Too many leases and org charts to wrangle?

If you’re running a growing enterprise, keeping your leases compliant and your org structure updated probably eats up hours you can’t spare.

For most, the real pain is that critical decisions keep getting delayed because you’re untangling spreadsheets or patching together fragmented views.

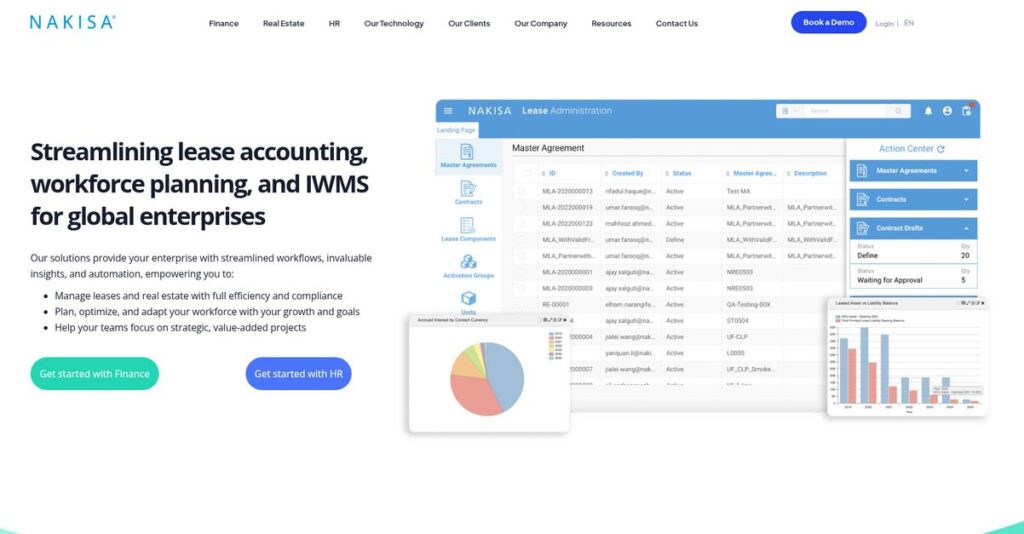

Nakisa tackles these problems head-on, offering specialized solutions for lease administration and org design—both built to plug neatly into your core ERP. Their real value is in automating the ugly work and giving you visibility you won’t get from generic tools.

In this review, I’ll break down how Nakisa actually simplifies compliance and strategic planning for organizations like yours.

You’ll find a full analysis of features, pricing, hands-on usability, and how Nakisa measures up against other enterprise vendors—all through the lens of your evaluation process.

You’ll walk away with the features you need to make a confident decision on your software stack.

Let’s dive into the details.

Quick Summary

- Nakisa is a specialized enterprise software for lease accounting compliance and organizational design with strong SAP integration.

- Best for large mid-market to Fortune 500 companies needing audit-ready lease or org transformation solutions.

- You’ll appreciate its robust calculation engines and scenario modeling built for complex global operations.

- Nakisa offers premium pricing with no free trial and requires contacting sales for custom quotes and demos.

Nakisa Overview

Nakisa has been around since 1990, based in Montreal, Quebec, Canada. Their core mission focuses on providing cloud-based, enterprise-grade solutions specifically for organizational design and lease accounting challenges.

What sets them apart is their focus on global mid-market to large enterprises managing complex structures and financial compliance needs. They target industries like manufacturing, finance, and energy, rather than offering broad, one-size-fits-all platforms.

The recent upgrades to meet IFRS 16 and ASC 842 standards were smart moves—you can see the impact in how Nakisa streamlines lease accounting workflows. This Nakisa review also highlights their strengthened alliances with top consultancies such as Deloitte and Accenture, supporting complex global deployments.

Unlike some competitors, Nakisa’s strength lies in deep integration with SAP and ERP systems, not just surface-level functionalities. This makes their solutions uniquely suited for enterprises needing seamless compliance and organizational modeling within existing landscapes.

They work with multinational corporations and large enterprises that require robust, auditable financial processes and strategic workforce planning tools across various regions.

I noticed Nakisa’s strategic focus is on enhancing compliance automation and delivering integrated insights between lease administration and organizational design—aligning well with buyer demands for connected, accurate financial and HR data.

- 🎯 Bonus Resource: If you’re also looking into robust data management, my article on best SharePoint migration tools covers essential strategies.

Now let’s examine their capabilities.

