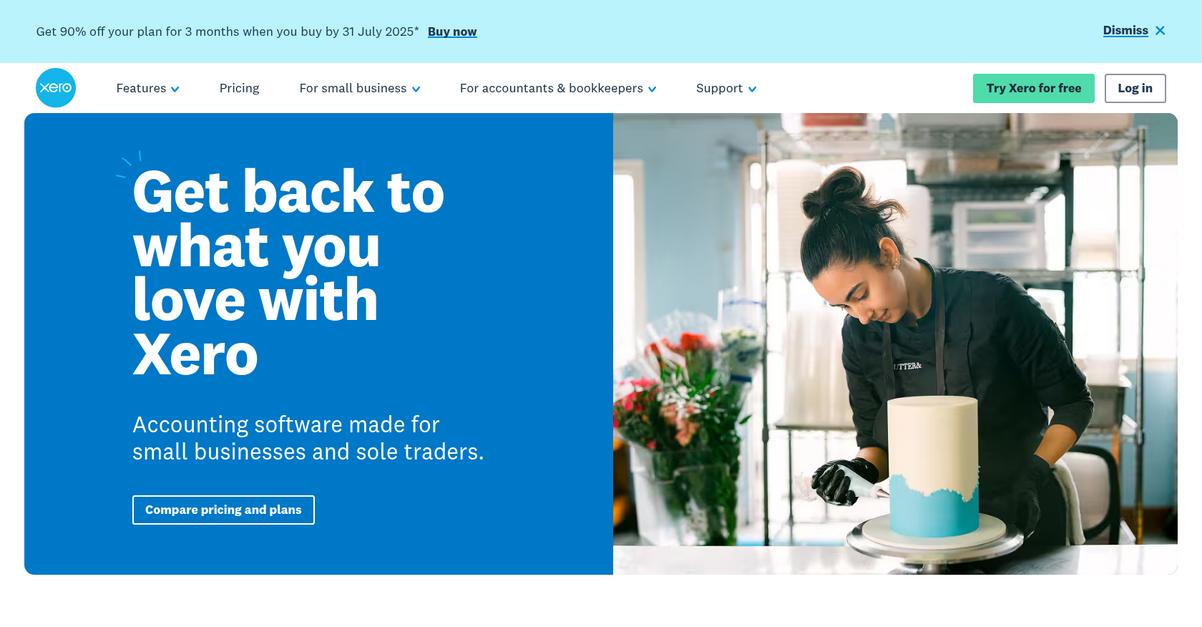

2. Xero

Feeling overwhelmed by financial spreadsheets and manual tasks?

You might be struggling with outdated processes and needing real-time insights for your growth-stage company. Xero offers centralized, cloud-based accounting to handle all your finances.

This means you can say goodbye to information overload and approval bottlenecks, as Xero provides smart data and customizable reporting for confident decisions.

It’s time to simplify your operations.

Xero allows you to centralize your finances with safe and secure cloud accounting software. This removes the burden of managing disparate financial data and helps eliminate comparison fatigue often associated with similar-sounding features from other tools.

You’ll save time with automated features, from bank reconciliation to invoice reminders. The platform helps streamline reporting and simplifies budgeting, ensuring you gain clearer forecasts and improved financial control. Plus, with automatic data capture from bills and receipts via Hubdoc, you reduce manual admin and integrate seamlessly with existing systems. Your finances are always up-to-date, ready for confident business decisions.

If you’re also looking into optimizing business communication, my article on best WhatsApp Business API providers covers key solutions.

Key features:

- All-in-one, paperless record keeping: Centralize your financial data securely in the cloud, removing reliance on cumbersome manual processes and disparate spreadsheets.

- Automated features to save time: From reconciling bank transactions to sending invoice reminders, Xero handles repetitive tasks, freeing your team for strategic work.

- Smart data and insights: Gain customizable reporting and trend analysis, enabling confident business decisions and clearer financial forecasting for your company.

Xero features, pricing, & alternatives →

Verdict: Xero is a strong contender for the best finance management software, offering cloud-based centralization and automation. It addresses common pain points like manual processes and fragmented data, helping you gain real-time insights and streamline reporting. With features like automated bank reconciliation and robust data capture, it promises improved financial control and clear forecasts.

