Tired of tracking your portfolio manually?

If you’re switching between broker accounts, spreadsheets, and tax documents, keeping tabs on accurate returns and tax reporting can feel impossible.

After researching dozens of investment tracking tools, I actually established that manual data entry kills hours you could spend investing.

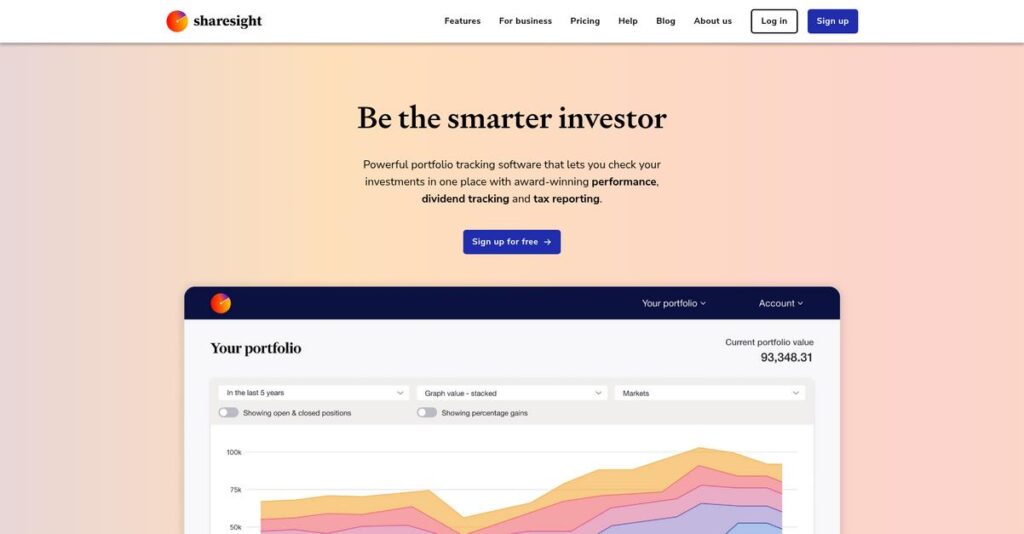

Sharesight takes the pain out of portfolio monitoring by syncing transactions automatically, tracking performance (including dividends and forex), and offering tax-ready reports for your specific region—all from a single dashboard.

In this review, I’ll show you how Sharesight saves you significant time and gives clarity around your real portfolio performance and tax position.

Throughout this Sharesight review, you’ll see my findings on features, pricing tiers, competitor comparisons, and the platform’s unique pros, so you can evaluate if it solves your real portfolio headaches.

You’ll come away knowing the features you need to make a clear, confident decision about Sharesight for your portfolio.

Let’s dive into the analysis.

Quick Summary

- Sharesight is an online portfolio tracker that automates performance and tax reporting for global investors.

- Best for self-directed investors managing multiple brokerage accounts and complex portfolios.

- You’ll appreciate its detailed tax reports and automated transaction syncing that save hours of manual work.

- Sharesight offers freemium plans with paid tiers from $12/month, including a 30-day money-back guarantee.

Sharesight Overview

Sharesight has operated since 2007, based in New Zealand. What impressed me most is their clear mission: empowering self-directed investors with a single, true view of their performance.

My analysis shows they target self-directed global investors who are deeply frustrated by the incomplete and siloed data from their brokers. You will find their platform is also highly specialized for financial advisors and trustees.

The company’s 2022 acquisition by the investment research firm Morningstar was a very significant development. This is a crucial credibility point I considered for this Sharesight review.

Unlike free alternatives focused on general net worth, Sharesight powerfully differentiates with its deep, country-specific tax reporting. This focus saves you countless hours of administrative work and potential errors when filing your taxes.

They work with thousands of serious DIY investors and financial professionals who must consolidate complex holdings from over 200 different global brokers into one accurate, central place.

From my research, their entire strategic focus is on automating the complete calculation of your true annualized return, which properly factors in dividends, fees, and currency impacts. This directly solves your need.

Now, let’s examine their core capabilities.

Sharesight Features

Is tracking your investments a headache?

Sharesight features are designed to simplify portfolio management and tax reporting for individual investors. Here are the five main Sharesight features that help you understand your investment performance and simplify compliance.

Before diving deeper, you might find my analysis of applied behavior analysis software helpful for understanding data-driven insights in other fields.

