Struggling to make sense of disjointed financial data?

If you’re juggling spreadsheets, news feeds, and half-baked charting tools, real analysis gets buried in busywork. You’re likely here because finding a cost-effective platform with institutional-grade analytics isn’t easy.

My research shows: manual data work is killing real analysis time for anyone who needs fast, trustworthy market insights each day.

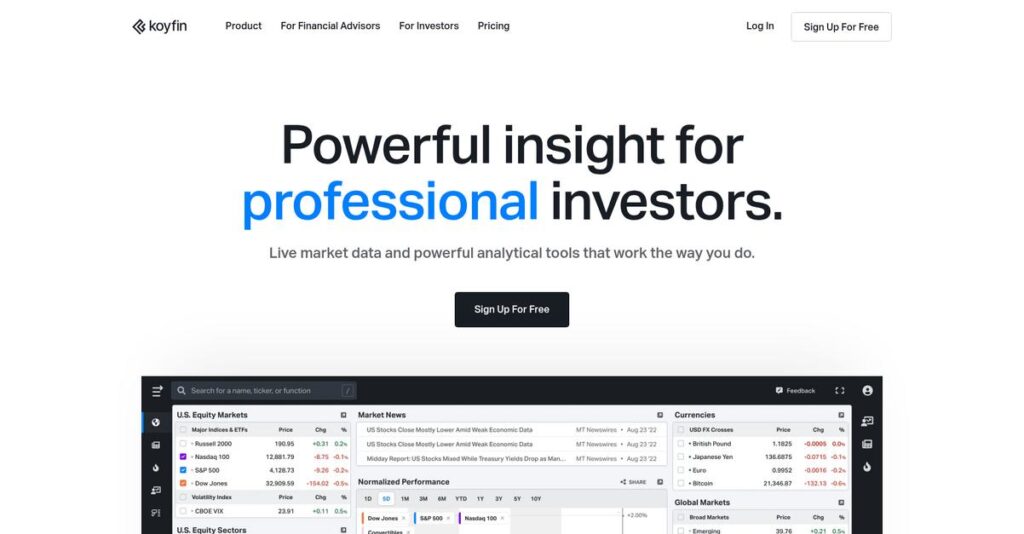

After analyzing Koyfin’s platform, I saw how much it cuts through the complexity—offering advanced charting, customizable dashboards, and live financial modeling, all in one clean interface. Their brokerage aggregation and global macro dashboards deliver a full picture without the Bloomberg price tag.

In this review, I’ll walk you through how Koyfin actually saves your research hours while delivering professional-grade depth.

You’ll see what I found about their key features, transparent pricing, and the pros and cons versus alternatives in this Koyfin review to clarify your decision.

You’ll leave knowing the features you need to finally ditch patchwork tools and build real investment confidence.

Let’s dive into the analysis.

Quick Summary

- Koyfin is a financial data and analytics platform offering advanced charting, customizable dashboards, and integrated portfolio tools for deep equity analysis.

- Best for individual investors, financial advisors, and smaller funds seeking professional-grade tools without the high cost of institutional terminals.

- You’ll appreciate its customizable dashboards and powerful charting that let you visualize market and fundamental data in one place efficiently.

- Koyfin offers a freemium model with paid plans starting at $39/month and a 7-day free trial for all subscriptions.

Koyfin Overview

Based in New York, Koyfin has been around since 2016. What impressed me most is their clear mission: giving you the powerful, institutional-grade financial data tools.

My analysis shows they specifically target individual investors, financial advisors, and smaller investment funds who can’t justify a Bloomberg. They really shine by serving the ambitious ‘prosumer’ investor market with powerful, yet genuinely affordable, analytics.

I found their recent $10 million funding round is fueling serious data expansion and new portfolio tools, a key development I noted for this Koyfin review.

Unlike complex institutional platforms, Koyfin feels built by people who actually do this analysis. From my evaluation, they deliver institutional power without the institutional price, which is the core value proposition you need to consider.

You’ll find them working with a growing base of sophisticated retail investors, financial advisors, and research analysts who have clearly outgrown the free, basic charting tools.

From what I’ve seen, Koyfin’s strategy is laser-focused on bridging the vast gap between simplistic free tools and six-figure terminals. Their priority is becoming your command center for serious, non-institutional financial analysis.

