Are your systems disconnected during a crisis?

It’s a huge challenge when your current tools can’t provide real-time risk insights or integrate with your existing IT infrastructure.

Worse, you’re pressured to prove ROI while navigating strict compliance rules, making any new software choice a high-stakes decision for your institution.

Choosing the wrong tool doesn’t just waste budget. It can lead to long-term operational disruptions that put the entire business in a vulnerable position.

But finding the right platform doesn’t have to be a gamble when you can focus on your specific needs.

In this article, I’ll guide you through the best business continuity management software designed to integrate systems and deliver critical risk insights for your team.

You will learn how to identify solutions that automate reporting, ensure regulatory adherence, and centralize your planning for a more resilient operation.

Let’s get started.

Quick Summary:

| # | Software | Rating | Best For |

|---|---|---|---|

| 1 | Fusion Risk Management → | Large financial institutions | |

| 2 | Everbridge → | Financial institutions needing fast response | |

| 3 | LogicManager → | Mid-sized financial institutions | |

| 4 | Riskonnect → | Financial institutions needing unified risk | |

| 5 | Noggin → | Mid-sized regulated institutions |

1. Fusion Risk Management

Struggling with fragmented business continuity plans?

Fusion Risk Management offers the Fusion Framework System, a solution to transform your manual plans into dynamic, actionable data for streamlined business continuity.

This allows you to quickly import your existing plans, freeing your team to focus on optimizing strategies, not just data collection.

So, how can you achieve true operational resilience?

Fusion Framework System acts as an enterprise software for resilience, enabling proactive continuity strategies. It offers intuitive, visual, and interactive ways to analyze your business, helping you identify friction points, single points of failure, and key risks. You can also test scenarios at scale to predict where you might break during disruptions. Plus, its robust integration capabilities bring data from anywhere to empower your entire team, creating a unified view of your organization’s operations for better decision-making and DORA compliance. The result is a more resilient organization that anticipates, prepares, and responds confidently.

Speaking of compliance, my article on best contract analysis software explores how to master compliance and mitigate risk effectively.

Key features:

- Fusion Framework System: Centralizes business operations, providing a single integrated dashboard to dynamically see interconnections and identify risks.

- BC Plan inFusion: Quickly imports manual business continuity plans, transforming them into dynamic, actionable data for efficient plan optimization.

- Integrations & Scenario Simulation: Gathers data from various sources to empower teams and allows for large-scale testing to foresee and mitigate potential disruptions.

Fusion Risk Management features, pricing, & alternatives →

Verdict: Fusion Risk Management provides a robust, integrated platform essential for IT directors and risk managers in financial institutions. Its unique ability to import existing plans, offer real-time risk insights, and support DORA compliance makes it a top contender for the best Business Continuity Management Software.

2. Everbridge

Are you struggling with fragmented risk insights and slow responses?

Everbridge’s High Velocity Critical Event Management (CEM) platform helps you connect disparate systems for comprehensive visibility.

This means you can proactively monitor physical and digital threats, like IT disruptions or DORA compliance issues, ensuring your organization stays ahead of potential risks.

It’s time to transform your approach.

Everbridge 360™ provides a comprehensive, user-friendly solution for managing critical events, optimizing responses and minimizing communication delays. You’ll gain real-time insights to detect threats with advanced business continuity planning and leading risk intelligence, all powered by Purpose-built AI. This allows for seamless, one-click automation from emergency communications to clear instructions, keeping your people safe.

Additionally, Everbridge helps you improve continuously with AI-powered after-action reports, response analytics, and interactive dashboards. These features empower you to turn data into insights, strengthening your organizational resilience for the future.

This helps you gain a business resilience advantage.

Key features:

- Purpose-built AI: Empowers faster, smarter decisions by providing real-time insights to detect threats to your people and operations.

- High Velocity CEM Platform: Delivers full lifecycle automation, from proactive monitoring and planning to rapid incident response and continuous improvement.

- Comprehensive Risk Intelligence: Proactively monitors and visualizes risk, including cybersecurity, inclement weather, and operational disruptions.

Everbridge features, pricing, & alternatives →

Verdict: Everbridge stands out as the best business continuity management software for financial institutions needing integrated systems and real-time risk insights. With its High Velocity CEM platform delivering 358% ROI and enabling 15x faster response times, it directly addresses critical challenges like regulatory compliance and operational resilience.

3. LogicManager

Struggling to integrate systems for real-time risk insights?

LogicManager serves as your central hub, bridging insights from the front line to the boardroom. This empowers your business by uncovering hidden risks and recommending controls, directly addressing your integration and insight needs.

It also tackles your pain points around information overload and compliance, ensuring critical insights reach decision-makers. You’ll gain cross-functional visibility and cohesive risk management.

This means better outcomes.