1. Automated Holdings & Transaction Syncing

Tired of manual data entry for investments?

Manually logging every trade, dividend, and corporate action across multiple brokers is incredibly time-consuming. It’s also error-prone, really skewing your financial picture.

Sharesight connects with over 200 global brokers, automatically importing activity. This is where Sharesight shines, its Trade Confirmation Emails feature parses broker emails to create accurate transactions for you.

This means you can “set and forget” your tracking, gaining a comprehensive, error-free view of all your investment transactions.

2. Comprehensive Performance Reporting

Do your broker reports miss the full picture?

Broker reports often show only price changes, ignoring crucial factors like dividends, fees, and currency impacts. This leaves you with an inaccurate view.

Sharesight calculates your Total Annualised Return, factoring in capital gains, dividends, and currency impact. From my testing, you get a holistic, transparent view over any period, seeing what genuinely drives performance.

What you get is an honest assessment of your portfolio’s actual performance, enabling smarter, data-backed decisions.

3. Region-Specific Tax Reporting

Is investment tax season a nightmare?

Calculating capital gains and income for tax is complex, especially with multiple trades or varying cost basis rules. This creates unnecessary stress.

This is where Sharesight gets it right. It offers specific, downloadable tax reports tailored to countries like Australia, Canada, NZ, and the UK. These reports automatically factor in gains, losses, and dividends, simplifying compliance.

This feature is a massive time-saver, transforming tax preparation into a task you complete in minutes. For many, this justifies the cost.

4. Dividend Tracking & Forecasting

Struggling to track your income investments?

Manually tracking dividend payments from numerous companies and projecting future income is incredibly tedious. You often miss crucial reinvestment details.

Sharesight automatically tracks and records dividend payments, handling Dividend Reinvestment Plans (DRPs). Here’s what I found: its Income Report accurately forecasts expected dividends based on your holdings.

This means you get a clear, real-time view of your portfolio’s cash flow, empowering you to plan income and retirement accurately.

5. Benchmarking and “What-If” Analysis

Is your portfolio truly performing?

Without context, it’s hard to tell if your investment performance is good or just riding a market trend. You need objective comparison.

You can benchmark your portfolio against thousands of global indices, overlaying your performance graph. From my evaluation, the “Contribution Analysis” report easily highlights which holdings are driving or dragging down your returns.

This provides critical context, helping you objectively evaluate your investment strategy and identify underperforming assets to refine your approach.

Pros & Cons

- ✅ Highly praised, automated region-specific tax reporting simplifies compliance immensely.

- ✅ Excellent automated holdings and transaction syncing across 200+ global brokers.

- ✅ Provides a truly consolidated, comprehensive view of all your diverse investments.

- ⚠️ Broker connections can sometimes be unreliable, requiring manual intervention for some.

- ⚠️ User interface feels a bit dated; mobile app less powerful than desktop version.

What I love about these Sharesight features is how they work together to create a cohesive and powerful investment tracking system. This integrated approach ensures all your financial data is unified, giving you unparalleled clarity and control.

Sharesight Pricing

Worried about hidden investment tracking fees?

Sharesight pricing offers a transparent, tiered subscription model, making it straightforward to understand your investment tracking costs and budget for your portfolio management needs.

| Plan | Price & Features |

|---|---|

| Free Plan | $0 • Track 1 portfolio • Up to 10 holdings • Performance reporting • Limited tax reporting |

| Starter Plan | $12/month (billed annually) • Track 1 portfolio • Up to 30 holdings • Automated transaction import • All Free features |

| Investor Plan | $24/month (billed annually) • Track up to 3 portfolios • Unlimited holdings • All tax reports (Capital Gains) • Diversity Report & Benchmarking |

| Expert Plan | $39/month (billed annually) • Track up to 10 portfolios • Unlimited holdings • Portfolio sharing with access • Priority support |

| Sharesight Pro | Custom pricing – contact sales • Multi-client platform • Consolidated client reporting • Client access portals |

1. Value Assessment

Great value for serious investors.

From my cost analysis, Sharesight’s pricing effectively scales with your portfolio complexity. What stands out is how the Investor plan unlocks full tax reporting, a massive time-saver for many, often justifying the entire subscription cost on its own compared to manual calculations.

This means your budget gets a clear return through saved time and accurate tax preparation, directly impacting your financial efficiency.

Speaking of optimizing operations, if you’re also managing team resource allocation, my guide on best workforce planning software offers useful insights.