Now let’s examine their core capabilities.

Koyfin Features

Overwhelmed by scattered financial data?

Koyfin offers powerful, integrated financial data and analytics capabilities, designed to bring institutional-grade insights to your desktop. These are the five core Koyfin solutions that address common financial analysis challenges.

Before diving deeper, you might find my analysis of best anti spyware software helpful for safeguarding your information.

1. Advanced Financial Charting

Basic charts just aren’t cutting it?

Relying on simple graphs leaves you missing crucial context. You need deeper insights to make confident investment decisions quickly and easily.

Koyfin’s charting gives you institutional-level visualization, overlaying technicals with fundamentals. From my testing, plotting P/E ratios directly on price charts dramatically simplifies valuation analysis. This powerful solution helps you visually correlate market performance with business fundamentals.

This means you can quickly identify trends and valuation extremes, making complex data digestible without tedious spreadsheet work.

2. Custom Dashboards

Is your research workflow inefficient?

Juggling multiple screens or tabs to gather data wastes precious time. You need a centralized, custom view of your key metrics for streamlined analysis.

Koyfin’s custom dashboards allow you to build personalized views with drag-and-drop modules. What I love about this solution is how you can consolidate charts, watchlists, and news feeds into a single, cohesive workspace. This helps you surface relevant data automatically.

The result is a highly efficient research environment, tailored exactly to your unique workflow, saving significant time daily.

3. Financial Analysis & Modeling Tools

Tired of manual data entry for models?

Pulling financial statements into spreadsheets is error-prone and tedious. You spend more time on data gathering than on actual insightful analysis.

Koyfin streamlines financial analysis, offering decades of detailed statements and powerful in-platform modeling. This is where Koyfin gets it right by letting you:

- Access as-reported and standardized financials

- Create custom formulas within the platform

- Build real-time DCF models This robust solution dramatically cuts down on prep work.

You drastically reduce time spent on data gathering and model building, allowing you to focus on high-value analytical insights.

4. Global Macro & Market Dashboards

Losing sight of the big market picture?

Getting a comprehensive view of global economic data and sector performance from one source is challenging. You miss crucial market context.

Koyfin provides pre-built dashboards for monitoring global markets and macro trends. From my evaluation, the ability to view sector heatmaps and track factor performance against individual equities is particularly insightful. This solution helps you understand broader market drivers.

This enables top-down analysis, helping you understand the macroeconomic forces driving market movements and informing your asset allocation decisions.

5. News, Transcripts, and Filings Search

Sifting through endless financial documents?

Manually searching press releases or earnings call transcripts for specific keywords is a major time drain for any analyst. You need speed.

Koyfin aggregates real-time news, but its standout feature is the powerful search for transcripts and filings. Here’s what I found during testing: you can search keywords across thousands of transcripts simultaneously. This key solution saves hours of manual reading.

You quickly find management commentary on key topics across an entire industry, invaluable for competitive analysis and spotting emerging trends.

Pros & Cons

- ✅ Institutional-grade data at an affordable price point.

- ✅ Highly customizable dashboards and powerful charting capabilities.

- ✅ Automated financial modeling drastically saves your valuable time.

- ⚠️ Occasional data loading or chart rendering delays reported by users.

- ⚠️ New users face a significant learning curve to master all features.

What I love about these Koyfin solutions is how they seamlessly work together, creating a truly integrated research platform. This cohesive environment empowers you to connect financial data and insights efficiently.

Koyfin Pricing

Pricing transparency is crucial for your budget.

Koyfin pricing offers a transparent freemium model with clear tiered subscriptions, designed to provide institutional-grade financial data without the prohibitive costs of legacy terminals. You’ll find options to suit various user needs.

| Plan | Price & Features |

|---|---|

| Free | $0 • Basic charting • End-of-day pricing data • Limited financial statement history (2 years) • Company snapshots & market dashboards |

| Basic | $39/month (billed annually) or $49/month (billed monthly) • Real-time US stock prices • Extended financial data history (10 years) • Advanced charting tools • Basic news feed |

| Plus | $79/month (billed annually) or $99/month (billed monthly) • Earnings & conference call transcripts • Comprehensive SEC filings • Portfolio analytics (brokerage linking) • Custom dashboards & global data |

| Pro | $119/month (billed annually) or $149/month (billed monthly) • Powerful custom formula features • Extensive macroeconomic data sets • Advanced financial modeling tools • Priority support |

| Enterprise | Custom pricing – contact sales • All Pro features • Team management & API access (in development) • Dedicated support & bespoke solutions |

While discussing various software capabilities, you might also find my guide on best PIM software helpful for managing product data.