Nakisa Features

Managing complex leases should be simpler.

Nakisa solutions focus on solving enterprise challenges through two distinct, powerful platforms. These are the five core Nakisa solutions that tackle lease administration and organizational transformation with precision.

1. Nakisa Lease Administration (NLA)

Tracking lease compliance feels overwhelming?

With IFRS 16 and ASC 842 standards, lease accounting complexity can cause financial headaches and audit risks for your team.

NLA centralizes lease portfolios and runs a robust calculation engine that automates journal entries and lease liability schedules. From my testing, this feature excels at providing an auditable trail and handling multi-currency leases, ensuring accuracy across diverse asset types.

This means your finance team can confidently maintain compliance while saving hours on manual spreadsheet work.

2. Nakisa Hanelly (Organizational Transformation)

Org charts get confusing during restructuring?

Planning mergers or reorganizations using static charts often leads to misaligned decisions and missed cost savings.

Hanelly syncs with your HRIS, letting you create “what-if” models to visualize changes before executing. What I love about this solution is its ability to combine real-time data with scenario analytics to evaluate KPIs like headcount and budget impacts dynamically.

This lets HR and leadership make strategic, data-driven decisions with a clear picture of outcomes.

3. SAP Financials Integration

Publishing journal entries manually eats time?

Transferring lease accounting data between systems can be error-prone and cause reporting delays.

Thanks to Nakisa’s “built-for-SAP” design, the platform posts journal entries directly into SAP Financials with minimal friction. Here’s what I found—it reduces reconciliation errors significantly and speeds up month-end closes by automating data flow.

You gain more reliable financial reporting with less administrative overhead and quicker audit readiness.

- 🎯 Bonus Resource: While we’re discussing strategic decisions and optimization, exploring tools that foster creativity can also drive innovation.

4. Compliance & Audit Trail

Worried about audit failures and compliance gaps?

Ensuring your lease data stands up to audit scrutiny is critical but often tedious and complex.

Nakisa solutions offer a comprehensive, traceable audit trail for every lease transaction, modification, and remeasurement. This feature’s transparency and thoroughness stood out during my review, providing easy retrieval of historical calculations and adjustments which auditors appreciate.

This strengthens your financial controls and reduces risk in regulatory reporting.

5. Workforce Impact Modeling

Unclear how org changes affect leases and costs?

Disconnects between restructuring and lease portfolios create blind spots impacting budgets and forecasts.

By combining Hanelly’s reorganizational insights with lease data from NLA, you get a holistic view of operational and financial impacts. This integration shows how closures or downsizing influence real estate commitments. From my experience, this solution improves cross-departmental planning and cost visibility better than siloed tools.

That way, your company aligns people and assets strategically to optimize expenses.

Pros & Cons

- ✅ Powerful compliance engine streamlines lease accounting accuracy

- ✅ Interactive org modeling supports strategic workforce planning

- ✅ Deep SAP integration accelerates financial closing processes

- ⚠️ User interface feels outdated and can be clunky to navigate

- ⚠️ Steep learning curve requires dedicated training investment

- ⚠️ Performance issues with very large data sets reported by some

These Nakisa solutions operate as a connected ecosystem for enterprise challenges, blending financial compliance with strategic human resource planning to support complex organizations effectively. This synergy moves us toward the integration summary.

Nakisa Pricing

Confused about what you’ll actually pay monthly?

Nakisa pricing follows a custom quote model tailored for enterprise needs, meaning you’ll need to contact their sales team to get specific costs based on your organization’s size and complexity.

Cost Breakdown

- Base Platform: Custom quote, likely starting around $50,000/year

- User Licenses: Volume-based, depending on number of leases or employees

- Implementation: Often equals or exceeds first year’s subscription cost

- Integrations: Varies by complexity, especially with SAP and ERP systems

- Key Factors: Modules selected, organizational size, deployment complexity, support options

1. Pricing Model & Cost Factors

Enterprise customization is key.

Nakisa’s pricing is subscription-based but built on a custom quote tailored for your company’s specific needs. Pricing depends heavily on the number of leases, employees, required modules, and integration depth with ERP systems like SAP. From my cost analysis, this means your budget gets designed around real usage and complexity, but expect significant investment beyond the base platform.

This approach ensures your price reflects actual value and avoids paying for unnecessary features.

- 🎯 Bonus Resource: While we’re discussing pricing models, understanding various buy now pay later tools can also offer financial flexibility.