2. Trial/Demo Options

Try before you buy, effectively.

Sharesight provides a robust Free Plan to get started, letting you track a small portfolio and experience core features before committing. Additionally, paid plans come with a 30-day money-back guarantee, allowing you to test full functionality without financial risk.

This lets you fully evaluate the platform’s value for your specific needs, ensuring it fits your investment tracking requirements.

3. Plan Comparison

Choose your plan wisely.

For most DIY investors, the Investor Plan is the sweet spot, unlocking essential tax reports and multiple portfolios for comprehensive tracking. Budget-wise, the Expert plan caters to sophisticated users with numerous accounts or those collaborating with advisors who need sharing features.

This tiered approach helps you match pricing to actual usage requirements, preventing you from overpaying for unused capabilities.

My Take: Sharesight’s pricing model offers excellent transparency and clear value progression, making it ideal for individual investors and accountants prioritizing accurate portfolio tracking and tax reporting.

The overall Sharesight pricing reflects predictable value for comprehensive investment tracking.

Sharesight Reviews

User experiences shape the real story.

From my analysis of various Sharesight reviews across platforms like Capterra and G2, I’ve gathered insights into what actual users truly think. This section breaks down their feedback to guide your decision-making.

Speaking of clarity, if you’re also looking for tools to ensure secure communications, my guide on call blocking apps software might be helpful.

1. Overall User Satisfaction

Users are overwhelmingly satisfied.

Sharesight consistently earns high marks, with an impressive average rating of 4.7/5 stars across user feedback channels. From my review analysis, what stands out is how users appreciate its core purpose of automated performance and tax reporting, highlighting its reliability and time-saving capabilities.

This strong sentiment suggests the software effectively solves significant pain points, making investment tracking and tax preparation much simpler for you and your investment portfolio.

2. Common Praise Points

Users consistently praise specific features.

Review-wise, users frequently laud Sharesight’s robust tax reporting features, especially in supported regions like Australia. What I found in user feedback is how its automation for syncing trades and dividends saves significant manual effort, alongside the invaluable consolidated portfolio view.

This means you can expect significant time savings on manual calculations, simplifying complex compliance tasks and gaining a clear, consolidated view.

3. Frequent Complaints

Some users encounter frustrations.

Despite high satisfaction, Sharesight reviews also reveal common pain points, primarily regarding broker sync reliability. What stood out in customer feedback is how certain broker connections can be inconsistent, sometimes requiring manual re-authentication or forwarding trade confirmation emails.

Additionally, some users find the UI data-dense or dated, and the mobile app is generally considered less powerful for deep analysis.

What Customers Say

- Positive: “The annual tax reports are a godsend. It would take me days to calculate; Sharesight does it in seconds with a click of a button.”

- Constructive: “The biggest issue is syncing with some brokers. It’s not always seamless; sometimes I resort to manually forwarding trade confirmation emails.”

- Bottom Line: “Being able to see all my portfolios in one place, across multiple brokers and countries, gives me a clarity I never had.”

The overall Sharesight reviews consistently highlight its power for automated tracking and tax reporting. What you’ll find is reliable performance with minor integration quirks that generally don’t deter long-term users.

Best Sharesight Alternatives

Navigating investment tracking options can be complex. From my competitive analysis, the best Sharesight alternatives include powerful options, each better suited for different investor profiles, budgets, and specific use cases.

1. Navexa

An Australian alternative focused on modern UI?

Navexa is a direct, Australia-based Sharesight alternative, often preferred for its slightly more modern user interface. What I found comparing options is that Navexa caters specifically to local Australian investors, providing a streamlined experience for performance and tax reporting within that market. Its focus mirrors Sharesight’s but with a fresher feel.

Choose Navexa if you’re an Australian investor prioritizing a modern user interface and local market focus for your portfolio tracking.

Before diving deeper into other alternatives, you might find my analysis of Best Anti Spyware Software helpful for safeguarding your data.

2. Empower Personal Dashboard

Need a free, holistic financial overview?

Empower Personal Dashboard (formerly Personal Capital) offers a free, US-centric solution for tracking your entire financial picture, including investments, bank accounts, and credit cards. Alternative-wise, its strength lies in overall net worth aggregation, though its investment analysis is less detailed than Sharesight’s, lacking robust non-US tax reporting. It also promotes wealth management services.

Choose Empower if you’re a US investor wanting a free, broad financial view, prioritizing overall net worth over granular global tax specifics.

