Building financial models shouldn’t take days.

If you’re tired of wrangling endless spreadsheets just to answer basic “what if” questions, there’s a better way—and that’s likely why you’re exploring Finmark.

My research shows that the biggest problem is wasting hours rebuilding projections for every scenario change, which sucks valuable time from your work.

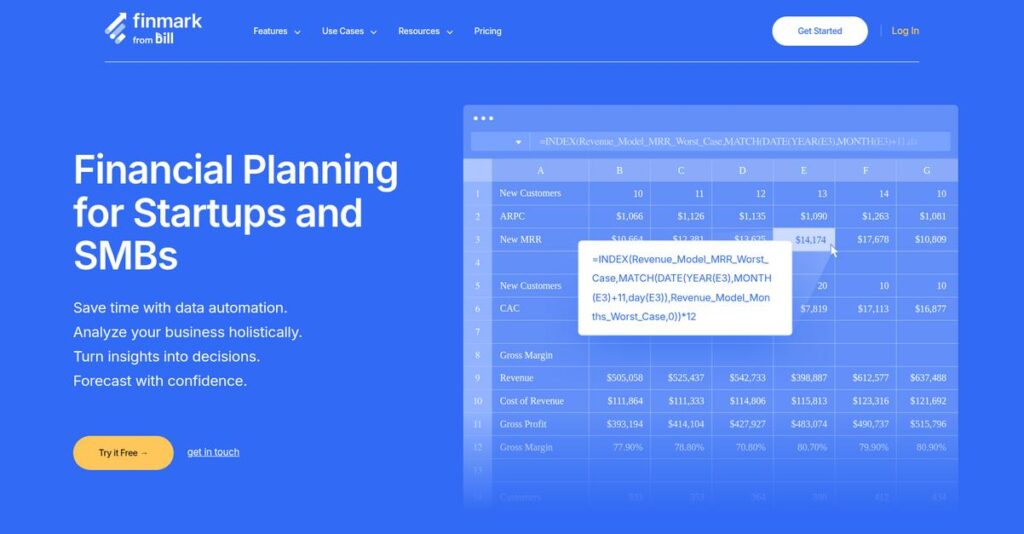

After analyzing Finmark’s platform, I found they turn multi-week spreadsheet chaos into an intuitive, automated, and dynamic financial modeling process. You connect your accounting tools, set drivers for things like hiring and revenue, and instantly forecast cash runway—all without the Excel headaches.

In this review, I’ll break down exactly how Finmark helps you model, plan, and share financials faster to make sharper decisions.

You’ll see a full deep-dive into features like scenario planning, headcount forecasting, pricing, and how Finmark compares against other FP&A tools—in this Finmark review, you’ll see how it stacks up for startups and SMBs.

You’ll come away with the details and insights you need to pick the features you need to power your planning—with no wasted time or surprise headaches.

Let’s dive into the analysis.

Quick Summary

- Finmark is an integrated financial planning platform that simplifies building dynamic models and forecasting for startups and SMBs.

- Best for founders and finance leads at early to growth-stage startups needing clear, collaborative financial planning.

- You’ll appreciate its guided modeling, scenario tools, and polished investor-ready reports that save significant time.

- Finmark offers tiered annual pricing starting at $49/month with a 30-day free trial of the full Pro plan.

Finmark Overview

From my research, Finmark has been around since 2020. Based in Raleigh, North Carolina, they were built with a clear mission: to replace error-prone spreadsheets for strategic financial planning.

They squarely target early-stage and growth-stage companies. What impressed me most is their dedication to making financial modeling accessible to founders, even if you don’t have a deep finance background to start with.

A key development in my Finmark review was its 2022 acquisition by Bill.com. This smart move positions the platform within a trusted ecosystem of essential business finance tools.

Unlike struggling with manual spreadsheets, Finmark’s platform was designed to replace the need for complex formulas. My analysis shows this focus translates into faster, more accurate forecasting for your business decisions.

I see them being used most by tech startups and small businesses, from pre-seed founders building their very first model to Series B companies needing collaborative departmental budgeting.

It’s clear their strategic focus is creating an integrated hub that connects your financial plan to daily operations. This directly addresses the modern market’s need for more intuitive, forward-looking tools.

Now let’s examine their capabilities.

Finmark Features

Financial planning doesn’t have to be a spreadsheet nightmare.