3. Intuit

Tired of spreadsheet chaos and manual finance tasks?

Intuit, through its QuickBooks suite, offers accounting software that streamlines your operations.

This means you can say goodbye to information overload and comparison fatigue, allowing you to centralize all your financial data effortlessly.

Ready to gain real-time insights?

Intuit’s QuickBooks includes robust accounting software, payroll, and online payments. This means you can easily track expenses and automate invoicing, freeing up valuable time previously spent on tedious, manual processes.

Additionally, QuickBooks offers time tracking, term loans, and lines of credit, which helps with forecasting and financial control, and even includes options like bookkeeper services and business tax preparation through TurboTax Live. The result is improved financial control and clearer forecasts for your business.

Get superior financial control.

Before diving deeper, you might find my analysis of best web scraping tools helpful for broader market data collection.

Key features:

- Comprehensive Accounting: Manage your finances with accounting software, including invoicing and online payments, designed to replace manual processes and centralize your data.

- Integrated Payroll & Time Tracking: Simplify payroll and monitor employee hours, which helps automate expense tracking and ensures accurate financial reporting.

- Business Funding Solutions: Access term loans and lines of credit directly, providing flexible capital to support your growth and improve overall financial control.

Intuit features, pricing, & alternatives →

Verdict: Intuit’s QuickBooks is undeniably one of the best finance management software options for growth-stage companies. Its robust accounting, payroll, and invoicing features, combined with funding solutions, directly address the pain points of manual processes and a lack of real-time insights, offering improved financial control.

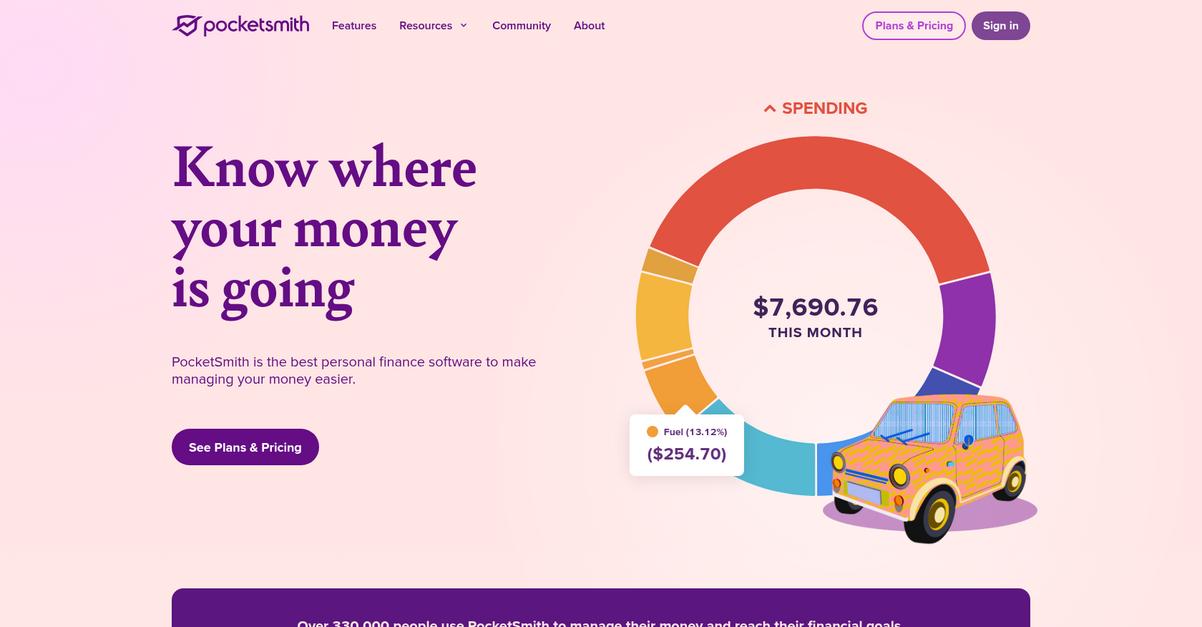

4. PocketSmith

Tired of financial uncertainty and manual tracking?

