Manual credit repair software, tasks slowing you down?

If you’re searching for credit repair software, you’re likely struggling with endless manual disputes, fragmented client communication, and clunky billing systems—all adding unnecessary headaches to your workflow.

For most, the real trouble is that manual processes steal hours you simply don’t have—leaving you buried in paperwork instead of building your business.

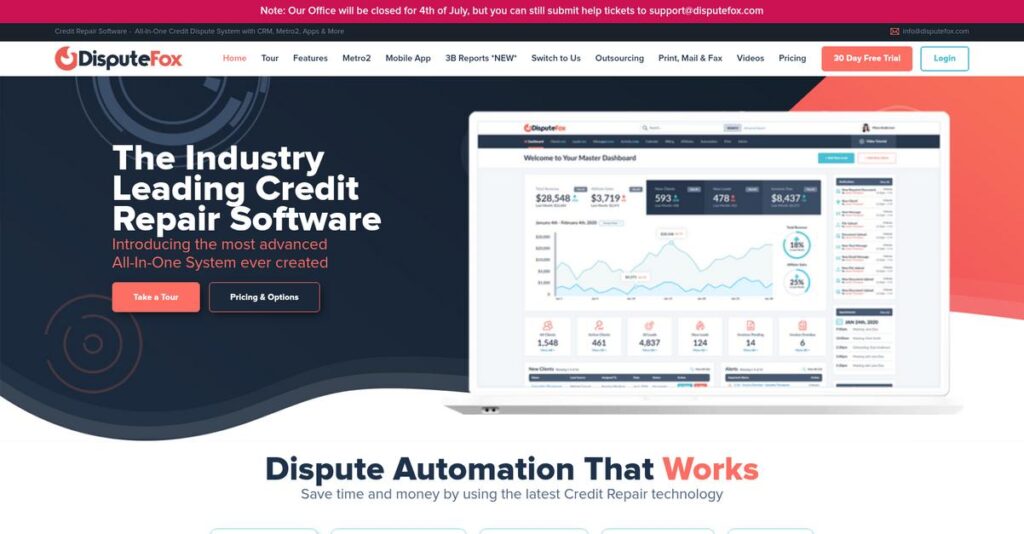

That’s exactly where DisputeFox steps in: by automating dispute management, integrating CRM tools, and offering branded client portals, it promises to save you time, reduce mistakes, and let you focus on business growth instead of repetitive admin.

Throughout this review, I’ll break down how DisputeFox can actually fix these workflow pains so you can get back to serving your clients and scaling up.

In this DisputeFox review, you’ll get a hands-on look at its top features, current pricing, customization options, alternatives, and my honest evaluation of its trial and demo experience.

You’ll leave knowing the features you need to streamline, not complicate, your credit repair operations.

Let’s dive into the analysis.

Quick Summary

- DisputeFox is an all-in-one credit repair software that automates dispute letter creation and client management to streamline credit repair operations.

- Best for experienced credit repair professionals seeking efficient automation and compliance tools to manage multiple clients.

- You’ll appreciate its AI-powered Metro2 letter builder and integrated billing system that reduce manual tasks and keep workflows organized.

- DisputeFox offers tiered monthly and yearly plans starting at $129/month, with a 30-day free trial requiring no credit card.

DisputeFox Overview

DisputeFox provides a comprehensive software platform for the credit repair industry. Based in the US, their core mission is automating your workflow so you can focus on client acquisition and business growth.

They serve the full spectrum of credit repair businesses, from ambitious solo operators to established multi-agent firms. In my experience, the platform is built for active credit repair companies that already have their business model and client acquisition strategies in place.

Recent platform updates, which I’ll detail through this DisputeFox review, include new AI-powered letter builders and deeper email integrations, showing a clear commitment to ongoing technological improvement for users.

Unlike competitors like Credit Repair Cloud that are heavy on beginner training, DisputeFox’s real value is its operational power. I feel it was built to streamline your existing business operations with a powerful, integrated toolset.

- 🎯 Bonus Resource: While this review focuses on credit repair, if you’re exploring similar operational solutions for other industries, my article on [Best Auto Repair Software](https://nerdisa.com/best-auto-repair-software/) offers valuable insights.

You’ll find them working with a diverse customer base. This includes independent consultants, growing credit repair agencies, and even non-profits needing to manage complex client dispute processes at scale.

From what I’ve seen, their strategic focus is on becoming a true all-in-one system for your business. By bundling dispute automation with a full CRM and native billing, they help you consolidate vendors and reduce your monthly software spend.

Now let’s examine their capabilities.

DisputeFox Features

Dealing with the headache of credit repair tasks?