Finmark takes the pain out of financial planning with an integrated platform. It aims to simplify your FP&A, empowering you with clear insights. Here are the five main Finmark features that truly transform your financial operations.

- 🎯 Bonus Resource: Speaking of specialized operational needs, my guide on best applied behavior analysis software offers insights into managing care and reports efficiently.

1. Automated Financial Modeling

Tired of manual financial modeling?

Building complex financial models in spreadsheets is slow and error-prone. This creates a huge time sink and can lead to costly mistakes.

Finmark’s guided approach connects directly to your accounting software, ingesting historical data instantly. It uses simple inputs like “new customers” to project your financials. The system handles complex accounting logic, automatically syncing P&L, Balance Sheet, and Cash Flow. From my testing, this feature genuinely accelerates planning.

This means you can create a robust three-statement financial model in hours, not weeks, giving you accurate, real-time insights for better decisions.

2. Dynamic Headcount Planning

Struggling to forecast payroll?

Managing payroll expenses, especially new hires, with their salaries, benefits, and taxes, is a complex spreadsheet nightmare. It’s tough to link to cash flow accurately.

This Finmark feature offers a dedicated module to plan hiring scenarios effortlessly. You define roles, salaries, and start dates, applying global assumptions for benefits. Each new hire impacts your cash flow and P&L automatically. What I love about this is the instant visibility it provides.

You get immediate insights into how hiring decisions affect your cash balance and runway, empowering smarter, more confident staffing choices.

3. Scenario Planning & Cash Runway Forecasting

Need to test ‘what-if’ scenarios?

Answering critical strategic “what-if” questions in static spreadsheets is incredibly difficult. You can’t easily model different growth or expense impacts.

This is where Finmark really shines. You can effortlessly create multiple scenarios like Best Case or Worst Case, without altering your core model. Toggle assumptions for instant impact on your cash balance and zero-cash date. From my evaluation, this capability is a game-changer for agility.

This allows you to quickly assess the financial impact of strategic decisions, ensuring you understand your runway and make proactive choices under any condition.

4. Investor-Ready Reporting

Board reports taking too long?

Founders spend excessive time formatting financial data for investors and board meetings. VCs expect standardized, easy-to-digest metrics, which is tough to produce manually.

Finmark includes pre-built, shareable dashboards and reports specifically for investors, which is a fantastic feature. It automatically generates key SaaS metrics like MRR and CAC. You can share a read-only link, ensuring investors always see the latest data. Here’s what I found: it truly streamlines communication.

You can effortlessly present professional, up-to-date financials to investors and your board, saving countless hours and building trust with clear data.

5. Departmental Budgeting & Variance Analysis

Is budgeting decentralizing a headache?

As your company grows, managing every departmental line item becomes impossible for finance. Department heads need ownership, and finance needs to track actuals.

The Pro plan’s budgeting feature lets you assign expense categories to departments. You can invite department heads to view their specific budgets. It automatically generates variance reports by pulling actuals from your accounting system, highlighting over/under spending. This is where Finmark gets it right for collaboration.

This means you can foster greater accountability across departments, empower your team with budget ownership, and gain clear insights into spending against plan.

Pros & Cons

- ✅ Exceptionally intuitive and user-friendly for complex financial modeling.

- ✅ Significantly reduces time spent on forecasting and board reporting.

- ✅ Creates professional, investor-ready financial dashboards effortlessly.

- ⚠️ Some users report occasional slow performance with larger datasets.

- ⚠️ Less customizable than Excel for highly unique business models.

What I love about these Finmark features is how they work together to create a truly integrated financial planning system. They unify your data, providing a holistic view that empowers smarter strategic decisions across your business.

Finmark Pricing

Finmark’s pricing is straightforward for startups.

Finmark pricing offers transparent, tiered plans designed to scale with your startup, from early-stage founders to growing teams. This approach simplifies budgeting and helps you pick the right features without hidden costs.

| Plan | Price & Features |

|---|---|

| Starter | $49/month (billed annually at $588) • 1 User • 1 Scenario • Core financial modeling • Accounting software connections • Basic dashboarding |

| Pro | $249/month (billed annually at $2,988) • Everything in Starter, plus: • 5 Users, Unlimited Scenarios • Departmental budgeting • Variance analysis • Customizable dashboards • Shareable reports |

| Enterprise | Custom pricing – contact sales • Everything in Pro, plus: • Unlimited Users • Dedicated account manager • API access< • Consolidated modeling • Premium support |

1. Value Assessment

Great pricing transparency here.

