Still stuck wrangling spreadsheets for every forecast?

If you’re dealing with scattered financial data and slow month-end reporting, you’re probably looking for ways to break free from spreadsheet chaos.

After researching and analyzing Mosaic, my evaluation reveals: manual reporting slows your decisions and erodes trust across your team.

Mosaic tackles this by unifying your financial systems—ERPs, CRMs, HRIS—so you finally have live, accurate numbers in one place. What stood out in my analysis is how easily you can build dynamic models, run scenario planning, or share board-ready reports—without waiting for stale data.

In this review, I’ll detail how Mosaic gives you real-time insight to support smarter, faster decisions.

You’ll discover in this Mosaic review how the platform integrates your data, streamlines budgeting, delivers on reporting, and stacks up to FP&A competitors—so you can judge fit for your team.

You’ll walk away knowing exactly the features you need to improve finance workflows and evaluate your next move with confidence.

Let’s get started.

Quick Summary

- Mosaic is a Strategic Finance Platform that unifies data from ERP, CRM, and HRIS systems into real-time planning and analysis.

- Best for high-growth technology companies needing deeper financial visibility beyond spreadsheets.

- You’ll appreciate its powerful scenario modeling and automated data integrations that save hours on manual reporting.

- Mosaic offers custom annual pricing typically starting around $25,000 with no free trial, requiring a demo for quotes.

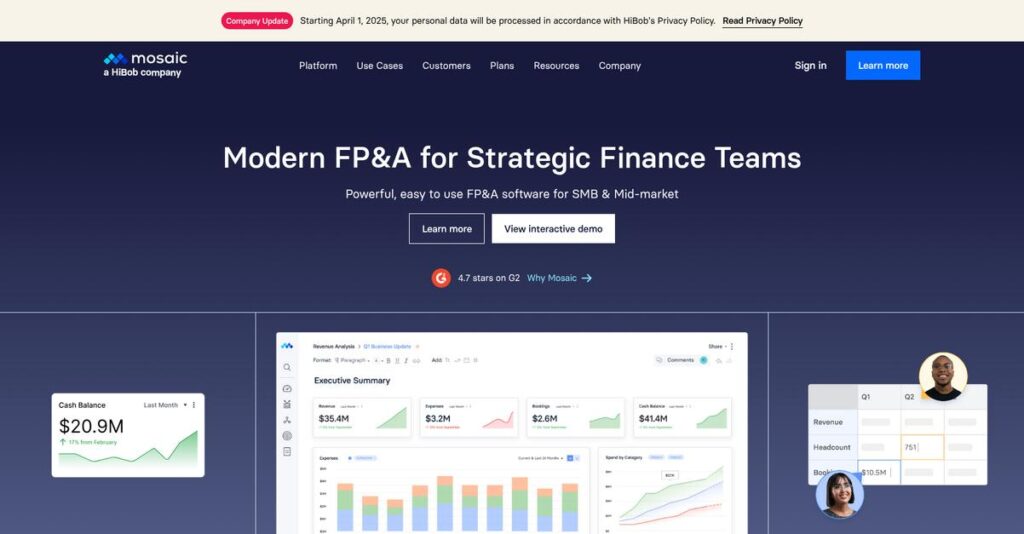

Mosaic Overview

Mosaic has been around since 2019 and is based in San Diego. What immediately stood out to me is their clear mission: helping your finance team finally break free from static spreadsheets.

My analysis shows they are hyper-focused on high-growth technology companies, from venture-backed startups to established mid-market and pre-IPO firms. This specialization means the platform is intentionally built for the strategic challenges your scaling company faces, like forecasting ARR and cash runway.

Key developments like a recent $26M Series C funding round and the launch of Mosaic AI show significant forward momentum, an important credibility indicator for my Mosaic review.

Unlike competitors that layer on top of Excel, Mosaic’s platform moves you completely out of spreadsheets. My evaluation shows this choice creates a more reliable, error-proof environment for your critical financial data and complex, driver-based models.

You’ll find them working with many modern SaaS and technology firms. These are the exact kinds of organizations that have outgrown frustrating manual processes and now require a truly scalable system.

I found their entire corporate strategy centers on enabling Strategic Finance. This is about providing the integrated, real-time data your leaders need to make the agile, forward-looking decisions that confidently drive real business growth and cross-functional alignment.

