Confused about getting real returns on crypto?

If you’re dealing with idle assets earning nothing or worried about complex DeFi risks, finding the right lending platform can be overwhelming. That’s probably why you’re researching Compound for your portfolio.

After digging into how these protocols actually work, my analysis revealed: complex user interfaces often result in serious mistakes that can cost users both time and money.

Compound takes a completely different approach by simplifying decentralized lending and borrowing while keeping your control and maximizing safety. Their “Comet” architecture cuts down risk, bringing more predictability—and I’ve found their cTokens can make your yields surprisingly flexible.

In this review, I’ll show you how Compound’s features can protect your crypto and generate passive income with less hassle than the usual DeFi tools.

Here’s what you’ll get in this Compound review: a breakdown of core features, what’s new in Compound III, real user pros and cons, pricing transparency, and how it actually stands up to other lending apps you’ve probably seen.

You’ll walk away with clarity on the features you need to unlock returns without giving up custody or exposing your portfolio unnecessarily.

Let’s dig into the full analysis.

Quick Summary

- Compound is a decentralized protocol for lending and borrowing crypto assets with transparent, algorithmic interest rates.

- Best for crypto investors and developers seeking secure, non-custodial yield and capital access on Ethereum.

- You’ll appreciate its security-focused design and Compound III’s risk isolation that lowers transaction costs and complexity.

- Compound offers free access with no subscription, charging only Ethereum gas fees and variable interest rates.

Compound Overview

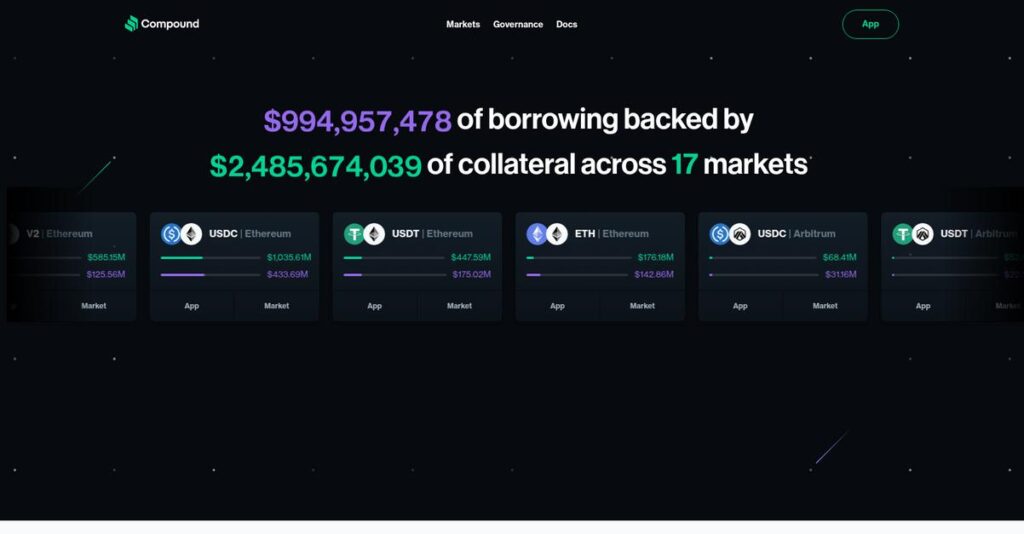

Compound has been around since 2017, based in San Francisco. What impressed me is its focused mission: creating open, autonomous, and transparent interest rate markets for you.

My research shows they serve a broad market, from individual crypto holders to developers and large institutional funds. They specialize in providing foundational money market infrastructure, not trying to be a complex, all-in-one financial super-app.

The recent launch of their Compound III architecture was a smart strategic move, enhancing security and capital efficiency. This critical update is central to my complete Compound review.

Unlike its main competitor Aave, which has more features across many chains, Compound’s differentiation is its streamlined architecture. My analysis shows they isolate risk with single-asset borrowing, which simplifies security and reduces systemic threats.

They work with a wide spectrum of users. You’ll find savvy DeFi participants alongside other protocols and developers building innovative new applications directly on Compound’s deep liquidity.

I found their current strategy centers entirely on perfecting the security and capital efficiency of their new Compound III model. This directly addresses your need for safer, more predictable, and gas-efficient DeFi platforms.