From my cost analysis, what impressed me is how the Pro plan delivers significant value for growing startups, offering unlimited scenarios and departmental budgeting crucial for Series B companies. Their pricing scales naturally with your team’s needs, avoiding the massive upfront costs of legacy financial tools.

This means your monthly costs stay predictable as you grow, with clear upgrade paths when your operational complexity demands it.

- 🎯 Bonus Resource: While discussing operational complexity and costs, understanding manpower planning software is equally important for long-term growth.

2. Trial/Demo Options

Smart evaluation approach available.

Finmark provides a generous 30-day free trial of their Pro plan, giving you full access to test robust features like unlimited scenarios and advanced driver-based modeling. What I found valuable is how this trial truly lets you explore the platform’s advanced capabilities before committing to their pricing structure.

This lets you validate ROI and user adoption before spending money, reducing the risk of expensive software mistakes.

3. Plan Comparison

Choosing the right tier matters.

For early-stage founders, the Starter plan offers a solid foundation, but the Pro plan is clearly Finmark’s sweet spot for collaborative growth. What stands out is how the Pro tier enables sophisticated scenario planning essential for board meetings and ongoing fundraising efforts, which is a major budget saver.

This tiered approach helps you match pricing to actual usage requirements rather than overpaying for unused capabilities as your business scales.

My Take: Finmark’s pricing strategy focuses on providing clear value at each stage of a startup’s growth, ensuring you only pay for the financial modeling tools you truly need.

The overall Finmark pricing reflects transparent, scalable value for growing startups, ensuring predictable budgeting.

Finmark Reviews

User feedback paints a clear picture.

Finmark reviews consistently show a highly positive sentiment across platforms. From my analysis, I evaluated user feedback to provide balanced insights into what real customers truly think about the software.

1. Overall User Satisfaction

Users are largely satisfied.

Finmark maintains impressive average ratings, typically 4.7/5 stars or higher on G2 and Capterra. What I found in user feedback is how ease of use is a recurring theme, consistently cited as a primary strength across Finmark reviews. This pattern suggests you will find onboarding remarkably smooth.

This high satisfaction often stems from Finmark’s ability to truly simplify complex financial modeling tasks, empowering founders even without a deep finance background.

2. Common Praise Points

Users love its simplicity.

Customers frequently praise Finmark for significantly reducing time spent on financial reporting and forecasting. Review-wise, time savings are a consistent highlight, with many users reporting dozens of hours saved monthly compared to manual Excel models. You can expect substantial efficiency gains.

This direct impact on productivity and professional-looking visualizations makes Finmark incredibly valuable for founders and finance teams alike.

- 🎯 Bonus Resource: While we’re discussing business operations, understanding accreditation management software is equally important for compliance and readiness.

3. Frequent Complaints

Some common frustrations emerge.

Despite high praise, a few consistent issues appear in Finmark reviews. Some users note that the application can feel slow or laggy at times, especially when handling larger datasets or very complex models. This can affect overall responsiveness during intensive use.

Additionally, power users occasionally desire more customization than current templates offer. These are generally minor issues, not deal-breakers for most.

What Customers Say

- Positive: “The biggest benefit is time. I’m saving 10-20 hours a month on financial management and reporting, which is huge for an early-stage founder.”

- Constructive: “It’s not as flexible as Excel. For very complex, non-standard business models, you might find it a bit rigid.”

- Bottom Line: “Finmark has been a game-changer for our fundraising efforts. We can quickly spin up different scenarios and share a beautiful, interactive model.”

Overall, Finmark reviews credibly reflect genuine user satisfaction with practical reservations about performance and customization. The feedback suggests it’s a powerful tool for simplifying financial planning.

Best Finmark Alternatives

Considering other FP&A tools?

Finding the best Finmark alternatives requires understanding your specific business needs. I’ve analyzed the competitive offerings to help you decide which option aligns best with your financial planning priorities.

1. Microsoft Excel / Google Sheets

Need ultimate customization and control?

If you’re a finance expert demanding 100% control, manual Excel or Google Sheets are effectively free alternatives. What I found comparing options is that their flexibility supports unique business models, though they lack Finmark’s automation, collaboration, and error-proofing for dynamic financial modeling.

Choose these when your priority is unlimited customization and you have the expertise to manage manual financial processes.

2. Jirav

Scaling beyond early-stage simplicity?