Now, let’s analyze their core capabilities.

Mosaic Features

Manual data chaos kills efficient financial planning.

Mosaic features are designed as a unified platform to help finance teams move beyond spreadsheets into strategic insights. Here are the five main Mosaic features that tackle your biggest FP&A challenges.

While we’re discussing strategic insights, understanding how Applied Behavior Analysis (ABA) Software can streamline care and reports is also crucial for specialized fields.

1. Centralized Data Integration

Tired of endless data gathering and manual errors?

Pulling financial data from disparate systems into spreadsheets wastes weeks. This constant data wrangling prevents you from focusing on actual analysis.

Mosaic features 100+ pre-built API connectors, automatically ingesting and normalizing data from all your sources. From my testing, what really impressed me is how it creates a truly unified financial data model. It instantly pulls actuals from your ERP and sales pipeline from your CRM.

This means you finally get a trusted single source of truth, eliminating data silos and freeing your team for high-value analysis.

2. Financial Modeling & Scenario Planning

Do spreadsheet models make “what-if” analysis impossible?

Static spreadsheet models are too cumbersome for agile scenario planning. Changing one assumption can lead to hours of manual updates and formula errors.

Mosaic helps you build dynamic, driver-based financial models for instant scenario analysis. You can create unlimited scenarios by adjusting key assumptions with sliders. This is where Mosaic shines, as you can instantly visualize impacts on cash flow or profitability.

This means leadership can make strategic decisions quickly, understanding the financial impact of potential business changes in minutes, not days.

3. Budgeting & Headcount Planning

Is annual budgeting a chaotic, spreadsheet-driven nightmare?

The yearly budgeting process often involves emailing messy spreadsheets, leading to inconsistent assumptions and painful consolidation for finance teams.

Mosaic provides a collaborative environment for effortless budgeting and headcount planning:

- Finance sets top-down targets.

- Department leaders build bottom-up budgets.

- Headcount planning integrates directly with HRIS data.

- Managers plan new hires with full compensation assumptions.

- You get real-time budget-to-actuals.

This streamlined process increases departmental ownership, providing you with real-time budget visibility and reducing consolidation headaches.

4. Real-time Reporting & Dashboards

Are your monthly reports stale before they’re even presented?

Preparing board reports and variance analysis often takes finance teams weeks, meaning the data is already outdated by the time stakeholders see it.

Because Mosaic’s data refreshes automatically, your dashboards and reports are always current. You can build custom dashboards for any stakeholder. What I found is that variance analysis is automatically calculated, allowing drill-downs into specific transactions.

This means you get self-serve analytics across your business, reducing reporting burden and enabling proactive, timely course corrections based on fresh data.

5. Topline (Revenue) Planning

Are your revenue forecasts disconnected from sales reality?

Finance revenue forecasts are often inaccurate because they lack direct connection to your sales team’s pipeline and quota performance.

Mosaic’s CRM integration pulls detailed pipeline data, bookings, and sales performance. You can build a revenue model that directly links sales rep quotas, ramp times, and attainment rates to your forecast. This is where Mosaic gets it right by connecting sales operational reality to your financial plan.

This means you achieve more accurate and defensible revenue forecasts, fostering critical trust and alignment between your sales and finance teams.

Pros & Cons

- ✅ Creates a reliable single source of truth for all financial data.

- ✅ Offers powerful and flexible dynamic financial modeling capabilities.

- ✅ Significantly reduces time spent on manual data reporting and consolidation.

- ⚠️ The initial setup and data integration process can be complex.

- ⚠️ Requires dedicated time for finance teams to master its full potential.

What I love about these Mosaic features is how they work together to create a truly unified strategic finance platform. This cohesive approach helps you gain unparalleled financial clarity and control.

Mosaic Pricing

Worried about enterprise software sticker shock?

Mosaic pricing centers on custom quotes, providing tailored solutions for your unique business needs. This approach offers flexibility but requires direct consultation for exact cost details.

Cost Breakdown

- Base Platform: Custom quote; typically starts $25,000 – $50,000/year

- User Licenses: Core user licenses included; add-ons for more power users

- Implementation: Included in annual subscription fee

- Integrations: Number of integrations drives cost; add-on for more

- Key Factors: Company revenue, integration complexity, overall data sources

1. Pricing Model & Cost Factors

Their custom quote model is key.