1. Value Assessment

Significant value for your investment.

From my cost analysis, Koyfin delivers professional-grade data that was once exclusive to five-figure terminals, now at a fraction of the price. What I found regarding pricing is how it democratizes access, enabling serious analysis without breaking your budget, providing tools previously out of reach for individual investors.

This means your investment in Koyfin provides substantial ROI by equipping you with powerful tools for smarter, data-driven financial decisions, offering clear budget benefits.

2. Trial/Demo Options

Evaluate before you commit.

Koyfin offers a practical 7-day free trial across all its paid plans, allowing you to thoroughly test features like real-time data, transcript search, and custom dashboards. What I found is this trial helps you assess true value before committing to their full pricing structure, ensuring fit for your analytical needs.

This lets you effectively gauge the platform’s utility and ensure it meets your specific analytical requirements, reducing the risk for your budget.

3. Plan Comparison

Choose the perfect plan for you.

For most serious individual investors, the Plus plan is the sweet spot, unlocking critical features like transcript search and comprehensive portfolio analytics. Budget-wise, the Pro plan offers comprehensive pricing for professionals needing advanced modeling and extensive macroeconomic data, essential for deep dive analysis.

This tiered approach ensures you match Koyfin’s powerful capabilities to your actual usage, optimizing your budget for maximum analytical impact and long-term value.

My Take: Koyfin’s pricing strategy effectively democratizes professional financial tools, offering clear tiers that scale with user needs from serious individuals to RIA’s. It’s a compelling, cost-effective alternative to expensive legacy platforms.

Overall, Koyfin’s pricing model is remarkably transparent, providing exceptional value for professional-grade financial data. This offers unparalleled access to powerful financial intelligence without the prohibitive costs.

Koyfin Reviews

What do real Koyfin users say?

My analysis of Koyfin reviews reveals a consistent story about user experiences. I’ve sifted through actual feedback to present what customers truly think, highlighting both their praises and their pain points.

While we’re discussing comprehensive analysis, understanding how to manage legal documents with contract analysis software is equally vital.

1. Overall User Satisfaction

Users find impressive value.

From my review analysis, Koyfin users consistently laud its truly exceptional value proposition. They feel they’re getting institutional-quality tools at an accessible price, often citing it provides 80% of a Bloomberg Terminal’s functionality for less than 2% of the cost. Reviews overwhelmingly reflect high satisfaction.

This strong sentiment indicates Koyfin successfully democratizes professional-grade financial data. You can expect powerful tools for serious analysis previously reserved for expensive institutional platforms.

2. Common Praise Points

Key features win users over.

Users consistently praise Koyfin’s powerful customization options, particularly the ability to create tailored dashboards and charts. From the reviews I analyzed, the intuitive data visualization capabilities stand out, making complex financial information easy to grasp and understand. Value for money is also a constant theme.

This means you can expect a highly adaptable platform for your specific workflow, saving significant time and enhancing your analytical depth effectively.

3. Frequent Complaints

Some common frustrations emerge.

What I found in user feedback reveals occasional data speed or loading lags, especially for lower-tier users. Some reviews mention a learning curve for new users, particularly mastering custom formulas. The absence of certain niche data sets also comes up sometimes in user feedback.

These issues generally seem minor trade-offs for the price, rather than deal-breakers, especially if you manage expectations regarding ultra high-speed data.

What Customers Say

- Positive: “Koyfin is an indispensable tool. It’s the closest thing you can get to a Bloomberg Terminal without paying $25k per year.”

- Constructive: “The platform can be a bit slow to load at times, especially with multiple complex charts. For the price, it’s a minor inconvenience.”

- Bottom Line: “For serious investors, Koyfin delivers immense power and value, an essential tool despite minor performance quirks for the price.”

Overall, Koyfin reviews paint a picture of highly satisfied users. My analysis indicates its value proposition is a genuine differentiator, making professional-grade tools accessible despite a few common, minor frustrations.

Best Koyfin Alternatives

Considering other financial data platforms?