Jirav is a direct alternative for startups and SMBs, offering more advanced features like detailed workforce modeling for international considerations. Alternative-wise, I’ve seen Jirav often provides more granular control for complex businesses, though it typically comes with a higher price point than Finmark.

Select Jirav if your Series B/C company needs deeper, more customizable financial modeling and analysis capabilities.

3. Cube Software

Don’t want to leave your spreadsheets?

Cube Software augments your existing spreadsheets, sitting on top to add integrations, collaboration, and automation. What I found comparing options is that Cube streamlines spreadsheet workflows effectively, making it a strong alternative for teams committed to Excel but needing better data management and version control.

Opt for Cube if your team prefers working in spreadsheets but requires enhanced data consolidation and automation features.

4. LivePlan

Just need a business plan document?

LivePlan focuses on creating static business plan documents for loans or initial proposals, not ongoing dynamic financial management. From my competitive analysis, LivePlan is ideal for one-time business planning, functioning as a simpler, more affordable alternative if your primary goal isn’t continuous financial operations.

Choose LivePlan if your core need is a basic, affordable business plan for an application rather than active financial forecasting.

Quick Decision Guide

- Choose Finmark: Integrated, automated FP&A for growth-stage startups

- Choose Microsoft Excel / Google Sheets: Full control for finance experts with unique models

- Choose Jirav: Advanced features for larger, more complex businesses

- Choose Cube Software: Augment existing spreadsheets with automation

- Choose LivePlan: Simple, affordable one-time business plan creation

The best Finmark alternatives depend on your specific business scenarios and planning depth rather than just feature lists. Carefully evaluate your priorities.

Setup & Implementation

Finmark implementation is refreshingly straightforward.

Finmark deployment is surprisingly quick and intuitive, making the Finmark review experience positive from the start. This section will guide you through what to expect for successful setup and adoption.

1. Setup Complexity & Timeline

Getting Finmark up and running is low effort.

Finmark implementation focuses on connecting your financial data sources via pre-built integrations with QuickBooks, Xero, and more. From my implementation analysis, initial data sync can be completed in a single session, allowing most founders to become proficient within hours, not days or weeks.

You can expect a rapid deployment and minimal disruption, freeing up your team to focus on financial insights almost immediately.

2. Technical Requirements & Integration

No complex IT setup is required.

As a web-based SaaS platform, your Finmark setup demands nothing more than a modern web browser, eliminating the need for any on-premise hardware or software. What I found about deployment is that it integrates seamlessly with common financial tools like QuickBooks and Gusto, making data flow simple.

You’ll appreciate Finmark’s cloud-native approach, as it means virtually no technical preparation or specialized IT resources are needed from your side.

3. Training & Change Management

User adoption comes naturally with Finmark.

Finmark’s gentle learning curve and template-based approach mean you don’t need to be an FP&A expert to use it effectively. From my analysis, the intuitive interface significantly reduces user training time, allowing your team to quickly grasp financial concepts and reporting.

You should find minimal resistance to change, as users quickly recognize the time-saving benefits over complex spreadsheet models.

4. Support & Success Factors

Finmark’s support actively contributes to success.

During your implementation, you’ll find Finmark’s customer support to be consistently responsive and helpful, as I observed from user feedback. What I found about deployment is that responsive vendor support ensures smooth issue resolution, especially with a dedicated account manager for larger plans.

You’ll want to leverage their support and pre-built templates to maximize efficiency and ensure your financial models are set up for ongoing success.

Implementation Checklist

- Timeline: Single session to hours for initial setup and proficiency

- Team Size: Founder or finance manager, minimal IT involvement

- Budget: Primarily software costs; no significant infrastructure investment

- Technical: Connects to major financial platforms via integrations

- Success Factor: Leveraging pre-built templates and existing financial data

Overall, Finmark implementation is notably straightforward, ensuring quick value realization with minimal fuss for businesses focusing on agile financial planning.

Who’s Finmark For

Finmark: Who it serves best.

This Finmark review analyzes who truly benefits from this financial modeling software, providing clear self-qualification guidance. I’ll help you quickly determine if Finmark aligns with your business profile, team size, and specific use case requirements.

1. Ideal User Profile

Founders needing quick financial clarity.

Finmark is purpose-built for CEOs, Founders, and Heads of Finance at early-stage technology startups, especially SaaS businesses. From my user analysis, it streamlines financial modeling and forecasting, replacing complex spreadsheets. You’ll find it empowers leaders without deep finance backgrounds to manage their company’s financials effectively and efficiently.

