Late GST filings stressing you out?

Managing GST invoicing and tax compliance manually often leads to stressful errors, wasted hours, and the risk of costly penalties. As business owners and finance managers, you already juggle enough. Struggling to keep up with shifting regulations and correct tax calculations can make even routine processes feel overwhelming.

When mistakes pile up, valuable time slips away and confidence in your compliance drops. I have been there myself, and I know how a single calculation error can threaten both your finances and reputation.

Here is something worth noting from KPMG: 59% of businesses have experienced errors in tax calculation or filings when handling everything manually. That number highlights just how common and risky manual systems can be. With such a high error rate, the need for a better solution is clear.

The good news is that the right GST billing software can automate these processes, drastically reduce errors, and free up your time.

That’s exactly what I aim to help you with here. In this article, I am going to break down the best GST billing software for simplifying your tax invoicing and making compliance much less of a headache.

You will discover user-friendly tools that deliver error-free invoicing, save you hours, and fit perfectly with your business workflows.

Let’s get started.

Quick Summary:

| # | Software | Target Users |

|---|---|---|

| 1 | Vyapar ↗ | Small business owners needing easy, all-in-one GST billing |

| 2 | Tally Solutions ↗ | Small businesses seeking simplified GST compliance and invoicing |

| 3 | Zoho Books ↗ | Small businesses wanting automated accounting and GST compliance |

| 4 | CaptainBiz ↗ | Indian SMBs needing quick, mobile-friendly GST billing solutions |

| 5 | BUSY Software ↗ | Micro and medium businesses needing scalable GST billing software |

1. Vyapar

Worried about managing your GST billing effortlessly?

Vyapar helps small business owners create accurate GST invoices and save time with its simple, easy-to-use billing templates.

Using Vyapar, you get more than just an invoicing tool; it’s a full business assistant. You can generate GST-compliant bills, automate tax calculations, and share invoices instantly over WhatsApp or email, boosting professionalism and speed.

The software safeguards your data with automatic backups and works both online and offline, which is perfect if you run your business in areas with poor internet. It also lets you manage your inventory smartly by tracking stock levels, expiry dates, and batch numbers to reduce losses.

What’s great is the integrated cash flow management system that sends payment reminders automatically, helping you get paid faster and avoid delays. You can accept multiple payment options, including UPI, cards, and e-wallets, giving your customers convenience.

Vyapar also offers detailed business reports like GSTR1 to GSTR9, sales analysis, and balance sheets. These reports help you make informed decisions to grow your business confidently, much like some of the best small business ERP software available.

You can customise your invoices, choose from 10+ GST billing formats, and print them in different sizes for thermal or regular printers to impress your customers.

Vyapar is built for various industries like retail, pharma, restaurants, and freelancers, making it a versatile solution designed specifically for your small business needs as well as those needing comprehensive scheduling software to eliminate double-bookings.

Key features:

Easy GST billing and invoice generation: Create fully GST-compliant invoices within minutes and share instantly via WhatsApp or email to save time and avoid errors.

Smart inventory management: Track stock with batch numbers, expiry dates, and get low-stock alerts to avoid theft and stockouts, helping you optimise inventory space.

Automated payment reminders and multiple payment options: Send bulk payment notifications via WhatsApp or email, and accept payments through UPI, credit/debit cards, e-wallets, and more for reliable cash flow.

Learn more about Vyapar features, pricing, & alternatives →

Verdict:

Vyapar stands out as the best GST billing software for small business owners who need an intuitive tool to handle invoicing, inventory, and payments all in one. Over 1 crore Indian SMEs trust it to cut down billing errors, speed up GST filing, and improve cash flow management without complexity.

2. Tally Solutions

Struggling with complex GST billing challenges?

Tally Solutions simplifies your tax invoicing while making compliance effortless.

Their software is crafted mainly for small business owners who need to stay GST compliant without drowning in paperwork or confusing calculations. You get everything from quick GST invoicing to complete tax management under one roof. Instead of juggling multiple tools, Tally handles your accounts, GST returns, and billing workflows seamlessly. This means fewer errors and more consistent filings so you avoid penalties and save valuable time.

It really reduces your hassle.

One feature I find valuable is how Tally automates GST returns filing, which relieves that constant worry about deadlines and accuracy. Plus, it supports multi-state and multi-goods invoicing, which suits businesses that sell across different regions.

You’ll also notice how its inventory management ties neatly with billing, so you have real-time stock updates directly while creating invoices. No more second-guessing or manual stock checks.