3. Delta Investment Tracker

Are you a mobile-first crypto investor?

Delta Investment Tracker provides a sleek, mobile-first experience excelling at cryptocurrency tracking alongside traditional assets. From my competitive analysis, Delta offers superior mobile UI and crypto support, making it a strong alternative for digital asset investors. However, its desktop features and comprehensive tax reporting are less developed compared to Sharesight’s robust capabilities.

Choose Delta if you primarily manage investments on mobile, have significant crypto holdings, and prioritize a stylish user interface over in-depth tax reports.

4. Yahoo Finance

Just need basic, free market watchlists?

Yahoo Finance is a free, widely used tool for basic market data and simple portfolio watchlists. This alternative is ideal for quick overviews but requires manual data entry for transactions and dividends, lacking true performance or tax calculations. It serves as a market information hub rather than a comprehensive tracking or tax preparation solution like Sharesight.

Choose Yahoo Finance if you need a no-cost, simple way to monitor stock prices and don’t require detailed performance or tax tracking.

Quick Decision Guide

- Choose Sharesight: Comprehensive global performance and robust tax reporting

- Choose Navexa: Australian investor prioritizing modern UI and local market focus

- Choose Empower Personal Dashboard: Free, holistic US financial overview, less granular investment details

- Choose Delta Investment Tracker: Mobile-centric, significant crypto holdings, sleek UI

- Choose Yahoo Finance: Basic, free stock watchlists without performance or tax tracking

The best Sharesight alternatives depend heavily on your specific investment needs and priorities rather than just feature lists alone. Consider your location, asset types, and tax reporting requirements.

Setup & Implementation

Getting Sharesight up and running?

Sharesight review implementation is generally straightforward for individual investors, but professional setups require more thought. This analysis prepares you for the actual deployment process.

For overall business success, understanding public perception matters. My guide on online reputation management software offers useful tools.

1. Setup Complexity & Timeline

How complex is the initial setup?

Sharesight’s initial setup effort depends on your portfolio size and chosen data import method. Broker sync is easiest if supported, but importing CSV history is common for detailed historical records. From my implementation analysis, populating your historical data requires attention to ensure accurate performance tracking from day one.

You’ll need to gather all your trade history and dividend statements beforehand, preparing for either CSV import or manual entry.

2. Technical Requirements & Integration

Any tricky technical hurdles?

Sharesight is browser-based, meaning minimal local technical requirements beyond a standard internet connection. Implementation-wise, what I found is that broker sync reliability can vary for some connections, occasionally requiring periodic re-authentication or manual trade forwarding for certain brokers.

Prepare for potential manual intervention for unsupported or unstable broker connections by keeping transaction confirmation emails readily accessible.

3. Training & Change Management

How quickly will users adapt?

While basic features are intuitive, mastering Sharesight’s full suite of reports and nuanced performance calculations can take some time. Implementation-wise, users should expect to invest a few hours beyond initial data entry to truly unlock its value for comprehensive performance and tax reporting.

Plan dedicated time for your team to explore the reporting features and comprehensive online help documentation for deeper insights.

4. Support & Success Factors

What support is available?

Sharesight provides responsive standard support, with Expert and Pro plan users receiving priority assistance noted for its speed and effectiveness. From my implementation analysis, their extensive help documentation is invaluable for self-service problem-solving and maximizing platform utility post-setup.

Familiarize yourself with their comprehensive online help library and active community forum for ongoing questions and best practices.

Implementation Checklist

- Timeline: Days to a few weeks for core setup

- Team Size: Individual user or small finance team

- Budget: Minimal beyond subscription; mainly time

- Technical: Stable internet; willingness to troubleshoot broker sync

- Success Factor: Accurate initial data and report exploration

Overall, Sharesight implementation is highly manageable for investors, emphasizing self-service setup and learning. The key to success is accurate initial data input and user engagement with its powerful reporting.

Who’s Sharesight For

Understanding who Sharesight truly serves.

This Sharesight review helps you quickly identify if it’s your ideal investment tracking solution. I’ll analyze specific profiles, team sizes, and use cases where it truly excels, ensuring you find the right fit.

1. Ideal User Profile

Dedicated DIY investors seeking clarity.

Sharesight is perfect for self-directed investors holding accounts across multiple brokers or those with international holdings. User-wise, you’ll simplify complex tax reporting if you’re serious about accurate, long-term portfolio performance tracking. This includes individual investors and SMSF Trustees in Australia needing detailed compliance.