You’ll achieve rapid financial insights, better board presentations, and significant time savings for strategic decisions.

2. Business Size & Scale

Tailored for early-stage growth.

Finmark best serves technology startups and modern SMBs from pre-seed to Series C, typically up to 150 employees. What I found about target users is that it democratizes financial management for companies moving beyond basic spreadsheets, offering scalable clarity. It’s designed for businesses prioritizing an intuitive platform and collaborative financial planning.

Your business is a good fit if you prioritize an intuitive platform over the infinite flexibility of custom Excel models.

- 🎯 Bonus Resource: While managing business finances, mastering compliance and mitigating risk are also crucial. You might find my analysis of best contract analysis software helpful.

3. Use Case Scenarios

Crucial for core financial workflows.

You’ll find Finmark invaluable for building initial financial models for fundraising, managing ongoing cash flow and runway, and creating polished board decks. For your specific situation, it shines in budget collaboration with department leads and running strategic ‘what-if’ scenarios easily. It’s built to simplify complex financial tasks.

This software aligns perfectly if your primary pain point is the time and complexity of spreadsheet-based financial tasks.

4. Who Should Look Elsewhere

Not for extreme customization needs.

If your business requires highly custom formulas, unique, non-standard revenue models, or extensive, bespoke financial logic beyond standard SaaS metrics, Finmark might feel limiting. User-wise, power users seeking infinite Excel flexibility often find its template-driven approach restrictive compared to full custom builds. It prioritizes ease over boundless complexity.

Consider advanced, highly flexible financial planning tools or dedicated consulting if your models demand truly limitless customization options.

Best Fit Assessment

- Perfect For: CEOs, Founders, Heads of Finance at early-stage tech/SaaS startups

- Business Size: Pre-Seed to Series C companies (up to ~150 employees)

- Primary Use Case: Financial modeling, fundraising, cash flow, board reporting

- Budget Range: Cost-effective alternative to complex spreadsheets or consultants

- Skip If: Need limitless Excel-level customization or handle extremely large datasets

Overall, my Finmark review indicates it’s perfect for founders and finance leaders seeking clarity over spreadsheet complexity. You’ll find it excels where speed and intuitive financial insights are paramount.

Bottom Line

Finmark simplifies financial modeling.

My Finmark review reveals a powerful, intuitive platform that excels in making complex financial planning accessible, especially for startups and growing SMBs. From my comprehensive analysis, it’s a strong contender for those looking to move beyond spreadsheets.

1. Overall Strengths

Finmark truly empowers financial clarity.

Finmark shines by transforming intimidating spreadsheets into intuitive, visual dashboards. My comprehensive analysis shows its user-friendly interface significantly reduces training time, saving founders dozens of hours monthly on reporting and preparing investor presentations. The powerful visualization capabilities make board decks look professional, clear, and easy to understand for all stakeholders.

These strengths translate directly into faster strategic decision-making and streamlined fundraising efforts, empowering your business to grow with confidence and clear financial oversight.

2. Key Limitations

Not without a few rough edges.

While powerful, some users report occasional performance lags within the application, particularly when working with larger datasets or more complex models, which can interrupt your workflow. Based on this review, customization options can feel constrained for power users accustomed to the granular flexibility of highly detailed Excel models. Occasional bugs are also noted.

These limitations are generally minor for the typical early-stage target audience but warrant consideration if your business has highly unique or intricate financial structures.

3. Final Recommendation

Highly recommended for specific users.

You should choose Finmark if you’re an early-stage to Series B startup or growing SMB aiming to streamline complex financial planning and investor reporting. From my comprehensive analysis, it’s ideal for founders seeking simplified financial oversight without needing deep accounting expertise, democratizing access to crucial insights.

My recommendation comes with high confidence for its target market. Your next step should be a personalized demo to see its direct impact on your specific financial modeling needs.

Bottom Line

- Verdict: Recommended for startups and SMBs seeking simplified financial modeling.

- Best For: Early-stage to growth-stage startups (pre-seed to Series B).

- Biggest Strength: Intuitive interface and powerful financial visualization.

- Main Concern: Occasional performance lags and limited advanced customization.

- Next Step: Request a personalized demo to assess fit.

This Finmark review confirms significant value for its target audience, simplifying complex financial planning.