Tally Solutions makes tax compliance straightforward, reliable, and less time-consuming. It empowers you to focus on growing your business rather than paperwork. And, with features designed to manage business finance, billing, and compliance in one place, it’s a smart choice if reducing complexity around GST billing is your goal.

This software has been trusted by millions of businesses, proving its robustness and widespread acceptance in India’s GST ecosystem.

Key features:

- All-in-one GST billing and compliance: Automatically generates GST-compliant invoices, tracks tax liabilities, and supports seamless e-return filing to reduce manual errors and save time.

- Integrated inventory management: Real-time stock tracking linked with billing helps prevent stockouts or overstocking, improving order accuracy and business efficiency.

- Multi-location and multi-state support: Ideal for businesses with operations across states, enabling correct tax calculation and compliance with different GST rates and regulations.

Learn more about Tally Solutions features, pricing, & alternatives →

Verdict:

Tally Solutions clearly stands out as the best GST billing software for small business owners who want to simplify compliance and invoicing. Trusted by millions, it automates tax returns and integrates billing with inventory, helping users avoid costly errors. Its proven capabilities make it a dependable choice for easy GST management.

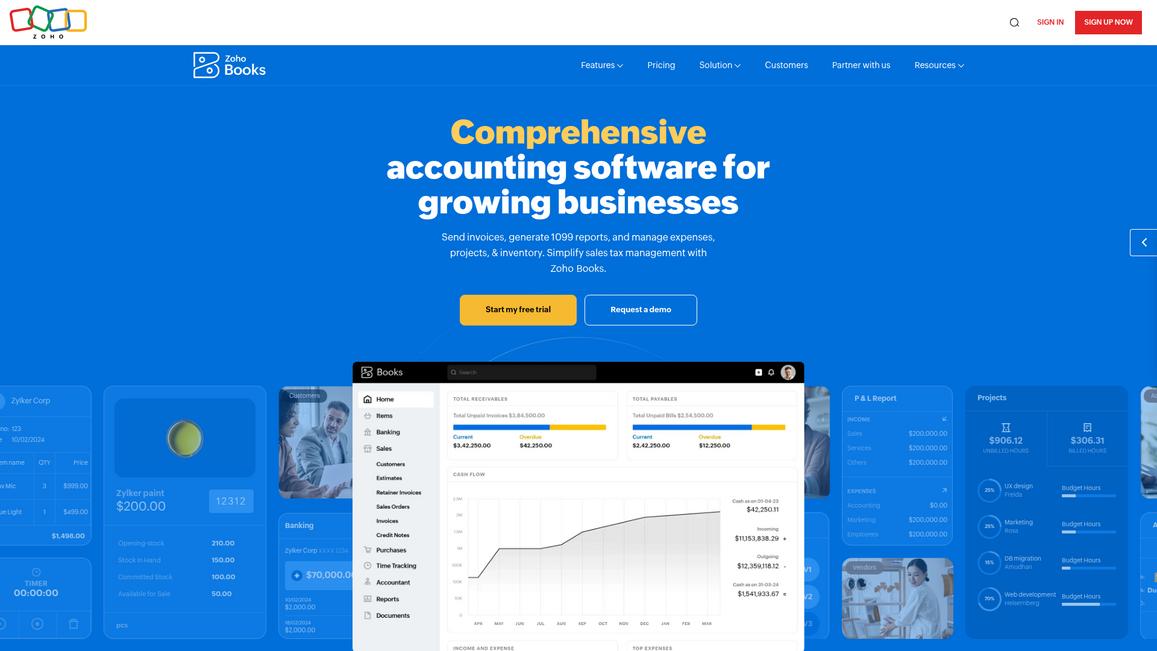

3. Zoho Books

Struggling to stay on top of your business finances?

Zoho Books simplifies accounting with smart automation for invoicing, expenses, taxes, and inventory.

If you’re a small business owner, keeping your cash flow steady and managing GST tax compliance can be overwhelming. Zoho Books helps by automating sales tax calculations, bills, and bank reconciliations, so you avoid manual errors and stay audit-ready effortlessly. Plus, you can access your finances anywhere with mobile and desktop apps.

You can regain control of your books.

Zoho Books lets you create professional invoices, automate payment reminders, and accept online payments easily to get paid faster.

Another strength is its robust project management tools that help you track billable hours and budgets, improving your project profitability with real-time insights.

It’s an ideal solution for small business owners wanting an all-in-one platform to save time and maintain compliance.

Key features:

- Automated sales tax and GST calculations that ease compliance and reduce errors, helping you file tax reports confidently and on time.

- Integrated inventory and expense management keeps your stock updated in real time and tracks bills to avoid surprises in cash flow.