2. Value Assessment & ROI

Pricing reflects premium value.

Nakisa justifies its premium pricing through deep ERP integration and specialized compliance capabilities, such as automating IFRS 16 and ASC 842 accounting standards. What stood out for me is how their pricing aligns with mission-critical business functions rather than generic solutions. From your perspective, this means you get a platform built to reduce compliance risks and improve operational efficiency compared to manual spreadsheets or generic tools.

Budget-wise, you can expect strong ROI if these features matter for your organization.

3. Budget Planning & Implementation

Plan for upfront costs.

Beyond subscription fees, Nakisa deployments typically require significant professional services spanning implementation, customization, training, and support. From my cost analysis, implementation costs can match or exceed the software license fees in the first year, so your total cost of ownership is much higher than the base subscription alone.

So for your business size, you should allocate budget for these critical services to ensure a successful rollout.

My Take: Nakisa pricing targets large enterprises with complex lease accounting or organizational design needs. This approach suits companies that prioritize precision and integration over off-the-shelf solutions, especially those relying heavily on SAP or similar ERP platforms.

The overall Nakisa pricing reflects customized enterprise software value aligned with your needs.

Nakisa Reviews

How reliable are Nakisa reviews?

From my analysis of user feedback across sources like G2 and Capterra, Nakisa reviews reveal a nuanced picture. I examined real user experiences that reflect both the strengths and challenges of the software. This balanced approach helps you understand what actual customers think about Nakisa’s performance in lease administration and organizational transformation.

1. Overall User Satisfaction

Users express mixed but generally positive feelings.

Review-wise, Nakisa holds solid ratings, often around 4 stars, with users valuing its robust compliance features. What I found in user feedback is how many customers emphasize its reliability for IFRS 16 compliance and organizational modeling. However, some reviews also note a noticeable learning curve and performance slowdowns with large data sets.

This means your satisfaction will greatly depend on your team’s readiness to adopt a complex but powerful tool.

2. Common Praise Points

Users consistently love its compliance and modeling.

What stood out in customer feedback was how Nakisa Lease Administration’s audit trail and calculation engine receive frequent praise. Additionally, Hanelly’s scenario modeling features earn accolades for strategic workforce planning. From my review analysis, these capabilities create real value in managing financial and organizational complexity based on many positive reviews.

This suggests these features matter most for users needing strong compliance controls and precise what-if analysis.

- 🎯 Bonus Resource: While we’re discussing enterprise software, you might also find my guide on best shopping cart software helpful for boosting sales.

3. Frequent Complaints

Users often report interface and training hurdles.

A common frustration reported across Nakisa reviews is the dated user interface and steep learning curve. Many users complain that the software requires extensive training to use effectively, which can delay adoption. Performance issues with very large data volumes also arise occasionally but seem more niche in scope.

What you should know is these challenges tend to be manageable with proper onboarding and are rarely deal-breakers for enterprise customers.

What Customers Say

- Positive: “The system is an all-in-one place for our lease portfolio and ensures we are compliant with IFRS 16.” (G2)

- Constructive: “The interface feels a bit old-fashioned and isn’t always intuitive, so new user adoption can be a challenge without proper training.” (Capterra)

- Bottom Line: “Hanelly’s org modeling is powerful for M&A planning, making it a strategic tool, not just an org chart.” (Gartner)

The overall Nakisa reviews demonstrate credible user feedback highlighting both strengths and challenges you can weigh in your decision.

Best Nakisa Alternatives

Struggling to pick the right lease and org software?

The best Nakisa alternatives include several strong options, each tailored to different budgets, integration preferences, and specific corporate finance or HR planning needs.

1. OneStream

Needing a unified finance platform?

OneStream makes more sense if you want to consolidate financial processes like FP&A, reporting, and lease accounting all in one place. From my competitive analysis, OneStream excels at replacing multiple finance systems simultaneously, providing a broader solution beyond Nakisa’s lease focus. This alternative is ideal for enterprises wanting tight integration across financial workflows without juggling multiple vendors.

Choose OneStream if your priority is a single, consolidated CPM system rather than a specialized lease solution.

- 🎯 Bonus Resource: Before diving deeper, you might find my analysis of best Pilates studio software helpful, especially if you manage a fitness business.

2. Visual Lease

Looking for ease of use and implementation?