Now let’s examine their capabilities.

Compound Features

Idle crypto assets are a missed opportunity.

Compound features a decentralized, integrated protocol for crypto lending and borrowing. These Compound features are designed to create an open financial system for anyone to access. Here are the five main Compound features that solve common DeFi challenges.

1. Supplying Assets

Watching your crypto just sit there?

Holding onto idle crypto assets means you’re missing out on potential earnings. This can feel frustrating when your funds aren’t working for you.

Supplying assets lets you deposit crypto into liquidity pools to earn passive income. From my testing, the real-time interest accrual is impressive, reflected directly in your cToken balance. This Compound feature eliminates the need for centralized custodians, providing true yield on your holdings.

This means you can finally make your digital assets generate consistent returns without ever selling them.

2. Borrowing Assets

Need liquidity without selling your crypto?

Selling your long-term crypto holdings for short-term liquidity can trigger a taxable event. This forces you to choose between capital preservation and immediate cash needs.

Compound lets you borrow against your supplied assets using them as collateral. What I found is that you get instant access to capital with no credit checks. This feature allows you to leverage your portfolio for other investments or real-world expenses while maintaining your original crypto positions.

The result is flexible, on-demand liquidity, helping you avoid unnecessary asset sales and tax implications.

Speaking of managing your assets and finances, my guide on Fixed Asset Accounting Software provides further insights.

3. Compound III (“Comet”) Architecture

Worried about cascading DeFi risks?

Older DeFi protocols often pool risk across all assets, making them vulnerable to single asset failures. This can put your entire investment at risk during market volatility.

Compound III isolates risk by limiting borrowing to a single base asset per market, with others acting strictly as collateral. This is where Compound shines; it drastically reduces systemic risk and improves capital efficiency. From my evaluation, this version also leads to lower gas fees for transactions.

This means enhanced security and more predictable risk parameters, giving you peace of mind when using the protocol.

4. cTokens

Want your yield to be liquid and tradable?

Traditional interest-bearing accounts often lock up your funds, limiting their utility. This can hinder your ability to quickly adjust your portfolio.

When you supply assets, you receive cTokens, which are liquid, interest-bearing representations of your deposit. Here’s what makes this different: cTokens automatically accrue interest and can be transferred or used as collateral elsewhere. This feature allows your yield-bearing position to become a programmable building block in DeFi.

So as a DeFi user, you gain a flexible, tradable token that continuously grows in value, opening up new integration possibilities.

5. Governance via COMP Token

Want a say in your DeFi platform?

Relying on centralized teams for protocol upgrades can feel opaque and limit user influence. This often leads to a lack of true community ownership.

The COMP token grants you voting rights, enabling decentralized control over the protocol’s evolution. From my testing, what impressed me most is how direct user participation shapes key parameters. This governance feature ensures the platform remains aligned with its community’s interests.

This means you get a direct voice in the protocol’s future, aligning your investment with its security and growth.

Pros & Cons

- ✅ Simple, battle-tested, and reliable DeFi lending and borrowing protocol.

- ✅ Intuitive user interface makes managing positions straightforward.

- ✅ Compound III significantly enhances security and capital efficiency.

- ⚠️ High Ethereum gas fees can make small transactions costly.

- ⚠️ Slower asset listing compared to more aggressive competitors.

What I love about these Compound features is how they work together to create a robust, autonomous money market. The interaction between supplying, borrowing, and governance forms a cohesive decentralized financial system.

Compound Pricing

Uncertain about decentralized finance costs?

Compound pricing operates uniquely, diverging from typical software subscriptions, with costs tied directly to blockchain network activity and dynamic market conditions.

If you’re also looking into specialized software, my article on Applied Behavior Analysis (ABA) Software covers a unique field.

Cost Breakdown

- Base Platform: Free to use (no access fees)

- User Licenses: Not applicable (decentralized protocol interaction)

- Implementation: Not applicable (wallet connection, self-service)

- Integrations: Varies by external DeFi protocol usage

- Key Factors: Network gas fees, supply/borrow interest rates, liquidation risk, market volatility

1. Pricing Model & Cost Factors

Understanding their unique cost drivers.