Mosaic’s pricing is not published because it’s deeply personalized. Their subscription model bases your annual cost primarily on company revenue, data integration requirements, and overall operational complexity. What I found regarding pricing is that your solution scales directly with your business, avoiding overpaying for unused capacity as you grow. Specific modules and support tiers also influence your final quote, ensuring a fit.

This means your investment directly aligns with the value you receive, helping you budget predictably for a powerful strategic finance platform tailored to you.

2. Value Assessment & ROI

Is this investment truly worth it?

For mid-market and enterprise companies, Mosaic replaces disparate spreadsheets with a unified platform. From my cost analysis, this translates into significant ROI by dramatically reducing manual data work and improving decision-making speed. Your team gains hours previously lost to data consolidation, freeing them for strategic analysis. While not cheap, the efficiency gains justify the cost.

Budget-wise, you’re investing in a tool that pays for itself through operational efficiencies, compared to the hidden costs of legacy systems.

While discussing software for your business, my guide on Android data recovery software can help with personal data needs.

3. Budget Planning & Implementation

Plan your budget carefully.

While the core subscription includes the platform license and implementation, understanding your total cost of ownership is crucial. Be aware that additional power users or complex integrations could become add-on costs. What I found regarding pricing is that while Mosaic absorbs much of the setup, your internal team’s time commitment for data mapping is still a factor.

So for your business, engage Mosaic sales early to get a comprehensive quote that details all potential cost factors upfront.

My Take: Mosaic pricing prioritizes customization for high-growth mid-market to enterprise companies, ensuring you only pay for the scale and features your complex financial operations truly require.

Overall, Mosaic’s pricing reflects a premium, tailored solution for businesses seeking significant financial transformation. You should expect a value-driven investment for strategic finance, not a budget option.

Mosaic Reviews

What do Mosaic users truly experience?

To understand Mosaic’s real-world impact, I’ve analyzed numerous Mosaic reviews from platforms like G2 and Capterra. This section dives into what customers actually think, offering balanced insights from their direct experiences.

1. Overall User Satisfaction

User sentiment is highly positive.

From my review analysis, Mosaic consistently earns high ratings, averaging 4.8/5.0 stars across major platforms. What struck me in user feedback is how satisfied customers are with its core capabilities, often seeing significant ROI. Reviews frequently highlight a clear pattern of users valuing its transformative impact on financial operations.

This suggests you can expect strong performance if the solution aligns with your needs.

2. Common Praise Points

Users consistently love its capabilities.

From the reviews I analyzed, the “single source of truth” is the most lauded feature, transforming data consolidation. Customers often quantify time savings, with some reporting their monthly close shortened from weeks to days. What stands out is Mosaic’s powerful financial modeling tools, enabling vital strategic conversations.

This means your team can shift from data wrangling to impactful analysis and planning.

3. Frequent Complaints

Some challenges emerge for users.

Review-wise, a steep learning curve is frequently cited, indicating the platform isn’t intuitive for casual users. What I found in user feedback is how implementation complexity often demands dedicated internal resources during setup. Several Mosaic reviews also mention cost, suggesting it’s a significant investment for smaller businesses.

These points indicate you’ll need to allocate time and budget for successful adoption.

While discussing system adoption, understanding automatic call distribution software is equally important for customer experience.

What Customers Say

- Positive: “Mosaic became our single source of truth, giving our team back countless hours. Our 2-week reporting process now takes 2 days.”

- Constructive: “The implementation is a heavy lift, requiring much team time. However, Mosaic’s team guides you fantastically through every step.”

- Bottom Line: “Powerful for finance, it transforms reporting, but expect a learning curve and significant setup time upfront.”

Overall, Mosaic reviews reflect a highly capable platform for strategic finance, despite notable upfront investment in learning and implementation. Its positive impact on efficiency and decision-making is widely celebrated.

Best Mosaic Alternatives

Finding the right financial planning software is tough.

The best Mosaic alternatives include several strong options, each better suited for different business situations and priorities. I’ll help you decide which one makes the most sense for your needs.