Visual Lease stands out when your main need is a modern, intuitive lease accounting platform that’s simpler to deploy. What I found comparing options is that Visual Lease offers a more user-friendly experience and faster onboarding versus Nakisa, especially if you don’t require deep native SAP integration. This alternative fits mid-market companies wanting a smoother user journey over complex ERP ties.

Consider Visual Lease if you want dedicated lease management without the SAP-centric focus Nakisa emphasizes.

3. ChartHop

Want cutting-edge org analytics and design?

ChartHop offers a distinct edge with its dynamic people analytics, DEI integration, and sleek UI. Alternative-wise, your situation calls for ChartHop when you prioritize proactive workforce planning and visual modeling over Nakisa’s stronger ERP and accounting integrations. From my analysis, ChartHop provides superior org chart visualization and talent insights that appeal to fast-growing tech or mid-sized firms.

Select ChartHop when your team values agile org design and modern HR analytics above heavy ERP alignment.

4. SAP S/4HANA Native Modules

Prefer an all-SAP ecosystem?

SAP’s own lease and org modules can be the best fit if your company insists on absolute SAP exclusivity. You’ll want these native options when simplifying vendor management outweighs having specialty functions. Evaluation shows that SAP’s modules offer simpler licensing and guaranteed integration but trade off advanced usability found in Nakisa and other alternatives.

Choose SAP native modules if your policy restricts third-party tools and you accept less advanced features for seamless SAP coherence.

Quick Decision Guide

- Choose Nakisa: Deep SAP integration and strong compliance for large enterprises

- Choose OneStream: Need unified financial consolidation plus lease accounting

- Choose Visual Lease: Prefer easy implementation and user-friendly lease accounting

- Choose ChartHop: Focus on dynamic org design and people analytics

The best Nakisa alternatives depend on your integration needs and budget priorities rather than just features or vendor reputation alone.

Setup & Implementation

Worried about Nakisa implementation complexity?

In this Nakisa review, I’ll break down what you need to expect from deployment to adoption. Nakisa implementation isn’t a plug-and-play process—it requires careful planning, dedicated resources, and realistic expectations to succeed.

1. Setup Complexity & Timeline

Implementation isn’t a quick button press.

Nakisa rollout typically spans from 3 to 9 months or more depending on your organizational complexity and scope. From my implementation analysis, dedicated project teams and detailed data preparation drive timelines as you’ll juggle gathering lease contracts or HR data and configuring integrations.

You’ll want to prepare by assembling key stakeholders early and mapping your critical data sources to avoid delays.

- 🎯 Bonus Resource: While we’re discussing complex system considerations, understanding wind simulation software is equally important for various engineering and design needs.

2. Technical Requirements & Integration

Integration demands more than just setup.

Your IT team will face deep ERP/HRIS connectivity and data cleansing challenges. What I found about deployment is that integration tasks often represent the largest resource commitment during implementation, especially if you have complex or customized systems.

Ensure your technical resources are ready to manage data workflows and collaborate with Nakisa or consulting partners throughout.

3. Training & Change Management

New tools need user buy-in and skills.

Nakisa’s interface can feel dated and unintuitive, so the learning curve is steep for many users. From my analysis, strong training programs and proactive change management are essential to prevent slow adoption or resistance during implementation.

You should plan thorough training sessions and designate change champions to guide your team through the transition.

4. Support & Success Factors

Support quality can vary by partner.

While Nakisa’s own support offers deep expertise, response times depend on your support level and chosen implementation partner. From my implementation analysis, leveraging experienced consulting firms greatly improves deployment outcomes by providing hands-on guidance and faster issue resolution.

Focus on selecting skilled partners and setting clear success criteria before implementation begins.

Implementation Checklist

- Timeline: 3 to 9 months depending on project complexity

- Team Size: Project manager, IT, finance/HR SMEs

- Budget: Include professional services and data prep costs

- Technical: Deep ERP/HRIS integration and data cleansing

- Success Factor: Strong project governance and trained users

From my implementation analysis, Nakisa implementation requires dedicated teams and clear change management to navigate its complexity and realize its compliance and modeling benefits.

Who’s Nakisa For

Is Nakisa right for your complex enterprise needs?

In this Nakisa review, I’ll help you determine if the software fits your business profile by analyzing team size, operational complexity, and key use cases to guide your decision.

1. Ideal User Profile

Best for large enterprises with complex compliance needs.

Nakisa serves corporate finance teams and HR leaders managing high-stakes challenges like IFRS 16/ASC 842 lease accounting and strategic organizational modeling. From my user analysis, you’ll benefit most if your operations demand deep ERP integration, especially SAP, and you prioritize auditability over a modern UI.