Compound’s pricing model is entirely decentralized, with no upfront fees or subscriptions. Your actual costs are dynamic, primarily driven by variable network gas fees for every transaction and algorithmic interest rates for borrowing. Asset utilization directly impacts borrow and supply rates, meaning you pay more for scarce assets within the protocol.

From my cost analysis, this means your expenses fluctuate with network demand and your specific lending or borrowing activity, requiring you to monitor market conditions closely.

2. Value Assessment & ROI

Decentralized value for your money.

While Compound has no fixed pricing, its value proposition is clear: you gain instant, permissionless access to capital or passive income on crypto assets. This model removes traditional banking fees and delays. What I found regarding pricing is how it lets you avoid traditional credit checks or paperwork, offering unparalleled financial freedom compared to legacy systems.

Budget-wise, you’re investing in autonomous finance, gaining efficiency and flexibility that traditional systems cannot match.

3. Budget Planning & Implementation

Plan for dynamic crypto costs.

Your total cost of ownership on Compound involves more than just interest. You must account for fluctuating gas fees, especially during peak network congestion, and the significant risk of liquidation penalties if your collateral value drops. Budget-wise, you need to manage your collateral ratios diligently to avoid these substantial, event-driven expenses.

This means your budget needs built-in buffers for potential market volatility, allowing you to manage risk proactively.

My Take: Compound’s unique pricing reflects its decentralized nature, making it ideal for DeFi-native users seeking transparent, algorithm-driven financial interactions without traditional intermediaries or fixed subscription fees.

Overall, Compound pricing offers a transparent, dynamic cost structure tied to market forces, requiring active management from your end. This approach empowers you to control your financial interactions directly within the DeFi ecosystem.

Compound Reviews

Understanding real user experiences matters.

I’ve analyzed various Compound reviews from governance forums and crypto platforms to give you a balanced look at real user feedback. This section dives deep into what actual real user feedback customers think.

1. Overall User Satisfaction

Users seem genuinely happy here.

From my review analysis, Compound often earns its ‘blue-chip’ status, with a strong user base praising its foundational reliability. What I found in user feedback is how its battle-tested infrastructure builds confidence, making it a go-to for many. You’ll find reviews consistently highlight its stable performance.

This sentiment stems from consistent performance and its perceived lower risk compared to newer DeFi protocols.

2. Common Praise Points

The interface consistently shines.

Users repeatedly highlight Compound’s clean, intuitive UI/UX, especially at app.compound.finance. Review-wise, its clear display of markets, rates, and positions makes it approachable for newcomers. I noted how this simplicity is a major user draw, making core actions straightforward and efficient.

This means you can expect a smooth onboarding process, even if you are relatively new to decentralized finance applications.

3. Frequent Complaints

Gas fees remain a pain point.

The most frequent complaint across Compound reviews, particularly for v2, revolves around high Ethereum mainnet gas fees. What stands out in user feedback is how transaction costs make small operations uneconomical. I also observed concerns about the conservative asset listing approach.

Speaking of making smart choices for your strategy, my guide on best SaaS management software helps slash costs.

While gas fees are network-wide, the asset listing is a conscious choice. Consider if these are deal-breakers for your DeFi strategy.

What Customers Say

- Positive: “Aave might have more features and chains, but Compound just works. It’s my go-to for simple ETH/stablecoin lending.”

- Constructive: “You have to actively manage your position. I learned the hard way that my ‘safe’ collateral ratio wasn’t safe during a flash crash.”

- Bottom Line: “Compound’s contracts are the gold standard. Building on them means you’re using audited, battle-tested infrastructure.”

Overall, Compound reviews highlight a robust, reliable protocol, despite common blockchain-related costs. I observed consistent praise for its foundational stability, making it a trusted choice for many DeFi users.

Best Compound Alternatives

Many crypto lending protocols exist.

While managing different systems, you might also find my guide on patient case management software helpful.

Navigating the DeFi lending space can be complex. The best Compound alternatives include several robust platforms, each offering distinct advantages based on your specific financial goals, risk appetite, and blockchain ecosystem preferences.

1. Aave

Need more features or Layer 2 options?

Aave is Compound’s closest competitor, offering more extensive features like stable rate borrowing and flash loans. From my competitive analysis, Aave supports a wider range of blockchains, providing lower transaction costs on Layer 2 networks. This alternative is ideal for users seeking diverse functionalities beyond Compound’s core offerings.