The best Koyfin alternatives offer distinct strengths, helping you choose based on specific financial goals, professional requirements, and your individual budget.

1. Bloomberg Terminal

Need unparalleled institutional-grade data?

Bloomberg Terminal excels where cost is no object and you require the absolute broadest, deepest, and most real-time data coverage across all asset classes, including obscure private markets. From my competitive analysis, Bloomberg delivers a complete ecosystem for professionals, far surpassing Koyfin’s focus on equity and macro data.

Choose Bloomberg if your workflow demands proprietary news, secure communication, and complex execution services for large-scale operations.

2. YCharts

Focused on client-facing financial reporting?

YCharts shines for financial advisors prioritizing client reporting and seamless integration with Excel for in-depth analysis. What I found comparing options is that YCharts provides more robust client report generation capabilities than Koyfin’s more general data visualization tools.

Consider this alternative when your primary need is creating polished, customizable client-ready PDF reports directly from your financial data.

3. Seeking Alpha Premium

Seeking investment ideas and qualitative analysis?

Seeking Alpha Premium is a strong alternative if your priority is uncovering investment ideas and benefiting from extensive crowdsourced research and detailed qualitative analysis. Alternative-wise, Seeking Alpha offers deep expert-driven insights that complement Koyfin’s raw data and quantitative tools.

Choose Seeking Alpha when your decision-making leans heavily on fundamental research narratives rather than pure data charting.

Quick Decision Guide

- Choose Koyfin: Powerful, affordable data and analytics for prosumers

- Choose Bloomberg Terminal: Unmatched depth and ecosystem for institutional users

- Choose YCharts: Strong Excel integration and client reporting for advisors

- Choose Seeking Alpha Premium: Rich qualitative analysis and investment idea generation

While we’re discussing various software needs, understanding patient registration software is equally important for those in healthcare.

The best Koyfin alternatives really depend on your specific use case and budget considerations more than just feature parity.

Setup & Implementation

Worried about a lengthy software rollout?

Our Koyfin review shows a refreshing deployment. It’s largely a self-service setup, meaning your implementation effort focuses on user configuration, not heavy technical lifts. Set realistic expectations here.

1. Setup Complexity & Timeline

Getting started is truly simple.

As a web-based SaaS, Koyfin has no software to install. The main “implementation” effort is user-side: configuring watchlists, custom dashboards, and learning charting. What I found about deployment is this takes hours to a few days for most users to become fully comfortable.

You’ll want to allocate dedicated user time for personalization and mastering tools, ensuring early productivity gains from your efforts.

2. Technical Requirements & Integration

Minimal tech, maximum access.

Technical requirements are straightforward: a modern web browser and a stable internet connection are all you need. Performance is best on a desktop with a large screen for data-rich dashboards. Implementation-wise, this avoids significant IT overhead typical with legacy financial terminals.

Ensure your team has reliable internet and adequate screen real estate for optimal data visualization and workflow to get started.

3. Training & Change Management

User adoption: where the work begins.

Koyfin provides a help center with articles and video tutorials. However, user reviews point to a moderate learning curve to unlock full potential. From my implementation analysis, mastering advanced features requires dedication, especially custom formulas and dashboard configuration.

Plan for dedicated training time beyond basic navigation to empower users to leverage Koyfin’s powerful analytics capabilities fully.

4. Support & Success Factors

Support smooths the journey.

Support is via email and chat, with priority for Pro plan users. General feedback is positive, reporting helpful and timely responses. What I found about deployment is that proactive use of help resources aids adoption and speeds up issue resolution during your implementation phase.

Utilize the provided help center and engage support early for any advanced setup queries, ensuring a smoother rollout process.

Implementation Checklist

- Timeline: Hours to a few days for core setup; weeks for mastery.

- Team Size: Individual users for configuration; minimal IT for connectivity.

- Budget: Primarily user time for learning and dashboard setup.

- Technical: Modern web browser, stable internet, large monitor.

- Success Factor: User dedication to exploring and customizing dashboards.

Overall, Koyfin implementation is highly accessible for most users and businesses. Its web-based nature and self-service model mean quick value realization with minimal technical barriers. Effort focuses on user-side customization.

Who’s Koyfin For

Koyfin fits precise financial analysis needs.