LogicManager provides AI-powered, tailored solutions that go beyond simple feature lists. Their Risk Ripple Intelligence uncovers hidden risks and connections, ensuring every action drives smarter decisions and improves your business performance. You can spot risks siloed in specific departments before they escalate, preventing them from becoming larger issues that ripple across your organization. Additionally, the Risk Maturity Model (RMM) facilitates corporate governance by promoting a two-way conversation with your board, providing benchmarking KPIs against industry standards, actionable steps to improve your risk program, and ready-to-deliver reports for your board.

This comprehensive approach saves valuable time.

Key features:

- AI-powered Risk Ripple Analytics: Uncovers hidden and siloed risks, predicts ripple effects, and enhances collaboration across departments for comprehensive risk visibility.

- Centralized Risk Management Hub: Links insights from the front line to the boardroom, connecting departments and vendors to recommend controls and ensure regulatory adherence.

- Risk Maturity Model (RMM): Provides board-ready reporting, benchmarks KPIs against industry standards, and offers actionable steps to improve your risk program.

LogicManager features, pricing, & alternatives →

Verdict: LogicManager is uniquely positioned as the best business continuity management software for mid-sized financial institutions due to its holistic approach. It addresses critical needs like integrating systems, delivering real-time risk insights, and automating compliance reporting, making it ideal for demonstrating resilience ROI to executives.

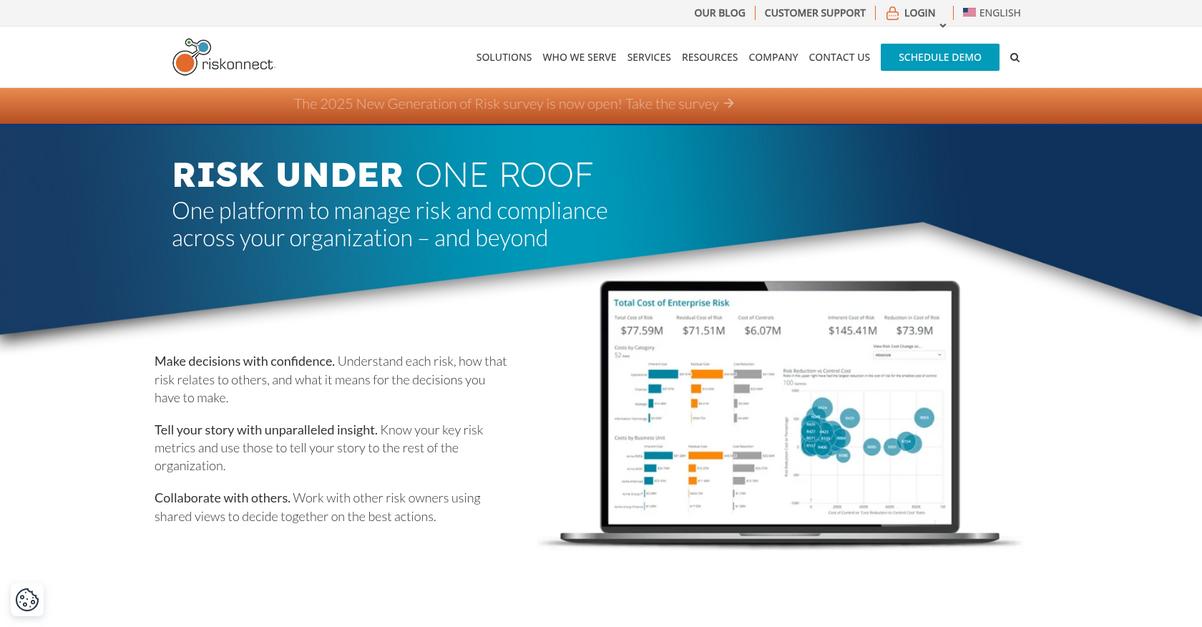

4. Riskonnect

Are you struggling with fragmented risk data?

Riskonnect provides a unified platform to manage risk and compliance, helping you make confident decisions. This means you understand each risk and its interconnectedness across your organization.

You’ll gain unparalleled insight into key risk metrics, empowering you to tell a compelling story to your organization. The platform also enables collaboration through shared views.

Here’s how you can connect the dots.

Riskonnect’s integrated approach unifies diverse risk elements, from Business Continuity Management to IT Risk Management, on one platform. This allows you to start anywhere and expand everywhere.

Their Intelligent Risk capabilities go beyond basic AI, transforming your risk decisions through advanced technology and analytics. You can automate tasks, uncover risk correlations, and aggregate data with speed and precision.

It offers AI-driven tools for contextual insights, advanced analytics and machine learning for predictive outcomes, and intuitive dashboards with KPIs for real-time guidance. This comprehensive view ensures you stay ahead.

The result is a complete, never-before-seen view of your risk.

While understanding risk is critical, effectively communicating insights is also vital. Explore my guide on best writing tools to enhance your content quality.

Key features:

- Integrated Risk Management Platform: Unifies business continuity, governance, compliance, and IT risk management, centralizing your risk data for a holistic view.