- Cross-device accessibility with mobile and desktop apps lets you manage your accounting on the go, so you’re never disconnected from your business finances.

Learn more about Zoho Books features, pricing, & alternatives →

Verdict:

Zoho Books stands out as one of the best GST billing software options for small business owners. Its automation of tax calculations and invoicing helped companies like Site Search & Select streamline their financial and forecasting needs. Customers report saving up to 25% of their time by switching from QuickBooks, making Zoho Books a smart choice for effortless accounting and compliance.

4. CaptainBiz

Struggling with GST billing hassles?

CaptainBiz simplifies your invoicing and tax compliance with an easy-to-use dashboard tailored for small business owners in India.

This software helps you create GST-compliant invoices quickly and manages inventory in real-time. It tracks payments and automates tax calculations, so you avoid costly manual errors.

You get regular updates that keep your business aligned with GST reforms, making sure you’re always compliant without extra effort.

CaptainBiz works well for retailers, wholesalers, and service providers alike.

Managing multiple companies or users is also simple, helping you grow without complexity.

It offers mobile apps for Android and iOS, so you can generate invoices and e-way bills on the go. If you want to explore further tools for retail businesses, you might also look into virtual phone system to boost your business, which can help streamline your customer communication alongside billing platforms.

You can even customize invoice templates to fit your branding, streamlining your sales process.

Another standout feature is the seamless integration with accounting tools like Tally, which makes data export easy and reliable.

No need to juggle between several apps for billing and reports, especially when you have specialized solutions like GST reconciliation software to simplify your compliance and enhance tax accuracy.

Key features:

GST-compliant invoicing made easy: Quickly generate accurate invoices that follow government rules, saving time and reducing errors.

Real-time inventory and payment tracking: Keep up with your stock and outstanding payments without manual checks, improving cash flow.

Mobile-friendly with customization options: Manage billing anywhere using Android or iOS apps, plus customize invoices to maintain professional branding.

Learn more about CaptainBiz features, pricing, & alternatives →

Verdict:

CaptainBiz stands out as the best GST billing software for small business owners in India who want to cut down manual work and stay tax compliant. Trusted by over 46,000 SMBs and recommended by GST Network, its automation and mobile billing features help you focus on growing your business without billing headaches.

5. BUSY Software

Managing GST billing can be overwhelming for many business owners.

BUSY Software helps simplify your GST compliance with features like GST invoicing, filing, and auto generation of e-way bills and e-invoices.

This all-in-one accounting solution is designed for micro, small, and medium businesses, making tax invoicing and bookkeeping much more manageable for you. It’s scalable to fit your business needs and available on desktop, cloud, and mobile app.

It actually works.

Busy’s financial accounting tools speed up tracking income, expenses, and bank reconciliation, so you avoid costly errors and maintain compliance.

You’ll also appreciate its advanced inventory management, which keeps stock details organized by location, batch, expiry date, and more, helping you control costs and avoid shortages.

You can access over 100 reports anytime through the mobile app, create and share invoices or quotations on the go.

BUSY Software gives you peace of mind.

Key features:

- Complete GST compliance package including invoicing, filing, automatic e-invoice and e-way bill generation that helps you stay accurate and avoid penalties.

- Robust financial accounting and reconciliation tools that give you clear views of your cash flow, purchases, and sales to support smarter business decisions.

- Advanced inventory controls across multiple locations and lot details to keep your stock transparent and reduce losses through better tracking.

Learn more about BUSY Software features, pricing, & alternatives →

Verdict:

BUSY Software stands out as one of the best GST billing software options for business owners who need a straightforward, scalable solution. With over 360,000 customers trusting BUSY, its GST automation and inventory management features help you save time and reduce errors, as seen in clients like Rachna Sagar Pvt. Ltd, who achieved smoother multi-branch management .

Conclusion

Managing GST compliance doesn’t have to be stressful.

As small business owners, you often grapple with the complexities and pressures of tax regulations, leading to mistakes and wasted time. A typical shortfall in efficiency can spiral into costly penalties and lost confidence, and it’s something I’ve faced myself.

Studies indicate that a staggering 59% of businesses face errors in tax calculations when relying on manual processes. This statistic highlights the necessity for a reliable solution to mitigate these risks effectively.

That’s where Vyapar comes in. Its intuitive interface automates invoicing, makes tax calculations hassle-free, and helps you improve your compliance with ease.

With success stories from over a crore Indian SMEs, Vyapar has proven itself as a powerful ally in easing GST management. If you’re ready to take action, start a free trial of Vyapar today.

By making this choice, you’ll streamline your processes, minimize errors, and regain valuable time to focus on growing your business, freeing you from unnecessary stress.