This Koyfin review analyzes who truly benefits from its robust financial data and analytics. I’ll help you quickly determine if this software perfectly matches your business profile, team size, and specific use case requirements.

1. Ideal User Profile

Sophisticated investors and financial analysts.

Koyfin is perfect for financially literate individuals, prosumers, and analysts at small-to-mid-sized hedge funds or family offices. What I found about target users is that it bridges the gap from free tools to institutional capabilities without prohibitive cost. Your team benefits from professional charting.

You’ll excel if you need deep equity analysis, robust data visualization, and streamlined financial modeling without breaking your budget.

2. Business Size & Scale

Small-to-mid-sized financial operations.

This platform best serves smaller investment funds, RIAs, and individual investors who can’t justify high-end terminal expenses. What I found about target users is that teams under 50 employees find significant value in its features without needing enterprise IT support or complex integrations.

You’ll know it’s a good fit if you’re a lean financial operation seeking powerful data at an accessible price point.

3. Use Case Scenarios

Deep equity research and market tracking.

Koyfin excels for tasks like in-depth stock analysis, building custom dashboards for portfolio tracking, and visualizing complex financial data. From my analysis, the software shines in data visualization and customization, allowing you to tailor insights to your investment strategies and reporting needs.

You’ll find this works well if your primary need is efficient data gathering, professional charting, and tracking macro trends.

4. Who Should Look Elsewhere

Not for niche data or specific networks.

If your primary need involves niche data, such as extensive fixed-income or obscure international markets, Koyfin might fall short. What I found about target users is that it lacks certified communication networks or deep Excel-centric workflow, which larger institutions often require.

Consider specialized terminals or data providers if your operations demand highly specific, non-equity-focused datasets or robust qualitative idea generation.

Best Fit Assessment

- Perfect For: Financially literate investors and analysts needing professional-grade data

- Business Size: Sophisticated individual investors to small-to-mid-sized financial firms

- Primary Use Case: Deep equity analysis, data visualization, and portfolio tracking

- Budget Range: Cost-effective alternative to expensive institutional terminals

- Skip If: Need niche data (e.g., fixed income) or certified communication networks

This Koyfin review ultimately reveals its ideal users are those seeking powerful, cost-effective financial insights. Your success hinges on matching its strengths to your specific analytical needs and budget constraints.

Bottom Line

Koyfin delivers exceptional financial data value.

My Koyfin review concludes that it’s an indispensable tool for serious investors. This final assessment will guide your decision, highlighting where it excels and where alternative considerations might be necessary.

1. Overall Strengths

Koyfin excels at democratizing financial data.

The platform’s standout strength is its remarkable value for money, providing institutional-grade analytics at a fraction of the cost of legacy terminals. Its powerful customization and data visualization features empower users to tailor dashboards and charts for deep, personalized analysis, a true game-changer.

These strengths translate into significant analytical power, accelerating your research and decision-making and democratizing access to top-tier financial insights.

2. Key Limitations

However, Koyfin isn’t without its caveats.

Some users, especially on lower tiers, report occasional data loading lags and a steeper learning curve to master all features, particularly the custom formula builder. While robust, niche data sets can sometimes be missing compared to extremely expensive, comprehensive terminals like Bloomberg.

These limitations are generally manageable trade-offs, but they warrant consideration if real-time speed or ultra-specific data are paramount for your operations.

While we’re discussing operational considerations, understanding quality management software is equally important for data accuracy and streamlined processes.

3. Final Recommendation

My recommendation for Koyfin is clear.

You should choose Koyfin if you are an individual investor, financial advisor, or SMB fund seeking powerful financial analytics without the exorbitant cost. It’s ideal for serious fundamental analysis and custom dashboard creation, offering 80% of a Bloomberg Terminal for a fraction of the price.

Your decision should prioritize value, robust charting, and customization. My confidence in this recommendation is high, especially for those prioritizing affordability and deep analytical power.

Bottom Line

- Verdict: Recommended

- Best For: Individual investors, financial advisors, and SMB investment funds

- Biggest Strength: Institutional-grade data and analytics at an accessible price

- Main Concern: Occasional data lags and a moderate learning curve

- Next Step: Try the free trial or request a demo

This Koyfin review demonstrates outstanding value for serious financial analysis, making it a compelling alternative to high-cost terminals. I highly recommend it.