- Intelligent Risk Capabilities: Leverages AI, advanced analytics, and machine learning to automate tasks, identify risk correlations, and predict future outcomes.

- Collaborative Decision-Making: Provides shared views and intuitive dashboards, enabling various risk owners to work together and make informed decisions collectively.

Riskonnect features, pricing, & alternatives →

Verdict: Riskonnect stands out as the best business continuity management software for financial institutions due to its integrated platform, unifying business continuity with IT risk and compliance. This helps IT directors and risk managers gain a comprehensive, real-time understanding of risks, reducing recovery times and ensuring regulatory adherence with confidence.

5. Noggin

Are your systems truly resilient to disruption?

Noggin provides an integrated resilience workspace, unifying 10 core solutions into one easy-to-use software platform. This means you can manage everything from business continuity to security from a single location.

With Noggin, you get a comprehensive and holistic approach to resilience, facilitating crucial collaboration. This helps your team effectively protect what matters and strengthen resilience.

Here’s how you can simplify resilience.

Noggin solves the problem of disparate systems by integrating operational risk, business continuity, and incident management into one unified platform. This integrated approach ensures consistent information flow and streamlined workflows, reducing manual effort and improving decision-making.

You can streamline essential workflows for planning and response, unlocking critical insights to keep stakeholders informed. The platform helps you comply with international standards like ISO 22301 and NIMS, crucial for regulated industries. Additionally, its “no-code” designers empower you to easily customize workflows, notifications, and dashboards to fit your specific needs, without IT dependency.

It also includes a vast library of over 275 pre-configured modules and 25,000 objects. This library, built on best-practice standards, provides ready-to-use templates for various scenarios, enabling quicker deployment and ensuring your plans are robust and current.

The result is truly simplified resilience.

Before diving deeper, you might find my analysis of best audience response software helpful.

Key features:

- Integrated Resilience Workspace: Unifies ten core solutions, including business continuity, operational resilience, and risk management, into one platform for holistic control.

- No-Code Customization: Empowers you to easily create custom workflows, dashboards, and forms, or build new modules to address unique business requirements.

- Best Practice Library & Standards Compliance: Offers over 275 pre-configured modules and 25,000 objects based on industry best practices, supporting compliance with key international standards like ISO 22301.

Noggin features, pricing, & alternatives →

Verdict: For IT directors and risk managers at mid-sized financial institutions, Noggin stands out as the best business continuity management software. Its integrated, customizable, and standards-compliant platform helps simplify complex risk and continuity needs, ensuring regulatory adherence and enhanced resilience. Noggin was recently ranked the #1 operational resilience software platform by Verdantix.

6. SAI360

Struggling with fragmented risk and compliance systems?

SAI360 offers an integrated platform, unifying governance processes for a holistic approach to GRC. This means you can centralize business continuity, risk, and compliance.

This helps you break down silos, connecting compliance management, risk management, and policy administration. It’s like having all your GRC insights in one place.

So, how do you gain real-time risk insights?

SAI360 tackles information overload by unifying governance processes across functions. You get a single pane of glass for critical business processes, potential risks, and impacts.

This allows you to leverage risk insights and behavioral analytics, helping you adapt to new risks and regulations. It simplifies complexities and keeps you on top of changing regulations, ensuring you can demonstrate resilience ROI to executives.

Plus, with over 20 configurable modules, you can shape a program tailored to your needs, including specific solutions for financial services, integrating seamlessly with your existing IT infrastructure for automated reporting and agile response strategies.

It’s truly a comprehensive solution.

Key features:

- Integrated GRC platform unifies governance processes, connecting compliance, risk management, and policy administration to break down organizational silos.

- Risk insights and behavioral analytics empower you to adapt to new risks and regulations, providing a single pane of glass for critical business processes and their potential impact.

- Configurable modules and industry-tailored solutions offer flexibility to build a program that fits your specific needs, particularly for regulated sectors like financial services.

SAI360 features, pricing, & alternatives →

Verdict: SAI360 is ideal for IT directors and risk managers at mid-sized financial institutions seeking the best business continuity management software. Its integrated platform, real-time risk insights, and ability to handle hundreds of data pieces on a single pane of glass address critical compliance and scalability challenges, ensuring regulatory adherence and reducing recovery times.

Conclusion

Are your risk systems still disconnected?

Choosing the right BCM platform is tough, especially under pressure. You need seamless integration and real-time insights without disrupting your workflow.

The reality is, a single oversight during software selection can compromise your entire operation. This puts your entire business in a vulnerable position during a crisis, undermining the hard work of your team.

Here is what I recommend.

From my evaluation, Fusion Risk Management is the top choice. It excels at unifying your disconnected continuity plans into a single, actionable system.

I was especially impressed by how it imports your existing plans, turning static documents into dynamic, actionable data. Choosing the best Business Continuity Management Software like this helps you focus on strategy, not tedious data entry.

I suggest you book a free demo of Fusion Risk Management to see exactly how its integrated platform works for your organization.

You’ll gain true operational resilience.