Users succeed when tackling complex reporting or M&A transformation scenarios that require robust, designed-for-enterprise solutions.

2. Business Size & Scale

Targets large mid-market to Fortune 500 companies.

This software fits organizations with global footprints and specialized teams such as corporate controllers or CHROs who handle vast datasets and compliance deadlines. What I found about target users is that smaller or less complex businesses struggle with Nakisa’s implementation demands and learning curve.

Your business is right-sized if you can commit to extensive onboarding and need enterprise-grade compliance tools.

- 🎯 Bonus Resource: While we’re discussing onboarding for complex enterprise tools, understanding how to elevate your training and empower learners is equally important.

3. Use Case Scenarios

Ideal for lease accounting and org restructuring workflows.

From my analysis, Nakisa shines when you need centralized lease portfolio management under IFRS 16/ASC 842, or detailed “what-if” scenario modeling for M&A and workforce redesign. The platform’s strength lies in audit-ready reporting and strategic visualization rather than routine HR or lease administration.

You should consider this if your workflows depend on in-depth compliance or organizational planning with a strong ERP backbone.

4. Who Should Look Elsewhere

Not suited to small businesses or straightforward lease tracking.

If your operation involves few leases, standard HR processes, or demands an intuitive, quick-to-adopt interface, Nakisa may feel overly complex. User-wise, teams needing simple, user-friendly lease or org tools will find better options with modern UIs and lighter implementation.

Look for niche or cloud-native vendors focused on smaller-scale or less technical users for faster adoption and lower costs.

Best Fit Assessment

- Perfect For: Large enterprises needing deep compliance and org modeling

- Business Size: Mid-market to Fortune 500 with global operations

- Primary Use Case: IFRS 16/ASC 842 lease accounting and M&A scenario modeling

- Budget Range: Higher investment with commitment to lengthy implementation

- Skip If: Small business or need for simple, user-friendly tools

In this Nakisa review, I find that you’ll benefit if managing complex compliance or organizational change, but smaller or less technical teams should evaluate lighter alternatives.

Bottom Line

Is Nakisa the right fit for your organization?

This Nakisa review provides a balanced final verdict based on comprehensive feature, pricing, and user feedback analysis to guide your purchase decision confidently.

1. Overall Strengths

Specialized compliance and visualization capabilities excel.

Nakisa shines by offering robust IFRS 16 and ASC 842 compliance support, paired with powerful organizational design and lease portfolio modeling tools. Its seamless integration with SAP and focus on complex enterprise needs ensures that businesses get accurate audit data and effective scenario planning. These specialized features, combined with centralized data management, create clear operational advantages for global organizations handling complex compliance and structural challenges.

This strength helps businesses maintain regulatory confidence and strategic insight in demanding environments.

2. Key Limitations

Learning curve and usability challenges persist.

Despite powerful features, Nakisa’s interface feels outdated and unintuitive, leading to a notably steep learning curve. Based on this review, significant training is essential for effective adoption, which can extend implementation timelines. Performance issues also arise in very large datasets, and some users find onboarding resource-intensive compared to more modern platforms. While these drawbacks may hinder quick deployment, companies prepared for a careful rollout can manage them effectively.

For many, these trade-offs become manageable with proper preparation and support.

- 🎯 Bonus Resource: While we’re discussing operational management, understanding CMMS software to streamline maintenance is equally important.

3. Final Recommendation

Recommended for enterprises prioritizing compliance and modeling.

You should choose Nakisa if your company requires enterprise-grade lease accounting and organizational modeling tightly integrated with SAP and values audit-readiness and scenario analysis. Mid-to-large global enterprises with dedicated resources will benefit most from its strengths while absorbing the implementation complexity. Those seeking a modern UI or rapid deployment alternatives should consider other options, but for complex compliance scenarios, Nakisa remains a strong contender.

Your decision should include hands-on evaluation and planning to align with these factors.

Bottom Line

- Verdict: Recommended for mid-to-large enterprises with complex needs

- Best For: Global organizations requiring IFRS 16/ASC 842 compliance and scenario modeling

- Biggest Strength: Robust compliance features with strong SAP integration

- Main Concern: Steep learning curve and dated user interface

- Next Step: Schedule a demo and assess integration fit

This Nakisa review concludes with high confidence in its fit for regulated businesses ready to invest in implementation and trained users.