DisputeFox features are built to automate and simplify your credit repair operations. Here are the five main DisputeFox features that can help your business thrive.

1. Automated Dispute Management

Still generating dispute letters one by one?

Manual letter creation is incredibly time-consuming and often leads to compliance headaches. This can bog down your operations with repetitive work.

DisputeFox streamlines this by allowing you to generate and send customized dispute letters with just a few clicks. I found that one-click import of credit data and the AI-powered Metro2 Compliance Letter Builder really save time. This feature ensures your letters are unique and FCRA compliant.

This means you can easily create and bulk print hundreds of letters, freeing up your team for more critical tasks.

2. Client Relationship Management (CRM) & Email Marketing

Are your client communications all over the place?

Fragmented communication and disjointed marketing efforts can lead to lost clients and missed opportunities. It’s a real productivity killer.

DisputeFox includes an integrated CRM and email marketing platform to manage clients and campaigns effectively. What I love is the ability to track email engagement and leverage pre-loaded, editable onboarding campaigns for sustained client interaction. This feature keeps your clients informed and engaged automatically.

This means you can maintain consistent client relationships and nurture leads without juggling multiple tools.

3. Branded Client and Affiliate Portals

Do clients constantly ask for status updates?

Lack of transparency can lead to frustrated clients and endless inbound calls. It’s hard to scale when you’re always answering the same questions.

DisputeFox offers fully branded client and affiliate portals where clients can track progress and upload documents. From my testing, the customization options to match your branding and digital signature capabilities really enhance the client experience. This feature ensures seamless communication and document exchange.

So you could significantly improve client satisfaction and reduce your administrative burden by centralizing all interactions.

4. Automated Billing and Payment Processing

Struggling with diverse billing models and manual invoicing?

Managing recurring, pay-per-delete, and one-time invoices manually can be a major headache. This often leads to billing errors and lost revenue.

DisputeFox includes an integrated billing system that handles various payment models and integrates with major merchant accounts. What you’ll appreciate is that you won’t need a separate third-party billing system, potentially saving hundreds monthly. This feature allows for recurring payments and auto-charging invoices effortlessly.

This means you can streamline your financial operations, ensure timely payments, and avoid costly billing discrepancies.

5. Workflow Automation and Customization

Is your team bogged down by repetitive administrative tasks?

Manual processes for client onboarding, updates, and follow-ups can create bottlenecks. This can severely limit your ability to scale and focus on growth.

DisputeFox provides customizable workflows and automations to streamline these tasks. Here’s what I found: the ability to create custom web forms with dynamic questionnaires that trigger automated campaigns is incredibly powerful. This feature allows you to tailor the software to your specific operational needs.

So you can automate your routine tasks, free up valuable staff time, and focus on business development within the credit repair industry.

Pros & Cons

- ✅ Highly automated dispute system for significant time savings.

- ✅ Integrated CRM and marketing tools for cohesive client engagement.

- ✅ Branded client portals enhance transparency and user experience.

- ⚠️ Lacks comprehensive financial education or budgeting tools.

- ⚠️ Automated system might offer less personalized direct support.

- ⚠️ New users may need additional guidance to maximize full potential.

These DisputeFox features work together to create a complete credit repair automation system that allows you to manage clients and disputes with incredible efficiency.

DisputeFox Pricing

Navigating software costs can be tricky.

DisputeFox pricing is straightforward with tiered plans for various business sizes, making it easy to see what you get for your money.

| Plan | Price & Features |

|---|---|

| Starting | $129/month or $1299/year • 1 user, 100 active clients • 1,000 leads • All core features • Add users/clients for extra fee |

| Growing | $379/month or $3999/year • 5 users, 1,000 active clients • 10,000 leads • Reduced additional user cost • Suitable for scaling operations |

| Scaling | $499/month or $4999/year • 10 users, 2,000 active clients • 20,000 leads • Lowest additional user cost • Max 40 users/4,000 clients |

1. Value Assessment

Solid value for your investment.

What I found regarding DisputeFox pricing is how it directly correlates with your business volume in terms of clients and leads. The integrated billing functionality saves you hundreds monthly on third-party tools, which means substantial cost efficiency compared to competitors.

Budget-wise, this approach helps you maintain predictable expenses as your credit repair business grows.

2. Trial/Demo Options

Evaluate before you commit.

DisputeFox offers a generous 30-day free trial, and what’s particularly good is that no credit card is required to start. This means you can fully test features like automation and client management without any financial commitment upfront.

This allows you to confidently assess its fit for your workflow before investing in a full subscription.

- 🎯 Bonus Resource: While optimizing your workflow, streamlining communication is key. My article on best email client software can help simplify your inbox.