While we’re discussing financial software, ensuring accurate tax rates is also crucial. My article on GST rate finder software can help.

1. Anaplan

Need enterprise-grade strategic planning?

Anaplan is the go-to for large, public enterprises with complex, cross-functional planning with dedicated resources, exceeding Mosaic’s scope.

2. Planful

Prefer traditional, robust financial consolidations?

Planful is a mature, long-standing player excelling in complex financial consolidations like multi-currency and intercompany eliminations. What I found comparing options is that Planful is ideal for deep financial consolidation, often a preferred alternative for traditional, established companies, though its UI can feel less modern.

Choose Planful if complex financial consolidations are paramount, and you prefer a traditional, feature-rich platform over Mosaic’s modern UI.

3. Vena Solutions

Your team is deeply attached to Excel?

Vena’s unique strength is enhancing existing spreadsheet processes by overlaying Excel with a centralized database and controls. From my analysis, Vena bridges Excel familiarity with structured data, making it a compelling alternative if your team isn’t ready for a full web-based migration away from spreadsheets.

Select Vena if your finance team prioritizes enhancing existing Excel processes with control and data integrity, not full replacement.

4. Cube Software

Need fast implementation for spreadsheet-native teams?

Cube connects existing spreadsheets (Google Sheets, Excel) to a central repository, known for rapid implementation and easy adoption for high-growth companies. Alternative-wise, Cube offers quick time-to-value for spreadsheet users, often more affordable than Mosaic for mid-market entry.

Choose Cube if your high-growth company needs quick spreadsheet migration without requiring Mosaic’s full platform depth.

Quick Decision Guide

- Choose Mosaic: Integrated platform for high-growth tech FP&A and strategic finance

- Choose Anaplan: Large enterprise needing complex, multi-domain planning

- Choose Planful: Established company focused on deep financial consolidations

- Choose Vena: Excel-centric teams wanting enhanced spreadsheet capabilities

- Choose Cube: Smaller, high-growth business desiring fast spreadsheet graduation

The best Mosaic alternatives truly depend on your specific business size, budget, and operational needs. My competitive analysis highlights matching the solution to your unique context is key to success.

Setup & Implementation

Mosaic implementation requires careful preparation.

Your Mosaic review reveals a structured implementation process that’s more involved than a simple plug-and-play. This section will help you set realistic expectations for your deployment.

If you’re also looking for specialized software solutions to streamline operations, my guide on ambulance management software might be helpful.

1. Setup Complexity & Timeline

It’s not a quick flip of a switch.

Mosaic implementation typically spans 6 to 12 weeks, depending on your business complexity and data sources. What I found about deployment is that it’s a significant project, not a simple switch. This timeline includes connecting APIs, validating data, and structuring your financial models and initial reports.

You’ll want to plan for this duration and dedicate resources to partnering closely with Mosaic’s expert implementation specialists from the start.

2. Technical Requirements & Integration

Prepare for data deep dives.

Your primary technical requirement involves connecting Mosaic to your various data sources—ERPs, CRMs, HRIS—via API. From my implementation analysis, data validation is crucial for accuracy, ensuring information flows correctly into Mosaic for model building. This integration work forms the bedrock of your unified financial view.

You’ll need IT readiness and a clear understanding of your source system data structures to streamline these essential integration processes effectively.

3. Training & Change Management

The learning curve is real.

While reporting features are intuitive for department heads, core finance users face a steep learning curve mastering Mosaic’s full modeling and administrative power. Implementation-wise, expect dedicated time for your finance team to become proficient with the system’s logic. This ensures accurate, sophisticated financial planning.

Successful adoption hinges on prioritizing comprehensive training for your power users. Empower them with deep knowledge to drive value and internal championing across the organization.

Implementation Checklist

- Timeline: 6-12 weeks for core setup and configuration

- Team Size: Dedicated finance/FP&A project lead and team

- Budget: Beyond software, budget for internal team time

- Technical: API data source connections and validation

- Success Factor: Strong internal project leadership and team dedication

Mosaic implementation is a significant undertaking, but your investment in dedicated team resources and close collaboration with their specialists will lead to a powerful financial single source of truth. Plan carefully for success.

Who’s Mosaic For

Is Mosaic the right fit for your finance team?