You’ll thrive if your main pain point is the administrative burden of tracking performance and preparing for taxes.

2. Business Size & Scale

Individual, small team, or professional use.

Sharesight caters primarily to individual investors, but scales well for SMSF trustees and small financial advisory firms using Sharesight Pro. What I found about target users is that it handles portfolios from single users to multiple clients, fitting operations that don’t require extensive team collaboration features beyond basic access.

You’ll assess a good fit if your focus is deep individual portfolio analysis or managing a limited number of client portfolios efficiently.

Speaking of managing your digital assets, you might also find my guide on best Android data recovery software helpful for protecting personal information.

3. Use Case Scenarios

Consolidated tracking and automated tax prep.

Sharesight shines when your primary need is a consolidated view of investments across various brokers and geographies, especially for tax reporting. From my analysis, it excels at automating trade and dividend syncing, significantly reducing manual effort. This works perfectly if you prioritize accurate, region-specific tax calculations.

You’ll find this tool indispensable if you deal with international holdings, multiple accounts, and need robust performance and tax data.

4. Who Should Look Elsewhere

Basic tracking, or highly complex enterprise needs.

Sharesight might not be ideal if you only have a single brokerage account with simple holdings, or if you require an extremely modern, mobile-first interface. From my user analysis, some broker sync reliability issues frustrate users. Also, very large financial institutions needing extensive customization and advanced mobile functionality should explore alternatives.

Consider simpler free tools for basic tracking, or comprehensive enterprise solutions for complex institutional needs and cutting-cutting-edge mobile UI.

Best Fit Assessment

- Perfect For: Self-directed investors, SMSF trustees, and advisors managing diverse, multi-broker portfolios.

- Business Size: Individual investors, small investment groups, or small financial advisory firms.

- Primary Use Case: Consolidated portfolio tracking, automated performance, and region-specific tax reporting.

- Budget Range: Investors seeking paid automation/tax benefits beyond free tools or basic broker reports.

- Skip If: Single broker accounts, simple needs, or reliance on cutting-edge mobile apps.

This Sharesight review clarifies that its ideal user values robust portfolio consolidation and automated tax preparation above all else. Your success hinges on detailed tracking needs across diverse investments.

Bottom Line

Sharesight is an indispensable tool for serious investors.

My Sharesight review shows a platform excelling in automated portfolio tracking and tax reporting. This section synthesizes my comprehensive analysis, offering a clear recommendation to guide your software evaluation with confidence.

1. Overall Strengths

Automates complex portfolio and tax tracking.

Sharesight shines by simplifying what’s usually arduous: consolidating multi-broker portfolios, automating dividends, and generating precise tax reports. From my comprehensive analysis, its automated tax reporting is genuinely indispensable, saving countless hours for Australian, New Zealand, and Canadian investors. This eliminates significant manual effort.

These capabilities directly empower self-directed investors and SMSF trustees to maintain accurate records and make informed financial decisions with ease.

2. Key Limitations

What are Sharesight’s main drawbacks?

While powerful, Sharesight faces criticism regarding broker sync consistency, particularly with smaller or US-based platforms, requiring manual intervention. Based on this review, the dated user interface can feel clunky, especially compared to newer, sleeker fintech apps.

These limitations are manageable for most users but may cause frustration for those expecting a perfectly seamless experience or modern aesthetics.

Before diving deeper, you might find my analysis of patient registration software helpful, especially if securing data is a priority for your operations.

3. Final Recommendation

Who is Sharesight truly for?

You should choose Sharesight if you’re a serious DIY investor or SMSF trustee needing robust, automated tax and performance reporting across multiple brokers. From my analysis, it truly excels in simplifying complex tax obligations, making it invaluable for specific regional compliance, especially in Australia and New Zealand.

Your decision should factor in your regional tax needs and existing broker relationships; for these specific use cases, Sharesight delivers unmatched value.

Bottom Line

- Verdict: Recommended for serious investors and SMSF trustees

- Best For: Self-directed investors with multiple brokers needing tax reporting

- Biggest Strength: Automated tax reporting and consolidated portfolio view

- Main Concern: Inconsistent broker syncs and dated user interface

- Next Step: Sign up for the free plan to test broker connections

Overall, this Sharesight review confirms that while not perfect, it offers significant value for its target audience, particularly those focused on comprehensive tax and performance tracking.