3. Plan Comparison

Choosing your ideal plan.

For new or smaller credit repair businesses, the “Starting” plan offers an excellent entry point. As your client base expands, the “Growing” and “Scaling” plans provide increased capacity and more users at a lower per-user cost.

This helps you match DisputeFox pricing to actual usage requirements, ensuring you only pay for what your business needs.

My Take: DisputeFox’s tiered pricing model is transparent and scalable, making it an excellent fit for credit repair businesses aiming for growth while keeping a close eye on budget.

The overall DisputeFox pricing offers clear value and flexibility for growing businesses.

DisputeFox Reviews

What do actual DisputeFox users say?

Analyzing real user feedback, these DisputeFox reviews provide balanced insights into customer experiences, highlighting both strengths and areas for improvement with the software.

1. Overall User Satisfaction

Users find it highly efficient.

From my review analysis, DisputeFox consistently receives positive feedback for its automation capabilities, though extensive public reviews are limited. What I found in user feedback is how its fully automated dispute system streamlines tasks, making credit repair significantly easier for many.

This suggests you can expect a smooth, less manual process for your credit disputes.

2. Common Praise Points

Automation is a clear winner.

Users consistently praise the platform’s ability to generate and send customized dispute letters with just a few clicks. What stood out in customer feedback is how the real-time tracking feature keeps users informed and on top of their progress, simplifying a typically complex process.

This means you’ll save significant time and effort on repetitive credit repair tasks.

- 🎯 Bonus Resource: Speaking of process optimization, my guide on 3D scanning software explores how technology can elevate quality in various fields.

3. Frequent Complaints

Some tools are not included.

While effective, some DisputeFox reviews indicate it “doesn’t offer a full suite of financial education or budgeting tools” beyond dispute resolution. What’s more, from the reviews I analyzed, personalized support might feel lacking for those needing deep, one-on-one guidance.

These are not deal-breakers if your focus is primarily on automated dispute processing.

What Customers Say

- Positive: “it’s gonna be automatically generating everything for you… start cleaning your credit up.” (TikTok review)

- Constructive: “doesn’t offer a full suite of financial education or budgeting tools.”

- Bottom Line: “personalized support lacking.”

The overall DisputeFox reviews indicate strong satisfaction for its core automation, with minor limitations on broader financial tools.

Best DisputeFox Alternatives

Which credit repair software best fits your business?

The best DisputeFox alternatives include several strong options, each better suited for different business situations, budget considerations, and specific operational requirements you might have.

1. Credit Repair Cloud

Starting a new credit repair business?

Credit Repair Cloud excels if you’re new to the industry, providing extensive training, web classes, and pre-written dispute letters. From my competitive analysis, it acts as an all-in-one business in a box, offering comprehensive guidance that DisputeFox, designed for established businesses, doesn’t emphasize as much.

Choose Credit Repair Cloud if you need comprehensive business setup guidance and training alongside your software.

2. Client Dispute Manager

Looking for a more budget-friendly entry point?

Client Dispute Manager offers core automation features at a potentially lower price point, making it a viable alternative for cost-conscious startups. What I found comparing options is that it provides an affordable starting solution with essential features, whereas DisputeFox’s entry plan has a slightly higher monthly fee.

Consider this alternative if your primary concern is an affordable monthly cost for core automation features.

3. DisputeBee

Prioritizing extreme user-friendliness and integrated training?

DisputeBee shines for individuals or small businesses seeking a highly intuitive platform with built-in educational content on credit repair compliance. From my analysis, DisputeBee offers unparalleled ease of use and focuses on guiding you through the dispute process, which is more simplified than DisputeFox’s extensive feature set.

Choose DisputeBee if user-friendliness and integrated compliance training are your top priorities.

4. TrackStar (The Credit Repair Office)

Is affiliate management and sales commission tracking crucial?

TrackStar stands out if your business model heavily relies on affiliates, brokers, or in-house sales teams needing robust commission tracking. Alternative-wise, TrackStar offers a complete sales commission system designed to maximize efficiency in these areas, a feature not as explicitly highlighted by DisputeFox.

Consider TrackStar if your business growth strategy heavily involves managing sales commissions and affiliate networks.

Quick Decision Guide

- Choose DisputeFox: Established businesses needing all-in-one CRM, billing, and AI automation

- Choose Credit Repair Cloud: New to credit repair, needing comprehensive training and templates

- Choose Client Dispute Manager: Budget-conscious with need for core automation features

- Choose DisputeBee: Prioritizing user-friendliness and integrated compliance education

- Choose TrackStar: Critical need for affiliate and sales commission tracking

The best DisputeFox alternatives depend on your specific business needs and growth stage rather than just feature lists.