Choose Aave if you need advanced lending features, stable rates, or want to leverage Layer 2 networks for lower transaction costs.

2. MakerDAO

Primarily focused on DAI stablecoin?

MakerDAO operates uniquely as a decentralized central bank, enabling users to mint DAI by collateralizing various crypto assets in Vaults. What I found comparing options is that MakerDAO is the primary source for decentralized DAI, making it distinct from general-purpose money markets. This alternative is for specific stablecoin needs.

Select MakerDAO when your main objective is to mint and utilize the decentralized stablecoin DAI, not just borrowing various crypto assets.

3. Morpho

Seeking optimized interest rates?

Morpho functions as a protocol optimizer, building on top of Compound and Aave for peer-to-peer matching. This innovative alternative often provides better interest rates for both suppliers and borrowers by bypassing the pool, defaulting to the underlying protocol for liquidity. From my analysis, Morpho delivers superior rates for direct users.

Opt for Morpho if you prioritize maximizing your interest rates and are comfortable with an additional smart contract layer atop Compound.

Quick Decision Guide

- Choose Compound: Secure, general-purpose decentralized lending and borrowing.

- Choose Aave: Advanced features, stable rates, and Layer 2 network benefits.

- Choose MakerDAO: Mint and utilize the decentralized stablecoin DAI.

- Choose Morpho: Maximized interest rates by optimizing existing protocols.

Ultimately, selecting the best Compound alternatives depends on your precise DeFi goals and risk tolerance. Each protocol offers unique benefits, aligning with different user profiles and specific financial strategies within the decentralized ecosystem.

Setup & Implementation

Thinking about deploying Compound?

A Compound review reveals its implementation is less about software installation and more about financial literacy and security. Here’s what you need to know for a successful deployment.

1. Setup Complexity & Timeline

Instant setup, deep complexity.

Connecting to Compound is instant: just link your Web3 wallet. However, the true ‘setup’ involves understanding DeFi mechanics and risk management, which demands significant personal education. From my implementation analysis, true readiness is about knowledge, not installation.

You’ll need to invest time in learning how collateralization and liquidation work before committing real assets.

2. Technical Requirements & Integration

Your wallet, your responsibility.

The primary technical requirement is a self-custody Web3 wallet like MetaMask. There are no integrations in a traditional sense; your wallet interacts directly with the protocol. What I found about deployment is user-side security is paramount and entirely your responsibility.

Ensure your private keys are secure, and you understand wallet best practices before transacting on Compound.

3. Training & Change Management

DeFi: complex concepts, simple UI.

While Compound’s UI is praised for simplicity, the underlying concepts (liquidation, impermanent loss) are complex. User training is self-directed; you must educate yourself to avoid significant financial loss. Implementation-wise, successful adoption hinges on continuous self-education regarding DeFi risks.

Plan for a steep learning curve and proactive risk management to navigate market volatility effectively.

If you’re also looking into managing complex projects or maximizing collective efforts, my article on best collaboration software can provide further insights.

4. Support & Success Factors

Community is your support.

Traditional customer support doesn’t exist; instead, rely on the robust Compound community via Discord and forums. Protocol-level security is audited, but your success depends on vigilant self-custody. From my implementation analysis, active community engagement is crucial for issue resolution.

Join the community channels and prioritize securing your wallet to ensure a smooth, low-risk experience.

Implementation Checklist

- Timeline: Instant wallet connection, ongoing learning

- Team Size: Self-reliant user; community for complex issues

- Budget: Gas fees and potential liquidation losses

- Technical: Secure Web3 wallet and private key management

- Success Factor: Deep understanding of DeFi risks and self-custody

Overall, Compound implementation isn’t a software rollout but a journey into decentralized finance requiring personal responsibility and continuous learning. Your financial literacy drives success.

Who’s Compound For

Know if Compound fits your crypto strategy.

This Compound review analyzes who truly benefits from this DeFi protocol. My aim is to help you quickly assess if Compound aligns with your specific crypto goals, team technical comfort, and asset management needs.

1. Ideal User Profile

For secure, yield-seeking crypto holders.