PocketSmith offers a centralized hub, connecting your accounts to show where your money goes. This means you can track spending and build custom dashboards for what matters to you.

The software addresses the challenge of information overload by providing clear graphs and charts, giving you new-found clarity over your money. You’ll always know your financial standing.

It’s time to gain control.

PocketSmith helps you solve problems by enabling you to connect all your accounts in one place, giving you a comprehensive overview of your finances. You can track spending, identify patterns, and easily see where your money goes.

It offers a robust calendar and forecasting feature, allowing you to project daily account balances up to 30 years into the future. This empowers you to make confident financial decisions. Additionally, the flexible budgeting system and in-depth reports ensure you control your money your way, bringing everything together to show you how you’re tracking. Plus, custom dashboards let you focus on essential financial details and block out the noise.

Achieve clearer forecasts and control your finances.

Key features:

- Centralized Account Connection: Connect all your accounts to see everything in one place, streamlining your financial overview and reducing manual data entry efforts.

- Long-Term Financial Forecasting: Utilize the calendar and forecasting capabilities to project daily account balances up to 30 years ahead, ensuring confident, forward-looking financial decisions.

- Customizable Budgeting & Reporting: Gain control with a flexible budgeting system and in-depth reports, allowing you to manage your money your way and track progress effectively.

PocketSmith features, pricing, & alternatives →

Verdict: PocketSmith is a strong contender for the title of best finance management software, especially for growth-stage companies needing to replace spreadsheets. Its robust forecasting up to 30 years, combined with multi-currency support and customer testimonials highlighting 20-30x savings, makes it an excellent choice for improved financial control.

5. Zoho

Are you drowning in financial data and manual processes?

Zoho provides a unique and powerful software suite, including Zoho Books, a comprehensive accounting platform designed for growing businesses.

This means you can transform your financial operations and streamline your workflows, moving beyond outdated spreadsheets and legacy tools.

You need clear financial visibility.

Zoho’s unified cloud software, Zoho One, serves as an operating system for your entire business. This helps you break down silos between departments, centralizing all your financial data and increasing organizational efficiency.

You can achieve improved financial control and clearer forecasts by automating processes and unifying data. This leads to higher productivity, with some users reporting an 80% increase in the last year, proving its efficacy for scaling without manual data entry.

It helps you unify your entire business.

Key features:

- Comprehensive accounting platform: Zoho Books provides powerful tools for growing businesses to manage their finances effectively, addressing the limitations of manual processes.

- Unified cloud software (Zoho One): This integrated suite breaks down departmental silos, centralizing all business data for real-time financial insights and improved efficiency.

- Automation and efficiency tools: Zoho automates processes, helping businesses streamline operations and track sales, investments, and client data, leading to significant productivity gains.

Zoho features, pricing, & alternatives →

Verdict: For growth-stage companies seeking to centralize financial data, automate tasks, and gain clearer forecasts, Zoho provides an all-in-one suite that is a strong contender for the Best Finance Management Software. It simplifies budgeting and reporting, helping you achieve autonomous control and improved productivity, as seen in cases with 80% efficiency gains.

Conclusion

Still drowning in manual financial tasks?

I know the feeling. It cripples your ability to make confident decisions and leads to serious information overload when choosing the right tool for your startup.

The market reflects this shift. Financial software adoption is projected to grow to $253.77 billion by 2029. This growth is fueled by automation, proving that manual methods are quickly becoming obsolete for any small enterprise.

Here’s what I recommend.

From my experience, Tipalti stands out as the top choice for automating these manual processes. It centralizes your entire financial workflow, providing total clarity.

Success stories like ServiceRocket cutting AP time by 80% prove its power. The best finance management software should deliver measurable efficiency gains like this for your team.

For broader productivity, optimizing team output is key. My article on best collaboration software offers strategies to maximize your team’s collective efforts.

I highly recommend you book a free demo of Tipalti to see its full capabilities. It’s the fastest way to understand its true impact.

You’ll gain back control and clarity.