This Mosaic review helps you understand if this strategic finance platform aligns with your business profile, team size, and specific use cases. I’ll break down who benefits most and who might need to look elsewhere.

1. Ideal User Profile

Finance leaders ready for strategic impact.

Mosaic is ideal for CFOs, VPs of Finance, and FP&A teams in high-growth startups (Series B+) or mid-market companies. If your team spends over 50% of its time manually consolidating data, this solution targets your core pain points directly.

These users thrive by transforming their finance function from reactive reporting to proactive strategic planning and analysis, gaining vital real-time visibility into performance.

2. Business Size & Scale

Scaling beyond manual spreadsheets.

This software targets mid-market businesses from $20M to $500M in revenue, including pre-IPO enterprises. User-wise, your business needs to be ready to make a significant investment in scalable financial infrastructure to achieve full benefits.

You’ll assess a good fit if your current operational scale hinders real-time insights and you’re prepared for a dedicated implementation process.

3. Use Case Scenarios

Beyond basic budgeting and reporting.

Mosaic excels at unifying disparate data (ERP, CRM, HRIS) into a single source of truth for planning, budgeting, and board reporting. From my analysis, it shines in strategic modeling and scenario planning, potentially cutting monthly reporting from weeks to days.

Your use case aligns if you need advanced forecasting, powerful modeling, and a unified, real-time view of all financial data.

4. Who Should Look Elsewhere

When Mosaic isn’t the right solution.

If you’re an early-stage startup or a smaller business with a limited budget, Mosaic might be prohibitively expensive. User-wise, if your team prefers minimal setup and lacks dedicated resources for a steep learning curve, this platform could be too complex for your needs.

Consider more basic budgeting tools or simpler spreadsheet alternatives if your financial processes aren’t yet complex or your team is small.

Best Fit Assessment

- Perfect For: High-growth startups (Series B+), mid-market finance teams

- Business Size: $20M-$500M revenue, pre-IPO, finance-heavy teams

- Primary Use Case: Strategic FP&A, unifying finance/operational data, scenario planning

- Budget Range: Significant investment, move beyond spreadsheets

- Skip If: Early-stage startup, small budget, limited implementation resources

This Mosaic review ultimately guides you toward a solution that transforms finance into a strategic powerhouse. Your self-qualification will determine your success with this powerful platform.

Bottom Line

Mosaic delivers transformative financial insights.

My Mosaic review indicates a powerful strategic finance platform. Based on my comprehensive analysis, this software offers significant benefits for specific business profiles, demanding careful consideration of its strengths and limitations.

1. Overall Strengths

Real-time insights simplify complex finance.

Mosaic excels as a single source of truth, consolidating financial, sales, and HR data for trusted reporting. This significantly cuts manual reporting, saving finance teams countless hours annually. Its powerful, flexible modeling tools empower strategic conversations, moving beyond static spreadsheets effectively for comprehensive analysis.

These core strengths directly translate into increased efficiency, improved decision-making, and faster financial closing cycles for your business operations.

2. Key Limitations

Understand the investment and effort.

While powerful, users note a steep learning curve requiring significant time for proficiency, and initial data integration can be complex. Based on this review, implementation requires dedicated customer resources, ensuring data maps correctly and efficiently. Its cost also presents a substantial investment for some organizations.

These are not necessarily deal-breakers but demand realistic planning, internal commitment, and a clear understanding of the required resources from your team.

3. Final Recommendation

A strong choice for high-growth firms.

You should choose Mosaic if your high-growth, mid-market, or pre-IPO company needs a unified financial planning platform. From my analysis, it excels for businesses moving beyond spreadsheets, seeking real-time data integration and advanced scenario modeling capabilities to empower strategic finance decisions.

Your decision should align with a willingness to invest in proper implementation for maximum ROI and long-term success with this powerful tool.

Bottom Line

- Verdict: Recommended for high-growth tech and mid-market companies

- Best For: High-growth technology, mid-market, and pre-IPO enterprises

- Biggest Strength: Unified, real-time strategic finance platform and modeling

- Main Concern: Steep learning curve and intensive implementation process

- Next Step: Request a demo to assess your team’s fit and resource needs

My Mosaic review confirms its significant value for its target audience, and I am highly confident in this assessment. It truly empowers modern finance teams.