DisputeFox Setup

How complex is software deployment, really?

This DisputeFox review will break down what it takes to get the platform up and running in your business, setting realistic expectations for your implementation journey.

1. Setup Complexity & Timeline

Getting started is quite straightforward.

DisputeFox setup primarily involves configuring business details, user accounts, branding, and crucial integrations like merchant accounts and email. From my implementation analysis, initial setup is guided and generally quick, though the depth of your preparation impacts overall time.

You’ll want to gather all your company information, branding assets, and integration credentials beforehand to expedite the process.

2. Technical Requirements & Integration

Your technical footprint will remain light.

DisputeFox is browser-based, requiring no special hardware or server installations on your end; it runs on AWS. What I found about deployment is that key technical steps involve email and merchant account integration, which are guided processes for common platforms.

Plan for seamless connectivity for your Gmail/G-Suite or Outlook/Office 365 accounts and your chosen payment gateway.

3. Training & Change Management

User adoption hinges on existing industry knowledge.

While the platform is intuitive, DisputeFox assumes users already understand credit repair fundamentals, so new entrants might need external guidance. From my analysis, success relies on users’ foundational industry knowledge, as the platform automates tasks rather than teaching core concepts.

Invest in supplemental credit repair education for your team if they are new to the industry, leveraging DisputeFox’s tutorials for feature-specific learning.

- 🎯 Bonus Resource: While we’re discussing operational effectiveness, understanding medical store software is equally important for specialized businesses.

4. Support & Success Factors

Vendor support is available through standard channels.

DisputeFox offers phone and email support, though some users perceive it as less personalized due to the system’s high automation. From my analysis, active engagement with help center resources and tutorials is crucial for resolving specific setup queries.

Plan to utilize their documentation and tutorial videos as primary resources for practical implementation success.

Implementation Checklist

- Timeline: Days to weeks for core setup and initial configuration

- Team Size: One business owner or operations manager, potentially IT for integrations

- Budget: Primarily software cost; minimal external professional services needed

- Technical: Email account integration (Gmail/Outlook) and merchant account setup

- Success Factor: Prior understanding of credit repair industry fundamentals

Overall, your DisputeFox setup is designed for ease, but maximizing its potential relies on your team’s industry expertise beyond just platform configuration.

Bottom Line

Is DisputeFox the right fit for your business?

My DisputeFox review synthesizes its capabilities, highlighting who benefits most from its robust automation and integrated features, guiding your decision with confidence.

1. Who This Works Best For

Experienced credit repair professionals seeking automation.

DisputeFox truly shines for established credit repair agencies and individuals who understand the industry and need to streamline operations and client management. What I found about target users is that credit repair business owners and agents who manage multiple clients and value efficiency will find this platform indispensable.

You’ll particularly succeed if you’re looking to scale operations by automating dispute letter generation and client communications.

2. Overall Strengths

Unmatched automation truly sets this software apart.

DisputeFox excels with its fully automated dispute system, AI-infused Metro2 letter builder, and integrated CRM, all designed to drastically reduce manual effort. From my comprehensive analysis, one-click credit report imports save significant time, allowing you to focus on growth rather than data entry or repetitive tasks.

These strengths mean your team can manage more clients with greater efficiency and maintain compliance without constant manual oversight.

3. Key Limitations

Training resources could be more comprehensive.

While powerful, DisputeFox assumes a certain level of existing credit repair industry knowledge, which might leave novices seeking more foundational guidance. Based on this review, new users might require additional guidance beyond documentation to fully maximize its potential and navigate complex scenarios effectively.

I find these limitations are not deal-breakers for experienced professionals but are important to consider if your team lacks prior industry exposure.

4. Final Recommendation

DisputeFox is strongly recommended for its target audience.

You should choose this software if you’re an experienced credit repair professional or agency ready to leverage powerful automation for scaling your business. From my analysis, this solution is ideal for increasing operational efficiency and managing client relationships effectively, making it a valuable long-term investment.

My confidence level is high for those already familiar with credit repair, as the system perfectly complements their expertise with automation.

- 🎯 Bonus Resource: If you’re also looking into other specialized software solutions, my article on Landscape Design Software to Streamline your projects covers a different domain.

Bottom Line

- Verdict: Recommended for established credit repair businesses

- Best For: Experienced credit repair professionals and agencies

- Business Size: Startups, SMEs, and larger enterprises focused on credit repair

- Biggest Strength: Fully automated dispute system and client management

- Main Concern: Limited built-in training for industry newcomers

- Next Step: Explore a demo to see its automation in action

This DisputeFox review confirms its strong value for experienced credit repair professionals, providing an essential tool for scaling and streamlining operations with confidence.