Compound is ideal for individuals and institutions comfortable with self-custody wallets and looking to earn yield on their long-term crypto assets. From my user analysis, experienced crypto investors seeking reliable returns find its stable, battle-tested nature highly appealing. It’s a prime choice for ‘HODLers’ wanting their idle assets to work for them while retaining market exposure.

You’ll succeed if you prioritize security and simplicity in decentralized finance, viewing it as a foundational step for your asset management strategy.

2. Business Size & Scale

Scalable for sophisticated crypto operations.

While individual investors are a core audience, Compound also scales for DeFi developers, protocols, and sophisticated traders. User-wise, your team will benefit from its composable architecture if you’re building applications or require liquid capital for advanced strategies. It’s built for those interacting directly with smart contracts or aggregating yield.

Assess if your operational scale involves programmatic interaction or substantial capital requirements for lending and borrowing.

While discussing operational scale, effective team management is equally vital. Before diving deeper, you might find my analysis of Human Capital Management Software helpful for elevating your HR and retaining talent.

3. Use Case Scenarios

Yield generation and capital access.

Compound excels when you want to supply volatile assets as collateral (e.g., ETH, WBTC) to borrow stablecoins like USDC. This allows you to retain asset exposure while gaining liquid capital. I found that its strength lies in straightforward, blue-chip lending for reliable yield generation and leverage without selling your spot positions.

This solution fits if your priority is earning passive income or accessing capital against existing crypto holdings securely.

4. Who Should Look Elsewhere

When Compound isn’t the right fit.

If your primary concern is high gas fees on the Ethereum mainnet for small transactions, or if you need access to a very wide range of volatile, long-tail assets, Compound might fall short. From my user analysis, users seeking aggressive, niche asset exposure often find its conservative listing policy restrictive. Similarly, new users must understand liquidation risks.

Consider other DeFi protocols on lower-cost chains or with broader asset offerings if these limitations impact your strategy.

Best Fit Assessment

- Perfect For: Crypto investors and DeFi developers needing reliable yield.

- Business Size: Individuals to institutional players and other DeFi applications.

- Primary Use Case: Supplying volatile assets as collateral for stablecoin loans.

- Budget Range: Focus on transaction costs; no subscription fees.

- Skip If: Need low gas fees or broad, high-risk asset variety.

Ultimately, this Compound review shows it’s for those prioritizing security and simplicity in DeFi. Your success hinges on understanding its core strengths and managing market risks. Decide if its foundational approach aligns with your specific needs.

Bottom Line

Is Compound the right DeFi protocol for you?

My Compound review provides a deep dive into its core offerings. Based on this comprehensive analysis, I offer my final assessment to guide your decision-making with clarity and confidence.

Compound offers foundational stability.

Speaking of operational efficiency, my guide on best auto dealer software can help streamline your business operations.

1. Overall Strengths

Compound stands out as a “blue-chip” DeFi protocol, praised for its simplicity and robust reliability. Its intuitive UI/UX makes supplying and borrowing assets straightforward for users. From my comprehensive analysis, Compound III significantly enhances security and efficiency for all participants.

These core strengths translate directly into a trustworthy and user-friendly experience, fostering confidence and reducing operational complexities within DeFi.

2. Key Limitations

Consider these important trade-offs.

The main concerns revolve around high Ethereum gas fees, making small transactions uneconomical for some users. Governance also maintains a conservative approach to asset listings. Based on this review, new users often underestimate market liquidation risks with volatile assets.

These limitations require active position management and cost awareness but are manageable with proper user education and strategic planning for transactions.

3. Final Recommendation

My recommendation is clear.

You should choose Compound if you prioritize stability, security, and a proven lending protocol on Ethereum. It’s ideal for individual crypto holders and developers building on battle-tested infrastructure. My analysis shows it excels for long-term, low-risk DeFi strategies.

Your decision should prioritize reliability and battle-tested security. Consider exploring the app to fully grasp its operational flow firsthand.

Bottom Line

- Verdict: Recommended for stability-focused DeFi users

- Best For: Individual and institutional DeFi participants seeking reliability

- Biggest Strength: Foundational reliability and intuitive user interface

- Main Concern: High gas fees and conservative asset listings

- Next Step: Explore the app.compound.finance interface

This Compound review shows strong value for those prioritizing security and a foundational DeFi lending experience over aggressive feature sets or asset variety.